YourClick Specialty to edit Master Chemical title Partner style Second Quarter 2018 Financial Results August 2, 2018 TREC

Safe Harbor Statements in this presentation that are not historical facts are forward looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward looking statements are based upon Management's belief, as well as, assumptions made by and information currently available to Management. Because such statements are based upon expectations as to future economic performance and are not statements of fact, actual results may differ from those projected. These risks, as well as others, are discussed in greater detail in Trecora Resources' filings with the Securities and Exchange Commission, including Trecora Resources' Annual Report on Form 10-K for the year ended December 31, 2017, and the Company‘s subsequent Quarterly Reports on Form 10-Q. All forward-looking statements included in this presentation are based upon information available to the Company as of the date of this presentation. The Company undertakes no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. 2

Second Quarter 2018 Overview Multi-year, $100+ million capital building campaign completed with commissioning of Advanced Reformer • Full focus on operational excellence and maximizing return on invested capital South Hampton Resources: Successful commissioning of Advanced Reformer unit in July, but: • Second quarter volume depressed by specific customer operating issues; non-recurring international volume captured in the first quarter accentuated sequential volume decline • Total gross margin decreased quarter-over-quarter primarily driven by lower sales volume and higher operating costs; product mix shift and some price increases aided feed margin • One-time start-up costs associated with the Advanced Reformer also pressured operating margin in Q2 Trecora Chemical: Continued progress • Record wax revenue and near-record wax volume in Q2 • Focus on equipment reliability, process and employee safety and operational excellence AMAK delivered $0.2 million in equity in earnings in Q2 as production levels continue to rise • Net income before depreciation and amortization of $8.0 million; $15.3 million year-to-date Refinancing of credit facility resulting in lower borrowing costs and greater flexibility 3

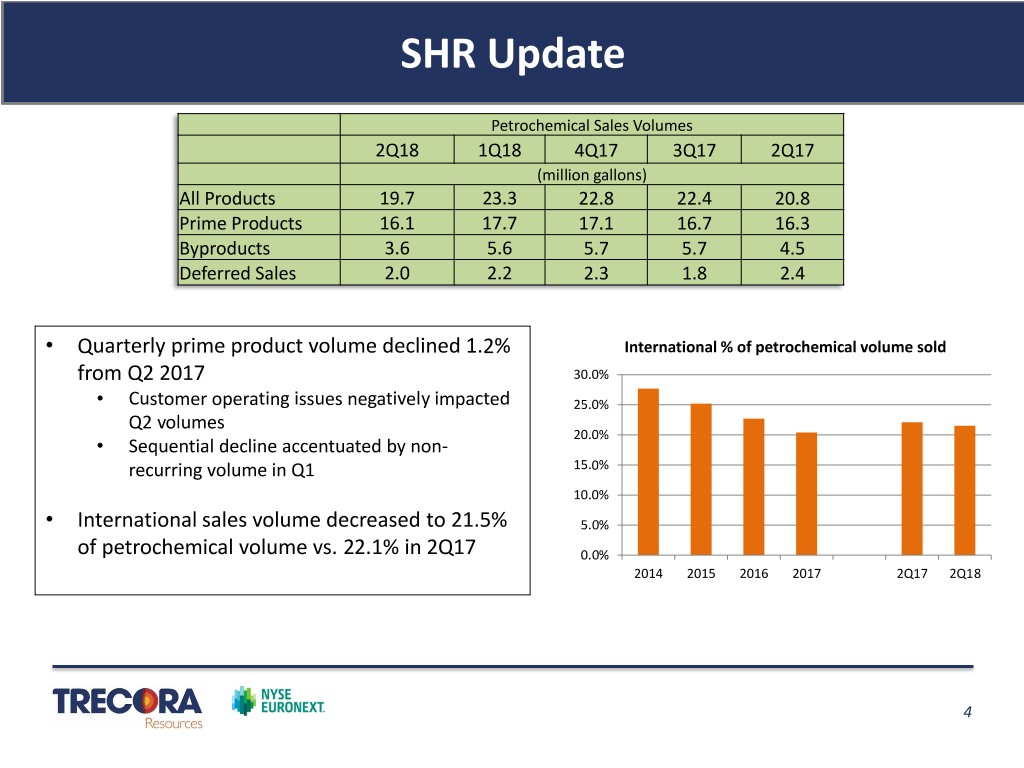

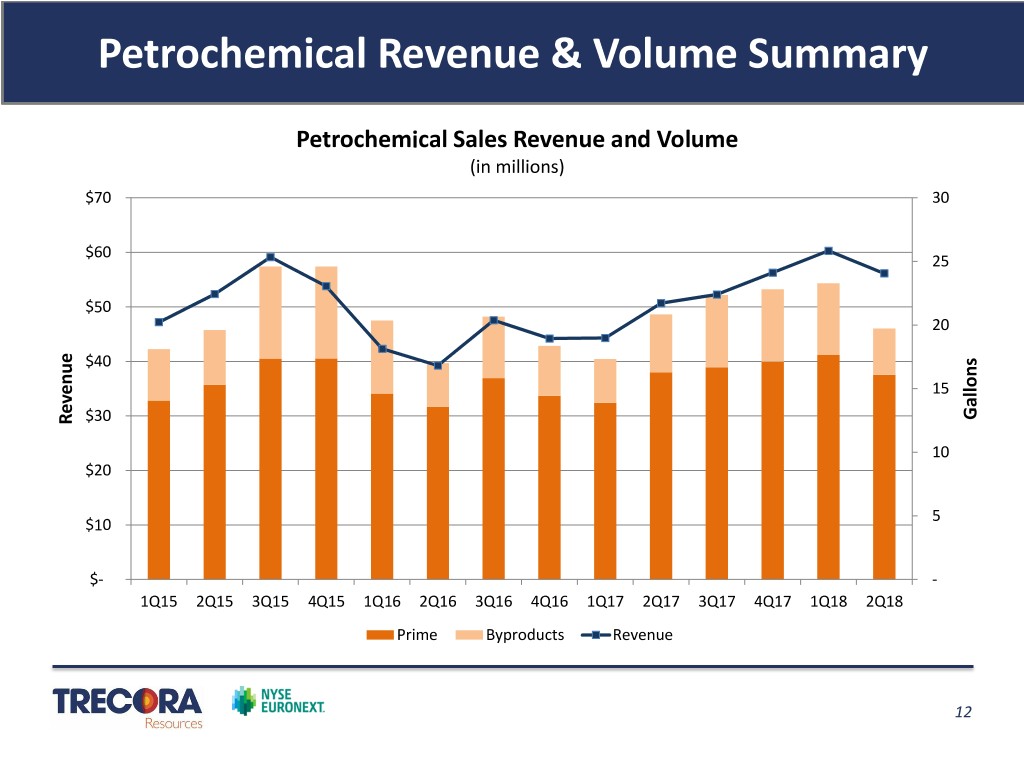

SHR Update Petrochemical Sales Volumes 2Q18 1Q18 4Q17 3Q17 2Q17 (million gallons) All Products 19.7 23.3 22.8 22.4 20.8 Prime Products 16.1 17.7 17.1 16.7 16.3 Byproducts 3.6 5.6 5.7 5.7 4.5 Deferred Sales 2.0 2.2 2.3 1.8 2.4 • Quarterly prime product volume declined 1.2% International % of petrochemical volume sold from Q2 2017 30.0% • Customer operating issues negatively impacted 25.0% Q2 volumes 20.0% • Sequential decline accentuated by non- recurring volume in Q1 15.0% 10.0% • International sales volume decreased to 21.5% 5.0% of petrochemical volume vs. 22.1% in 2Q17 0.0% 2014 2015 2016 2017 2Q17 2Q18 4

SHR Advanced Reformer Project Advanced Reformer safely and successfully commissioned in early July, 2018 At $58 million, our largest capital project designed to produce a significantly higher value-added byproduct stream During Q3 operations will be optimized At current byproduct pricing, the margin uplift is approximately 40 cents per gallon Production levels will grow as pentane volumes grow – annual EBITDA contribution reaching $12-$14 million by 2022 5

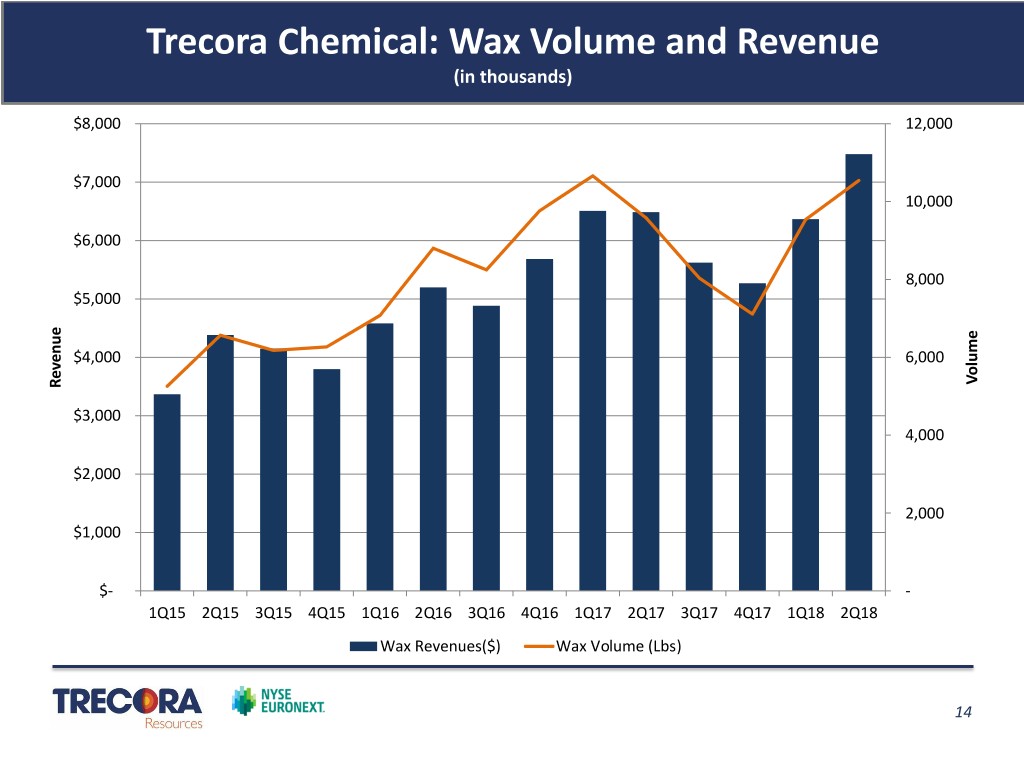

Trecora Chemical Update Quarterly Revenue – up 7.9% compared to second quarter 2017 and up 7.2% relative to 1Q18 Wax • Q2 sales volume up 10.0% year-over-year • Record Q2 revenue up 14.2% year-over-year • Average pricing up 4.4% as mix shifts to higher value sales Custom Processing • Q2 custom processing revenues negatively impacted by equipment reliability despite continued strong customer demand • Organizational changes implemented to improve reliability and efficiency; expect to see benefits in the future B Plant • Q2 revenue of $0.8 million; YTD revenue o f $2.1 million • On track to contribute $4-$6 M/year in EBITDA run-rate by end of 2018 Hydrogenation/Distillation Units • Continued progress, but volumes ramping at slower rate than anticipated – ongoing operational issues • Full functionality and expected $6-$8 M/year in EBITDA run rate delayed into 2019 6

Transformation Plan People – March 2018 – appointed Peter Loggenberg Chief Sustainability Officer » Holds a PhD in Chemistry (Catalysis) and has over 25 years of experience in the chemical industry, especially new products – May 23, 2018 – appointed Dick Townsend EVP, Chief Manufacturing Officer » Brings many years of experience leading transformational change in manufacturing environments – July 9, 2018 – appointed Mike Humby EVP – Commercial » Brings more than 30 years of petrochemical industry experience with Eastman Chemical Company and PPG including leadership positions in procurement, sales, marketing, general business management and M&A Safety and Culture – Behavior based safety program implemented – addressing the human factors – Process Safety Management standardized across the company – Operating discipline and accountability implemented in same way at both sites – Organizational changes have been implemented to more clearly define roles and responsibilities and facilitate better organizational alignment – Skills assessment gap analysis underway/robust training program to follow 7

Transformation Plan - continued Margin – Unlock additional value through customer/market segmentation – Revamp custom processing selection (stage gate process) and implementation Cost and Equipment Reliability – Focus on cost management and appropriate headcount – “PI” system to provide conditioned, time stamped process control – Advanced analytics package purchased to improve personnel – Instituting online equipment monitoring system Sustainability – Improve feedstock and logistics position for both SHR and TC – Ethylene pipeline connection (close proximity) – Understand significant global trends in the production/use of performance chemicals 8

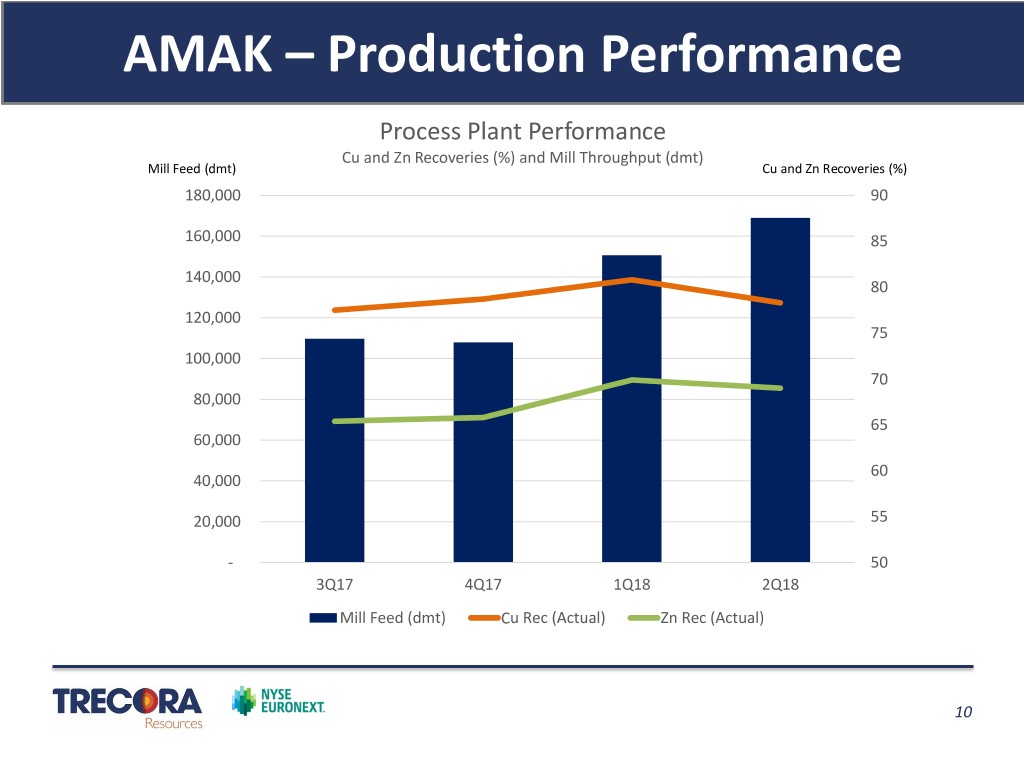

AMAK Mine Developments Operations • 14,400 dmt sold in 2Q18 • 6,400 dmt copper concentrate and 8,000 dmt zinc concentrate • Concentrate quality, throughput rates and recoveries continued steady progress (brief recurrence of water quality issues in June) • Equity in earnings of $0.2 million in 2Q18 • Net profit before depreciation and amortization in 1H18 improved $19.4 million from 1H17 Exploration • Drilling in Guyan and surrounding areas likely to continue through year end • Guyan gold project pushed back six months • Commission Guyan Gold Project at end of 2019 (design slower, more time for drilling, financing) • Drilling continues for Al Masane copper and zinc Precious Metal Circuit/SART • Availability of PMC, SART capacity continue to improve • Gold and silver sales doré sales now expected in 3rd quarter Saudi Industrial Development Fund (SIDF) loan amended on July 8, 2018 • Repayment schedule adjusted and repayment terms extended through April 2024 Growing consistency of operations and established cash flow generation enhances marketability • Potential buyers approached in Q2 • Saudi investor most likely to purchase our position 9

AMAK – Production Performance Process Plant Performance Cu and Zn Recoveries (%) and Mill Throughput (dmt) Mill Feed (dmt) Cu and Zn Recoveries (%) 180,000 90 160,000 85 140,000 80 120,000 75 100,000 70 80,000 65 60,000 60 40,000 20,000 55 - 50 3Q17 4Q17 1Q18 2Q18 Mill Feed (dmt) Cu Rec (Actual) Zn Rec (Actual) 10

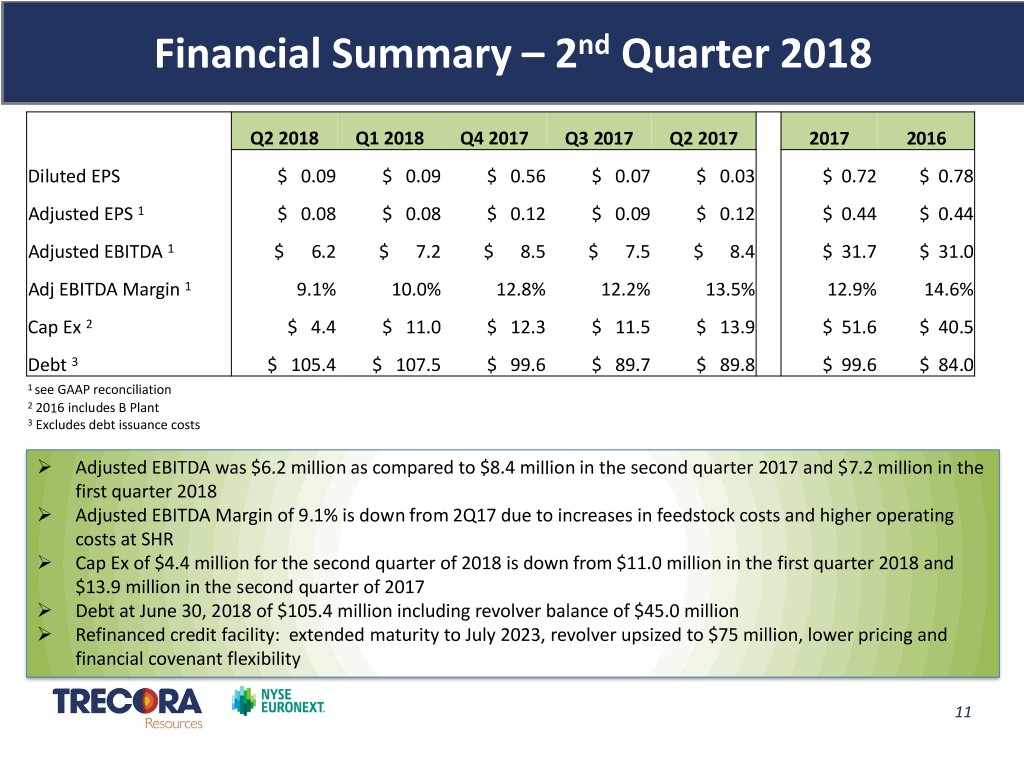

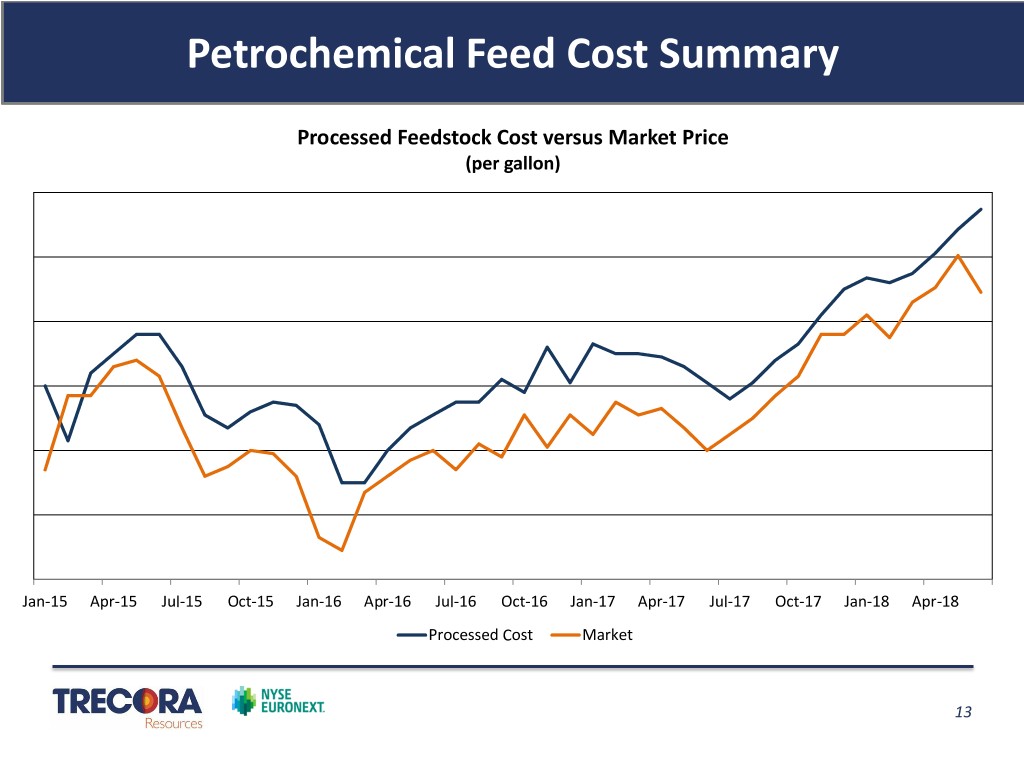

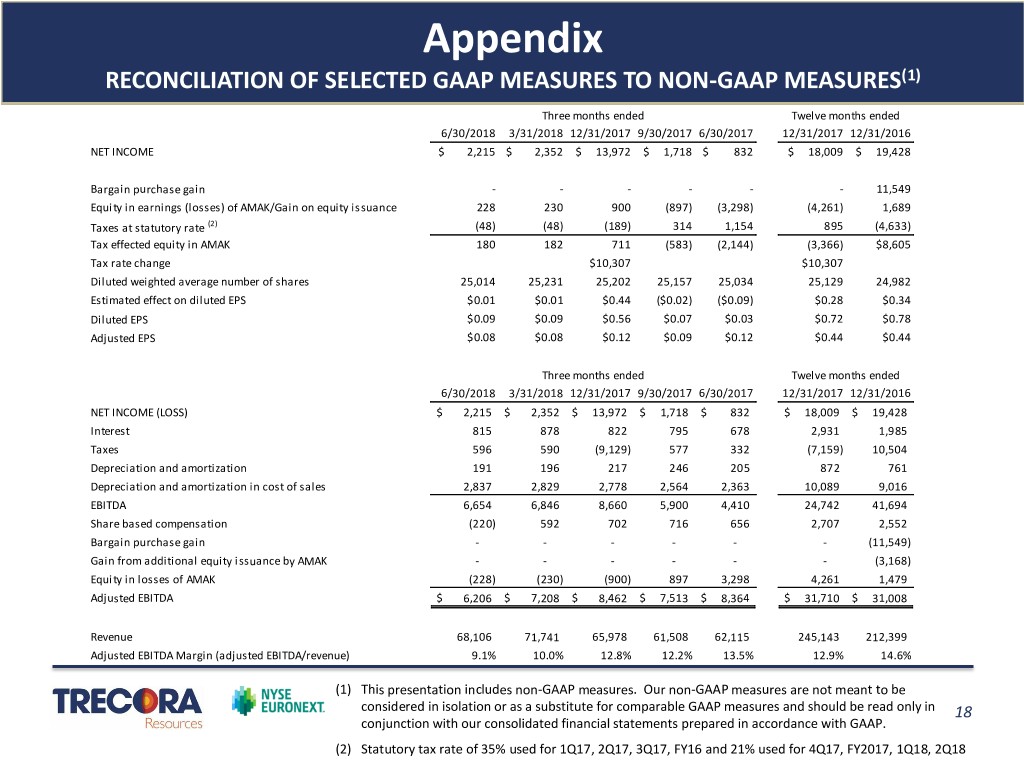

Financial Summary – 2nd Quarter 2018 Q2 2018 Q1 2018 Q4 2017 Q3 2017 Q2 2017 2017 2016 Diluted EPS $ 0.09 $ 0.09 $ 0.56 $ 0.07 $ 0.03 $ 0.72 $ 0.78 Adjusted EPS 1 $ 0.08 $ 0.08 $ 0.12 $ 0.09 $ 0.12 $ 0.44 $ 0.44 Adjusted EBITDA 1 $ 6.2 $ 7.2 $ 8.5 $ 7.5 $ 8.4 $ 31.7 $ 31.0 Adj EBITDA Margin 1 9.1% 10.0% 12.8% 12.2% 13.5% 12.9% 14.6% Cap Ex 2 $ 4.4 $ 11.0 $ 12.3 $ 11.5 $ 13.9 $ 51.6 $ 40.5 Debt 3 $ 105.4 $ 107.5 $ 99.6 $ 89.7 $ 89.8 $ 99.6 $ 84.0 1 see GAAP reconciliation 2 2016 includes B Plant 3 Excludes debt issuance costs Adjusted EBITDA was $6.2 million as compared to $8.4 million in the second quarter 2017 and $7.2 million in the first quarter 2018 Adjusted EBITDA Margin of 9.1% is down from 2Q17 due to increases in feedstock costs and higher operating costs at SHR Cap Ex of $4.4 million for the second quarter of 2018 is down from $11.0 million in the first quarter 2018 and $13.9 million in the second quarter of 2017 Debt at June 30, 2018 of $105.4 million including revolver balance of $45.0 million Refinanced credit facility: extended maturity to July 2023, revolver upsized to $75 million, lower pricing and financial covenant flexibility 11

Petrochemical Revenue & Volume Summary Petrochemical Sales Revenue and Volume (in millions) $70 30 $60 25 $50 20 $40 15 Gallons Revenue $30 10 $20 5 $10 $- - 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Prime Byproducts Revenue 12

Petrochemical Feed Cost Summary Processed Feedstock Cost versus Market Price (per gallon) Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Processed Cost Market 13

Trecora Chemical: Wax Volume and Revenue (in thousands) $8,000 12,000 $7,000 10,000 $6,000 8,000 $5,000 $4,000 6,000 Volume Revenue $3,000 4,000 $2,000 2,000 $1,000 $- - 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Wax Revenues($) Wax Volume (Lbs) 14

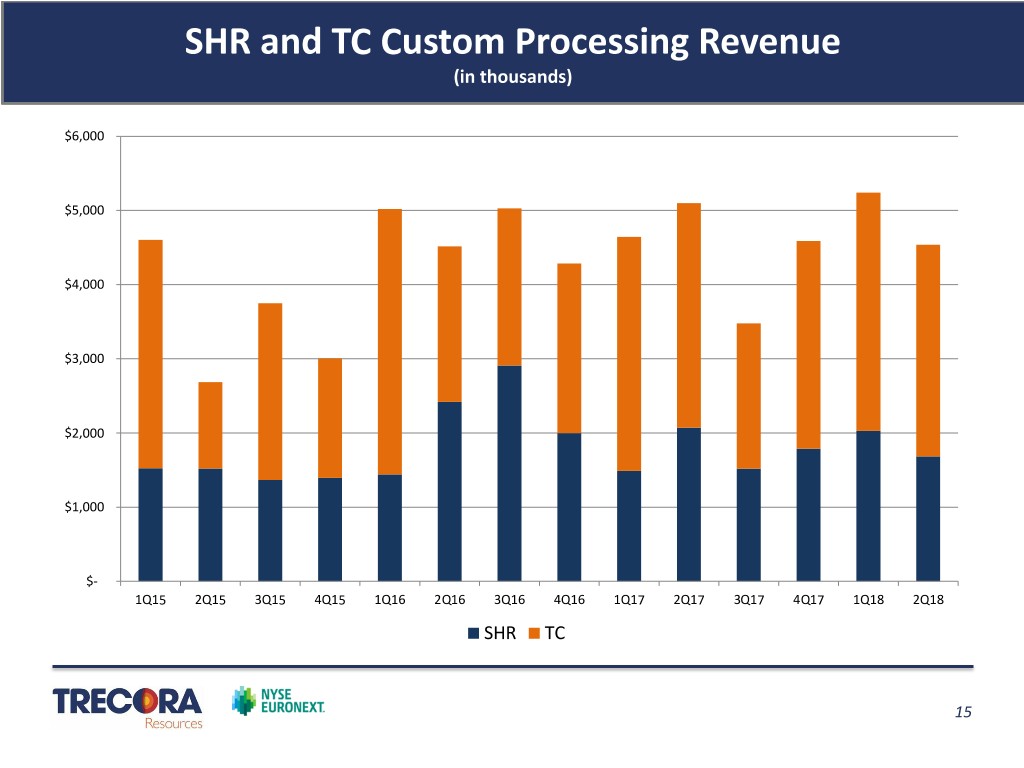

SHR and TC Custom Processing Revenue (in thousands) $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $- 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 SHR TC 15

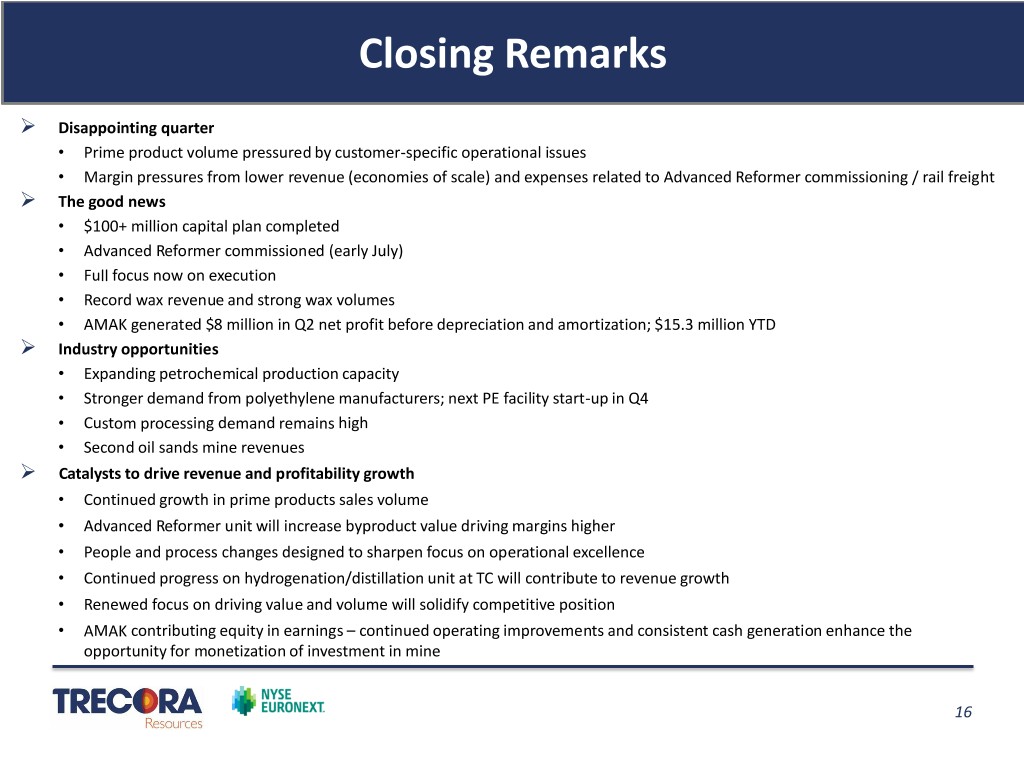

Closing Remarks Disappointing quarter • Prime product volume pressured by customer-specific operational issues • Margin pressures from lower revenue (economies of scale) and expenses related to Advanced Reformer commissioning / rail freight The good news • $100+ million capital plan completed • Advanced Reformer commissioned (early July) • Full focus now on execution • Record wax revenue and strong wax volumes • AMAK generated $8 million in Q2 net profit before depreciation and amortization; $15.3 million YTD Industry opportunities • Expanding petrochemical production capacity • Stronger demand from polyethylene manufacturers; next PE facility start-up in Q4 • Custom processing demand remains high • Second oil sands mine revenues Catalysts to drive revenue and profitability growth • Continued growth in prime products sales volume • Advanced Reformer unit will increase byproduct value driving margins higher • People and process changes designed to sharpen focus on operational excellence • Continued progress on hydrogenation/distillation unit at TC will contribute to revenue growth • Renewed focus on driving value and volume will solidify competitive position • AMAK contributing equity in earnings – continued operating improvements and consistent cash generation enhance the opportunity for monetization of investment in mine 16

Q&A Thank You Please visit our websites: www.trecora.com www.southhamptonr.com www.TrecChem.com www.amak.com.sa 17

Appendix RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES(1) Three months ended Twelve months ended 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 12/31/2017 12/31/2016 NET INCOME $ 2,215 $ 2,352 $ 13,972 $ 1,718 $ 832 $ 18,009 $ 19,428 Bargain purchase gain - - - - - - 11,549 Equity in earnings (losses) of AMAK/Gain on equity issuance 228 230 900 (897) (3,298) (4,261) 1,689 Taxes at statutory rate (2) (48) (48) (189) 314 1,154 895 (4,633) Tax effected equity in AMAK 180 182 711 (583) (2,144) (3,366) $8,605 Tax rate change $10,307 $10,307 Diluted weighted average number of shares 25,014 25,231 25,202 25,157 25,034 25,129 24,982 Estimated effect on diluted EPS $0.01 $0.01 $0.44 ($0.02) ($0.09) $0.28 $0.34 Diluted EPS $0.09 $0.09 $0.56 $0.07 $0.03 $0.72 $0.78 Adjusted EPS $0.08 $0.08 $0.12 $0.09 $0.12 $0.44 $0.44 Three months ended Twelve months ended 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 12/31/2017 12/31/2016 NET INCOME (LOSS) $ 2,215 $ 2,352 $ 13,972 $ 1,718 $ 832 $ 18,009 $ 19,428 Interest 815 878 822 795 678 2,931 1,985 Taxes 596 590 (9,129) 577 332 (7,159) 10,504 Depreciation and amortization 191 196 217 246 205 872 761 Depreciation and amortization in cost of sales 2,837 2,829 2,778 2,564 2,363 10,089 9,016 EBITDA 6,654 6,846 8,660 5,900 4,410 24,742 41,694 Share based compensation (220) 592 702 716 656 2,707 2,552 Bargain purchase gain - - - - - - (11,549) Gain from additional equity issuance by AMAK - - - - - - (3,168) Equity in losses of AMAK (228) (230) (900) 897 3,298 4,261 1,479 Adjusted EBITDA $ 6,206 $ 7,208 $ 8,462 $ 7,513 $ 8,364 $ 31,710 $ 31,008 Revenue 68,106 71,741 65,978 61,508 62,115 245,143 212,399 Adjusted EBITDA Margin (adjusted EBITDA/revenue) 9.1% 10.0% 12.8% 12.2% 13.5% 12.9% 14.6% (1) This presentation includes non-GAAP measures. Our non-GAAP measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in 18 conjunction with our consolidated financial statements prepared in accordance with GAAP. (2) Statutory tax rate of 35% used for 1Q17, 2Q17, 3Q17, FY16 and 21% used for 4Q17, FY2017, 1Q18, 2Q18