UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 10-K

(MARK ONE)

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2016

OR

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Transition Period from ___________ to ________

|

Commission File Number 1-33926

TRECORA RESOURCES

(Exact name of registrant as specified in its charter)

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

75-1256622

(I.R.S. Employer

Identification No.)

|

|

1650 Hwy 6 S, Suite 190

Sugar Land, TX

(Address of principal executive offices)

|

77478

(Zip code)

|

Registrant’s telephone number, including area code: (409) 385-8300

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Title of Class Name of exchange on which registered

Common stock, par value $0.10 per share New York Stock Exchange

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☐ Noý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes☐ No ý

_____________________

Indicate by check mark whether the registrant (l) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesý No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesý No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer ☐ Accelerated filer ý

Non-accelerated filer ☐ Smaller reporting company☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes☐ No ý

The aggregate market value on June 30, 2016, of the registrant’s voting securities held by non-affiliates was approximately $173 million.

Number of shares of registrant’s Common Stock, par value $0.10 per share, outstanding as of March 7, 2017 (excluding 254,282 shares of treasury stock): 24,252,564.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the definitive proxy statement for the registrant’s Annual Meeting of Stockholders to be held on or about May 15, 2017.

Item Number and Description

|

|

||

|

1

|

||

|

1

|

||

|

1

|

||

|

3

|

||

|

3

|

||

|

3

|

||

|

4

|

||

|

4

|

||

|

4

|

||

|

7

|

||

|

8

|

||

|

13

|

||

|

13

|

||

|

16

|

||

|

17

|

||

|

|

||

|

18

|

||

|

19

|

||

|

20

|

||

|

21

|

||

|

21

|

||

|

21

|

||

|

26

|

||

|

33

|

||

|

35

|

||

|

37

|

||

|

38

|

||

|

38

|

||

|

38

|

||

|

42

|

||

|

|

||

|

42

|

||

|

42

|

||

|

42

|

||

|

42

|

||

|

42

|

||

|

|

||

|

42

|

||

Trecora Resources (the “Company”) was incorporated in the State of Delaware in 1967. The Company’s principal business activities are the manufacturing of various specialty petrochemical products and synthetic waxes and the provision of custom processing services. Unless the context requires otherwise, references to “we,” “us,” “our,” and the “Company” are intended to mean consolidated Trecora Resources and its subsidiaries.

This document includes the following abbreviations:

|

(1)

|

TREC – Trecora Resources

|

|

(2)

|

TOCCO – Texas Oil & Chemical Co. II, Inc. – Wholly owned subsidiary of TREC and parent of SHR and TC

|

|

(3)

|

SHR – South Hampton Resources, Inc. – Petrochemical segment and parent of GSPL

|

|

(4)

|

GSPL – Gulf State Pipe Line Co, Inc. – Pipeline support for the petrochemical segment

|

|

(5)

|

TC – Trecora Chemical, Inc. – Specialty wax segment

|

|

(6)

|

AMAK – Al Masane Al Kobra Mining Company – Mining equity investment – 33% ownership

|

|

(7)

|

PEVM – Pioche Ely Valley Mines, Inc. – Inactive mine - 55% ownership

|

|

(8)

|

Acquisition – October 1, 2014, purchase of TC

|

On October 1, 2014, TOCCO, a Texas corporation, acquired 100% of the Class A common stock of SSI Chusei, Inc. (“SSI”), a Texas corporation and leading manufacturer of specialty synthetic waxes and custom toll processing services in Pasadena, Texas. On November 15, 2014, SSI’s name was changed to TC.

The Company also owns a 33% interest in AMAK, a Saudi Arabian closed joint stock mining company, which is engaged in the commercial production of copper and zinc concentrates and silver and gold doré. Finally, we have a 55% interest in PEVM, a Nevada mining corporation, which presently does not conduct any substantial business activity but owns undeveloped properties in the United States.

In October 2014 with the completion of the Acquisition, we began operating in two business segments; the manufacturing of various specialty petrochemical products and the manufacturing of specialty synthetic waxes.

Our specialty petrochemical products segment is conducted through SHR, a Texas corporation. SHR owns and operates a specialty petrochemical facility near Silsbee, Texas which produces high purity hydrocarbons and other petroleum based products including isopentane, normal pentane, isohexane and hexane. These products are used in the production of polyethylene, packaging, polypropylene, expandable polystyrene, poly-iso/urethane foams, crude oil from the Canadian tar sands, and in the catalyst support industry. Our petrochemical products are typically transported to customers by rail car, tank truck, iso-container, and by ship. SHR owns all of the capital stock of GSPL, a Texas corporation, which owns and operates pipelines that connect the SHR facility to a natural gas line, to SHR’s truck and rail loading terminal and to a major petroleum products pipeline owned by an unaffiliated third party. SHR also provides custom processing services.

Our specialty synthetic wax segment is conducted through TC, a Texas corporation, located in Pasadena, Texas which produces specialty polyethylene and poly alpha olefin waxes and provides custom processing services. The specialty polyethylene waxes are used in markets from paints and inks to adhesives, coatings, and PVC lubricants. The highly specialized synthetic poly alpha olefin waxes are used in applications such as toner in printers and as additives for candles providing rigidity and retention of fragrances. These waxes are sold in solid form as pastilles or, for large adhesive companies, in bulk liquid form.

SHR’s specialty petrochemical facility is approximately 30 miles north of Beaumont and 90 miles east of Houston. The facility consists of eight operating units which, while interconnected, make distinct products through differing processes: (i) a Penhex Unit; (ii) a Reformer Unit; (iii) a Cyclo-pentane Unit; (iv) an Aromax® Unit; (v) an Aromatics

1

Hydrogenation Unit; (vi) a White Oil Fractionation Unit; (vii) a Hydrocarbon Processing Demonstration Unit and (viii) a P-Xylene Unit. All of these units are currently in operation.

The Penhex Unit currently has the permitted capacity to process approximately 11,000 barrels per day of fresh feed with the Reformer Unit, the Aromax® Unit, and the Cyclo-Pentane Unit further processing streams produced by the Penhex Unit. The Aromatics Hydrogenation Unit has a capacity of approximately 400 barrels per day, and the White Oils Fractionation Unit has a capacity of approximately 3,000 barrels per day. The Hydrocarbon Processing Demonstration Unit has a capacity of approximately 300 gallons per day. The P-Xylene Unit has a capacity of approximately 20,000 pounds per year. The facility generally consists of equipment commonly found in most petrochemical facilities such as fractionation towers and hydrogen treaters except the facility is adapted to produce specialized products that are high purity and very consistent with precise specifications that are utilized in the petrochemical industry as solvents, additives, blowing agents and cooling agents. We produce eight distinct product streams and market several combinations of blends as needed in various customer applications. We do not produce motor fuel products or any other commodity type products commonly sold directly to retail consumers or outlets.

During 2015 we constructed a new unit which is part of the Penhex Unit, D Train, which began production in the fourth quarter of 2015. The D Train expansion increased our capacity by approximately 6,000 barrels per day of fresh feed. Our present total capacity is 13,000 barrels per day of fresh feed; however, we are currently only permitted to process 11,000 barrels per day. Products from the Penhex Unit, Reformer Unit, Aromax® Unit, and Cyclo-pentane Unit are marketed directly to the customer by our marketing personnel. The Penhex Unit had a utilization rate during 2016 of approximately 48% based upon 11,000 barrels per day of capacity. The Penhex Unit had a utilization rate during 2015 of approximately 84% based upon 7,000 barrels per day. The Penhex Unit utilization rate for 2014 was approximately 84% based upon 6,700 barrels per day. Penhex Unit capacity is now configured in three independent process units. The three unit configuration improves reliability by reducing the amount of total down time due to mechanical and other factors.

The Reformer and Aromax® Units are operated as needed to support the Penhex and Cyclo-pentane Units. Consequently, utilization rates of these units are driven by production from the Penhex Unit. Operating utilization rates are affected by product demand, raw material composition, mechanical integrity, and unforeseen natural occurrences, such as weather events. The nature of the petrochemical process demands periodic shut-downs for de-coking and other mechanical repairs.

The Aromatics Hydrogenation Unit, White Oils Fractionation Unit, Hydrocarbon Processing Demonstration Unit and P-Xylene Unit are operated as independent and completely segregated processes. These units are dedicated to the needs of three different toll processing customers. The customers supply and maintain title to the feedstock, we process the feedstock into products based upon customer specifications, and the customers market the products. Products may be sold directly from our storage tanks or transported to the customers’ location for storage and marketing. The units have a combined capacity of approximately 3,400 barrels per day. Together they realized a utilization rate of 26% for 2016, 27% for 2015, and 36% for 2014. The units are operated in accordance with customer needs, and the contracts call for take or pay minimums of production.

In support of the petrochemical operation, we own approximately 100 storage tanks with total capacity approaching 233,000 barrels, and 127 acres of land at the plant site, 92 acres of which are developed. We also own a truck and railroad loading terminal consisting of storage tanks, four rail spurs, and truck and tank car loading facilities on approximately 55 acres of which 25 acres are developed.

We obtain our feedstock requirements from a sole supplier. The agreement is primarily a logistics convenience. The supplier buys or contracts for material and utilizes their tank and pipeline connections to transport into our pipeline. The supplier’s revenue above feed cost is primarily related to the cost and operation of the tank, pipelines, and equipment. A contract was signed in August 2015 with a seven year term with subsequent one year renewals unless cancelled by either party with 180 days’ notice. In 2015 a pipeline connection to the supplier’s dock was added to give alternative means of receiving feedstock. Prior to this addition, all feedstock came from Mont Belvieu, Texas.

As a result of various expansion programs and the toll processing contracts, essentially all of the standing equipment at SHR is operational. We have various surplus equipment stored on-site which may be used in the future to assemble additional processing units as needs arise.

2

GSPL owns and operates three (3) 8-inch diameter pipelines and five (5) 4-inch diameter pipelines aggregating approximately 70 miles in length connecting SHR’s facility to: (1) a natural gas line, (2) SHR’s truck and rail loading terminal and (3) a major petroleum products pipeline system owned by an unaffiliated third party. All pipelines are operated within Texas Railroad Commission and DOT regulations for maintenance and integrity.

We sell our products to predominantly Fortune 500 companies. Products are marketed via personal contact and through continued long term relationships. Sales personnel visit customer facilities regularly and also attend various petrochemical conferences throughout the world. We also have a website with information about our products and services. We utilize either formula based or spot pricing depending upon a customer’s requirements. Under formula pricing the price charged to the customer is based on a formula which includes as a component the average cost of feedstock over the prior month. With this pricing mechanism, product prices move in conjunction with feedstock prices without the necessity of announced price changes. However, because the formulas use an average feedstock price from the prior month, the movement of prices will trail the movement of costs, and formula prices may or may not reflect our actual feedstock cost for the month during which the product is actually sold. In addition, while formula pricing can reduce product margins during periods of increasing feedstock costs, during periods of decreasing feedstock costs formula pricing will follow feed costs down but will retain higher margins during the period by trailing the movement of costs by approximately 30 days. During 2016 and 2015, sales to one customer exceeded 10% of our consolidated revenues. Specifically, in 2016 sales to ExxonMobil and their affiliates represented 20.1% of revenues. In 2015 sales to ExxonMobil and their affiliates also represented 20.1% of revenues. These sales represented multiple products sold to multiple facilities.

TC is a leading manufacturer of specialty synthetic waxes and also provides custom processing services from its 27.5 acre plant located in the heart of the petrochemical industry in Pasadena, Texas. TC provides custom manufacturing, distillation, blending, forming and packaging of finished and intermediate products and wax products for coatings, hot melt adhesives and lubricants. Situated near the Houston Ship Channel, the facility allows for easy access to international shipping and direct loading to rail or truck. The location is within reach of major chemical pipelines and on-site access to a steam pipeline and dedicated hydrogen line create a platform for expansion of both wax production capacity and custom processing capabilities. We manufacture a variety of hard, high melting point, low to medium viscosity polyethylene wax products along with a wide range of other waxes and lubricants. These products are used in a variety of applications including performance additives for hot melt adhesives; penetration and melting point modifiers for paraffin and microcrystalline waxes; lubrication and processing aides for plastics, PVC, rubber; and dry stir-in additives for inks. In oxidized forms, applications also include use in textile emulsions.

TC also provides turnkey custom manufacturing services including quality assurance, transportation and process optimization. The plant has high vacuum distillation capability for the separation of temperature sensitive materials. We have a fully equipped laboratory and pilot plant facility and a highly trained, technically proficient team of engineers and chemists suited to handle the rapid deployment of new custom processes and development of new wax products. TC’s custom manufacturing services provide a range of specialized capabilities to chemical and industrial customer including synthesis, distillation, forming and propoxylation in addition to a number of other chemical processes.

Our only mineral interest in the United States is our 55% ownership interest in an inactive corporation, PEVM. PEVM’s properties include 48 patented and 5 unpatented claims totaling approximately 1,500 acres. All of the claims are located in Lincoln County, NV.

At this time, neither we nor PEVM have plans to develop the mining assets near Pioche, NV. Periodically proposals are received from outside parties who are interested in developing or using certain assets. We do not anticipate making any significant domestic mining capital expenditures.

Matters pertaining to the environment are discussed in Part I, Item 1A. Risk Factors; Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations; and Notes 2 and 15 to the Consolidated Financial Statements.

3

In 1993 during remediation of a small spill area, the Texas Commission on Environmental Quality (TCEQ) required SHR to drill a well to check for groundwater contamination under the spill area. Two pools of hydrocarbons were discovered to be floating on the groundwater at a depth of approximately 25 feet. One pool is under the site of a former gas processing plant owned and operated by Sinclair, Arco and others before its purchase by SHR in 1981. Analysis of the material indicates it entered the ground prior to SHR’s acquisition of the property. The other pool is under the original SHR facility and analysis indicates the material was deposited decades ago. Tests conducted have determined that the hydrocarbons are contained on the property and not migrating in any direction. The recovery process was initiated in June 1998 and approximately $53,000 was spent setting up the system. The recovery is proceeding as planned and is expected to continue for many years until the pools are reduced to acceptable levels. Expenses of recovery and periodic migration testing are being recorded as normal operating expenses. Expenses for future recovery are expected to stabilize and be less per annum than the initial set up cost, although there is no assurance of this effect. The light hydrocarbon recovered from the former gas plant site is compatible with our normal Penhex feedstock and is accumulated and transferred into the Penhex feedstock tank. The material recovered from under the original SHR site is accumulated and sold as a by-product. Approximately 70, 70, and 75 barrels were recovered during 2016, 2015 and 2014, respectively. The recovered material had an economic value of approximately $3,200, $3,500, and $6,700 during 2016, 2015, and 2014, respectively. Consulting engineers estimate that as much as 20,000 barrels of recoverable material may be available to us for use in our process or for sale. At current market values this material, if fully recovered would be worth approximately $1.0 million. The final volume present and the ability to recover it are both highly speculative issues due to the area over which it is spread and the fragmented nature of the pockets of hydrocarbon. We have drilled additional wells periodically to further delineate the boundaries of the pools and to ensure that migration has not taken place. These tests confirmed that no migration of the hydrocarbon pools has occurred. The TCEQ has deemed the current action plan acceptable and reviews the plan on a semi-annual basis.

The number of our regular, U.S. based employees was approximately 310, 296, and 271 for the years ended December 31, 2016, 2015, and 2014, respectively. Of these employees, none are covered by collective bargaining agreements. Regular employees are defined as active executive, management, professional, technical and wage employees who work full time or part time for the Company and are covered by our benefit plans and programs. Our workforce has increased primarily due to expansions at both facilities.

The petrochemical, specialty wax, and mining industries are highly competitive. There is competition within the industries and also with other industries in supplying the chemical and mineral needs of both industrial and individual consumers. We compete with other firms in the sale or purchase of needed goods and services and employ all methods of competition which are lawful and appropriate for such purposes. See further discussion under “Intense competition” in Item 1a.

As of December 31, 2016, we owned a 33% interest in AMAK.

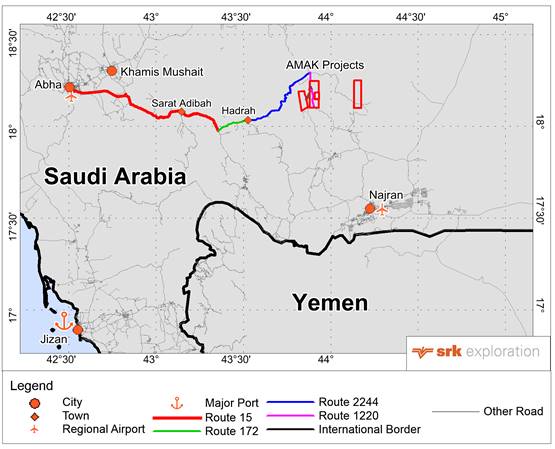

Location, Access and Transportation.

The facility site is located in Najran province in southwestern Saudi Arabia. Najran, the capital of the province of the same name, is approximately 700 km southeast of Jeddah. The site is located 145 km northwest of Najran, midway between the outpost of Rihab and the district town of Sufah. A modern, paved highway extends from Najran through the town of Habuna passing by the project site and on to Sufah. Another modern, paved highway extends west from the town of Tirima about 30 km to the Asir provincial line, becomes a four-lane divided highway, and intersects with a highway leading to Khamis Mushait and Abha. A joining highway then extends down the western slope of the Sarawat mountains to the coastal highway which follows the coast south to the Port of Jazan. The latter is the route AMAK’s trucks carry concentrate to the port for export.

Conditions to Retain Title.

The Saudi government granted the Company a mining lease for the Al Masane area comprising approximately 44 square kilometers or approximately 10,870 acres on May 22, 1993 (the “Lease”) under Royal Decree No. M/17. The Lease was

4

assigned to AMAK in December 2008. The initial term of the Lease is thirty years beginning May 22, 1993, with AMAK having the option to renew or extend the term of the Lease for additional periods not to exceed twenty years. Under the Lease, AMAK is obligated to pay advance surface rental in the amount of 10,000 Saudi riyals (approximately $2,667 at the current exchange rate) per square kilometer per year (approximately $117,300 annually) during the term of the Lease. In addition, AMAK must pay income tax in accordance with the laws of Saudi Arabia and pay all infrastructure costs. The Lease gives the Saudi Arabian government priority to purchase any gold production from the project, as well as, the right to purchase up to 10% of the annual production of other minerals on the same terms and conditions then available to other similar buyers and at current prices then prevailing in the free market. Furthermore, the Lease contains provisions requiring that preferences be given to Saudi Arabian suppliers and contractors, that AMAK employ Saudi Arabian citizens and provide training to Saudi Arabian personnel. In November 2015 AMAK received notification of final approval for additional licenses and leases. The approval includes an additional 151 square kilometers (km2) of territory contiguous to AMAK’s current 44 km2 mine. The new territory comprises the Guyan and Qatan exploration licenses covering 151 km2, and within the Guyan exploration license, a 10 km2 mining lease, which has potential for significant gold recovery. Under the new leases, AMAK is required to pay surface rental of SR 110,000 (approximately $29,333) for a period of 20 years expiring in 2035.

Rock Formations and Mineralization.

Three mineralized zones, the Saadah, Al Houra and Moyeath, have been outlined by diamond drilling. The Saadah and Al Houra zones occur in a volcanic sequence that consists of two mafic-felsic sequences with interbedded exhalative cherts and metasedimentary rocks. The Moyeath zone was discovered after the completion of underground development in 1980. It is located along an angular unconformity with underlying felsic volcanics and shales. The principle sulphide minerals in all of the zones are pyrite, sphalerite, and chalcopyrite. The precious metals occur chiefly in tetrahedrite and as tellurides and electrum.

Description of Current Property Condition.

The AMAK facility includes an underground mine, ore-treatment plant and related infrastructures. The ore-treatment plant is comprised of primary crushing, ore storage, SAG milling and pebble crushing, secondary ball milling, pre-flotation, copper and zinc flotation, concentrate thickening, tailings filtration, cyanide leaching, reagent handling, tailings dam and utilities. Related infrastructure includes a 300 man capacity camp for single status accommodation for expatriates and Saudi Arabian employees, an on-site medical facility, a service building for 300 employees, on-site diesel generation of 10 megawatts, potable water supply primarily from an underground aquifer, sewage treatment plant and an assay laboratory. The facilities at the Port of Jazan are comprised of unloading facilities, concentrate storage and reclamation and ship loading facilities. The above-ground ore processing facility became fully operational during the second half of 2012. Late in the fourth quarter of 2015 AMAK temporarily closed the operation to preserve the assets in the ground while initiating steps to improve efficiencies and optimize operations. AMAK took advantage of this outage to improve the gold and silver recovery process through the installation of SART modifications. This change allows improved precious metal recovery while also lowering chemical use, thereby reducing operating costs once processing resumes. AMAK also upgraded and refurbished other parts of the facility during the outage; therefore it remains in relatively good condition. The plant resumed operation in the fourth quarter of 2016 and is scheduled to be at full operating rates during the second quarter of 2017.

AMAK shipped approximately 16,000, 51,000, and 55,000 metric tons of copper and zinc concentrate to outside smelters during 2016, 2015, and 2014, respectively. In addition, in 2014 AMAK initiated operation of its precious metal recovery circuit at the mill and produced 4.1 kilograms of gold and 115.6 kilograms of silver. In 2015, 46.2 kilograms of gold and 833.6 kilograms of silver were produced. Since the facility was idle until December 2016, no gold or silver was produced in 2016.

Saudi Industrial Development Fund (“SIDF”) Loan and Guarantee

On October 24, 2010, we executed a limited guarantee in favor of the SIDF guaranteeing up to 41% of the SIDF loan to AMAK in the principal amount of 330,000,000 Saudi Riyals (US$88,000,000) (the “Loan”). As a condition of the Loan, SIDF required all shareholders of AMAK to execute personal or corporate guarantees totaling 162.55% of the overall Loan amount. As ownership percentages have changed over time, the loan guarantee allocation has not changed. The other AMAK shareholders provided personal guarantees. We were the only AMAK shareholder providing a corporate guarantee. The loan was required in order for AMAK to fund construction of the underground and above-ground portions of its mining project in southwest Saudi Arabia and to provide working capital for

5

commencement of operations. The SIDF reviewed the current AMAK strategy relating to the shutdown, modifications, and improvements and agreed that it was appropriate.

6

Accounting Treatment of Investment in AMAK.

We have significant influence over the operating and financial policies of AMAK and therefore, account for it using the equity method. One of our directors is chairman of the Nomination, Reward and Compensation Committee of the Board of Directors and is an ex-officio member of the Executive Committee of the Board of Directors of AMAK. One of our directors and officers is Chair of the Audit Committee of the Board of Directors of AMAK. We also have two directors on the Commercial Committee of AMAK. We recently hired a director with extensive mining experience to serve as a third AMAK director representing TREC, and he serves on the investment committee. A new CEO with significant mining experience has recently been hired by AMAK with full support of TREC. He began work at the site in February of 2017. See Note 11 to the Notes to the Consolidated Financial Statements.

We assess our investment in AMAK for impairment when events are identified, or there are changes in circumstances that indicate that the carrying amount of the investment might not be recoverable. We consider recoverable ore reserves, mineral prices, operational costs, and the amount and timing of the cash flows to be generated by the production of those reserves, as well as recent equity transactions within AMAK.

We will provide paper copies of this Annual Report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to those reports, all as filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, free of charge upon written or oral request to Trecora Resources, P. O. Box 1636, Silsbee, TX 77656, (409) 385-8300. These reports are also available free of charge on our website, www.trecora.com, as soon as reasonably practicable after they are filed electronically with the SEC. SHR also has a website at www.southhamptonr.com, TC has a website at TrecChem.com, and AMAK has a website at www.amak.com.sa. These websites and the information contained on or connected to them are not incorporated by reference herein to the SEC filings.

7

Our financial and operating results are subject to a variety of risks inherent in the global petrochemical, specialty wax and mining businesses (due to our investment in AMAK). Many of these risk factors are not within our control and could adversely affect our business, our financial and operating results or our financial condition. We discuss some of these risks in more detail below in no particular order of priority.

Dependence on a limited number of customers could adversely impact profitability

During 2016 sales to one customer exceeded 10 percent of SHR’s revenues. See the information regarding dependence on a limited number of customers set forth in Part I, Item I Business under the caption “United States Specialty Petrochemical Operation”. The total loss of a large volume customer could adversely affect our ability to market products on a competitive basis and generate a profit.

Climate change and greenhouse gas restrictions

Due to concern over the risk of climate change, a number of countries have adopted, or are considering the adoption of, regulatory frameworks to reduce greenhouse gas emissions. These include adoption of cap and trade regimes, carbon taxes, restrictive permitting, increased efficiency standards, and incentives or mandates for renewable energy. These requirements could make our products more expensive, lengthen project implementation times, and reduce demand for hydrocarbons, as well as shift hydrocarbon demand toward relatively lower-carbon sources such as natural gas. Current and pending greenhouse gas regulations may also increase our compliance costs, such as for monitoring or sequestering emissions.

Varying economic conditions could adversely impact demand for products and metals

The demand for our products and metals correlates closely with general economic growth rates. The occurrence of recessions or other periods of low or negative growth will typically have a direct adverse impact on our results. Other factors that affect general economic conditions in the world or in a major region, such as changes in population growth rates or periods of civil unrest, also impact the demand for our products and metals. Economic conditions that impair the functioning of financial markets and institutions also pose risks to us, including risks to the safety of our financial assets and to the ability of our partners and customers to fulfill their commitments to us. In addition, the revenue and profitability of our operations have historically varied, which makes future financial results less predictable. Our revenue, gross margin and profit vary among our products, customer groups and geographic markets; and therefore, will likely be different in future periods than currently. Overall gross margins and profitability in any given period are dependent partially on the product, customer and geographic mix reflected in that period’s net revenue. In addition, newer geographic markets may be relatively less profitable due to investments associated with entering those markets and local pricing pressures. Market trends, competitive pressures, increased raw material or shipping costs, regulatory impacts and other factors may result in reductions in revenue or pressure on gross margins of certain segments in a given period which may necessitate adjustments to our operations.

Environmental regulation

Our industries are subject to extensive environmental regulation pursuant to a variety of federal and state regulations. Such environmental legislation imposes, among other things, restrictions, liabilities and obligations in connection with storage, transportation, treatment and disposal of hazardous substances and waste. Legislation also requires us to operate and maintain our facilities to the satisfaction of applicable regulatory authorities. Costs to comply with these regulations are significant to our business. Failure to comply with these laws or failure to obtain permits may expose us to fines, penalties or interruptions in operations that could be material to our results of operations. In addition, some of the finished goods our customers produce, such as expandable polystyrene (EPS), are subject to increasing scrutiny and regulation, which could lead to a reduction in demand for our products.

Safety, business controls, environmental and cyber risk management

Our results depend upon management’s ability to minimize the inherent risks of our operations, to control effectively our business activities and to minimize the potential for human error. We apply rigorous management systems and continuous focus to workplace safety and to avoid spills or other adverse environmental events. Substantial liabilities and other adverse impacts could result if our systems and controls do not function as intended. Business risks also

8

include the risk of cyber security breaches. If our systems for protecting against cyber security risks prove to be insufficient, we could be adversely affected by having our business systems compromised, our proprietary information altered, lost or stolen, or our business operations disrupted.

The implementation of a new enterprise resource planning system could cause a financial statement error not to be detected

We are in the process of implementing a new enterprise resource planning (“ERP”) system to replace our current system. This is a complex process, and the new system will result in changes to our internal controls over financial reporting, including disclosure controls and procedures. The possibility exists that the migration to the new ERP system could adversely affect the effectiveness of our internal controls over financial reporting.

Regulatory and litigation

Even in countries with well-developed legal systems where we do business, we remain exposed to changes in law that could adversely affect our results, such as increases in taxes, price controls, changes in environmental regulations or other laws that increase our cost of compliance, and government actions to cancel contracts or renegotiate items unilaterally. We may also be adversely affected by the outcome of litigation or other legal proceedings, especially in countries such as the United States in which very large and unpredictable punitive damage awards may occur. AMAK’s mining and exploration leases are subject to the risk of termination if AMAK does not comply with its contractual obligations. Further, our investment in AMAK is subject to the risk of expropriation or nationalization. If a dispute arises, we may have to submit to the jurisdiction of a foreign court or panel or may have to enforce the judgment of a foreign court or panel in that foreign jurisdiction. Because of our substantial international investment, our business is affected by changes in foreign laws and regulations (or interpretation of existing laws and regulations) affecting our industries, and foreign taxation. We will be directly affected by the adoption of rules and regulations (and the interpretations of such rules and regulations) regarding the exploration and development of mineral properties for economic, environmental and other policy reasons. We may be required to make significant capital expenditures to comply with non-U.S. governmental laws and regulations. It is also possible that these laws and regulations may in the future add significantly to our operating costs or may significantly limit our business activities. Additionally, our ability to compete in the international market may be adversely affected by non-U.S. governmental regulations favoring or requiring the awarding of leases, concessions and other contracts or exploration licenses to local contractors or requiring foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. We are not currently aware of any specific situations of this nature, but there are always opportunities for this type of difficulty to arise in the international business environment.

Loss of key personnel and management effectiveness

In order to be successful, we must attract, retain and motivate executives and other key employees including those in managerial, technical, sales, and marketing positions. We must also keep employees focused on our strategies and goals. The failure to hire, or loss of, key employees could have a significant adverse impact on operations. An important component of our competitive performance is our ability to operate efficiently including our ability to manage expenses and minimize the production of low margin products on an on-going basis. This requires continuous management focus including technological improvements, cost control and productivity enhancements. The extent to which we manage these factors will impact our performance relative to competition.

Risk associated with extraordinary transactions

As part of our business strategy, we sometimes engage in discussions with third parties regarding possible investments, acquisitions, strategic alliances, joint ventures, divestitures and outsourcing transactions (“extraordinary transactions”) and enter into agreements relating to such extraordinary transactions in order to further our business objectives. In order to pursue this strategy successfully, we must identify suitable candidates for and successfully complete extraordinary transactions, some of which may be large and complex, and manage post-closing issues such as the integration of acquired companies or employees. Integration and other risks of extraordinary transactions can be more pronounced for larger and more complicated transactions, or if multiple transactions are pursued simultaneously. If we fail to identify and complete successfully extraordinary transactions that further our strategic objectives, we may be required to expend resources to develop products and technology internally, we may be at a competitive disadvantage or we may be adversely affected by negative market perceptions, any of which may have a material adverse effect on our revenue,

9

gross margin and profitability. Integration issues are complex, time-consuming and expensive and, without proper planning and implementation, could significantly disrupt our business. The challenges involved in integration include:

| • |

Combining product offerings and entering into new markets in which we are not experienced;

|

| • |

Convincing customers and distributors that the transaction will not diminish client service standards or business focus, preventing customers and distributors from deferring purchasing decisions or switching to other suppliers (which could result in our incurring additional obligations in order to address customer uncertainty), and coordinating sales, marketing and distribution efforts;

|

| • |

Minimizing the diversion of management attention from ongoing business concerns;

|

| • |

Persuading employees that business cultures are compatible, maintaining employee morale and retaining key employees, engaging with employee works councils representing an acquired company’s non-U.S. employees, integrating employees into the Company, correctly estimating employee benefit costs and implementing restructuring programs;

|

| • |

Coordinating and combining administrative, manufacturing, and other operations, subsidiaries, facilities and relationships with third parties in accordance with local laws and other obligations while maintaining adequate standards, controls and procedures;

|

| • |

Achieving savings from supply chain integration; and

|

| • |

Managing integration issues shortly after or pending the completion of other independent transactions.

|

We periodically evaluate and enter into significant extraordinary transactions on an ongoing basis. We may not fully realize all of the anticipated benefits of any extraordinary transaction, and the timeframe for achieving benefits of an extraordinary transaction may depend partially upon the actions of employees, suppliers or other third parties. In addition, the pricing and other terms of our contracts for extraordinary transactions require us to make estimates and assumptions at the time we enter into these contracts, and, during the course of our due diligence, we may not identify all of the factors necessary to estimate our costs accurately. Any increased or unexpected costs, unanticipated delays or failure to achieve contractual obligations could make these agreements less profitable or unprofitable. Managing extraordinary transactions requires varying levels of management resources, which may divert our attention from other business operations. These extraordinary transactions also have resulted and in the future may result in significant costs and expenses and charges to earnings. Moreover, we have incurred and will incur additional depreciation and amortization expense over the useful lives of certain assets acquired in connection with extraordinary transactions, and, to the extent that the value of goodwill or intangible assets with indefinite lives acquired in connection with an extraordinary transaction becomes impaired, we may be required to incur additional material charges relating to the impairment of those assets. In order to complete an acquisition, we may issue common stock, potentially creating dilution for existing stockholders, or borrow, affecting our financial condition and potentially our credit ratings. Any prior or future downgrades in our credit rating associated with an acquisition could adversely affect our ability to borrow and result in more restrictive borrowing terms. In addition, our effective tax rate on an ongoing basis is uncertain, and extraordinary transactions could impact our effective tax rate. We also may experience risks relating to the challenges and costs of closing an extraordinary transaction and the risk that an announced extraordinary transaction may not close. As a result, any completed, pending or future transactions may contribute to financial results that differ from the investment community’s expectations in a given quarter.

Guaranteeing performance by others including third parties and others

From time to time, we may be required or determine it is advisable to guarantee performance of loan agreements by others in which we maintain a financial interest. In such instances, if the primary obligor is unable to perform its obligations, we might be forced to perform the primary obligor’s obligations which could negatively impact our financial interests.

Economic and political instability; terrorist acts; war and other political unrest

The conflict and hostilities in Yemen could disrupt or interfere with the operations of AMAK whose corporate offices and mining assets are located in Najran province of Saudi Arabia. In addition, the potential for additional future terrorist

10

acts and other recent events, including ISIS terrorist related activities and civil unrest in the Middle East, have caused uncertainty in the world’s financial markets and have significantly increased global political, economic and social instability, including in Saudi Arabia, a country in which we have a substantial investment. It is possible that further acts of terrorism may be directed against the United States domestically or abroad, and such acts of terrorism could be directed against our investment in those locations. Such economic and political uncertainties may materially and adversely affect our business, financial condition or results of operations in ways that cannot be predicted at this time. Although it is impossible to predict the occurrences or consequences of any such events, they could result in a decrease in demand for our products, make it difficult or impossible to deliver products to our customers or to receive components from our suppliers, create delays and inefficiencies in our supply chain and result in the need to impose employee travel restrictions. We are predominantly uninsured for losses and interruptions caused by terrorist acts, conflicts and wars. Our future revenue, gross margin, expenses and financial condition also could suffer due to a variety of international factors, including:

• Ongoing instability or changes in a country’s or region’s economic or political conditions, including inflation, recession, interest rate fluctuations and actual or anticipated military or political conflicts;

• Longer accounts receivable cycles and financial instability among customers;

• Trade regulations and procedures and actions affecting production, pricing and marketing of products;

• Local labor conditions and regulations;

• Geographically dispersed workforce;

• Changes in the regulatory or legal environment;

• Differing technology standards or customer requirements;

• Import, export or other business licensing requirements or requirements relating to making foreign direct investments, which could affect our ability to obtain favorable terms for labor and raw materials or lead to penalties or restrictions;

• Difficulties associated with repatriating cash generated or held abroad in a tax-efficient manner and changes in tax laws; and

• Fluctuations in freight costs and disruptions in the transportation and shipping infrastructure at important geographic points of exit and entry for our products and shipments.

Business disruption

Business disruptions could harm our future revenue and financial condition and increase our costs and expenses. Our operations could be subject to earthquakes, power shortages, telecommunications failures, water shortages, tsunamis, floods, hurricanes, typhoons, fires, extreme weather conditions, medical epidemics and other natural or manmade disasters or business interruptions, for some of which we may be self-insured. The occurrence of any of these business disruptions could harm our revenue and financial condition and increase our costs and expenses.

Dependence on AMAK management

We rely upon AMAK’s management and Board to employ various respected engineering and financial advisors to assist in the development and evaluation of the mining projects in Saudi Arabia. Notwithstanding the utilization of any outside consultants, our risk will continue to and will ultimately depend upon AMAK’s ability to use consultants and experienced personnel to manage the operation in Saudi Arabia.

Inability to control AMAK activities

Although we believe that we have significant influence over the operating and financial policies of AMAK, we do not control AMAK’s activities. The extent to which we are able to influence specific operating and financial decisions depends on our ability to persuade other AMAK board members and management regarding these policies. Our ability

11

to persuade them may be adversely affected by cultural differences, differing accounting and management practices, differing governmental laws and regulations, and the fact that the AMAK mining project is halfway around the world from our main base of operations in the United States.

Inability to recoup investment in AMAK

We will only recover our investment in AMAK through the receipt of dividends from AMAK or the sale of part or all of our interest in AMAK. There is a risk that we will be unable to recover our investment in AMAK if AMAK is not profitable, or if AMAK’s Board of Directors chooses not to declare dividends even if AMAK is profitable. With respect to the sale of part or all of our interest in AMAK, under Saudi Arabian law, AMAK must sell a portion of its equity to the public once AMAK has been profitable for two years. While the proceeds of such a sale might allow us to recover our investment in AMAK, there is no assurance that AMAK will achieve the profitability required for such a public sale, or that the market conditions for any such public sale will be favorable enough to allow us to recover our investment.

AMAK’s inability to provide timely financial information

In the event that AMAK is unable to provide timely, accurate financial information to us, our ability to file reports with the Securities and Exchange Commission within required deadlines could be affected and our standing on the New York Stock Exchange and in the investment community could suffer.

Cancellation of the current mining leases held by AMAK

In the event that the Saudi Ministry of Petroleum and Minerals cancels the current leases, AMAK shareholders including us could lose their investment or be forced to sell for a loss.

AMAK could suffer sustained operational difficulties

Operating difficulties are many and various, ranging from unexpected geological variations that could result in significant ground or containment failure to breakdown of key capital equipment. Reliable roads, rail networks, ports, power generation and transmission, and water supplies are required to access and conduct AMAK’s operations. AMAK transports all of its products first by truck and then by sea. Limitations or interruptions in transport infrastructure could impede its ability to deliver products. Although going forward, operations will be owner-managed, availability of sufficiently skilled operators, engineers, geologists and maintenance technicians in Saudi Arabia can from time to time be severely limited.

AMAK may have fewer mineral reserves than its estimates indicate

AMAK’s reserves estimations may change substantially if new information subsequently becomes available. Fluctuations in the price of commodities, variation in production costs or different recovery rates may ultimately result in AMAK’s estimated reserves being revised. If such a revision were to indicate a substantial reduction in proven or probable reserves at one or more of AMAK’s projects, it could negatively affect our investment in AMAK.

Cost pressures could negatively impact AMAK’s operating margins and expansion plans

Cost pressures may continue to occur across the resources industry. As the prices for AMAK’s products are determined by the global commodity markets in which it operates, AMAK does not generally have the ability to offset these cost pressures through corresponding price increases, which can adversely affect its operating margins or require changes in operations, including, but not limited to, temporary planned shutdowns. Notwithstanding AMAK’s efforts to reduce costs and a number of key cost inputs being commodity price-linked, the inability to reduce costs and a timing lag may adversely impact AMAK’s operating margins for an extended period.

Excess products

As noted previously, an important component of our competitive performance is our ability to minimize the production of low margin products on an on-going basis. Although the hydrocarbon constituents comprising the petrochemical feedstock we use may vary somewhat over time, they tend to fall into relatively narrow percentage bands as compared to overall feedstock composition. By nature of the fractionation process that we utilize, if we make one product, we make them all; therefore, when we receive a significant order for a particular finished product, additional products may be

12

manufactured necessitating sales into secondary, lower margin markets. We continue to investigate options to maintain or improve margins. We are in the process of constructing an advanced reformer unit with a capacity of 4,000 barrels per day which will allow us to upgrade the value of our byproducts in order to maximize margins. The unit is expected to start up in the fourth quarter of 2017.

An impairment of goodwill could negatively impact our financial results

At least annually, we assess goodwill for impairment. If an initial qualitative assessment identifies that it is more likely than not that the carrying value of a reporting unit exceeds its estimated fair value, additional quantitative testing is performed. We may also elect to skip the qualitative testing and proceed directly to quantitative testing. If the quantitative testing indicates that goodwill is impaired, the carrying value of goodwill is written down to fair value with a charge against earnings. Since we utilize a discounted cash flow methodology to calculate the fair value of our operating units, continued weak demand for a specific product line or business could result in an impairment. Accordingly, any determination requiring the write-off of a significant portion of goodwill could negatively impact our results of operations.

None

United States Specialty Petrochemical Facility

SHR owns and operates a specialty petrochemical facility near Silsbee, Texas which is approximately 30 miles north of Beaumont, Texas, and 90 miles east of Houston. The facility consists of eight operating units which, while interconnected, make distinct products through differing processes: (i) a Penhex Unit; (ii) a Reformer; (iii) a Cyclo-pentane Unit; (iv) an Aromax® Unit; (v) an Aromatics Hydrogenation Unit; (vi) a White Oil Fractionation Unit; (vii) a Hydrocarbon Processing Demonstration Unit, and (viii) a P-Xylene Unit. All of these units are currently in operation.

GSPL owns and operates three (3) 8-inch diameter pipelines and five (5) 4-inch diameter pipelines aggregating approximately 70 miles in length connecting SHR’s facility to: (1) a natural gas line, (2) SHR’s truck and rail loading terminal and (3) a major petroleum products pipeline system owned by an unaffiliated third party. All pipelines are operated within Texas Railroad Commission and DOT regulations for maintenance and integrity.

United States Specialty Polyethylene Wax Facility

TC owns and operates a specialty synthetic wax facility from its 27.5 acre plant site located in Pasadena, Texas. After the recent acquisition of the adjacent BASF facility the plant now contains several stainless steel reactors ranging in size from 3,300 to 16,000 gallons with overhead condensing systems, two 4,000 gallon glass line reactors; 5 Sandvik forming belts with pastillating capabilities, five high vacuum wiped film evaporators varying in size from 12 to 20 m2, steel batch column with 10,000 gallon still pot and 20 theoretical stages of structured packing. The plant also now has the ability to crystallize and recover solids from the crystallization process. There are also three fully equipped laboratories onsite. With a base product offering polyethylene waxes, TC is well suited to manage high molecular weight materials that must be managed in the molten state. TC offers pastillating for waxes, polymers and resins, flaking capabilities, as well as solids packaging services.

Investment in AMAK

As of December 31, 2016, we owned a 33% interest in AMAK.

Prior to December 2008, we held a thirty (30) year mining lease (which commenced on May 22, 1993) covering an approximate 44 square kilometer area in Najran Province in southwestern Saudi Arabia. The lease carried an option to renew or extend the term of the lease for additional periods not to exceed twenty (20) years. The lease and other related assets located in Saudi Arabia were contributed to AMAK in December 2008. The above-ground ore processing facility became fully operational during the second half of 2012. Late in the fourth quarter of 2015 AMAK temporarily closed the operation to preserve the assets in the ground while initiating steps to improve efficiencies and optimize operations. AMAK took advantage of this outage to improve the gold and silver recovery process through the installation of SART

13

modifications. This change allows improved precious metal recovery while also lowering chemical use, thereby reducing operating costs once processing resumes. The facility resumed operation in the fourth quarter of 2016 and is scheduled to be at full operating rates during the second quarter of 2017.

AMAK shipped approximately 16,000, 51,000, and 55,000 metric tons of copper and zinc concentrate to outside smelters during 2016, 2015 and 2014, respectively. In addition, in 2014 AMAK initiated operation of its precious metal recovery circuit at the mill and produced 4.1 kilograms of gold and 115.6 kilograms of silver. In 2015, 46.2 kilograms of gold and 833.6 kilograms of silver were produced. Since the facility was idle until December 2016, no gold or silver was produced in 2016.

The facility includes an underground mine, ore-treatment plant and related infrastructures. The ore-treatment plant is comprised of primary crushing, ore storage, SAG milling and pebble crushing, secondary ball milling, pre-flotation, copper and zinc flotation, concentrate thickening, tailings filtration, cyanide leaching, reagent handling, tailings dam and utilities. Related infrastructure includes a 300 men capacity camp for single status accommodation for expatriates and Saudi employees, an on-site medical facility, a service building for 300 employees, on-site diesel generation of 10 megawatts, potable water supply, sewage treatment plant and an assay laboratory. The facilities at the Port of Jazan are comprised of unloading facilities, concentrate storage and reclamation and ship loading facilities.

Metal price assumptions follow U. S. Securities and Exchange Commission guidance not to exceed a three year trailing average. The following chart illustrates the change in metal prices from the previous three year average to current levels:

|

Average Price

|

Spot Price as of

|

Percentage

|

||||||||||

|

For 2014-2016

|

12/31/16

|

Increase (Decrease)

|

||||||||||

|

Gold per ounce

|

$

|

1,224.96

|

$

|

1,159.10

|

(5.38

|

)%

|

||||||

|

Silver per ounce

|

$

|

17.29

|

$

|

16.24

|

(6.07

|

)%

|

||||||

|

Copper per pound

|

$

|

2.60

|

$

|

2.50

|

(3.85

|

)%

|

||||||

|

Zinc per pound

|

$

|

0.94

|

$

|

1.16

|

23.40

|

%

|

||||||

Three mineralized zones, the Saadah, Al Houra and Moyeath, were outlined by initial diamond drilling. The following tables set forth a summary of the diluted recoverable, proven and probable mineralized materials of AMAK in the Al Masane area along with the estimated average grades of these mineralized materials as adjusted to reflect production that began in July 2012:

|

Zone

|

Proven Reserves

(Tonnes)

(000’s)

|

Copper

(%)

|

Zinc

(%)

|

Gold

(g/t) |

Silver

(g/t) |

||||||||||

|

Saadah

|

448

|

1.5

|

3.7

|

0.8

|

21.0

|

||||||||||

|

Al Houra

|

29

|

0.8

|

3.8

|

0.7

|

21.0

|

||||||||||

|

Moyeath

|

-

|

-

|

-

|

-

|

-

|

||||||||||

|

Total

|

477

|

1.4

|

3.7

|

.8

|

21.0

|

||||||||||

|

Zone

|

Probable Reserves

(Tonnes)

(000’s)

|

Copper

(%)

|

Zinc

(%)

|

Gold

(g/t) |

Silver

(g/t) |

||||||||||

|

Saadah

|

5,193

|

1.2

|

3.4

|

0.8

|

23.0

|

||||||||||

|

Al Houra

|

1,894

|

0.9

|

3.8

|

1.2

|

39.0

|

||||||||||

|

Moyeath

|

702

|

0.8

|

7.2

|

1.0

|

55.0

|

||||||||||

|

Total

|

7,789

|

1.1

|

3.9

|

0.9

|

29.0

|

||||||||||

|

Total proven and probable reserves

|

8,266

|

||||||||||||||

|

Less production through December 31, 2016

|

2,371

|

||||||||||||||

|

Remaining proven and probable reserves

|

5,895

|

||||||||||||||

Our rights to obtain additional mining licenses to other adjoining areas were also transferred to AMAK in December 2008 as part of our initial capital contribution. AMAK received formal approval in November 2015 of an additional 151 square kilometers or 37,313 acres of territory relatively close to the current mine. The new territory comprises the

14

Guyan and Qatan exploration licenses covering 151 square kilometers and within the Guyan exploration license, a 10 square kilometers or 2,471 acre mining lease which has potential for significant gold recovery. Although some exploration holes were drilled in both Guyan and Qatan up to 40 years ago, no reserves are attributable to these areas. Exploration activities were restarted in both of these areas during 2016, and results are being evaluated.

For purposes of calculating proven and probable mineralized materials, a dilution of 5% at zero grade on the Saadah zone and 15% at zero grade on the Al Houra and Moyeath zones was assumed. A mining recovery of 80% was used for the Saadah zone and 88% for the Al Houra and Moyeath zones. Mining dilution is the amount of wallrack adjacent to the ore body that is included in the ore extraction process. Base case cutoffs used were 5.0% zinc equivalent. Ore reserves were estimated using metal prices of USD $0.85 per pound for zinc, $2.50 per pound for copper, $800 per ounce for gold and $12.0 per ounce for silver. Resource estimates are exclusive of reserve estimates.

Historic three-year average commodity prices are shown in the following table:

|

Average Price in USD

|

||||||||||||

|

2012-2014

|

2013-2015

|

2014-2016

|

||||||||||

|

Gold per ounce

|

$

|

1,448.33

|

$

|

1,278.98

|

$

|

1,224.96

|

||||||

|

Silver per ounce

|

$

|

24.67

|

$

|

19.53

|

$

|

17.29

|

||||||

|

Copper per pound

|

$

|

3.25

|

$

|

2.98

|

$

|

2.60

|

||||||

|

Zinc per pound

|

$

|

0.88

|

$

|

0.91

|

$

|

0.94

|

||||||

Proven mineralized materials are those mineral deposits for which quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes, and grade is computed from results of detailed sampling. For ore deposits to be proven, the sites for inspection, sampling and measurement must be spaced so closely and the geologic character must be so well defined that the size, shape, depth and mineral content of reserves are well established. Probable mineralized materials are those for which quantity and grade are computed from information similar to that used for proven mineralized materials, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. However, the degree of assurance, although lower than that for proven mineralized materials, must be high enough to assume continuity between points of observation.

The metallurgical studies conducted on the ore samples taken from the zones indicated that 87.7% of the copper and 82.6% of the zinc could be recovered in copper and zinc concentrates. Overall, gold and silver recovery from the ore was estimated to be 77.3% and 81.3%, respectively, partly into copper concentrate and partly as bullion through cyanide processing of zinc concentrates and mine tailings. Further studies recommended by consultants may improve those recoveries and thus the potential profitability of the project; however, there can be no assurances of this effect.

In the 1994 feasibility study the geologists and engineers stated that there is potential to find more reserves within the Lease area, as the ore zones are all open at depth. Further diamond drilling is required to quantify the additional mineralization associated with these zones. An extensive underground and surface diamond drilling exploration program commenced in late 2016. A significant feature of the Al Masane ore zones is that they tend to have a much greater vertical plunge than strike length; relatively small surface exposures such as the Moyeath zone may be developed into sizeable ore tonnages by thorough and systematic exploration. Similarly, systematic prospecting of the small surface indicators of mineralization in the area could yield significant tonnages of new ore. Updates to the feasibility study were completed in 1996, 2005 and July 2009.

An updated reserve study or audit has not been performed over the last three years. AMAK has contracted with SRK Consulting to provide an update on reserves which is scheduled to be completed during the second quarter of 2017.

15

The following table sets forth tonnage mined with average assay values per year:

|

Year

|

Mine Head Grade

|

Mill Throughput

|

||||||||||

|

%Cu

|

%Zn

|

dmt

|

||||||||||

|

2011

|

1.26

|

3.02

|

9,460

|

|||||||||

|

2012

|

1.18

|

3.39

|

399,892

|

|||||||||

|

2013

|

1.48

|

3.19

|

699,316

|

|||||||||

|

2014

|

1.22

|

3.15

|

670,812

|

|||||||||

|

2015

|

1.11

|

3.69

|

591,419

|

|||||||||

|

2016

|

-

|

-

|

-

|

|||||||||

The following table sets forth tonnage milled with average assay values and metallurgical recoveries per year:

|

Year

|

Copper Concentrate

|

Zinc Concentrate

|

||||||||||||||||||||||||||||||

|

dmt

|

%Cu

|

%Zn

|

Recovery

|

dmt

|

%Zn

|

%Cu

|

Recovery

|

|||||||||||||||||||||||||

|

2011

|

443

|

16.51

|

7.51

|

61.64

|

377

|

40.69

|

3.56

|

53.64

|

||||||||||||||||||||||||

|

2012

|

15,944

|

23.91

|

5.46

|

80.62

|

20,738

|

50.03

|

1.16

|

76.54

|

||||||||||||||||||||||||

|

2013

|

35,140

|

25.20

|

4.73

|

85.68

|

33,460

|

49.82

|

0.83

|

74.62

|

||||||||||||||||||||||||

|

2014

|

28,476

|

24.20

|

4.31

|

84.24

|

31,600

|

51.02

|

0.70

|

76.26

|

||||||||||||||||||||||||

|

2015

|

24,218

|

22.70

|

5.13

|

84.12

|

35,447

|

48.46

|

0.62

|

78.63

|

||||||||||||||||||||||||

|

2016

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||||||||

The following table sets forth tonnage sold with concentrate assay values and value received per year:

|

Year

|

Copper Concentrate

|

Zinc Concentrate

|

||||||||||||||||||||||

|

dmt

|

%Cu

|

Value received

(in USD millions)

|

dmt

|

%Zn

|

Value received

(in USD millions)

|

|||||||||||||||||||

|

2011

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||

|

2012

|

5,488

|

23.51

|

$

|

6.9

|

15,193

|

47.53

|

$

|

8.7

|

||||||||||||||||

|

2013

|

35,908

|

23.86

|

$

|

80.8

|

38,430

|

47.79

|

$

|

24.2

|

||||||||||||||||

|

2014

|

25,691

|

24.20

|

$

|

42.3

|

29,326

|

50.52

|

$

|

21.0

|

||||||||||||||||

|

2015

|

26,378

|

23.50

|

$

|

34.6

|

24,547

|

49.68

|

$

|

16.0

|

||||||||||||||||

|

2016

|

-

|

-

|

-

|

15,845

|

48.28

|

$

|

9.5

|

|||||||||||||||||

United States Mineral Interest

Our only mineral interest in the United States is its ownership interest in PEVM. See Item 1 – Business – United States Mineral Interests.

Offices

Outside of the facilities that we own, SHR has a leased corporate and sales office in Sugar Land, Texas.

On March 21, 2011, Mr. El Khalidi filed suit against the Company in Texas alleging breach of contract and other claims. The 88th Judicial District Court of Hardin County, Texas dismissed all claims and counterclaims for want of prosecution in this matter on July 24, 2013. The Ninth Court of Appeals subsequently affirmed the dismissal for want of prosecution and the Supreme Court of Texas denied Mr. El Khalidi’s petition for review. On May 1, 2014, Mr. El Khalidi refiled his lawsuit against the Company for breach of contract and defamation in the 356th Judicial District Court of Hardin County, Texas. The case was transferred to the 88th Judicial District Court of Hardin County, Texas. On September 1, 2016, the Court dismissed all of Mr. El Khalidi’s claims and causes of action with prejudice. Mr. El Khalidi has filed a notice of appeal. Liabilities of approximately $1.0 million remain recorded, and the options will continue to accrue in accordance with their own terms until all matters are resolved.

On April 30, 2015, TC and TREC received notice of a lawsuit filed in the 152nd Judicial District Court of Harris County, Texas. The suit alleges that the plaintiff, an independent contractor employee, was injured while working on a

16

product line at TC. On March 31, 2016, plaintiff agreed to settle all claims against TC and TREC for an insignificant amount.

On or about August 3, 2015, SHR received notice of a lawsuit filed in the 14th Judicial District Court of Calcasieu Parish, Louisiana. The suit alleges that the plaintiff became ill from exposure to benzene. SHR placed its insurers on notice. Its insurers retained a law firm based in Louisiana to defend SHR.

On or about March 18, 2016, SHR received notice of a lawsuit filed in the 172nd Judicial District Court of Jefferson County, Texas. The suit alleges that the plaintiff became ill from exposure to benzene. SHR placed its insurers on notice. Its insurers retained a law firm based in Texas to defend SHR.

On or about August 2, 2016, SHR received notice of a lawsuit filed in the 58th Judicial District Court of Jefferson County, Texas. The suit alleges that the plaintiff became ill from exposure to benzene. SHR placed its insurers on notice. Its insurers retained a law firm based in Texas to defend SHR.

On or about November 5, 2016, SHR received notice of a lawsuit filed in the 172nd Judicial District Court of Jefferson County, Texas. The suit alleges that the plaintiff became ill from exposure to benzene. SHR placed its insurers on notice. Its insurers retained a law firm based in Texas to defend SHR.

Not applicable.

17

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities.

Our common stock traded on the New York Stock Exchange (“NYSE”) during the last two fiscal years under the symbol “TREC”. The following table sets forth the high and low bid prices for each quarter as reported by NYSE. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

|

NYSE

|

||||||||

|

High

|

Low

|

|||||||

|

Fiscal Year Ended December 31, 2016

|

||||||||

|

Fourth Quarter ended December 31, 2016

|

$

|

14.55

|

$

|

9.75

|

||||

|

Third Quarter ended September 30, 2016

|

$

|

11.74

|

$

|

9.81

|

||||

|

Second Quarter ended June 30, 2016

|

$

|

12.03

|

$

|

8.17

|

||||

|

First Quarter ended March 31, 2016

|

$

|

12.33

|

$

|

8.75

|

||||

|

Fiscal Year Ended December 31, 2015

|

||||||||

|

Fourth Quarter ended December 31, 2015

|

$

|

14.96

|

$

|

11.79

|

||||

|

Third Quarter ended September 30, 2015

|

$

|

16.50

|

$

|

11.50

|

||||

|

Second Quarter ended June 30, 2015

|

$

|

15.48

|

$

|

11.00

|

||||

|

First Quarter ended March 31, 2015

|

$

|

15.25

|

$

|

11.36

|

||||

At March 7, 2017, there were approximately 381 recorded holders (including brokers’ accounts) of the Company’s common stock. We have not paid any dividends since our inception and, at this time, do not have any plans to pay dividends in the foreseeable future. The current lender allows the petrochemical subsidiaries to pay dividends to the parent company of up to 30% of EBITDA. We were in compliance with this restriction as of December 31, 2016. See Note 13 to the Consolidated Financial Statements.

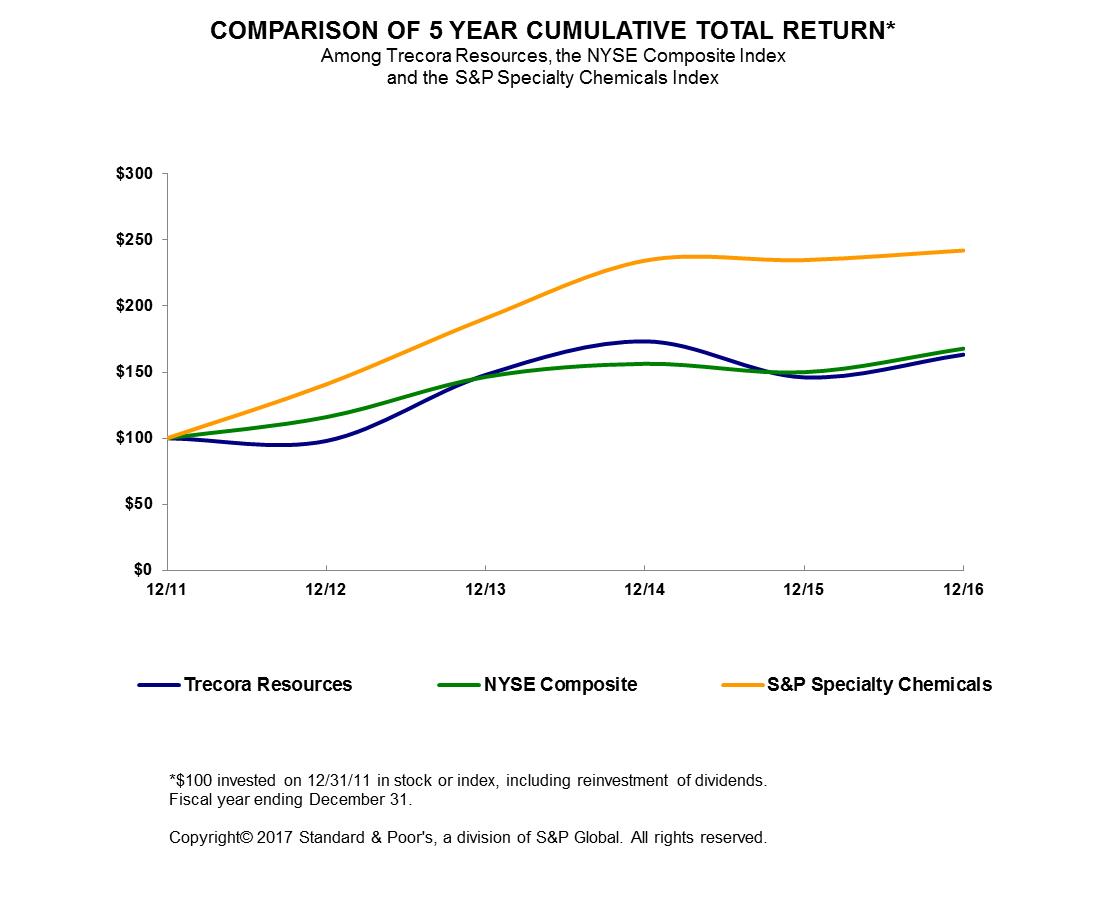

Total Stockholder Return

The following graph compares the cumulative total stockholder return on our common stock against the NYSE Composite Index and the S&P Specialty Chemical Index, for the five years ending December 31, 2016. The graph was constructed on the assumption that $100 was invested in our common stock and each comparative on December 31, 2011, and that any dividends were fully reinvested.

18