SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

|

Filed by the Registrant x Filed by a Party other than the Registrant ¨

|

|

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

¨

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

ARABIAN AMERICAN DEVELOPMENT COMPANY

(Name of Registrant as specified in its Charter)

Not applicable

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth amount on which the filing fee is calculated and state how it was determined):

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing:

|

| |

(1)

|

Amount Previously Paid:

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

Arabian American Development Co.

1600 Hwy 6 South, Suite 240

Sugar Land, TX 77478

(409) 385-8300

April 27, 2011

To Our Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the 2011 Annual Stockholders’ Meeting on Wednesday, June 8, 2011, at 10:00 a.m., Central Daylight Time. The meeting will be held at the Company’s petrochemical facility, South Hampton Resources, 7752 FM 418, Silsbee, Texas 77656. If you plan to attend the meeting in person, please call and let us know that you are coming so that we can plan accordingly.

Matters to be acted upon at the meeting are described in the attached Notice of 2011 Annual Meeting of Stockholders and Proxy Statement. We have also included a copy of our Annual Report on Form 10-K including the corrections that were made on Form 10-K/A for the year ended December 31, 2010, for your review.

Your vote on the business to be considered at the meeting is important regardless of the number of shares you own. Whether or not you plan to attend, please vote your proxy promptly in accordance with the instructions on the enclosed proxy card. If you do attend the meeting, you may, of course, withdraw your proxy should you wish to vote in person.

Sincerely,

/s/ Nicholas Carter

Nicholas Carter

Chairman of the Board

President

Chief Executive Officer

|

TABLE OF CONTENTS

|

| |

|

|

|

NOTICE OF 2011 ANNUAL MEETING OF STOCKHOLDERS

|

1

|

| |

|

|

PROXY STATEMENT

|

|

|

GENERAL EXPLANATION OF MATERIALS INCLUDED

|

2

|

| |

Specific Items of Business

|

2

|

| |

|

|

PROPOSAL NO. 1 – ELECTION/RE-ELECTION OF DIRECTORS

|

2

|

| |

Vote Required

|

3

|

| |

|

|

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

|

4

|

| |

Board Leadership Structure

|

4

|

| |

Board Policy Regarding Voting for Directors

|

4

|

| |

Board Independence

|

5

|

| |

Meetings of the Board and Its Committees

|

5

|

| |

The Company’s Director Independence Standards

|

5

|

| |

Board Structure and Committee Composition

|

6

|

| |

Audit Committee

|

7

|

| |

Compensation Committee

|

7

|

| |

Nominating Committee

|

8

|

| |

Stockholder Recommendations

|

8

|

| |

Director Qualifications

|

9

|

| |

Identifying and Evaluating Candidates for Directors

|

9

|

| |

Executive Sessions

|

10

|

| |

Communications with the Board

|

10

|

| |

|

|

|

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

|

10

|

| |

|

|

|

BENEFICIAL OWNERSHIP TABLE

|

11

|

| |

|

|

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

|

11

|

| |

|

|

|

EXECUTIVE COMPENSATION

|

11

|

| |

Executive Compensation Program Design

|

12

|

| |

Base Salary

|

12

|

| |

Annual Cash Incentive Plan

|

13

|

| |

Profit Sharing Program

|

14

|

| |

Long-Term Incentive – Stock Options

|

15

|

| |

Perquisites

|

15

|

| |

Governance of Pay Setting Process

|

16

|

| |

Role of Compensation Committee in Establishing Pay Levels

|

16

|

| |

Role of Management in Establishing Pay Levels

|

17

|

| |

Role of the Compensation Consultant in Establishing Pay Levels

|

17

|

| |

Regulatory Considerations

|

17

|

| |

Employment Arrangements

|

17

|

| |

Benchmarking Against Our Peer Group

|

17

|

| |

Determination of Performance Targets

|

20

|

| |

Individual Performance Goals for the President/CEO

|

20

|

| |

Company Goal (Operating Income)

|

20

|

| |

Report of the Compensation Committee

|

20

|

| |

Compensation Committee Interlocks and Insider Participation

|

21

|

| |

Compensation and Risk

|

21

|

| |

Executive Compensation Program for 2010 and 2011

|

21

|

| |

|

|

|

2010 SUMMARY COMPENSATION TABLE

|

23

|

| |

|

|

2010 GRANTS OF PLAN-BASED AWARDS

|

24

|

| |

|

|

OUTSTANDING EQUITY AWARDS AT 2010 FISCAL YEAR-END

|

26

|

| |

|

|

NON-EMPLOYEE DIRECTOR COMPENSATION

|

26

|

| |

2010 Non-Employee Director Compensation Table

|

27

|

| |

2010 Outstanding Equity Awards Table

|

28

|

| |

General

|

28

|

| |

Board Compensation

|

29

|

| |

Committee Compensation

|

29

|

| |

Equity Compensation

|

29

|

| |

Per Diem Compensation

|

29

|

| |

Potential Payments upon Termination or Change in Control

|

29

|

| |

Compensation Committee Interlocks and Insider Participation

|

29

|

| |

|

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

30

|

| |

Review, Approval or Ratification of Transactions with Management and Others

|

30

|

| |

Audit Committee Report

|

31

|

| |

|

|

|

PROPOSAL NO. 2 – RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

|

31

|

| |

|

|

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

32

|

| |

Audit Fees

|

32

|

| |

Tax Fees

|

32

|

| |

All Other Fees

|

32

|

| |

|

|

|

PROPOSAL NO. 3 – ADVISORY VOTE ON EXECUTIVE COMPENSATION

|

33

|

| |

|

|

|

PROPOSAL NO. 4 – ADVISORY VOTE THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

|

33

|

| |

|

|

|

QUESTIONS AND REQUESTS FOR ADDITIONAL INFORMATION

|

33

|

| |

Request for Multiple Copies of Proxy Materials

|

34

|

| |

Request for Single Copy of Proxy Materials

|

34

|

| |

|

|

|

VOTING

|

34

|

| |

Voting Securities, Record Date

|

34

|

| |

Stockholder of Record

|

34

|

| |

Beneficial Owner

|

34

|

| |

Voting in Person at the Annual Meeting

|

35

|

| |

Voting by Submitting a Proxy or Voting Instructions

|

35

|

| |

Proxies and Voting Instructions Are Revocable

|

35

|

| |

Voting Electronically

|

35

|

| |

Voting Procedures

|

35

|

| |

Election of Directors

|

36

|

| |

Voting on Other Business

|

36

|

| |

How Shares will be Voted by Proxy of Voting Instructions

|

36

|

| |

Broker Non-Votes

|

36

|

| |

Additional Business Proposals Presented at Meeting

|

36

|

| |

Quorum Requirement

|

36

|

| |

|

|

|

STOCKHOLDER PROPOSALS

|

37

|

| |

Stockholder Proposals Intended to be Included in Proxy Statement

|

37

|

| |

Stockholder Proposals Not Intended to be Included in Proxy Statement

|

37

|

| |

Stockholder Proposals for Director Candidates

|

37

|

| |

|

|

|

OTHER BUSINESS

|

37

|

ARABIAN AMERICAN DEVELOPMENT COMPANY

(“Arabian American”)

1600 Hwy 6 South, Suite 240

Sugar Land, TX 77478

(409) 385-8300

NOTICE OF 2011 ANNUAL MEETING OF STOCKHOLDERS

|

Time and Date:

|

|

10:00 a.m. – 12:00 noon CDT, June 8, 2011

|

| |

|

|

|

Place:

|

|

South Hampton Resources, Inc.

|

| |

|

7752 FM 418

|

| |

|

Silsbee, TX 77656

|

|

Items of Business:

|

(1)

|

Election/re-election of members to the Board of Directors

|

| |

(2)

|

Ratification of the selection of BKM Sowan Horan, LLP as the Company’s independent registered public accounting firm for 2011

|

| |

(3)

|

Advisory vote on executive compensation

|

| |

(4)

|

Advisory vote on the frequency of future advisory votes on executive compensation

|

| |

(5)

|

Consider and act upon such other business as may properly come before the meeting.

|

| |

|

|

|

Adjournments and Postponements:

|

|

Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed.

|

| |

|

|

|

Record Date:

|

|

You are entitled to vote only if you were an Arabian American Development Company stockholder of record as of the close of business on April 20, 2011. Your vote is important. We encourage you to vote by proxy, even if you plan to attend the meeting. You may vote your proxy by telephone, Internet or mail. A toll-free telephone number and website address are included on your proxy card.

|

| |

|

|

|

Meeting Admission:

|

|

You are entitled to attend the annual meeting only if you were an Arabian American stockholder of record as of the close of business on April 20, 2011 or hold a valid proxy for the annual meeting. You should be prepared to present photo identification for admittance. If you are not a stockholder of record but hold shares through a broker, trustee or nominee, you should provide proof of beneficial ownership as of the record date, such as your most recent account statement prior to April 20, 2011, a copy of the voting instruction card provided by your broker, trustee or nominee, or similar evidence of ownership. If you do not provide photo identification and comply with the other procedures outlined above, you will not be admitted to the annual meeting.

|

This notice of annual meeting and proxy statement and form of proxy are being distributed on or about April 27, 2011.

/s/ Connie Cook

Connie Cook, Secretary

PROXY STATEMENT

GENERAL EXPLANATION OF MATERIALS INCLUDED

This proxy statement is furnished in connection with the solicitation of proxies by The Board of Directors (the “Board”) of Arabian American Development Company, a Delaware corporation (the “Company”), for the Company’s Annual Meeting of Stockholders which is scheduled to take place on June 8, 2011. This proxy statement provides a description of the business matters to be covered at the annual meeting. As a stockholder, you are entitled and encouraged to attend the annual meeting and to vote on the matters described in this proxy statement. Detailed information on voting is provided below.

In addition to notifying you of the upcoming annual meeting of stockholders, we request your vote on the matters to be covered at the annual meeting. In making this solicitation, the Company will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. Proxies may be solicited in person by our employees, or by mail, courier, telephone, email, or facsimile. We estimate that approximately $20,000 will be spent in connection with the solicitation of stockholders. This amount does not include salaries or wages of regular employees or officers who may assist with this solicitation.

Specific Items of Business

The following four proposals will be presented at the meeting for your vote. Space is provided in the accompanying proxy card to vote for, against, or abstain from voting on each of the proposals except for the frequency of future advisory votes for which you can indicate one year, two years, three years, or abstain. If you vote using the telephone or Internet, you will be instructed how to vote on these issues.

|

(1)

|

The election/re-election of directors,

|

|

(2)

|

The ratification of selection of independent registered public accounting firm,

|

|

(3)

|

The advisory vote on executive compensation, and

|

|

(4)

|

The advisory vote on the frequency of future advisory votes on executive compensation.

|

|

|

ELECTION/RE-ELECTION OF DIRECTORS

|

There are two directors standing for re-election to our Board this year. The nominees are Nicholas N. Carter and Mohammed O. Al Omair. They have each served as a director since the last annual meeting and will serve a three year term expiring in 2014.

There is one director standing for election to our Board this year. The nominee is John R. Townsend. Mr. Townsend was appointed as a director to our Board in February of 2011. He will serve a one year term expiring in 2012.

Charles W. Goehringer, Jr. chose not to stand for re-election to the Board this year. His term will expire at the 2011 Annual Meeting of Stockholders.

There are no family relationships among our executive officers and directors.

If you sign your proxy or voting instruction card but do not give instructions with respect to voting for directors, your shares will be voted for the person recommended by the Board. If you wish to give specific instructions with respect to voting for directors, you may do so by indicating your instructions on your proxy or voting instruction card.

The nominees have indicated to the Company that they will be available to serve as directors. In the event that the nominee should become unavailable, however, the proxy holders, Connie Cook and/or Allen McKee, will vote for a nominee or nominees designated by the Board.

If an incumbent director nominee receives a greater number of votes “AGAINST” his or her election than votes “FOR” such election, he or she is required to tender his or her resignation for consideration by the Nominating Committee in accordance with Board policy.

Vote Required

Each director nominee who receives more “FOR” votes than “AGAINST” votes representing shares of Company common stock present in person or represented by proxy and entitled to be voted at the annual meeting will be elected.

Our Board recommends a vote FOR the election to the BOARD of the following nominees:

|

Nicholas N. Carter

Director since 2004

Age 64

|

Mr. Nicholas N. Carter, a U.S. citizen and the President and Chief Executive Officer of the Company since July 2009, is a 1975 graduate of Lamar University with a Bachelor of Business Administration Degree in Accounting. Mr. Carter has been a Certified Public Accountant since 1977. He worked at the Sabine River Authority of Texas as a Project Accountant from 1973 to 1975. From 1975 to 1977 he was a Staff Accountant with Wathen, DeShong and Company, CPA's. In 1977 he joined South Hampton as Controller. His job titles with the Company include 1979, Facility Manager at TOCCO, 1982, Treasurer of TOCCO, 1987, President of South Hampton. In 2007 he added the title of Executive Vice President of Arabian American Development Co. in addition to the petrochemical duties. He was named to his current position in 2009. From 1977 until the present Mr. Carter has been employed by the Company in a succession of positions with increasing and broader operating responsibilities, as follows; 1977-1979, Controller of South Hampton; 1979 to 1982, Facility Manager at a ship dock and terminal facility owned by TOCCO; 1982 to 1987, Treasurer of TOCCO; 1987 to 2011, President of South Hampton; and 2007 to 2009, Executive Vice President of Arabian American Development Co. This succession of positions with the Company gave Mr. Carter broad experience and knowledge in both the operations and finances of the Company, and in 2009 he was named to his current position, and also retains the petrochemical duties.

|

|

Mohammed O. Al Omair

Director since 2007

Age 67

|

Mr. Mohammed O. Al Omair, a Saudi citizen, resides in Riyadh, Saudi Arabia, and previously served as Senior Vice President & Deputy Chief Executive Officer for Fal Holdings Arabia Co. Ltd. Prior to his service with Fal, he held a senior position with the Gulf Cooperation Counsel (GCC), a six-nation organization of Arab nations in the region. He holds a Bachelor of Arts Degree in Political Science and a Master of Public Administration from the University of Washington. We believe that this experience, as well as his leadership abilities, brings valuable experience and skill to our board of directors.

|

|

John R. Townsend

Director since 2011

Age 57

|

Mr. John R. Townsend is a U.S. citizen with a Bachelor of Science in Chemical Engineering from Louisiana Tech University. Mr. Townsend has over 30 years experience in the petrochemical industry garnered through his employment with Mobil Chemical Company which subsequently became ExxonMobil Chemical Company. During his tenure he held the positions of Technical Service Engineer, Technical Department Section Supervisor, Planning Associate, Operations Manager, Plant Manager and Site Manager. We believe that with his vast experience and knowledge of the industry, Mr. Townsend will be a valuable member of our board of directors.

|

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

The Company is committed to maintaining the highest standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving our stockholders well and maintaining the Company’s integrity in the marketplace. The Company has adopted a Code of Ethics that applies to the Company’s principal executive officer, principal financial officer, principal accounting officer and controller, and to persons performing similar functions. The Company’s Code of Ethics, in conjunction with the Certificate of Incorporation, By-laws and Board committee charters, form the framework for governance of the Company.

The Company’s Code of Ethics, Certificate of Incorporation, By-laws and Board committee charters are available on the Company’s website at www.arabianamericandev.com. Stockholders may also request free printed copies of these from the Corporate Secretary at the address on page 34.

Board Leadership Structure

The Board believes the interests of all shareholders are best served at the present time through a leadership model with a combined Chairman/CEO position due to the Company’s relatively small market cap and the fact that the Chairman position merely administers Board meetings and has no special authority. The current CEO possesses an in-depth knowledge of the Company and the array of challenges to be faced. This knowledge was gained through more than 34 years of successful experience in progressively more senior positions. The Board believes that these experiences and other insights put the CEO in the best position to provide broad leadership for the Board as it considers strategy and as it exercises its fiduciary responsibilities to shareholders. Further, the Board has demonstrated its commitment and ability to provide independent oversight of management. Each independent director has access to the CEO and other Company executives on request; may call meetings of the independent directors; and, may request agenda topics to be added or dealt with in more detail at meetings of the full Board or an appropriate Board committee.

Board Policy Regarding Voting for Directors

The Company has implemented a plurality vote standard in the election of directors. In addition, the Company has adopted a policy whereby any incumbent director nominee who receives a greater number of votes “AGAINST” his or her election than votes “FOR” such election will tender his or her resignation for consideration by the Nominating Committee. The Nominating Committee will recommend to the Board the action to be taken with respect to such offer of resignation.

Board Independence

The Company has implemented a policy that a majority of the Board will consist of independent directors. The Board has determined that the non-employee director nominees, Mohammed O. Al Omair and John R. Townsend, standing for election and each of the members of each Board committee are independent within the meaning of the Company’s director independence standards. The Company standards reflect Nasdaq corporate governance listing standards. In addition, each member of the Audit Committee met the heightened independence standards required for audit committee members under the Nasdaq listing standards, with the exception of Ghazi Sultan who resigned from the Audit Committee on April 4, 2011, due to his October 27, 2010 agreement to serve as the Company’s Saudi Arabian branch representative. Following Mr. Sultan’s resignation, the Company regained compliance and Nasdaq closed the matter.

Meetings of the Board and Its Committees

Because of the geographical distance between members of the Board, meetings are typically held via telephone conference call. In the instance where all members cannot be contacted at once, members may be contacted individually, and upon agreement, Unanimous Consent Resolutions are signed. During 2010 the Board held eight meetings.

The Company’s Director Independence Standards

An independent director is a person other than an executive officer or employee of the Company or any other individual having a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

A director will not be considered independent in the following circumstances:

|

|

(1)

|

The director is, or has been in the past three years, an employee of the Company or an employee of any parent or subsidiary of the Company;

|

|

|

(2)

|

The director has accepted, or has a family member who has accepted during any twelve-month period within the last three years, more than $120,000 in compensation from the Company, other than compensation for Board or Board Committee service, compensation received by the director’s immediate family member for service as a non-executive employee of the Company, and benefits under a tax-qualified retirement plan, or non-discretionary compensation.

|

|

|

(3)

|

The director is a family member of an individual who is, or at any time during the past three years was, employed by the Company as an executive officer;

|

|

|

(4)

|

The director is, or has a family member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which the company made, or from which the company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than (i) payments arising solely from investments in the company’s securities; or (ii) payments under non-discretionary charitable contribution matching programs;

|

|

|

(5)

|

The director is, or has an immediate family member who is, employed as an executive officer of another entity where at any time during the past three years

|

any of the executive officers of the Company serve on the compensation committee of such other entity; or

|

|

(6)

|

The director is, or has a family member who is, a current partner of the Company’s outside auditor, or was a partner or employee of the Company’s outside auditor who worked on the Company’s audit at any time during any of the past three years.

|

For these purposes, a “family member” means a person’s spouse, parents, children and siblings, whether by blood, marriage or adoption, or anyone residing in such person’s home.

Board Structure and Committee Composition

As of the date of this proxy statement, our Board has six directors and the following three standing committees: (1) Audit, (2) Compensation, and (3) Nominating. Committee membership and meetings during the last fiscal year and the function of each of the standing committees are described below. Each of the standing committees operates under a written charter adopted by the Board. Committee charters are available on the Company’s website at www.arabianamericandev.com. Free printed copies are also available to any stockholder who makes a request to the address on page 34. Each current director attended at least 75% of all Board and applicable standing committee meetings during 2010 except for Mr. Al Omair. Directors are also encouraged to attend annual meetings of Company stockholders.

|

Name of Director

|

Audit

|

Compensation

|

Nominating

|

|

Non-Employee Directors:

|

|

|

|

|

Ghazi Sultan1

|

|

Member

|

Chair

|

|

Mohammed O. Al Omair2

|

Member

|

Member

|

Member

|

|

Charles W. Goehringer, Jr.3

|

|

|

|

|

Allen P. McKee4

|

Member

|

Chair

|

Member

|

|

John R. Townsend5

|

Chair

|

Member

|

|

|

Employee Directors:

|

|

|

|

|

Nicholas N. Carter

|

|

|

|

| |

|

|

|

|

Number of Meetings in Fiscal 2010

|

6

|

7

|

1

|

Notes to Board Committee Table

|

1

|

Mr. Sultan was elected to the Board in September 1993. He joined the Audit and Compensation Committees in 1994 and became the Chair of the Nominating Committee in April 2007. He resigned from the Audit Committee on April 4, 2011.

|

|

2

|

Mr. Al Omair was elected to the Board on October 23, 2007. He joined the Nominating and Audit Committees on October 23, 2007, and the Compensation Committee on December 31, 2007.

|

|

3

|

Mr. Goehringer was elected to the Board on October 23, 2007. He joined the Nominating and Audit Committees on October 23, 2007, and the Compensation Committee on December 31, 2007. He resigned from the Audit Committee in February 2008. He resigned from the Compensation and Nominating Committees in January 2009. His term will expire at the 2011 Annual Stockholders’ Meeting.

|

|

4

|

Mr. McKee was elected to the Board on April 28, 2009. He joined the Nominating, Audit and Compensation Committees on April 28, 2009. He became the Chair of the Compensation Committee in February 2010.

|

|

5

|

Mr. Townsend was appointed to the Board in February 2011. He concurrently joined the Audit and Compensation Committees. He became Chair of the Audit Committee on April 7, 2011.

|

Audit Committee

The Company has a separately-designated standing Audit Committee established in accordance with the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee assists the Board in fulfilling its responsibilities for generally overseeing the Company’s financial reporting processes and the audit of the Company’s financial statements, including the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the qualifications and independence of the independent registered public accounting firm, the performance of the Company’s internal audit function and the independent registered public accounting firm, risk assessment and risk management, and finance and investment functions. Among other things, the Audit Committee prepares the Audit Committee report for inclusion in the annual proxy statement; annually reviews its charter and performance; appoints, evaluates and determines the compensation of the independent registered public accounting firm; reviews and approves the scope of the annual audit, the audit fee and the financial statements; reviews and approves all permissible non-audit services to be performed by the independent registered public accounting firm; reviews the Company’s disclosure controls and procedures, internal controls, information security policies, internal audit function, and corporate policies with respect to financial information and earnings guidance; reviews regulatory and accounting initiatives and off-balance sheet structures, oversees the Company’s compliance programs with respect to legal and regulatory requirements; oversees investigations into complaints concerning financial matters; reviews other risks that may have a significant impact on the Company’s financial statements; reviews and oversees treasury matters, the Company’s loans and debt, loan guarantees and outsourcings; reviews the Company’s capitalization and operations; and coordinates with the Compensation Committee regarding the cost, funding and financial impact of the Company’s equity compensation plans and benefit programs. The Audit Committee works closely with management as well as the independent registered public accounting firm. The Audit Committee has the authority to obtain advice assistance from, and receive appropriate funding from the Company for, outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

The Board determined that each of John R. Townsend, Chair of the Audit Committee, and Audit Committee members Mohammed O. Al Omair and Allen P. McKee are independent pursuant to Nasdaq listing standards governing audit committee members. The Board also determined that Allen P. McKee is an audit committee financial expert as defined by SEC rules and Nasdaq listing standards.

The charter of the Audit Committee is available on the Company’s website at www.arabianamericandev.com. A free printed copy is also available to any stockholder who requests it from the Corporate Secretary at the address on page 34.

Compensation Committee

The Compensation Committee discharges the Board’s responsibilities relating to the compensation of the Company’s executives and directors; prepares the report required to be included in the annual proxy statement; provides general oversight of the Company’s compensation structure; reviews and provides guidance on the Company’s human resources programs; and retains and approves the terms of the retention of compensation consultants and other compensation experts. Other specific duties and responsibilities of the Compensation Committee include reviewing and approving objectives relevant to executive officer compensation, evaluating performance and determining the compensation of executive officers in accordance with those objectives; approving severance arrangements and other applicable

agreements for executive officers; overseeing the Company’s equity-based and incentive compensation plans; overseeing non-equity based benefit plans and approving any changes to such plans involving a material financial commitment by the Company; monitoring workforce management programs; establishing compensation policies and practices for service on the Board and its committees; developing guidelines for and monitoring director and executive stock ownership; and annually evaluating its performance and its charter.

The individuals serving on the Compensation Committee of the Board of Directors are Allen P. McKee (Chair), Mohammed O. Al Omair, Ghazi Sultan, and John R. Townsend. The Board determined that each of the Committee members is independent pursuant to Nasdaq listing standards governing nominating committee members.

The charter of the Compensation Committee is available on the Company’s website at www.arabianamericandev.com. A free printed copy is also available to any stockholder who requests it from the Corporate Secretary at the address on page 34.

Nominating Committee

The Nominating Committee recommends candidates to be nominated for election as directors at the Company’s annual meeting, consistent with criteria approved by the Board; develops and regularly reviews corporate governance principles and related policies for approval by the Board; oversees the organization of the Board to discharge the Board’s duties and responsibilities properly and efficiently; and sees that proper attention is given and effective responses are made to stockholder concerns regarding corporate governance. Other specific duties and responsibilities of the Nominating Committee include: annually assessing the size and composition of the Board, including developing and reviewing director qualifications for approval by the Board; identifying and recruiting new directors and considering candidates proposed by stockholders; recommending assignments of directors to committees to ensure that committee membership complies with applicable laws and listing standards; conducting a preliminary review of director independence and financial literacy and expertise of Audit Committee members and making recommendations to the Board relating to such matters; and overseeing director orientation and continuing education. The Nominating Committee also reviews and approves any executive officers for purposes of Section 16 of the Exchange Act (“Section 16 Officers”) standing for election for outside for-profit boards of directors; and reviews stockholder proposals and recommends Board responses.

The individuals serving on the Nominating Committee of the Board of Directors are Ghazi Sultan (Chair), Mohammed O. Al Omair, and Allen P. McKee. The Board determined that each of the Committee members is independent pursuant to Nasdaq listing standards governing nominating committee members.

The charter of the Nominating Committee is available on the Company’s website at www.arabianamericandev.com. A free printed copy is also available to any stockholder who requests it from the Corporate Secretary at the address on page 34.

Stockholder Recommendations

The policy of the Nominating Committee is to consider properly submitted stockholder recommendations of candidates for membership on the Board as described below under “Identifying and Evaluating Candidates for Directors.” In evaluating such recommendations, the Nominating Committee seeks to achieve a balance of knowledge, experience and capability on

the Board and to address the membership criteria set forth below under “Director Qualifications.” Any stockholder recommendations proposed for consideration by the Nominating Committee should include the candidate’s name and qualifications for Board membership and should be addressed to the Corporate Secretary at the address on page 34.

Director Qualifications

The Company maintains certain criteria that apply to nominees recommended for a position on the Company’s Board. Under these criteria, members of the Board should have the highest professional and personal ethics and values, consistent with longstanding Company values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public service. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all stockholders of the Company.

Identifying and Evaluating Candidates for Directors

The Nominating Committee uses a variety of methods for identifying and evaluating nominees for director. The Nominating Committee regularly assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Nominating Committee considers various potential candidates for director. Candidates may come to the attention of the Nominating Committee through current Board members, professional search firms, stockholders or other persons. Identified candidates are evaluated at regular or special meetings of the Nominating Committee and may be considered at any point during the year. As described above, the Nominating Committee considers properly submitted stockholder recommendations for candidates for the Board to be included in the Company’s proxy statement. Following verification of the stockholder status of people proposing candidates, recommendations are considered together by the Nominating Committee at a regularly scheduled meeting, which is generally the first or second meeting prior to the issuance of the proxy statement for the Company’s annual meeting. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials are forwarded to the Nominating Committee. In evaluating such nominations, the Nominating Committee seeks to achieve a balance of knowledge, experience and capability on the Board.

The Company recognizes the strength and effectiveness of the Board reflects the balance, experience, and diversity of the individual directors; their commitment; and importantly, the ability of directors to work effectively as a group in carrying out their responsibilities. The Company seeks candidates with diverse backgrounds who possess knowledge and skills in areas of importance to the Corporation. In addition to seeking a diverse set of business or academic experiences, the Nominating Committee seeks a mix of nominees whose perspectives reflect diverse life experiences and backgrounds. The Nominating Committee does not use quotas but considers diversity when evaluating potential new directors.

Executive Sessions

Executive sessions of independent directors are held at least three times a year. The sessions are scheduled and chaired by the lead independent director. Any independent director may request that an additional executive session be scheduled.

Communications with the Board

Individuals may communicate with the Board by contacting:

Nicholas N. Carter

Arabian American Development Company

P. O. Box 1636

Silsbee, TX 77656

All directors have access to this correspondence. In accordance with instructions from the Board, the Secretary to the Board reviews all correspondence, organizes the communications for review by the Board and relays communications to the full Board or individual directors, as appropriate. The Company’s independent directors have requested that certain items that are unrelated to the Board’s duties, such as spam, junk mail, mass mailings, solicitations, resumes and job inquiries, not be forwarded.

Communications that are intended specifically for the lead independent director, the independent directors or non-management directors should be sent to the address noted above to the attention of the lead independent director.

COMMON STOCK OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of December 31, 2010, concerning beneficial ownership by:

|

|

(1)

|

Company directors and nominees, each of the named executive officers, and all individuals owning more than 5% of the Company’s outstanding Common Stock, set forth in the Summary Compensation Table on page 23; and

|

|

|

(2)

|

Current directors and Company executive officers as a group.

|

The information provided in the table is based on the Company’s records, information filed with the SEC and information provided to the Company, except where otherwise noted.

The number of shares beneficially owned by each entity or individual is determined under SEC rules, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the entity or individual has sole or shared voting power or investment power and also any shares that the entity or individual has the right to acquire as of March 1, 2011 through the exercise of any stock option or other right. Unless otherwise indicated, each person has sole voting and investment power (or shares such powers with his or her spouse) with respect to the shares set forth in the following table.

BENEFICIAL OWNERSHIP TABLE

|

Name of Beneficial Owner

|

Amount and Nature of Beneficial Ownership1

|

Percent of

Class

|

|

Current Directors and Nominees:

|

|

|

|

Ghazi Sultan

|

130,000(2)(3)

|

0.5%

|

|

Robert E. Kennedy

|

50,000(2)(3)

|

0.2%

|

|

Allen P. McKee

|

49,667(2)(3)

|

0.2%

|

|

Charles W. Goehringer, Jr.

|

73,967(2)(3)

|

0.3%

|

|

Mohammed O. Al Omair

|

41,667(2)(3)

|

0.2%

|

|

Current Director, Nominee or Named Executive Officer:

|

|

|

|

Nicholas N. Carter

|

472,768(3)

|

2.0%

|

|

Connie J. Cook

|

40,350(3)

|

0.2%

|

|

Mark D. Williamson

|

30,000(3)

|

0.1%

|

|

Gerardo Maldonado

|

3,750(3)

|

0.0%

|

|

Ronald R. Franklin

|

2,028

|

0.0%

|

|

All current directors and executive officers as a group (10 persons)

|

894,197(3)

|

3.7%

|

| |

|

|

|

Individuals with beneficial ownership of more than 5% of outstanding Common Stock

|

|

|

|

Fahad Mohammed Saleh Al Athel

|

3,995,745

|

16.7%

|

|

Wellington Trust

|

2,049,524

|

8.6%

|

|

Prince Talal Bin Abdul Aziz

|

1,272,680

|

5.3%

|

Notes to Beneficial Ownership Table

(1) Unless otherwise indicated, to the knowledge of the Company, all shares are owned directly and the owner has sole voting and investment power. Includes shares of restricted stock.

(2) Includes 71,667 aggregated shares which these directors have the right to acquire through the exercise of presently exercisable stock options.

(3) Includes 196,917 aggregated shares which certain directors and executive officers have the right to acquire through the exercise of stock options or other rights exercisable presently or within 60 days.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act, requires our directors, executive officers and holders of more than 10% of Company common stock to file reports with the SEC regarding their ownership and changes in ownership of our securities. The Company believes that during fiscal 2010, its directors, executive officers and 10% stockholders complied with all Section 16(a) filing requirements. In making these statements, the Company has relied upon examination of the copies of Forms 3, 4, and 5, and amendments thereto, provided to the Company and the written representations of its directors, executive officers and 10% stockholders.

EXECUTIVE COMPENSATION

This Compensation Discussion and Analysis presents information about the compensation of our officers named in the Summary Compensation Table on page 23 (the “Named Executive Officers” or “NEOs”). Our executive compensation program is designed to promote a strong culture of leadership development, aligned with performance improvement (focused on both growth and productivity) and integrity, which in turn drives financial performance that provides value to our shareholders. The main components of our executive compensation program include base salary and annual and long-term incentives (total direct compensation). By having

two of the three main components of executive pay based upon corporate performance our incentive program is designed to emphasize a pay-for-performance relationship.

|

•

|

Annual incentive awards consist of cash bonuses generated under our new annual incentive program and our legacy profit sharing. Cash awards under our annual incentive plan are tied to financial results (Operating Income) and to a lesser extent individual performance. Our profit sharing program is available to all petrochemical segment employees (including our NEOs) and is based on cash flow from the petrochemical segment of the business. Our NEOs have historically participated in the profit sharing program with all of our petrochemical employees. We have seen a connection between our executives and our other employees when everyone gathers for a quarterly meeting to discuss Company performance. The checks that are handed out to each participant in attendance reflect the operating results of the previous quarter. Everyone from our lowest hourly rate petrochemical employee to our CEO feel the excitement or disappointment with the size of their respective profit sharing checks. We feel that it is important to continue this practice and do not want to disrupt this employee-wide participation and personal connection and identification with corporate’s quarterly results. For reasons stated below, we implemented a new annual incentive program for our NEOs in 2010 which could have eliminated the need for NEO participation in our profit sharing program. However, rather than eliminate NEO participation from the profit sharing plan we simply net out any quarterly payment made throughout the year from the bonus generated under the new annual incentive program. By doing this we maintain the connection between our executives and other employees. Both bonuses and profit sharing awards are paid in cash and provide a strong link between pay and performance as they are directly determined by operating income and profitability.

|

|

•

|

The 2008 long-term incentive program currently issues equity to our executives in the form of stock options. The equity-based reward to our executives is therefore highly correlated to the investment success of our shareholders as options hold value only as our stock price increases above the strike price.

|

Our long-term success depends on our people. We strive to ensure that our employees’ contribution and performance are recognized and rewarded through a competitive compensation program. We target an executive compensation package that is competitive against the market in which we compete for talent. A substantial portion of any of our executives’ annual total compensation package is variable compensation tied to performance (i.e., Operating Income and individual performance). We have designed our incentive program in such a way that if performance is at or above targeted levels, the executive’s total compensation will be at or above targeted levels. Conversely, if performance is below targeted levels, the executive’s compensation will be below targeted levels.

Executive Compensation Program Design

Base Salary. Base salaries provide for competitive pay based on the market value of the position and meet the objective of attracting and retaining talent needed to run the business. Salaries are reviewed by the Compensation Committee (the “Committee”) annually. Salary increases may be given based on individual factors, such as competencies, skills, experience, performance and market practices. There are no specific weightings assigned to these individual factors. Annual salary increases are generally effective in January. Increases may also be given when executives assume new roles or are promoted.

Annual Cash Incentive Plan. We use Operating Income as the financial metric for annual executive bonus awards. The Committee believes that this is the best financial metric to use as a company performance indicator because it excludes items outside of management’s control such as tax and interest rates. In addition, Operating Income is easily determinable because it is a line item on the Company’s Consolidated Statements of Operations and is equal to Revenues less Operating Costs and Expenses and General Administrative Expenses.

Once financials are available at the conclusion of the fiscal year, the Committee will review our Operating Income results and may choose to exclude or adjust certain items to ensure that award payments reflect the core operating performance of the business. Examples include scenarios where the Company’s product prices decline by 50% or more or increase by 100% or more. Operating Income measures our ability to generate income after covering operating costs and general and administrative expenses. Operating Income represents a challenging performance metric because feedstock costs and product prices have been very volatile in recent years. Operating Income grows by not only increasing revenues through increased sales or improved product prices, but also by maintaining product margins, reducing costs and managing assets. The primary challenge lies in maintaining reasonable product margins, especially when feedstock prices are rapidly changing from one month to the next.

Thus annual cash bonuses are designed to motivate and reward NEOs and all other executives on the achievement of Company and individual goals for the performance year. Our annual incentive plan is designed to allow NEOs and other executives to earn up to 200% of their target bonus based upon performance achieved. Each executive’s target bonus is expressed as a percentage of base salary. The bonus levels below were adopted by the Committee.

|

Participant Title

|

Target Bonus

(as % of Base Salary)

|

Max

|

Maximum Bonus

(as % of Base Salary)

|

|

President and CEO

|

80%

|

2X

|

160%

|

|

Chief Financial Officer

|

45%

|

2X

|

90%

|

|

Vice President of Marketing

|

45%

|

2X

|

90%

|

|

Vice President of Manufacturing

|

50%

|

2X

|

100%

|

Bonus payouts are determined by measuring performance on both a corporate and personal level.

|

•

|

20% of the target bonus is based upon individual performance. Each of the goals are equally weighted in this portion of a participant’s target bonus (i.e., if there are two individual performance goals then 10% of the target bonus each). The Committee is responsible for determining the President/CEO’s performance relative to any individual goals. The President/CEO determines the performance of his direct reports and makes a recommendation for approval to the Committee.

|

|

•

|

80% of the target bonus is based upon corporate performance and is determined by the achievement of a pre-established Operating Income goal. Actual Operating Income relative to the Operating Income goal determines the multiple to be applied to this portion of a participant’s bonus. For example, if 100% (“Target” Performance) of the Operating Income goal is met, then a 1.00X multiple is applied to 80% of the participant’s target bonus. Threshold payouts will occur when 80% of the Operating Income goal is met (“Threshold” Performance). In this case a 0.50X multiple is applied to 80% of the participant’s Target bonus. Performance below Threshold (80% Target of Operating Income) results in a zero dollar payout. The Maximum payout occurs when actual Operating Income is greater than or equal to 140% of the Operating Income goal (“Maximum” Performance). When Maximum

|

Performance is achieved, a 2.25X multiple is applied to 80% of the participant’s Target bonus (a 2.25X multiple applied to the corporate portion of the Target bonus allows a participant to earn up to two times the Target bonus, assuming the participant successfully achieved his or her individual performance goals). Payouts are scaled linearly between Threshold and Target for performance levels between 80% and 100% of Target Performance, and between Target and Maximum for performance levels between 100% and 140% of Target Performance.

Examples of bonus payout calculations for the President/CEO are as follows:

|

Base Salary: $250,000

|

|

|

|

|

Target Bonus as % of Base Salary: 80%

|

|

$ |

200,000 |

|

|

Maximum Bonus as % of Base Salary: 160%

|

|

$ |

400,000 |

(1) |

|

TARGET BONUS

|

|

|

Status

|

|

Multiple

|

|

|

Payout

|

|

|

Individual Goals

|

20 |

% |

Achieved

|

|

|

1 |

X |

|

$ |

40,000 |

|

|

Corporate Performance

|

80 |

% |

Target

|

|

|

1 |

X |

|

$ |

160,000 |

|

| |

100 |

% |

|

|

|

|

|

|

$ |

200,000 |

|

|

MAXIMUM BONUS

|

|

|

|

Status

|

|

Multiple

|

|

|

2X Target

|

|

|

Individual Goals

|

|

10 |

% |

(3) |

Achieved

|

|

|

1 |

X |

|

$ |

40,000 |

|

|

Corporate Performance

|

|

90 |

% |

|

Target

|

|

|

2.25 |

X |

|

$ |

360,000 |

(2) |

| |

|

100 |

% |

|

|

|

|

|

|

|

$ |

400,000 |

(1) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

$400,000 = 2X the Target Bonus

|

|

(2)

|

$360,000 = $200,000 X 80% X 2.25

|

|

(3)

|

There is only a “target” payout related to Individual Goals; therefore, this payout remains the same even in a maximum performance scenario and only accounts for 10% of the total payout; 90% of the maximum award payout is based upon Corporate Operating Income performance

|

The following payout schedule is applied to 80% of the participant’s target bonus which is tied to corporate performance in the form of Operating Income.

|

Payout level

|

Corporate Performance

Bonus Multiple

|

Performance Achievement

|

|

Maximum

|

2.25X(1)

|

140% of Operating Income goal

|

|

Target

|

1.00X

|

100% of Operating Income goal

|

|

Threshold

|

0.50X

|

80% of Operating Income goal

|

|

(1)

|

Applying a multiple of 2.25X the Corporate Performance portion of the target bonus is necessary to allow our participants an opportunity to earn 200% of their target bonus because it is being applied to only 80% of the targeted bonus payout. The amount of the target bonus paid for achieving individual goals does not change in a maximum corporate performance scenario.

|

Payouts are scaled linearly between Threshold and Target, and then between Target and Maximum for performance levels between 80% and 140% of Target Performance. Payouts will be interpolated for actual performance between these points.

Profit Sharing Program. South Hampton’s profit sharing program is available to all employees, including NEOs, based upon South Hampton’s quarterly performance. Since South Hampton is located about an hour north of a larger petrochemical sector, competition for qualified, intelligent and conscientious employees is high. Base pay for employees is typically about 20% less than larger facilities; however, the profit sharing program allows South Hampton to compensate employees with additional pay when profits are sound. It also enables South Hampton the ability to forego payments during times of economic slowdown. Profit sharing is done on a quarterly basis when cash flow permits. There is no set formula for calculating or allocating profit sharing

as it is based upon several factors including profit, cash flow, expectations and special cash needs of South Hampton and the Company. In 2010 the Committee adopted a written policy governing employee profit sharing. Pursuant to this policy, the pool of funds available for profit sharing during any particular calendar quarter cannot exceed 12% of South Hampton’s estimated earnings before interest, depreciation, taxes and amortization (“EBITDA”) for that quarter. In addition, the President/CEO must submit a recommended level of profit sharing with proposed employee allocations to the Committee for approval. The amount of the total award allocated to each executive officer and to each employee is based on (i) current base salary and pay levels, (ii) instances of individual superior performance, and (iii) instances of individual sub-standard performance. South Hampton has a wide range of salary and pay levels, and in general employees at the lower end of the pay scale will be granted higher awards as a percentage of their base pay. Under the policy, the Committee has authority to revise the amount of funding available for profit sharing, as well as, to adjust individual allocations. As previously explained, all profit sharing awards to NEOs and other participants in our new, annual incentive program are netted out of any annual incentives paid out under the Company’s annual incentive program.

As an incentive for safe work performance, a safety award program is incorporated into the profit sharing program. As part of this program, South Hampton pays every employee, including NEOs and other executives, a $500 net award at the end of each calendar quarter in which there are no lost-time or recordable accidents. This program has been very successful in encouraging employees to watch out for one another and to work safely. Consistent with profit sharing awards, all safe work awards are netted out of any annual bonuses paid to the NEOs and other executives under the Company’s annual incentive program.

Long-Term Incentive – Stock Options. Stock options align our executives’ interests with those of our shareholders since the options have realizable value only if the price of Arabian American Development Company stock increases after the options are granted. The size of future awards is evaluated and determined annually based on a consideration of competitive compensation practices and changes in our stock price year over year, as well as the number of shares remaining under our long-term incentive plan. NEOs and other executives receive nonqualified option grants with the following characteristics:

|

•

|

An exercise price equal to closing price of Arabian American Development Company stock on the grant date

|

|

•

|

Annual vesting in approximately equal installments over a specified period

|

|

•

|

Expiration seven to ten years after the grant date

|

Perquisites. We provide benefits that we believe are standard in the industry to all employees. These benefits consist of a group medical and dental insurance program for employees and their qualified dependents, group life insurance for employees and their spouses, accidental death and dismemberment coverage for employees, a Company sponsored cafeteria plan and a 401(k) employee savings and investment plan. The Company matches employee deferral amounts, including amounts deferred by named executive officers, up to a total of 6% of the employee’s eligible salary, excluding annual cash bonuses, subject to certain regulatory limitations. In December 2010 we provided our President/CEO with a company vehicle for business and personal travel. Our use of perquisites as an element of compensation is very limited. We do not view perquisites as a significant element of our comprehensive compensation structure.

|

|

Governance of Pay Setting Process

|

In setting total direct compensation, a consistent approach is applied for all executives:

|

•

|

We benchmark our NEOs to comparable positions within the market in terms of specific duties, responsibilities, and job scope.

|

|

•

|

Each position has an established target annual incentive award opportunity, executive benefits and perquisites. These incentive levels and benefits are reviewed by the Committee on an annual basis to determine their relative level of competitiveness with the market.

|

|

•

|

We generally target all elements of pay and total direct compensation to be positioned between the 25th to 50th percentiles of our peer group.

|

|

•

|

Individual executive pay positioning will vary based on the requirements of the job (competencies and skills), the executive’s experience and performance, and the organizational structure (internal alignment and pay relationships).

|

|

•

|

We also consider internal pay equity when establishing compensation levels. Currently, we believe that our compensation level for each of our NEOs reflects his or her job responsibility and scope appropriately and scale down from the CEO in a reasonable manner.

|

|

•

|

Exceptions to normal practice may be made based on critical business and people needs.

|

|

|

Role of the Compensation Committee in Establishing Pay Levels

|

|

•

|

The Compensation Committee (comprised of only independent directors) establishes, reviews and approves all elements of the executive compensation program. A copy of the Compensation Committee Charter is available on our website. During 2010 the Committee engaged Pearl Meyer & Partners (“PM&P”) to serve as its independent outside executive compensation consultant. PM&P’s primary role is to provide advice and perspective regarding market compensation trends that may impact decisions we make about our executive compensation program and practices. PM&P was instrumental in assisting the Committee in a complete overhaul of our executive compensation program in the latter half of 2010. The Company incurred expenses during 2010 payable to PM&P in the amount of $47,660. Management has the responsibility for effectively implementing the executive compensation program. Additional responsibilities of the Committee, management and the consultant include:

|

|

•

|

The Committee reviews and approves business goals and objectives relevant to executive compensation, evaluates the performance of the President/CEO in light of these goals and objectives, and determines and establishes the President/CEO’s compensation level.

|

|

•

|

Based on review of market data, individual performance and internal pay comparisons, the Committee independently sets the pay for our President/CEO and reviews and approves all NEO and other executive pay arrangements.

|

|

|

Role of Management in Establishing Pay Levels

|

|

•

|

The President/CEO makes recommendations on program design and pay levels, where appropriate, and oversees the implementation of such programs and directives approved by the Committee.

|

|

•

|

The President/CEO develops pay recommendations for his direct reports and other key executives. This includes all of our NEOs (with the exception of our CEO himself).

|

|

•

|

Our Chief Accounting Officer provides the financial information used by the Committee to make decisions with respect to incentive compensation goals and related payouts.

|

|

|

Role of the Compensation Consultant in Establishing Pay Levels

|

|

•

|

The compensation consultant is responsible for gathering, analyzing and presenting peer group pay practices and relevant data to the Committee. They do not have the authority to determine pay.

|

|

•

|

The consultant provides periodic updates to the Committee regarding various tax, accounting and regulatory issues that could have an impact on executive compensation design, administration and/or disclosure.

|

|

•

|

In 2010 the consultant assisted the Committee in revamping the executive compensation program.

|

|

|

Regulatory Considerations

|

We account for the equity compensation expense for our executives under the rule of Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718 (“ASC 718”), which requires us to estimate and record an expense for each award of equity compensation over the service period of the award. Accounting rules also require us to record cash compensation as an expense at the time the obligation is accrued.

Employment Arrangements

We have not entered into definitive employment agreements with any of our executives. All executives serve at the discretion of the Board with no fixed term of employment.

Benchmarking Against Our Peer Group

We benchmark executive compensation against a peer group. The peer group shown below was developed by the consultant in close consultation with the Committee and was approved the President/CEO. Peer group proxy data provides sufficient benchmarks for the executives, but because the companies are structured differently, not all peers have incumbents in the respective benchmarked positions. Some jobs have no peer benchmarks available from proxy data, such as Vice President of Marketing, which necessitates the use of industry specific and general industry related surveys as an additional data source. The consultant’s survey data provides expanded data to benchmark our executives’ positions. Peer group and survey data provides a focal point in our examination of compensation trends across the petrochemical and chemical processing industry. Each year the Committee reviews the peer group and determines whether any changes should be made. Based on the 2010 review, six companies, Crosstex Energy, Global Partners,

Syntroleum, Adams Resources, Synthesis Energy and Sulphco, were removed and replaced with American Vanguard Corp., Quaker Chemical Corp., Rogers Corp., and TPC Group Inc. The 2010 peer group, inclusive of these changes, consisted of the following nine companies:

American Pacific Corp. American Vanguard Corp. KMG Chemicals Inc.

Penford Corp. Quaker Chemical Corp. Rentech Inc.

Rogers Corp. Sterling Chemicals Inc. TPC Group Inc.

Peer group benchmarking is one of several factors considered in the pay setting process. Peer group practices are analyzed annually for the pay element making up total direct compensation, and periodically for other elements (such as executive benefits and perquisites). In addition to peer group benchmarking, we also used surveys from the consultant in the pay setting process. We used a combination of proxy and survey data, weighted 50% each, to develop market values. All data was summarized to relevant statistics (e.g., median, 25th percentile and 75th percentile), and where applicable, survey data was regressed because it provides a reliable method for size adjusting cash compensation data and is the standard methodology used for analyzing executive pay. The strategy behind the sources of data is to promote the best mix of authorities for competitive positions, utilize industry data for line operations and line executives and some general industry mix to staff executive positions, and balance the proxy data with published authorities to help smooth the volatility of executive changes in the peer group. Market values of cash compensation were correlated to company size as measured by revenue and the data the Committee considered was size-adjusted where possible to reflect our current revenue level ($120 million). This process made the market data points directly applicable to the company.

After the consultant’s completion of peer group and survey data benchmarking, it was apparent that our overall executive compensation program was below market. Specifically, our executives were at the 17th percentile for base salary, the 11th percentile for target total cash levels, the 13th percentile for long-term incentive awards, and the 10th percentile for total direct compensation. The Committee used this information to begin moving the executives’ pay to levels more in line with our compensation philosophy (e.g., paying between the 25th and 50th percentiles of the market data). The Committee adopted the philosophy of targeting pay between the 25th to 50th percentile range of market data based on several factors such as the lower cost of living in southeast Texas as compared to more urban areas and the relatively limited number of competing employment opportunities available to executives in southeast Texas. Our current philosophy of at or below market median pay levels in no way reflects on the qualifications or performance of our executives. It is primarily a function of location.

The table below sets forth the 2010 annualized targeted compensation elements for each of our NEOs and the amount of each element at the target level based market data presented by our compensation consultant.

|

Executive

|

|

Annualized

Base Salary

|

|

|

Annual

Incentive Plan Target

(Profit Sharing, Cash Bonus and

Commissions)

|

|

|

Long-Term Incentive Compensation(1)

|

|

|

Annualized

Total Direct Compensation

Target

|

|

|

Nicholas N. Carter

President & CEO

Compensation Amount

|

|

$ |

250,000 |

|

|

$ |

200,000 |

|

|

$ |

66,300 |

|

|

$ |

516,300 |

|

|

Market Targeted Range

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minimum

|

|

$ |

353,000 |

|

|

$ |

396,000 |

|

|

$ |

146,000 |

|

|

$ |

878,900 |

|

|

Maximum

|

|

$ |

434,000 |

|

|

$ |

481,000 |

|

|

$ |

315,000 |

|

|

$ |

1,104,200 |

|

|

Connie J. Cook

Chief Accounting Officer

Compensation Amount

|

|

$ |

145,000 |

|

|

$ |

65,250 |

|

|

$ |

33,150 |

|

|

$ |

243,400 |

|

|

Market Targeted Range

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minimum

|

|

$ |

189,000 |

|

|

$ |

203,000 |

|

|

$ |

57,000 |

|

|

$ |

351,900 |

|

|

Maximum

|

|

$ |

218,000 |

|

|

$ |

246,000 |

|

|

$ |

89,000 |

|

|

$ |

413,200 |

|

|

Mark D. Williamson

Vice President of Marketing

Compensation Amount

|

|

$ |

253,900 |

(2) |

|

$ |

74,300 |

|

|

$ |

44,200 |

|

|

$ |

372,400 |

|

|

Market Targeted Range

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minimum

|

|

$ |

148,000 |

|

|

$ |

173,000 |

|

|

$ |

41,000 |

|

|

$ |

266,300 |

|

|

Maximum

|

|

$ |

181,000 |

|

|

$ |

215,000 |

|

|

$ |

72,000 |

|

|

$ |

312,200 |

|

|

Ron Franklin

Vice President of Manufacturing

Compensation Amount

|

|

$ |

186,000 |

|

|

$ |

93,000 |

|

|

$ |

24,700 |

|

|

$ |

303,700 |

|

|

Market Targeted Range

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minimum

|

|

$ |

229,000 |

|

|

$ |

262,000 |

|

|

$ |

60,000 |

|

|

$ |

442,200 |

|

|

Maximum

|

|

$ |

265,000 |

|

|

$ |

332,000 |

|

|

$ |

104,000 |

|

|

$ |

495,700 |

|

|

(1)

|

The compensation amount for each NEO shown reflects the value of options granted to the NEOs by the Compensation Committee in the first quarter of 2010 based on the Company’s performance in 2009.

|

|

(2)

|

Includes commissions of $89,000 earned in 2010. Beginning January 1, 2011, the Vice President of Marketing will no longer receive commissions. However, his base salary for 2011 will be increased proportionately to account for the difference.

|

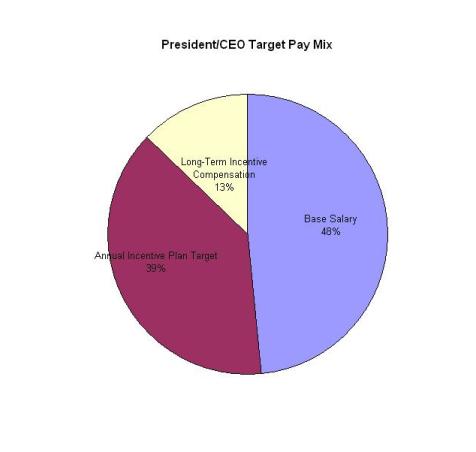

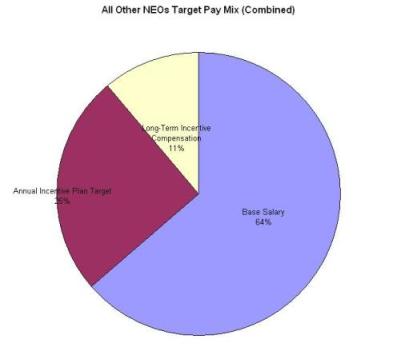

The charts below illustrate that a large portion of our NEOs’ pay is performance based (e.g., approximately 52% of our President/CEO’s pay is performance based and approximately 36% of our other NEOs’ pay is performance based).

Determination of Performance Targets