UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

___________________

FORM

10-K

(MARK ONE)

|

ý

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

For

The Fiscal Year Ended December 31, 2007

OR

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

For

The Transition Period from ___________ to ________

Commission

File Number 0-6247

|

___________________

ARABIAN

AMERICAN DEVELOPMENT COMPANY

(Exact name of registrant as

specified in its charter)

|

Delaware

(State

or other jurisdiction of incorporation or organization)

|

75-1256622

(I.R.S.

Employer

Identification

No.)

|

|

10830

North Central Expressway Suite 175

Dallas,

Texas

(Address

of principal executive offices)

|

75231

(Zip

code)

|

Registrant’s

telephone number, including area code: (214) 692-7872

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

(Title

of Class)

Common

stock, par value $0.10 per share

___________________

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes¨ Noý

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes¨ No ý

_____________________

Indicate

by check mark whether the registrant (l) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yesý No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ý

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of

“accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange

Act. (Check one):

Large

accelerated filer ¨ Accelerated

filer ý Non-accelerated

filer ¨

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes¨ No ý

The

aggregate market value on June 30, 2007 of the registrant’s voting securities

held by non-affiliates was $115,533,425.

Number of

shares of registrant’s Common Stock, par value $0.10 per share, outstanding as

of March 6, 2008: 23,431,995.

DOCUMENTS

INCORPORATED BY REFERENCE

No

documents are incorporated by reference into this report.

TABLE

OF CONTENTS`

Item

Number and Description

|

PART

I

|

||||

|

ITEM

1. BUSINESS

|

||||

|

General

|

1 | |||

|

International

Operations

|

2 | |||

|

Competition

|

5 | |||

|

Environmental

Matters

|

7 | |||

|

Personnel

|

8 | |||

|

Available

Information

|

8 | |||

|

ITEM

1A. RISK FACTORS

|

8 | |||

|

ITEM

1B. UNRESOLVED STAFF COMMENTS

|

11 | |||

|

ITEM

2. PROPERTIES

|

||||

|

United

States Specialty Products Facility

|

11 | |||

|

Mexico

Specialty Products Facility

|

13 | |||

|

Saudi

Arabia Mining Properties

|

13 | |||

|

United

States Mineral Interests

|

19 | |||

|

Offices

|

19 | |||

|

ITEM

3. LEGAL PROCEEDINGS

|

21 | |||

|

ITEM

4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY

HOLDERS

|

22 | |||

|

PART

II

|

||||

|

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY AND

RELATED SHAREHOLDER

MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES

|

23 | |||

|

ITEM

6. SELECTED FINANCIAL DATA

|

24 | |||

|

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND

RESULTS

OF OPERATION

|

||||

|

General

|

24 | |||

|

Liquidity

and Capital Resources

|

24 | |||

|

Results

of Operations

|

27 | |||

|

Critical

Accounting Policies

|

31 | |||

|

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK

|

33 | |||

|

ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY

DATA

|

34 | |||

|

ITEM

9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING

AND

FINANCIAL DISCLOSURE

|

34 | |||

|

ITEM

9A. CONTROLS AND PROCEDURES

|

34 | |||

|

ITEM

9B. OTHER INFORMATION

|

35 | |||

|

PART

III

|

||||

|

ITEM

10. DIRECTORS AND EXECUTIVE OFFICERS OF THE

REGISTRANT

|

36 | |||

|

ITEM

11. EXECUTIVE COMPENSATION

|

37 | |||

|

ITEM

12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS

AND

MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

41 | |||

|

ITEM

13. CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS

|

43 | |||

|

ITEM

14. PRINCIPAL ACCOUNTING FEES AND

SERVICES

|

43 | |||

|

PART

IV

|

||||

|

ITEM

15. EXHIBITS, FINANCIAL STATEMENT

SCHEDULES

|

45 | |||

PART

I

ITEM

1. Business.

General

Arabian

American Development Company (the “Company”) was organized as a Delaware

corporation in 1967. The Company’s principal business activities include

manufacturing various specialty petrochemical products and developing mineral

properties in Saudi Arabia and the United States.

United States Activities. The

Company’s domestic activities are primarily conducted through a wholly owned

subsidiary, American Shield Refining Company (the “Petrochemical Company”),

which owns all of the capital stock of Texas Oil and Chemical Co. II, Inc.

(“TOCCO”). TOCCO owns all of the capital stock of South Hampton Resources Inc.

(“South Hampton”), and South Hampton owns all of the capital stock of Gulf State

Pipe Line Company, Inc. (“Gulf State”). South Hampton owns and operates a

specialty petrochemical facility near Silsbee, Texas which produces high purity

petrochemical solvents and other petroleum based products. Gulf State owns and

operates three pipelines which connect the South Hampton facility to a natural

gas line, to South Hampton’s truck and rail loading terminal and to a major

petroleum products pipeline owned by an unaffiliated third party. The

Company also directly owns approximately 55% of the capital stock of a Nevada

mining company, Pioche-Ely Valley Mines, Inc. (“Pioche”). Pioche does

not conduct any substantial business activities. See Item 2.

Properties.

Saudi Arabia Activities. The

Company holds a thirty (30) year mining lease (which commenced on May 22, 1993)

covering an approximate 44 square kilometer area in the Al Masane area in

southwestern Saudi Arabia. The Company has the option to renew or extend the

term of the lease for additional periods not to exceed twenty (20)

years.

In 1999,

the Company applied for an exploration license covering an area of approximately

2,850 square kilometers surrounding the mining lease area, where it has

previously explored with the written permission of the Saudi Ministry of

Petroleum and Mineral Resources. In 2005 the Saudi Mining Code was

changed which necessitated the re-submission of these applications and the

re-submission is being prepared in the format required by the new

Code.

Mexico Activities. TOCCO

owned until June 2005 approximately 93% of the issued and outstanding shares of

common stock of Productos Quimicos Coin, S.A. de. C.V. (“Coin”), a specialty

petrochemical company. The facility is located in Coatzacoalcos, on the Yucatan

Peninsula. The facility was transferred, and the stock in the

corporation was sold in May and June, 2005, respectively.

See Item 2. Properties for

additional discussions regarding all of the Company’s properties and financing

of the Al Masane project.

Note 16 to the Consolidated

Financial Statements contains information regarding the Company’s

industry segments and geographic financial information for the years ended

December 31, 2007, 2006 and 2005. In addition, see Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations for a

discussion of the Company’s liquidity, capital resources and operating

results.

1

International

Operations

A

substantial portion of the Company’s mineral properties and related interests is

located in Saudi Arabia. Specific and known risks are discussed in detail in

this report; however, the Company’s international operations involve additional

general risks not usually associated with domestic operations, any of which

could have a material and adverse affect on the Company’s business, financial

condition or results of operations, including a heightened risk of the

following:

Economic and Political Instability;

Terrorist Acts; War and Other Political Unrest. The U.S. military action

in Iraq, the terrorist attacks that took place in the United States on September

11, 2001, the potential for additional future terrorist acts and other recent

events have caused uncertainty in the world’s financial markets and have

significantly increased global political, economic and social instability,

including in Saudi Arabia, a country in which the Company has substantial

interests and operations. It is possible that further acts of terrorism may be

directed against the United States domestically or abroad, and such acts of

terrorism could be directed against the properties and personnel of companies

such as the Company. The Company’s operations in Saudi Arabia and elsewhere

could be further adversely affected by post-war conditions in Iraq if armed

hostilities, acts of terrorism or other unrest persist. Recent acts of terrorism

and threats of armed conflicts elsewhere in the Middle East could also limit or

disrupt the Company’s operations.

War and

other political unrest also may cause unforeseen delays in the development of

the Company’s mineral properties and related interests located in Saudi Arabia

and may pose a direct security risk to such interests and

operations.

Such

economic and political uncertainties may materially and adversely affect the

Company’s business, financial condition or results of operations in ways that

cannot be predicted at this time.

Terrorist

acts, conflicts and wars may seriously harm our business and revenue, costs and

expenses and financial condition and stock price. Terrorist acts, conflicts or

wars (wherever located around the world) may cause damage or disruption to the

Company, its employees, facilities, partners, suppliers, distributors, resellers

or customers. The potential for future attacks, the national and international

responses to attacks or perceived threats to national security, and other actual

or potential conflicts or wars, including the ongoing military operations in

Iraq, have created many economic and political uncertainties. Although it is

impossible to predict the occurrences or consequences of any such events, they

could result in a decrease in demand for our products, make it difficult or

impossible to deliver products to our customers or to receive components from

our suppliers, create delays and inefficiencies in our supply chain and result

in the need to impose employee travel restrictions. The Company is predominantly

uninsured for losses and interruptions caused by terrorist acts, conflicts and

wars. The Company’s future revenue, gross margin, expenses and financial

condition also could suffer due to a variety of international factors,

including:

|

|

•

|

ongoing

instability or changes in a country’s or region’s economic or political

conditions, including inflation, recession, interest rate fluctuations and

actual or anticipated military or political

conflicts;

|

• longer

accounts receivable cycles and financial instability among

customers;

2

|

|

•

|

trade

regulations and procedures and actions affecting production, pricing and

marketing of products;

|

• local

labor conditions and regulations;

• geographically

dispersed workforce;

• changes

in the regulatory or legal environment;

• differing

technology standards or customer requirements;

|

|

•

|

import,

export or other business licensing requirements or requirements relating

to making foreign direct investments, which could affect our ability to

obtain favorable terms for labor and raw materials or lead to penalties or

restrictions;

|

|

|

•

|

difficulties

associated with repatriating cash generated or held abroad in a

tax-efficient manner and changes in tax laws;

and

|

|

|

•

|

fluctuations

in freight costs and disruptions in the transportation and shipping

infrastructure at important geographic points of exit and entry for our

products and shipments.

|

Currency

variations also contribute to variations in sales of products and services in

impacted jurisdictions. In addition, currency variations can adversely affect

margins on sales of the Company’s products in countries outside of the United

States.

Business

disruptions could harm the Company’s future revenue and financial condition and

increase its costs and expenses. The Company’s operations could be subject to

earthquakes, power shortages, telecommunications failures, water shortages,

tsunamis, floods, hurricanes, typhoons, fires, extreme weather conditions,

medical epidemics and other natural or manmade disasters or business

interruptions, for some of which the Company may be self-insured. The occurrence

of any of these business disruptions could harm the Company’s revenue and

financial condition and increase its costs and expenses.

Termination of Mining Lease;

Expropriation or Nationalization of Assets. The Company’s mining lease

for the Al Masane area in Saudi Arabia is subject to the risk of termination if

the Company does not comply with its contractual obligations. See Item 2. Properties. Further,

the Company’s foreign assets are subject to the risk of expropriation or

nationalization. If a dispute arises, the Company may have to submit to the

jurisdiction of a foreign court or panel or may have to enforce the judgment of

a foreign court or panel in that foreign jurisdiction.

Compliance with Foreign Laws.

Because of the Company’s substantial international operations, its business is

affected by changes in foreign laws and regulations (or interpretation of

existing laws and regulations) affecting both the mining and petrochemical

industries, and foreign taxation. The Company will be directly affected by the

adoption of rules and regulations (and the interpretations of such rules and

regulations) regarding the exploration and development of mineral properties for

economic, environmental and other policy reasons. The Company may be required to

make

3

significant

capital expenditures to comply with non-U.S. governmental laws and

regulations. It is also possible that these laws and regulations may

in the future add significantly to the Company’s operating costs or may

significantly limit its business activities. Additionally, the Company’s ability

to compete in the international market may be adversely affected by non-U.S.

governmental regulations favoring or requiring the awarding of leases,

concessions and other contracts or exploration licenses to local contractors or

requiring foreign contractors to employ citizens of, or purchase supplies from,

a particular jurisdiction. The Company is not currently aware of any

specific situations of this nature, but there is always opportunity for this

type of difficulty to arise in the international business

environment.

Mining Management

Risks. The Company’s management and Board of Directors have

many years of experience in the exploration for, and development of, mineral

prospects in various parts of the world. The members of the Board

are:

Mr. Hatem El Khalidi,

who holds a MSc. Degree in Geology from Michigan State University, is also a

consultant in oil and mineral exploration. He has served as President

of the Company since 1975 and Chief Executive Officer of the Company since

February 1994. Mr. El Khalidi originally discovered the Al Masane

deposits, and development has been under his direct supervision throughout the

life of the project. Mr. El Khalidi’s current term expires in

2010;

Mr. Ghazi Sultan, a

Saudi citizen, holds a MSc. Degree in Geology from the University of

Texas. Mr. Sultan served as the Saudi Deputy Minister of Petroleum

and Mineral Resources 1965-1988 and was responsible for the massive expansion of

the mineral resources section of the Ministry. Mr. Sultan is a member of the

Audit, Nominating, and Compensation Committees of the Company. Mr.

Sultan’s current term expires in 2010;

Mr. Nicholas Carter,

the Company’s Executive Vice President and Chief Operating Officer, is a

graduate of Lamar University with a BBA Degree in Accounting, is a CPA, and has

extensive experience in the management of the Company’s petrochemical

segment. His employment in the petrochemical business predates the

acquisition by the Company in 1987. Mr. Carter was appointed to the Board on

April 27, 2006. Mr. Carter’s current term expires in

2008. Mr. Carter also serves as a Director and President of Pioche

Ely Valley Mines, Inc. of which the Company owns 55% of the outstanding

stock;

Mr. Robert E. Kennedy

was appointed to the Board on January 15, 2007 and has extensive experience in

the petrochemical industry including over 30 years service with Gulf Oil and

Chevron Chemical. In 1989, while helping form the International

Business Development Group for Chevron Chemical, he was involved in the

development of a major installation in Saudi Arabia which came on stream in

1999. Mr. Kennedy is a member of the Company’s Audit, Compensation,

and Nominating Committees. Mr. Kennedy’s current term expires in

2009;

Dr. Ibrahim Al Moneef

was appointed to the Board on April 26, 2007. Dr. Al Moneef holds a

PhD in Business Administration from the University of Indiana. He

currently is owner and chief editor of The Manager Monthly Magazine,

a Saudi business journal. He has held key positions with companies doing

business in the Kingdom, including the Mawarid Group, the Ace Group, and the

Saudi Consolidated Electric Company. Dr. Al Moneef serves on the Compensation

and Nominating Committees, and his current term expires in 2009. Dr.

Al Moneef was a member of the Audit Committee until February 21, 2008, when he

tendered his resignation.

Mr. Mohammed O. Al Omair

was appointed to the Board on October 23, 2007. Mr. Al

Omair resides in Riyadh, Saudi Arabia and is currently serving as Senior Vice

President & Deputy Chief Executive Officer for FAL Holdings Arabia Co.

Ltd. He holds a BA Degree in Political Science and a Master of Public

Administration from the University of Washington. Mr. Al Omair served

on

4

the

Board of ARSD from 1993 until 2005 when he resigned for personal

reasons. Mr. Al Omair is a member of the Audit, Compensation, and

Nominating Committees. Mr. Al Omair’s current term expires in

2008;

Mr. Charles W. Goehringer,

Jr. was appointed to the Board on October 23, 2007. Mr. Goehringer is an

attorney with the law firm of Germer Gertz, LLP in Beaumont, Texas with more

than 12 years experience and currently serves as corporate counsel for

ARSD. He also worked in industry as an engineer for over 15

years. Mr. Goehringer holds a BS Degree in Mechanical Engineering

from Lamar University, a Master of Business Administration from Colorado

University, and a Doctor of Jurisprudence from South Texas College of

Law. Mr. Goehringer is a member of the Compensation and Nominating

Committees, and his current term expires in 2008. Mr. Goehringer was a member of

the Audit Committee until February 20, 2008, when he tendered his

resignation. Mr. Goehringer also serves as a Director and Vice

President of Pioche Ely Valley Mines, Inc. of which the Company owns 55% of the

outstanding stock;

Ms. Connie Cook was

appointed as Secretary/Treasurer of the Company on January 15, 2008. Ms. Cook is

a graduate of Lamar University with a BBA Degree in Accounting, is a CPA, and

has served as Controller for South Hampton for the last 11 years.

Neither

management nor Board members have personally operated a mine on a day to day

basis, nor have they marketed the product of a mining operation. The

Company has from time to time employed various respected engineering and

financial advisors to assist in the development and evaluation of the mining

projects. The consultants most currently used to update the

feasibility of the Al Masane project are SNC-Lavalin of Toronto,

Canada. The Company also uses the services of Adrian Molinari of

Toronto, Canada for ongoing guidance. The Company believes that with

the use of competent consultants and with the hiring of experienced personnel by

Al Masane Al Kobra Mining Company (ALAK), a Saudi Arabian joint stock company,

in which the Company holds a fifty percent ownership interest, the mining

venture is being established and operated in a professional and successful

manner. The amount of risk will ultimately depend upon the Company’s

and ALAK’s ability to use consultants and experienced personnel to manage the

operation.

Other Difficulties and Risks

Associated with International Operations. The Company also may experience

difficulty in managing and staffing operations across international borders,

particularly in remote locations. Additional risks associated with the Company’s

international operations, any of which could disrupt the Company’s operations,

include changing political conditions, foreign and domestic monetary policies,

international economics, world metal price fluctuations, foreign currency

fluctuations, foreign taxation, foreign exchange restrictions, trade protective

measures and tariffs. The establishment of ALAK, with its own

management and staff should assist in mitigating many of these potential

risks.

Competition

The

Company competes in both the petrochemical and mining industries. Accordingly,

the Company is subject to intense competition among a large number of companies,

both larger and smaller than the Company, many of which have financial

capability, facilities, personnel and other resources greater than the Company.

In the specialty products and solvents markets, the Petrochemical Company has

one principal competitor. Generally, favorable economic conditions have resulted

in strong demand for its specialty products and solvents.

5

All of

the Petrochemical Company’s raw materials are purchased on the open

market. The Company has contracts in place for approximately

two-thirds of its monthly supply and purchases the remainder on the spot market

depending on inventory and operational needs. The contracts are

priced upon monthly averages of posted market prices with the remainder being a

function of spot market oil and gas prices. The price of the

feedstock utilized by the Company historically carries an 88% correlation to

crude oil prices but is not as volatile on a day to day basis.

Because

of the following factors, as well as other variables affecting our operating

results, past financial performance may not be a reliable indicator of future

performance, and historical trends should not be used to anticipate results or

trends in future periods. The Company encounters aggressive

competition from numerous and varied competitors in all areas of its business,

and competitors may target the Company’s key market segments. The Company

competes primarily on the basis of performance, price, quality, reliability,

reputation, distribution, service, and account relationships. If the Company’s

products, services, support and cost structure do not enable it to compete

successfully based on any of those criteria, the Company’s operations, results

and prospects could be harmed. The Company has a portfolio of

businesses and must allocate resources across these businesses while competing

with companies that specialize in one or more of these product lines. As a

result, the Company may invest less in certain areas of its businesses than

competitors do, and these competitors may have greater financial, technical and

marketing resources available to them than the Company’s businesses that compete

against them. Industry consolidation also may affect competition by creating

larger, more homogeneous and potentially stronger competitors in the markets in

which the Company competes, and competitors also may affect the Company’s

business by entering into exclusive arrangements with existing or potential

customers or suppliers. The Company may have to continue to lower the prices of

many of its products and services to stay competitive, while at the same time

trying to maintain or improve revenue and gross margin.

If the

Company cannot continue to develop, manufacture and market products and services

that meet customer requirements, its revenue and gross margin may suffer. The

Company must make long-term investments and commit significant resources before

knowing whether its predictions will accurately reflect customer demand for

products and services. After the Company develops a product, it must be able to

manufacture appropriate volumes quickly and at competitive costs. In the course

of conducting business, the Company must adequately address quality issues

associated with its products and services. In order to address quality issues,

the Company works extensively with its customers and suppliers to determine the

cause of the problem and to determine appropriate solutions. However, the

Company may have limited ability to control quality issues. If the Company is

unable to determine the cause or find an appropriate solution it may delay

shipment to customers, which would delay revenue recognition and could adversely

affect the Company’s revenue and reported results. Finding solutions to quality

issues can be expensive, adversely affecting Company profits. If new or existing

customers have difficulty utilizing the Company’s products, its operating

margins could be adversely affected, and it could face possible claims if the

Company fails to meet its customers’ expectations. In addition, quality issues

can impair the Company’s relationships with new or existing customers and

adversely affect its reputation, which could have a material adverse effect on

operating results.

Economic

uncertainty could affect adversely the Company’s revenue, gross margin and

expenses. The Company’s revenue and gross margin depend significantly on general

economic conditions and the demand for products in the markets in which it

competes. Future economic

6

weakness

may result in decreased revenue, gross margin, earnings or growth rates and

problems with the Company’s ability to manage inventory levels and collect

customer receivables. The Company could experience such economic weakness and

reduced spending due to the effects of high fuel costs. In addition, future

customer financial difficulties could result in increases in bad debt write-offs

and additions to reserves in the Company’s receivables portfolio. The Company

also has experienced, and may experience in the future, gross margin declines in

certain businesses, reflecting the effect of items such as competitive pricing

pressures, inventory write-downs, charges associated with the cancellation of

planned production line expansion, and increases in pension and post-retirement

benefit expenses. Economic downturns also may lead to restructuring actions and

associated expenses. Uncertainty about future economic conditions makes it

difficult for the Company to forecast operating results and to make decisions

about future investments.

Environmental

Matters

In 1993,

during remediation of a small spill area, the Texas Commission on Environmental

Quality (TCEQ) required South Hampton to drill a well to check for groundwater

contamination under the spill area. Two pools of hydrocarbons were discovered to

be floating on the groundwater at a depth of approximately 25 feet. One pool is

under the site of a former gas processing plant owned and operated by Sinclair,

Arco and others before its purchase by South Hampton in 1981. Analysis of the

material indicates it entered the ground prior to South Hampton’s acquisition of

the property. The other pool is under the original South Hampton

facility and analysis indicates the material was deposited decades ago. Tests

conducted have determined that the hydrocarbons are contained on the property

and not migrating in any direction. The recovery process was initiated in June

1998 and approximately $53,000 was spent setting up the system. The recovery is

proceeding as planned and is expected to continue for several years until the

pools are reduced to acceptable levels. Expenses of recovery and periodic

migration testing are being recorded as normal operating expenses. Expenses for

future recovery are expected to stabilize and be less per annum than the initial

set up cost, although there is no assurance of this effect.

The light

hydrocarbon recovered from the former gas plant site is compatible with the

normal Penhex feedstock and is accumulated and transferred into the Penhex

feedstock tank. The material recovered from under the original South

Hampton site is accumulated and sold as a by-product. Approximately

457 barrels were recovered during 2006 and 503 barrels during

2007. The recovered material had an economic value of approximately

$29,550 during 2006 and $40,000 during 2007. Consulting engineers

estimate that as much as 20,000 barrels of recoverable material may be available

to South Hampton for use in its process or for sale, but no reduction has been

made in the accrual for remediation costs due to the uncertainties relating to

the recovery process. At current market values this material, if fully recovered

would be worth approximately $1.7 million. The final volume present and the

ability to recover it are both highly speculative issues due to the area over

which it is spread and the fragmented nature of the pockets of

hydrocarbon.

South

Hampton has drilled additional wells periodically to further delineate the

boundaries of the pools and to ensure that migration has not taken place. These

tests confirmed that no migration of the hydrocarbon pools has

occurred. The TCEQ has deemed the current action plan acceptable and

reviews the plan on a semi-annual basis.

In other

remediation activity, South Hampton investigated a potential chemical dump site

on the facility property relating to ownership by Arco in the 1950’s. The

investigation indicated no further

7

action

is required and the site was closed in November of 2007. The Company

also continues to remediate the site of a pipeline leak which occurred in 2001.

The affected site contains less than one-eighth acre of land and the cost of

remediation is being covered by insurance. The amount of material spilled was

minimal and due to the nature of the soil and location, further remediation will

rely on natural attenuation. The Company has applied to the Texas

Railroad Commission for approval to consider the site closed if two years of

annual monitoring indicate no movement of hydrocarbon. Also, see

Item 3. Legal

Proceedings.

The Clean

Air Act Amendments of 1990 have had a positive effect on the Petrochemical

Company’s business as manufacturers search for ways to use more environmentally

acceptable materials in their processes. There is a current trend among

manufacturers toward the use of lighter and more recoverable C5 hydrocarbons

(pentanes) which comprise a large part of the Petrochemical Company’s product

line. Management believes its ability to manufacture high quality solvents in

the C5 hydrocarbon market will provide a basis for growth over the coming

years. Also, as the use of C6 solvents is phased out in parts

of the industry, several manufacturers of such solvents have opted to no longer

market those products. As the number of producers has consolidated,

the Company has increased its market share at higher sales prices from customers

who still require C6 solvents in their business. Also, see Item

2. Properties.

Personnel

Mr. Hatem

El Khalidi, a US citizen and the Company’s President and Chief Executive Officer

splits his time between the US and Saudi Arabia. Mr. El Khalidi

supervises the Company’s 20 mining segment employees in Saudi Arabia, consisting

of the office personnel and field crews who are primarily charged with

maintaining and caring for the facilities and equipment located at the mine

site. Mr. El Khalidi also serves as a Director of ALAK.

Mr.

Nicholas Carter, Executive Vice President and Chief Operating Officer of the

Company and President of the Petrochemical Segment, resides in southeast Texas,

and is a US citizen. The Petrochemical Company employs 150 persons.

Ms.

Connie Cook, Secretary/Treasurer of the Company and Controller of the

petrochemical companies resides in southeast Texas, and is a US

citizen.

Available

Information

The

Company will provide paper copies of this Annual Report on Form 10-K, its

quarterly reports on Form 10-Q, its current reports on Form 8-K and amendments

to those reports, all as filed or furnished pursuant to Section 13(a) or 15(d)

of the Securities Exchange Act of 1934, free of charge upon written or oral

request to Arabian American Development Company, P. O. Box 1636, Silsbee,

TX 77656, (409) 385-8300. The Company’s website address is

arabianamericandev.com. The petrochemical subsidiary, South Hampton

Resources, Inc. has a website at southhamptonrefining.com.

ITEM

1A. Risk

Factors.

The

Company’s use of single source suppliers for certain raw materials could create

supply issues. Replacing a single source supplier could delay production of some

products as replacement suppliers initially may be subject to capacity

constraints or other output limitations.

8

The

loss of a single source supplier, the deterioration of the Company’s

relationship with a single source supplier, or any unilateral modification to

the contractual terms under which the Company is supplied raw materials by a

single source supplier could adversely affect the Company’s revenue and gross

margins.

The

revenue and profitability of the Company’s operations have historically varied,

which makes its future financial results less predictable. The Company’s

revenue, gross margin and profit vary among its products, customer groups and

geographic markets and therefore will likely be different in future periods than

currently. Overall gross margins and profitability in any given period are

dependent partially on the product, customer and geographic mix reflected in

that period’s net revenue. In addition, newer geographic markets may be

relatively less profitable due to investments associated with entering those

markets and local pricing pressures. Market trends, competitive pressures,

increased raw material or shipping costs, regulatory impacts and other factors

may result in reductions in revenue or pressure on gross margins of certain

segments in a given period, which may necessitate adjustments to the Company’s

operations.

Unanticipated

changes in the Company’s tax provisions or exposure to additional income tax

liabilities could affect its profitability. The Company is currently subject to

income taxes in the United States.

In order

to be successful, the Company must attract, retain and motivate executives and

other key employees, including those in managerial, technical, sales, and

marketing positions. The Company also must keep employees focused on the

Company’s strategies and goals. The failure to hire or loss of key employees

could have a significant impact on the Company’s operations.

The

Company’s stock price, like that of other companies, can be volatile. Some of

the factors that can affect its stock price are:

|

|

•

|

speculation

in the press or investment community about, or actual changes in, our

executive team, strategic position, business, organizational structure,

operations, financial condition, financial reporting and results,

effectiveness of cost cutting efforts, prospects or extraordinary

transactions;

|

|

|

•

|

announcements

of new products, services, technological innovations or acquisitions by

the Company or competitors; and

|

|

|

•

|

quarterly

increases or decreases in revenue, gross margin or earnings, changes in

estimates by the investment community or guidance provided by the Company,

and variations between actual and estimated financial

results.

|

General

or industry-specific market conditions or stock market performance or domestic

or international macroeconomic and geopolitical factors unrelated to the

Company’s performance also may affect the price of the Company’s common stock.

For these reasons, investors should not rely on recent trends to predict future

stock prices, financial condition, results of operations or cash flows. In

addition, following periods of volatility in a company’s securities, securities

class action litigation against a company is sometimes instituted. If instituted

against the Company, this type of litigation, while insured against monetary

awards and defense cost, could result in substantial diversion of management

time and resources.

9

As part

of the Company’s business strategy, it sometimes engages in discussions with

third parties regarding possible investments, acquisitions, strategic alliances,

joint ventures, divestitures and outsourcing transactions (‘‘extraordinary

transactions’’) and enters into agreements relating to such extraordinary

transactions in order to further our business objectives. In order to pursue

this strategy successfully, the Company must identify suitable candidates for

and successfully complete extraordinary transactions, some of which may be large

and complex, and manage post-closing issues such as the integration of acquired

companies or employees. Integration and other risks of extraordinary

transactions can be more pronounced for larger and more complicated

transactions, or if multiple transactions are pursued simultaneously. If the

Company fails to identify and complete successfully extraordinary transactions

that further its strategic objectives, it may be required to expend resources to

develop products and technology internally, it may be at a competitive

disadvantage or it may be adversely affected by negative market perceptions, any

of which may have a material adverse effect on the Company’s revenue, gross

margin and profitability. Integration issues are complex, time-consuming and

expensive and, without proper planning and implementation, could significantly

disrupt the Company’s business. The challenges involved in integration

include:

|

|

•

|

combining

product offerings and entering into new markets in which the Company is

not experienced;

|

|

|

•

|

convincing

customers and distributors that the transaction will not diminish client

service standards or business focus, preventing customers and distributors

from deferring purchasing decisions or switching to other suppliers (which

could result in our incurring additional obligations in order to address

customer uncertainty), and coordinating sales, marketing and distribution

efforts;

|

|

|

•

|

minimizing

the diversion of management attention from ongoing business

concerns;

|

|

|

•

|

persuading

employees that business cultures are compatible, maintaining employee

morale and retaining key employees, engaging with employee works councils

representing an acquired company’s non-U.S. employees, integrating

employees into the Company, correctly estimating employee benefit costs

and implementing restructuring

programs;

|

|

|

•

|

coordinating

and combining administrative, manufacturing, and other operations,

subsidiaries, facilities and relationships with third parties in

accordance with local laws and other obligations while maintaining

adequate standards, controls and

procedures;

|

• achieving

savings from supply chain integration; and

|

|

•

|

managing

integration issues shortly after or pending the completion of other

independent transactions.

|

The

Company periodically evaluates and enters into significant extraordinary

transactions on an ongoing basis. The Company may not fully realize all of the

anticipated benefits of any

10

extraordinary

transaction, and the timeframe for achieving benefits of an extraordinary

transaction may depend partially upon the actions of employees, suppliers or

other third parties. In addition, the pricing and other terms of the Company’s

contracts for extraordinary transactions require it to make estimates and

assumptions at the time it enters into these contracts, and, during the course

of its due diligence, the Company may not identify all of the factors necessary

to estimate its costs accurately. Any increased or unexpected costs,

unanticipated delays or failure to achieve contractual obligations could make

these agreements less profitable or unprofitable. Managing extraordinary

transactions requires varying levels of management resources, which may divert

the Company’s attention from other business operations. These extraordinary

transactions also have resulted and in the future may result in significant

costs and expenses and charges to earnings. Moreover, the Company has incurred

and will incur additional depreciation and amortization expense over the useful

lives of certain assets acquired in connection with extraordinary transactions,

and, to the extent that the value of goodwill or intangible assets with

indefinite lives acquired in connection with an extraordinary transaction

becomes impaired, the Company may be required to incur additional material

charges relating to the impairment of those assets. In order to complete an

acquisition, the Company may issue common stock, potentially creating dilution

for existing stockholders, or borrow, affecting the Company’s financial

condition and potentially its credit ratings. Any prior or future downgrades in

the Company’s credit rating associated with an acquisition could adversely

affect its ability to borrow and result in more restrictive borrowing terms. In

addition, the Company’s effective tax rate on an ongoing basis is uncertain, and

extraordinary transactions could impact its effective tax rate. The Company also

may experience risks relating to the challenges and costs of closing an

extraordinary transaction and the risk that an announced extraordinary

transaction may not close. As a result, any completed, pending or future

transactions may contribute to financial results that differ from the investment

community’s expectations in a given quarter.

ITEM

1B. Unresolved Staff

Comments.

None

ITEM

2. Properties.

United

States Specialty Products Facility

South

Hampton owns and operates a specialty petrochemical facility near Silsbee, Texas

which is approximately 30 miles north of Beaumont, Texas, and 90 miles east of

Houston. The facility presently consists of six operating units which, while

interconnected, make distinct products through differing processes: (i) a Penhex

Unit; (ii) a Reformer; (iii) a Cyclo-pentane Unit; (iv) an Aromax® Unit; (v) an

Aromatics Hydrogenation Unit; and (vi) a White Oil Fractionation Unit. All of

these units are currently in operation.

The

Penhex Unit processes approximately 3,000 barrels per day of fresh feed, with

the Reforming Unit, the Aromax® Unit, and the Cyclo-Pentane Unit further

processing streams produced by the Penhex Unit. The Aromatics

Hydrogenation Unit has a capacity of approximately 400 barrels per day, and the

White Oils Fractionation Unit has a capacity of approximately 3,000 barrels per

day. The facility generally consists of equipment commonly found in

most petroleum facilities such as fractionation towers and hydrogen treaters

except the facility is adapted to produce specialized products that are high

purity, very consistent, precise specification materials utilized in the

petrochemical industry as solvents, additives, blowing agents and cooling

agents. South Hampton

11

produces

eight distinct product streams and markets several combinations of blends as

needed in various customers’ applications. South Hampton does not

produce motor fuel products or any other commodity type products commonly sold

directly to retail consumers or outlets.

The

products from the Penhex Unit, Reformer, Aromax® Unit, and Cyclo-pentane Unit

are marketed directly to the customer by South Hampton marketing

personnel. The Penhex Unit had a utilization rate during 2007 of

approximately 91%. This compares to a rate of 87% for

2006. The Reformer and Aromax® units are operated as needed to

support the Penhex and Cyclo-pentane Units. Consequently, utilization

rates of these units are driven by production from the Penhex

Unit. Operating utilization rates are affected by product demand,

mechanical integrity, and unforeseen natural occurrences, such as weather

events. The nature of the refining process demands periodic

shut-downs for de-coking and other mechanical repairs. In 2007, there

were mechanical shut-downs resulting in approximately 12 total days of lost

production and another 6 days due to weather or other uncontrollable

issues. If these items are considered, utilization would have been

approximately 96% of capacity. In 2006, the comparable figures were

15 mechanical related, 6 weather related, and 93% utilization. In

2005 the adjusted utilization rate would have been 96%

The other

two operating units at the plant site, an Aromatics Hydrogenation Unit and a

White Oils Fractionation Unit, are operated as two, independent and completely

segregated processes. These units are dedicated to the needs of two

different toll processing customers. The customers supply and

maintain title to the feedstock, South Hampton processes the feedstock into

products based upon customer specifications, and the customers market the

products. Products may be sold directly from South Hampton’s storage

tanks or transported to the customers’ location for storage and

marketing. As of October 2005, after the expansion program, the units

have a combined capacity of 3,400 BPD. Together they realized a utilization rate

48% for 2006 and 58% for 2007. The units are operated in accordance

with customer needs, and the contracts call for take or pay minimums of

production.

To meet

market demand, South Hampton increased the capacity of the Penhex Unit by 30% in

March 2005. Equipment was purchased in late 2004 and a construction

permit was issued by TCEQ in late January 2005. Expansion was

accomplished primarily by the addition of two larger fractionation towers and

rearrangement of existing equipment. The expanded capacity was put

into service and fully operational by the end of the first quarter

2005. Additionally, South Hampton signed an agreement in late January

2005 with one of the toll processing customers calling for an expansion of the

White Oils Fractionation Unit by October 2005. Capacity was to be doubled to a

minimum of 2,000 BPD and final test runs indicated actual capacity to be

approximately 3,000 BPD. The expansion was completed within contract

terms and operation of the expanded facility began in October 2005. In the

summer of 2006, the Aromatics Hydrogenation Unit was modified to produce two

products in addition to that of the original design. Rotating the

three separate products through production should keep the unit operating

steadily throughout the year.

In March

2007 the Board of Directors approved the expansion of the South Hampton Penhex

unit. The total cost of the project will be approximately $12.0

million and the capacity will be increased from 3,000 barrels per day to

approximately 6,000 barrels per day. The Company immediately began

acquiring equipment and ordering items, such as instrumentation, pumps, and

compressors which require a long lead time for delivery. The project

consists of an additional fractionation train identical to the current design,

and will also entail the expansion of the Aromax, reformer, and Cyclo-pentane

units to support the increased volumes. Construction work began in

the fall of 2007, with the initial focus being the infrastructure required to

support the increased operation, such as

12

pipe

racks, electrical capacity increases, fire water line extensions, water well

modifications, etc. The final permit to construct was received from

the TCEQ on February 28, 2008, and foundation work for the primary equipment

started on that date. Final completion is expected to be towards the

end of the second quarter of 2008, which is approximately two months later than

originally projected due to delays in the permitting process. For additional

information see Note 7 to the

Consolidated Financial Statements.

South

Hampton, in support of the petrochemical operation, owns approximately 69

storage tanks with total capacity approaching 225,000 barrels, and 106 acres of

land at the plant site, 55 acres of which are developed. South

Hampton also owns a truck and railroad loading terminal consisting of storage

tanks, four rail spurs, and truck and tank car loading facilities on

approximately 53 acres, of which 13 acres are developed.

As a

result of various expansion programs and the toll processing contracts,

essentially all of the standing equipment at South Hampton is operational. South

Hampton has various surplus equipment stored on-site which may be used in the

future to assemble additional processing units as needs arise.

Gulf

State owns and operates three (3) 8-inch diameter pipelines aggregating

approximately 50 miles in length connecting South Hampton’s facility to: (1) a

natural gas line, (2) South Hampton’s truck and rail loading terminal and (3) a

major petroleum products pipeline system owned by an unaffiliated third

party. All pipelines are operated within Texas Railroad Commission

and DOT regulations for maintenance and integrity.

Mexico

Specialty Products Facility, Coatzacoalcos, Mexico

As

discussed in Note 21 to the

Consolidated Financial Statements, in February 2004, a creditor initiated

mortgage foreclosure proceedings against Coin which resulted in a court ordered

award of Coin’s plant facilities to the creditor. The Company knew

that Coin had a history of legal and credit problems when it was purchased in

early 2000 and intended to negotiate and resolve the issues outstanding after

acquisition, but found the legal system in Mexico to be cumbersome and

inflexible. The Company pursued all available remedies at law to

prevent or delay such legal action, but in May of 2005 negotiated a settlement

whereby title to the facility was signed over to the new owner in return for a

minor amount of cash and relief from certain liabilities. As a result,

management recorded the loss on the foreclosure of the facility with a charge to

consolidated operations of $2,900,964 during the fourth quarter of

2004. The Company then sold the stock in the corporation to another

Mexican entity and recorded a gain of $5,825,668 in June of

2005. There are no further liabilities or relationships with the Coin

facility, the Mexican government, or the new owners.

Saudi

Arabia Mining Properties

Al

Masane Project

Location, Access and

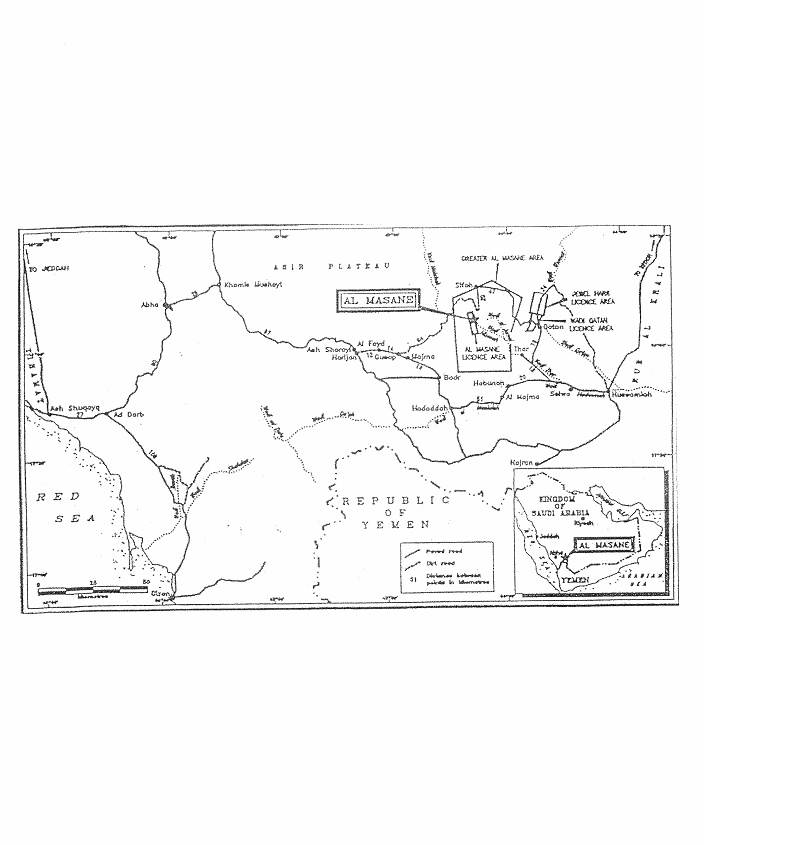

Transportation. The Al Masane project consists of a mining

lease area of approximately 44 square kilometers in southwestern Saudi Arabia

approximately 640 km southeast of Jeddah. Reference is made to the

map on page 20 of this Report for information concerning the location of the Al

Masane project. Presently, the site can be accessed by heavy trucks

via the 20 kilometer improved asphalt and gravel road from Sifah. The elevation

of the Al Masane project is

13

approximately

1,620 meters above sea level. Najran is the major town located in the

area and is serviced by air from Jeddah and Riyadh. Access from the

town of Najran to the project site is 130 km by a paved road to which continues

to Sifah. There are scheduled flights from Jeddah to Abha and

Najran. From the west, there is paved road between Abha and Gusap,

and then a dirt road to the site.

Conditions to Retain

Title. The Saudi government granted the Company a mining lease

for the Al Masane area on May 22, 1993. As holder of the Al Masane

mining lease, the Company is solely responsible to the Saudi Arabian government

for rental payments and other obligations required by the mining lease and

repayment of an $11 million loan. The Company’s interpretation of the mining

lease is that repayment of this loan will be made in accordance with a repayment

schedule to be agreed upon with the Saudi Arabian government from the Company’s

share of the project’s cash flows. The initial term of the lease is for a period

of thirty (30) years beginning May 22, 1993, with the Company having the option

to renew or extend the term of the lease for additional periods not to exceed

twenty (20) years. Under the lease, the Company is obligated to pay advance

surface rental in the amount of 10,000 Saudi riyals (approximately $2,667 at the

current exchange rate) per square kilometer per year (approximately $117,350

annually) during the period of the lease. The Company, in accordance with the

agreement with the Ministry, paid $266,000 of the back payments on January 3,

2005, and the remaining $320,000 on December 27, 2005. Additionally,

the Company paid $234,700 in March 2006, $117,300 in February 2007, and $117,300

in February 2008 which pays the lease amounts in full through the end of 2008.

In addition, the Company must pay income tax in accordance with the laws of

Saudi Arabia then in force and pay all infrastructure costs. The Saudi Arabian

Mining Code provides that income tax is to be paid yearly at the rate of 20%

commencing immediately upon realization of profits. The lease gives the Saudi

Arabian government priority to purchase any gold production from the project as

well as the right to purchase up to 10% of the annual production of other

minerals on the same terms and conditions then available to other similar buyers

and at current prices then prevailing in the free market. Furthermore, the lease

contains provisions requiring that preferences be given to Saudi Arabian

suppliers and contractors, that the Company employ Saudi Arabian citizens and

provide training to Saudi Arabian personnel.

History of Previous

Operations. The Al Masane project contains extensive ancient

mineral workings and smelters which were discovered by Hatem El Khalidi,

President and CEO of the Company while flying over the area and later mapped by

him on camel back during 1967. From ancient inscriptions in the area, it is

believed that mining activities occurred sporadically from 1000 BC to 700 AD.

The ancients are believed to have extracted mainly gold, silver and

copper. Various regional investigations of the Al Masane area were

carried out by the United States Geological Survey (USGS)

mission. The first systematic mapping was by Brown and Jackson who

published the Geologic Map of the Asir Quadrangle in 1959, and Greenwood carried

out reconnaissance mapping in 1974 of the Wadi Malahah quadrangle, which

includes Al Masane. Conway undertook geologic mapping of the area in

1976. Beginning in 1972, the Company undertook various geological,

geophysical, and geochemical surveys which lead to the discovery of the ore

lenses. In 1975, Robertson Research International (“RRI”)

reviewed the exploration program completed by the Company, prepared a

preliminary economic evaluation on the deposit and recommended ongoing

development. In 1977, the Company retained Watts, Griffis and McOuat

Limited of Toronto, Canada (WGM) to study the deposits and an underground

development program was recommended to define the tonnage and grade of the

deposit. By September 1980 a permanent exploration camp including

water supply and power plant was

14

established. In

April 1981 WGM completed a program of 3,700 meters of underground access and

development using trackless mining equipment and 25,000 meters of underground

diamond drilling and 20,000 meters of surface drilling (“Phase

I”). Bulk underground metallurgical samples were taken, and pilot

plant test work was conducted at the Colorado School of Mines Research to

confirm the laboratory test work completed previously by Lakefield Research in

Canada on the drill core. This work was financed primarily with the

$11 million interest-free loan from the Saudi Arabian Ministry of

Finance. Continued surface prospecting in the immediate area by the

Company led to the discovery of the Moyeath zone in late

1980. Although the surface expression of the gossans1 was small,

preliminary diamond drilling indicated a significant massive sulphide deposit at

depth. Between 1982 and 1987, infill diamond drilling was conducted

on the Al Houra and Moyeath deposits which expanded the ore

reserves. In addition, a number of studies relating to water supply

for the project were completed. Environmental studies for the project

were completed by independent consultants in 1995 as part of the bankable feasibility

studies.

Description of Current Property

Condition. In 1982 WGM concluded that sufficient ore reserves

were established to justify completion of a fully bankable feasibility study to

determine the economic potential of establishing a commercial mining and ore

treatment operation at Al Masane. WGM determined that the Al Masane deposits

would support commercial production of copper, zinc, gold and silver and

recommended implementation of Phase II of the Al Masane development program,

which included construction of underground mining, ore treatment and support

facilities. WGM’s September 1984 reevaluation of the project resulted in no

substantial changes of its initial conclusions and

recommendations. In 1993, the Company commissioned WGM to prepare a

new fully bankable feasibility study to be used to obtain financing for

commercial development of the project. The study, which was completed in 1994,

contained specific recommendations to insure that project construction was

accomplished expeditiously and economically. The engineering design and costing

portions of the study were performed by Davy International of Toronto, Canada

(“Davy”). WGM and Davy updated this study in 1996. WGM recommended

that the Al Masane reserves be mined by underground methods using trackless

mining equipment. Once the raw ore is mined, it would be subjected to a grinding

and treating process resulting in three products to be delivered to smelters for

further refining. These products are zinc concentrate, copper concentrate and

Dore2 bullion. The

copper and zinc concentrates also contain valuable amounts of gold and silver.

These concentrates and the Dore bullion to be produced from the proposed

cyanidization plant are estimated to be 22,000 ounces of gold and 800,000 ounces

of silver and will be sold to copper and zinc custom smelters and refineries

worldwide. After the smelter refining process, the metals could be sold by the

Company or the smelter for the Company’s account in the open

market. As recommended by WGM, the source of power for the Al Masane

site will be from diesel powered generators until such time as the site is

connected to the national power grid, which is presently 20 km from the

site.

In the

1994 feasibility study, WGM stated that there is potential to find more reserves

within the lease area, as the ore zones are all open at depth. Further diamond

drilling is required to quantify the additional mineralization associated with

these zones. A significant feature of the Al Masane ore zones is that they tend

to have a much greater vertical plunge than strike length;

relatively

|

1

|

“Gossan”

means the rust colored oxidized, capping or staining of a mineral deposit,

generally formed by the oxidation or alteration of iron

sulphide.

|

|

2

|

“Dore”

means unrefined gold and silver bullion bars consisting of approximately

90% precious metals which will be further refined to almost pure

metal.

|

15

small

surface exposures such as the Moyeath zone may be developed into sizeable ore

tonnages by thorough and systematic exploration. Similarly, systematic

prospecting of the small gossans in the area could yield significant tonnages of

new ore. The 1996 update showed the estimated capital cost to bring

the project into operation to be $89 million. At a production rate of 700,000

tons per year, the operating cost of the project (excluding concentrate freight,

ship loading, smelter charges, depreciation, interest and taxes) was estimated

to be $38.49 per ton of ore milled. The feasibility study was updated

in August of 2005, by SNC-Lavalin, Engineers and Constructors, Inc. of Toronto,

Canada using the field work and conclusions of the previous

studies. No design work or field work was performed, but the update

was designed to apply current costs and metal prices to the existing

work. The 2005 update indicates the current capital cost to be

approximately $116 million with an additional $7 million needed for the addition

of a Gold Recovery Circuit (GRC). The updated operating costs are

estimated to be $53.37 per ton of ore milled, without the GRC, or $60.01 with

the GRC.

Metal

prices were at record lows worldwide during 2003, and therefore, mining projects

were not economically feasible. As prices have recovered for the

2005-2007 time period, the project becomes economically viable. If

spot prices as of December 28, 2007, are used in the analysis, or even the ten

year average of prices is used, the project becomes very economically

attractive. Mining economics, as with other capital intensive

extractive industries such as offshore petroleum exploration, will vary over

time as market prices rise and fall with worldwide economic

performance.

The

following chart illustrates the change from the previous three year average to

current levels:

|

Average

Price

|

Spot

Price as of

|

Percentage

|

||||

|

For 2005-2007

|

12/28/07

|

Increase (Decrease)

|

||||

|

Gold

|

$568.67

per ounce

|

$833.75

per ounce

|

46.61 | % | ||

|

Silver

|

$

10.74 per ounce

|

$

14.76 per ounce

|

37.43 | % | ||

|

Copper

|

$ 3.10

per pound

|

$ 3.08 per

pound

|

(00.65 | %) | ||

|

Zinc

|

$ 1.19

per pound

|

$ 1.04 per

pound

|

(12.61 | %) | ||

Other

than a base camp with accompanying facilities and equipment, as well as 3,700

meters of underground access and water wells completed by WGM in April 1981,

there has been no other significant infrastructure development by the Company at

the Al Masane project. As noted above, the estimated total capital

cost to bring the Al Masane project into production is $116 million. See Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations for a further

discussion of these matters.

Pursuant

to the mining lease agreement, when the Al Masane project is profitable the

Company was obligated to form a Saudi public stock company with the Saudi

Arabian Mining Company, a corporation wholly owned by the Saudi Arabian

government (“Ma’aden”), as successor to and assignee of the mining interests

formerly held by the Petroleum Mineral Organization (“Petromin”). Ma’aden is the

Saudi Arabian government’s official mining company. In 1994, the Company

received instructions from the Saudi Ministry of Petroleum and Mineral Resources

stating that it is possible for the Company to form a Saudi company without

Petromin (now Ma’aden), but the sale of stock to the Saudi public could not

occur until the mine’s commercial operations were profitable for at least two

years. The instructions added that Petromin (now Ma’aden) still had the right to

purchase shares in the Saudi joint stock company any time it desires. Title to

the mining lease and the other obligations specified in the mining lease would

be transferred to the Saudi joint stock company. According to the terms of the

lease agreement the

16

Company

would remain responsible for repaying the $11 million loan to the Saudi Arabian

government. However, the Company believes that ultimate resolution of

the note may be open to negotiation and intends to approach the subject with the

Ministry of the Treasury at the appropriate time.

The

Company and eight Saudi investors formed a Saudi joint stock company under the

name Al Masane Al Kobra Mining Company (ALAK) and received a commercial license

from the Ministry of Commerce in January 2008. The Company's mining lease will

be transferred to ALAK and ALAK will build the mining and treatment facilities,

and operate the mine. The basic terms of agreement forming ALAK are as

follows: (1) the capitalization will be the amount necessary to develop the

project, approximately $120 million, (2) the Company will own 50% of ALAK with

the remainder being held by the Saudi investors, (3) the Company will

contribute the mining assets and mining lease for a credit of $60 million

and the Saudi investors have contributed $60 million cash, and (4) the remaining

capital for the project will be raised by ALAK by other means which may include

application for a loan from the Saudi Industrial Development Fund, loans from

private banks, and/or the inclusion of other investors. ALAK will have all

powers of administration over the Al Masane mining project. Subsequent to the

above agreement, the cash contribution was deposited in the accounts for ALAK in

September and October of 2007. The Company has four directors

representing its interests on an eight person board of directors with the

Chairman of ALAK chosen from the directors representing the Saudi investors. The

original documents are in Arabic, and English translations have been provided to

the parties.

The Saudi

Government published and implemented the new Mining Code on October 22, 2004

which contains several provisions the Company believes beneficial, not the least

of which is a reduction of taxes on profits from 45% to 20%.

Rock Formations and

Mineralization. Three mineralized zones, the Saadah, Al Houra

and Moyeath, have been outlined by diamond drilling. The Saadah and

Al Houra zones occur in a volcanic sequence that consists of two mafic-felsic

sequences with interbedded exhalative cherts and metasedimentary

rocks. The Moyeath zone was discovered after the completion of

underground development in 1980. It is located along an angular

unconformity with underlying felsic volcanics and shales. The

principle sulphide minerals in all of the zones are pyrite, sphalerite, and

chalcopyrite. The precious metals occur chiefly in tetrahedrite and

as tellurides and electrum. The following table sets forth a summary

of the diluted recoverable, proven and probable mineralized materials at the Al

Masane project, along with the estimated average grades of these mineralized

materials:

|

Zone

|

Mineralized

Materials

(Tonnes)

|

Copper

(%)

|

Zinc

(%)

|

Gold

(g/t)

|

Silver

(g/t)

|

|||||||||||||||

|

Saadah

|

3,872,400 | 1.67 | 4.73 | 1.00 | 28.36 | |||||||||||||||

|

Al

Houra

|

2,465,230 | 1.22 | 4.95 | 1.46 | 50.06 | |||||||||||||||

|

Moyeath

|

874,370 | 0.88 | 8.92 | 1.29 | 64.85 | |||||||||||||||

|

Total

|

7,212,000 | 1.42 | 5.31 | 1.19 | 40.20 | |||||||||||||||

For

purposes of calculating proven and probable mineralized materials, a dilution of

5% at zero grade on the Saadah zone and 15% at zero grade on the Al Houra and

Moyeath zones was

17

assumed.

A mining recovery of 80% was used for the Saadah zone and 88% for the Al Houra

and Moyeath zones. Mining dilution is the amount of wallrack adjacent to the ore

body that is included in the ore extraction process.

Proven

mineralized materials are those mineral deposits for which quantity is computed

from dimensions revealed in outcrops, trenches, workings or drill holes, and

grade is computed from results of detailed sampling. For ore deposits to be

proven the sites for inspection, sampling and measurement must be spaced so

closely and the geologic character must be so well defined that the size, shape,

depth and mineral content of reserves are well established. Probable mineralized

materials are those for which quantity and grade are computed from information

similar to that used for proven mineralized materials, but the sites for

inspection, sampling and measurement are farther apart or are otherwise less

adequately spaced. However, the degree of assurance, although lower than that

for proven mineralized materials, must be high enough to assume continuity

between points of observation.

The

metallurgical studies conducted on the ore samples taken from the zones

indicated that 87.7% of the copper and 82.6% of the zinc could be recovered in

copper and zinc concentrates. Overall, gold and silver recovery from the ore was

estimated to be 77.3% and 81.3%, respectively, partly into copper concentrate

and partly as bullion through cyanide processing of zinc concentrates and mine

tailings. Further studies recommended by consultants may improve those

recoveries and thus the potential profitability of the project; however, there

can be no assurances of this effect.

Other

Exploration Areas in Saudi Arabia

During

the course of its exploration and development work in the Al Masane area, the

Company has carried on exploration work in other areas in Saudi

Arabia.

Wadi

Qatan and Jebel Harr. The Wadi Qatan area is located in southwestern

Saudi Arabia. Jebel Harr is north of Wadi Qatan. Both areas are approximately 30

kilometers east of the Al Masane area. These areas consist of 40 square

kilometers, plus a northern extension of an additional 13 square kilometers. The

Company’s geological, geophysical and limited core drilling disclosed the

existence of massive sulfides containing an average of 1.2% nickel. Reserves for

these areas have not yet been classified and additional exploration work is

required. When the Company obtains an exploration license for the Wadi Qatan and

Jebel Harr areas, the Company intends to continue its exploratory drilling

program in order to prove whether sufficient ore reserves exist to justify a

viable mining operation; however there is no assurance that a viable mining

operation can be established.

Greater

Al Masane. On June 22, 1999, the Company submitted a formal application

for a five-year exclusive mineral exploration license for the Greater Al Masane

area of approximately 2,850 square kilometers, which surrounds the Al Masane

mining lease area and includes the Wadi Qatan and Jebel Harr areas. The Company

previously worked in the Greater Al Masane area after obtaining written

authorization from the Saudi Ministry of Petroleum and Mineral Resources, and

has expended over $2 million on exploration work. Geophysical, geochemical and