|

|

Filed

by the Registrant x Filed

by a Party other than the Registrant ¨

|

|

|

Check

the appropriate box:

|

|

¨

|

Preliminary

Proxy Statement

|

|

¨

|

Confidential, For Use of the

Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

x

|

Definitive

Proxy Statement

|

|

¨

|

Definitive

Additional Materials

|

|

¨

|

Soliciting

Material Pursuant to §240.14a-12

|

|

|

Payment

of Filing Fee (Check the appropriate

box):

|

|

x

|

No

fee required.

|

|

¨

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

|

|

(1)

|

Title

of each class of securities to which the transaction

applies:

|

|

|

|

(2)

|

Aggregate

number of securities to which the transaction

applies:

|

|

|

|

(3)

|

Per

unit price or other underlying value of the transaction computed pursuant

to Exchange Act Rule 0-11 (set forth amount on which the filing fee is

calculated and state how it was

determined):

|

|

|

|

(4)

|

Proposed

maximum aggregate value of the

transaction:

|

|

|

|||||

|

(5)

|

Total

fee paid:

|

|

|

|

¨

|

Fee

paid previously with preliminary

materials.

|

|

¨

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number,

or the form or schedule and the date of its

filing:

|

|

(1)

|

Amount

previously paid:

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement

Number:

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

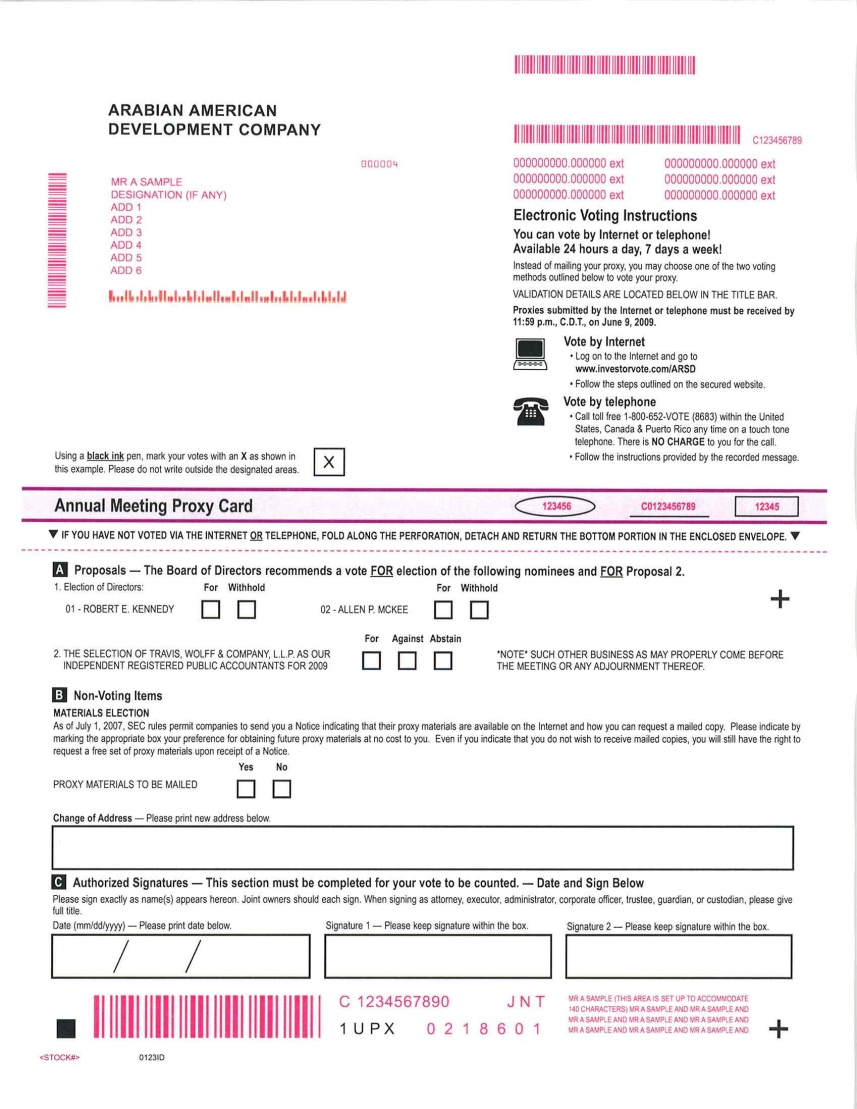

Time

and Date:

|

10:00

a.m. – 12:00 noon CDT, June 10, 2009

|

|

|

Place:

|

Courtyard

Dallas Central Expressway

|

|

|

10325

North Central Expressway

|

||

|

Dallas,

TX 75231

|

||

|

Items of

Business:

|

(1)

|

To

re-elect/elect members to the Board of Directors;

|

|

(2)

|

To

ratify the selection of Travis, Wolff & Company, L.L.P. as the

Company’s independent registered public accounting firm for 2009;

and

|

|

|

(3)

|

To

consider and act upon such other business as may properly come before the

meeting.

|

|

|

Adjournments

and Postponements:

|

Any

action on the items of business described above may be considered at

the

annual meeting at the time and on the date specified above or at any time

and date to which the annual meeting may be properly adjourned or

postponed.

|

|

|

Record

Date:

|

You

are entitled to vote only if you were an Arabian American Development

Company stockholder of record as of the close of business on April 22,

2009. Your

vote is important. We

encourage you to vote by proxy, even if you plan to attend the

meeting. You may vote your proxy by telephone, Internet or

mail. A toll-free telephone number and website address are

included on your proxy card.

|

|

|

Meeting

Admission:

|

You

are entitled to attend the annual meeting only if you were an Arabian

American stockholder of record as of the close of business on April 22,

2009 or hold a valid proxy for the annual meeting. You should

be prepared to present photo identification for admittance. If

you are not a stockholder of record but hold shares through a broker,

trustee or nominee, you should provide proof of beneficial ownership as of

the record date, such as your most recent account statement prior to April

22, 2009, a copy of the voting instruction card provided by your broker,

trustee or nominee, or similar evidence of ownership. If you do

not provide photo identification and comply with the other procedures

outlined above, you will not be admitted to the annual

meeting.

|

|

TABLE OF CONTENTS

|

|||

|

GENERAL

EXPLANATION OF MATERIALS INCLUDED

|

1

|

||

|

Specific

Items of Business

|

1

|

||

|

PROPOSALS

TO BE VOTED ON

|

1

|

||

|

PROPOSAL

NO. 1 – RE-ELECTION/ELECTION OF DIRECTORS

|

1

|

||

|

Vote

Required

|

2

|

||

|

PROPOSAL NO. 2 – RATIFICATION OF SELECTION OF

INDEPENDENT

REGISTERED

PUBLIC ACCOUNTING FIRM

|

3

|

||

|

PRINCIPAL

ACCOUNTING FEES AND SERVICES

|

3

|

||

|

Audit

Fees

|

3

|

||

|

Tax

Fees

|

4

|

||

|

QUESTIONS

AND REQUESTS FOR ADDITIONAL INFORMATION

|

4

|

||

|

Request

for Multiple Copies of Proxy Materials

|

4

|

||

|

Request

for Single Copy of Proxy Materials

|

4

|

||

|

VOTING

|

4

|

||

|

Voting

Securities, Record Date

|

5

|

||

|

Stockholder

of Record

|

5

|

||

|

Beneficial

Owner

|

5

|

||

|

Voting

in Person at the Annual Meeting

|

5

|

||

|

Voting

by Submitting a Proxy or Voting Instructions

|

5

|

||

|

Proxies

and Voting Instructions Are Revocable

|

5

|

||

|

Voting

Electronically

|

6

|

||

|

Voting

Procedures

|

6

|

||

|

Election

of Directors

|

6

|

||

|

Voting

on Other Business

|

6

|

||

|

How

Shares will be Voted by Proxy of Voting Instructions

|

6

|

||

|

Broker

Non-Votes

|

6

|

||

|

Additional

Business Proposals Presented at Meeting

|

7

|

||

|

Quorum

Requirement

|

7

|

||

|

STOCKHOLDER

PROPOSALS

|

7

|

||

|

Stockholder

Proposals Intended to be Included in Proxy Statement

|

7

|

||

|

Stockholder

Proposals Not Intended to be Included in Proxy Statement

|

7

|

||

|

Stockholder

Proposals for Director Candidates

|

7

|

||

|

CORPORATE

GOVERNANCE PRINCIPLES AND BOARD MATTERS

|

8

|

||

|

Board

Policy Regarding Voting for Directors

|

8

|

||

|

Board

Independence

|

8

|

||

|

Meetings

of the Board and Its Committees

|

8

|

||

|

The

Company’s Director Independence Standards

|

9

|

||

|

Board

Structure and Committee Composition

|

9

|

||

|

Audit

Committee

|

10

|

||

|

Audit

Committee Report

|

11

|

||

|

Compensation

Committee

|

12

|

||

|

Compensation

Committee Report

|

12

|

||

|

Nominating

Committee

|

12

|

||

|

Stockholder

Recommendations

|

13

|

||

|

Director

Qualifications

|

13

|

||

|

Identifying

and Evaluating Candidates for Directors

|

13

|

||

|

Executive

Sessions

|

14

|

||

|

Communications

with the Board

|

14

|

||

|

DIRECTOR

COMPENSATION AND STOCK OWNERSHIP GUIDELINES

|

14

|

||

|

COMMON STOCK OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS

AND

MANAGEMENT

|

15

|

||

|

BENEFICIAL

OWNERSHIP TABLE

|

16

|

||

|

SECTION

16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

|

16

|

||

|

EXECUTIVE

COMPENSATION

|

17

|

||

|

Compensation

Discussion and Analysis

|

17

|

||

|

General

|

17

|

||

|

Compensation

Components

|

17

|

||

|

Base

Salary

|

17

|

||

|

Incentive

Compensation

|

17

|

||

|

Stock

Option Plan

|

17

|

||

|

Other

Compensation

|

17

|

||

|

Termination

of Employment Payments

|

18

|

||

|

Tax

Considerations

|

18

|

||

|

Summary

of Executive Compensation

|

18

|

||

|

SUMMARY

COMPENSATION TABLE

|

19

|

||

|

Employment

Agreements

|

20

|

||

|

Director

Compensation

|

20

|

||

|

Compensation

Committee Interlocks and Insider Participation

|

20

|

||

|

OUTSTANDING

EQUITY AWARDS AT FISCAL YEAR-END

|

20

|

||

|

OPTION

EXERCISES AND STOCK VESTED

|

20

|

||

|

GRANTS

OF PLAN-BASED AWARDS

|

21

|

||

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

21

|

||

|

OTHER

BUSINESS

|

21

|

||

|

(1)

|

The

election of directors and

|

|

(2)

|

The

ratification of selection of independent registered public accounting

firm.

|

|

|

PROPOSAL

NO. 1

|

|

|

RE-ELECTION/ELECTION

OF DIRECTORS

|

|

Robert

E. Kennedy

Director

since 2007

Age

65

|

Mr.

Kennedy is the President of Robert E. Kennedy and Associates, a consulting

firm assisting various entities with transportation and project

development issues in Europe and the Middle East. He has

over thirty years experience in the oil and petrochemical industry and

retired as General Manager for Supply, Logistics, and Procurement from

Chevron Chemical in 2000. During his employment with Chevron he

was instrumental in developing the Aromax project in Jubail, Saudi

Arabia. Mr. Kennedy holds a BS Degree in Chemical Engineering

from the University of Iowa and attended the MBA program of American

University.

|

|

Allen

P. McKee

Director

since 2009

Age

67

|

Mr.

McKee has an extensive background in international finance and investment

management with over 20 years advising Fal Holdings Arabia Company

Ltd. He has also served as CFO and CEO with several companies

and headed the Middle East area of BankAmerica’s international banking

group. Mr. McKee holds a BA in Economics from the University of

Michigan and an MBA in Finance from the University of California,

Berkeley.

|

|

|

PROPOSAL

NO. 2

|

|

|

RATIFICATION

OF SELECTION OF INDEPENDENT

|

|

|

REGISTERED

PUBLIC ACCOUNTING FIRM

|

|

2008

|

2007

|

|||||||

|

Audit

Fees

|

$ | 335,173 | $ | 209,325 | ||||

|

Audit-Related

Fees

|

$ | 0 | $ | 0 | ||||

|

Tax

Fees

|

$ | 33,545 | $ | 23,200 | ||||

|

All

Other Fees

|

$ | 0 | $ | 0 | ||||

|

|

(1)

|

The

director is, or has been in the past three years, an employee of the

Company or an employee of any parent or subsidiary of the

Company;

|

|

|

(2)

|

The

director has accepted, or has a family member who has accepted during any

twelve-month period within the last three years, more than $60,000 in

compensation from the Company, other than compensation for Board or Board

Committee service, compensation received by the director’s immediate

family member for service as a non-executive employee of the Company, and

benefits under a tax-qualified retirement plan, or non-discretionary

compensation.

|

|

|

(3)

|

The

director is a family member of an individual who is, or at any time during

the past three years was, employed by the Company as an executive

officer;

|

|

|

(4)

|

The

director is, or has a family member who is, a partner in, or a controlling

shareholder or an executive officer of, any organization to which the

company made, or from which the company received, payments for property or

services in the current or any of the past three fiscal years that exceed

5% of the recipient’s consolidated gross revenues for that year, or

$200,000, whichever is more, other than (i) payments arising solely from

investments in the company’s securities; or (ii) payments under

non-discretionary charitable contribution matching

programs;

|

|

|

(5)

|

The

director is, or has an immediate family member who is, employed as an

executive officer of another entity where at any time during the past

three years any of the executive officers of the Company serve on the

compensation committee of such other entity;

or

|

|

|

(6)

|

The

director is, or has a family member who is, a current partner of the

Company’s outside auditor, or was a partner or employee of the Company’s

outside auditor who worked on the Company’s audit at any time during any

of the past three years.

|

|

Name

of Director

|

Audit

|

Compensation

|

Nominating

|

|

Non-Employee

Directors:

|

|||

|

Ghazi

Sultan1

|

Member

|

Member

|

Chair

|

|

Robert

E. Kennedy2

|

Chair

|

Chair

|

Member

|

|

Ibrahim

Al Moneef3

|

Member

|

Member

|

|

|

Mohammed

Al Omair4

|

Member

|

Member

|

Member

|

|

Charles

W. Goehringer, Jr.5

|

Member

|

||

|

Allen

P. McKee6

|

Member

|

Member

|

Member

|

|

Employee

Directors:

|

|||

|

Hatem

El Khalidi

|

|||

|

Nicholas

N. Carter

|

|||

|

Number

of Meetings in Fiscal 2008

|

4

|

1

|

1

|

|

1

|

Mr.

Sultan was elected to the Board in September 1993. He joined

the Audit and Compensation Committees in 1994, and became the Chair of the

Nominating Committee in April 2007.

|

|

2

|

Mr.

Kennedy was elected to the Board on January 13, 2007. He joined

the Nominating Committee in April 2007, became the Chair of the Audit

Committee in January, 2007, and became the Chair of the Compensation

Committee in March 2007. He also became the lead independent

director in March 2007.

|

|

3

|

Mr.

Al Moneef was elected to the Board on April 26, 2007. He joined the

Nominating, Audit and Compensation Committees in April 2007. He

resigned from the Audit Committee in February 2008. He

subsequently resigned from the Board, the Compensation Committee, and the

Nominating Committee in April 2009.

|

|

4

|

Mr.

Al Omair was elected to the Board on October 23, 2007. He

joined the Nominating and Audit Committees on October 23, 2007, and the

Compensation Committee on December 31,

2007.

|

|

5

|

Mr.

Goehringer was elected to the Board on October 23, 2007. He

joined the Nominating and Audit Committees on October 23, 2007, and the

Compensation Committee on December 31, 2007. He resigned from

the Audit Committee in February 2008. He resigned from the

Compensation Committee in January

2009.

|

|

6

|

Mr.

McKee was elected to the Board on April 28, 2009. He joined the

Nominating, Audit and Compensation Committees on April 28,

2009.

|

|

|

(1)

|

Company

directors and nominees, each of the named executive officers, and all

individuals owning more than 5% of the Company’s outstanding Common Stock,

set forth in the Summary Compensation Table on page 22;

and

|

|

|

(2)

|

Current

directors and Company executive officers as a

group.

|

|

Name of Beneficial Owner

|

Amount and Nature of Beneficial

Ownership1

|

Percent of

Class

|

||||||

|

Current

Directors and Nominees:

|

||||||||

|

Ghazi

Sultan3

|

190,000 | 0.797 | % | |||||

|

Robert

E. Kennedy

|

10,000 | 0.042 | % | |||||

|

Ibrahim

A. Al Moneef

|

600,000 | 2.527 | % | |||||

|

Charles

W. Goehringer, Jr.

|

32,967 | 0.139 | % | |||||

|

Mohammed

O. Al Omair

|

1,667 | 0.007 | % | |||||

|

Current

Director, Nominee or Named Executive Officer:

|

||||||||

|

Hatem

El Khalidi2

|

460,000 | 1.905 | % | |||||

|

Nicholas

N. Carter

|

207,918 | 0.876 | % | |||||

|

Connie

Cook

|

32,500 | 0.137 | % | |||||

|

Mark

Williamson

|

20,000 | 0.084 | % | |||||

|

All

current directors and executive officers as a group (9 persons)4

|

1,555,052 | 6.514 | % | |||||

|

Individuals

with beneficial ownership of more than 5% of outstanding Common

Stock

|

||||||||

|

Fahad

Mohammed Saleh Al Athel

|

3,632,953 | 15.302 | % | |||||

|

Mohammad

Salem ben Mahfouz

|

1,500,000 | 6.318 | % | |||||

|

Harb

S. Al Zuhair

|

1,423,750 | 5.997 | % | |||||

|

Prince

Talal Bin Abdul Aziz

|

1,272,680 | 5.360 | % | |||||

|

1

|

Unless

otherwise indicated, to the knowledge of the Company, all shares are owned

directly and the owner has sole voting and investment

power.

|

|

2

|

Includes

400,000 shares which Mr. El Khalidi has the right to acquire through the

exercise of presently exercisable stock options. Excludes

385,000 shares owned by Ingrid El Khalidi, Mr. El Khalidi’s wife, and

443,000 shares owned by relatives of Hatem El

Khalidi.

|

|

3

|

Includes

100,000 shares which Mr. Sultan has the right to acquire through the

exercise of presently exercisable stock

options.

|

|

4

|

Includes

500,000 shares which certain directors and executive officers have the

right to acquire through the exercise of stock or options or other rights

exercisable presently or within 60 days. Excludes 385,000

shares owned by Ingrid El Khalidi, the wife of Hatem El Khalidi, the

President, Chief Exectuive Officer and a director of the company, and

443,000 shares owned by relatives of Hatem El

Kahlidi.

|

|

Name

and

Principal Position

|

Year

|

Salary

($) (1)

|

Bonus

($)

|

Restricted

Stock

Award(s)

($)

|

Stock

Award(s)

|

Non-Equity

Incentive

Plan

Compensation($)

|

Change

in Pension Value and Nonqualified Deferred Compensation

Earnings($)

|

All

Other

Compensation

($) (2)(3)

|

Total

($)

|

||||||||||||||||||||||||

|

Hatem

El Khalidi,

President

and Chief

Executive

Officer, Director

|

2008

|

$ | 72,000 | -- | -- | -- | -- | -- | $ | 8,000 | $ | 80,000 | |||||||||||||||||||||

|

2007

|

$ | 72,000 | -- | -- | -- | -- | -- | $ | 8,000 | $ | 80,000 | ||||||||||||||||||||||

|

2006

|

$ | 72,000 | -- | -- | -- | -- | -- | $ | 8,000 | $ | 80,000 | ||||||||||||||||||||||

|

Nicholas

N. Carter,

Executive

Vice President and Chief Operating Officer

President,

Petrochemical Company

|

2008

|

$ | 209,918 | $ | 78,665 | $ | 99,800 | -- | -- | -- | $ | 12,595 | $ | 400,978 | |||||||||||||||||||

|

2007

|

$ | 172,059 | $ | 96,506 | $ | 66,000 | -- | -- | -- | $ | 10,324 | $ | 344,889 | ||||||||||||||||||||

|

2006

|

$ | 163,044 | $ | 97,994 | $ | 30,000 | -- | -- | -- | $ | 9,783 | $ | 300,821 | ||||||||||||||||||||

|

Connie

J. Cook,

Secretary

and Treasurer

|

2008

|

$ | 133,009 | $ | 51,143 | $ | 49,900 | -- | -- | -- | $ | 7,981 | $ | 242,033 | |||||||||||||||||||

|

2007

|

$ | 108,500 | $ | 70,085 | $ | 33,000 | -- | -- | -- | $ | 6,510 | $ | 218,095 | ||||||||||||||||||||

|

2006

|

$ | 102,816 | $ | 73,057 | $ | 15,000 | -- | -- | -- | $ | 6,169 | $ | 197,042 | ||||||||||||||||||||

|

Mark

D. Williamson,

Vice

President of Marketing, Petrochemical Company

|

2008

|

$ | 240,705 | $ | 51,143 | $ | 49,900 | -- | -- | -- | $ | 14,442 | $ | 356,190 | |||||||||||||||||||

|

2007

|

$ | 190,393 | $ | 70,023 | -- | -- | -- | -- | $ | 11,424 | $ | 271,840 | |||||||||||||||||||||

|

2006

|

$ | 193,830 | $ | 80,124 | $ | 15,000 | -- | -- | -- | $ | 11,630 | $ | 300,584 | ||||||||||||||||||||

|

Name

|

Number

of Securities Underlying Unexercised Options (#) Exercisable

|

Number

of Securities Underlying Unexercised Options

(#)

Unexercisable

|

Equity

Incentive Plan Awards:

Number

of Securities Underlying Unexercised Unearned Options

(#)

|

Option

Exercise

Price

|

Option

Expiration Date

|

||||||||||||

|

Hatem

El Khalidi

|

400,000 | - | - | $ | 1.00 |

Undetermined

|

|||||||||||

|

Ghazi

Sultan

|

100,000 | - | - | $ | 2.00 |

08/28/09

|

|||||||||||

|

Name

|

Number

of Shares Acquired on Vesting

(#)

|

Value

Realized on Vesting

($)

|

||||||

|

Nicholas

N. Carter

|

20,000 | $ | 99,800 | |||||

|

Connie

Cook

|

10,000 | $ | 49,900 | |||||

|

Mark

Williamson

|

10,000 | $ | 49,900 | |||||

|

Name

|

Grant Date

|

All

Other Stock Awards: Number of Shares of Stock or

Units (#)

|

Grant

Date Fair Value of Stock Awards

|

||||||

|

Nicholas

N. Carter

|

January

15, 2008

|

20,000 | $ | 141,000 | |||||

|

Connie

Cook

|

January

15, 2008

|

10,000 | $ | 70,500 | |||||

|

Mark

Williamson

|

January

15, 2008

|

10,000 | $ | 70,500 | |||||