Trecora Resources Reports First Quarter 2020 Results

• | First quarter net income from continuing operations of $5.9 million (includes $5.7 million tax benefit from enactment of the CARES Act) |

• | First quarter Adjusted EBITDA from continuing operations of $5.5 million |

• | Operating cash flow from continuing operations of $4.4 million, a $3.5 million improvement from first quarter 2019 |

• | Total consolidated cash of $37.5 million at end of March including borrowings of $20 million on the Company’s revolver (as a precautionary measure) and approximately $10 million cash proceeds from AMAK share sale |

• | Company's current value growth initiatives expected to yield approximately $4 million in incremental value creation in 2020 |

• | Conference call at 10:00 am ET tomorrow, May 6, 2020 |

SUGAR LAND, Texas, May 5, 2020 – Trecora Resources ("Trecora" or the "Company") (NYSE: TREC), a leading provider of specialty hydrocarbons and specialty waxes, today announced financial results for the first quarter ended March 31, 2020.

“At the onset of 2019, we set our priorities and launched a disciplined process for driving shareholder value, with a focus on improved earnings, enhanced free cash flow and meaningful debt reduction. Our approach has allowed us to enter this period of uncertainty in a position of relative strength and financial stability. Through increased operational reliability, steady execution and disciplined cost control, the Company's first quarter 2020 results yielded cash flow from continuing operations of $4.4 million, a $3.5 million improvement from first quarter 2019. First quarter 2020 net income from continuing operations, excluding a tax benefit from the enactment of the CARES Act, was breakeven, due to falling feedstock prices during the quarter. Consolidated Adjusted EBITDA from continuing operations was $5.5 million,” said Pat Quarles, Trecora’s President and Chief Executive Officer.

“In dealing with the impacts of the COVID-19 pandemic, our priorities remain the same: the health and safety of our people and those in the communities in which we operate, the reliability of our assets and the sustainability of our Company. We have taken early and aggressive measures to protect our people while being able to safely maintain our assets and continue to meet the needs of our customers. To date, we have not experienced any infections in our workforce, nor have we experienced any operational or supply chain interruptions to our business. However, we did see minor demand reductions in March as the COVID-19 pandemic progressed.

“Finally, under our new value growth initiative launched in the first quarter, we have already executed cost-saving agreements for both supply chain logistics and natural gasoline feedstock, which together, should provide more than $3 million of cost reduction this year. When combined with other projects in our project pipeline, we believe we can achieve approximately $4 million of incremental profit generation in 2020,” Mr. Quarles concluded.

Sami Ahmad, Trecora's Chief Financial Officer stated, “During this period of unprecedented economic uncertainty and market volatility, we are managing our business with a strong balance sheet and have taken steps to ensure ample liquidity. These include the closing of a portion of the AMAK sale in March, precautionary borrowings on our revolver and participation in the CARES Act, including the tax changes and pursuing borrowings under the Paycheck Protection Program, which will be essential to support the continuity of our workforce. Including the proceeds from the portion of the AMAK sale as well as precautionary borrowings on our revolver, total consolidated cash at the end of the first quarter was $37.5 million and increased to approximately $45.0 million as of the end of April. Finally, our plant improvement efforts have resulted in increases in Trecora Chemical's revenue, volume and gross margin in the first quarter of 2020 due to both the reliable operation of the hydrogenation unit and higher production in wax and other custom processing activities."

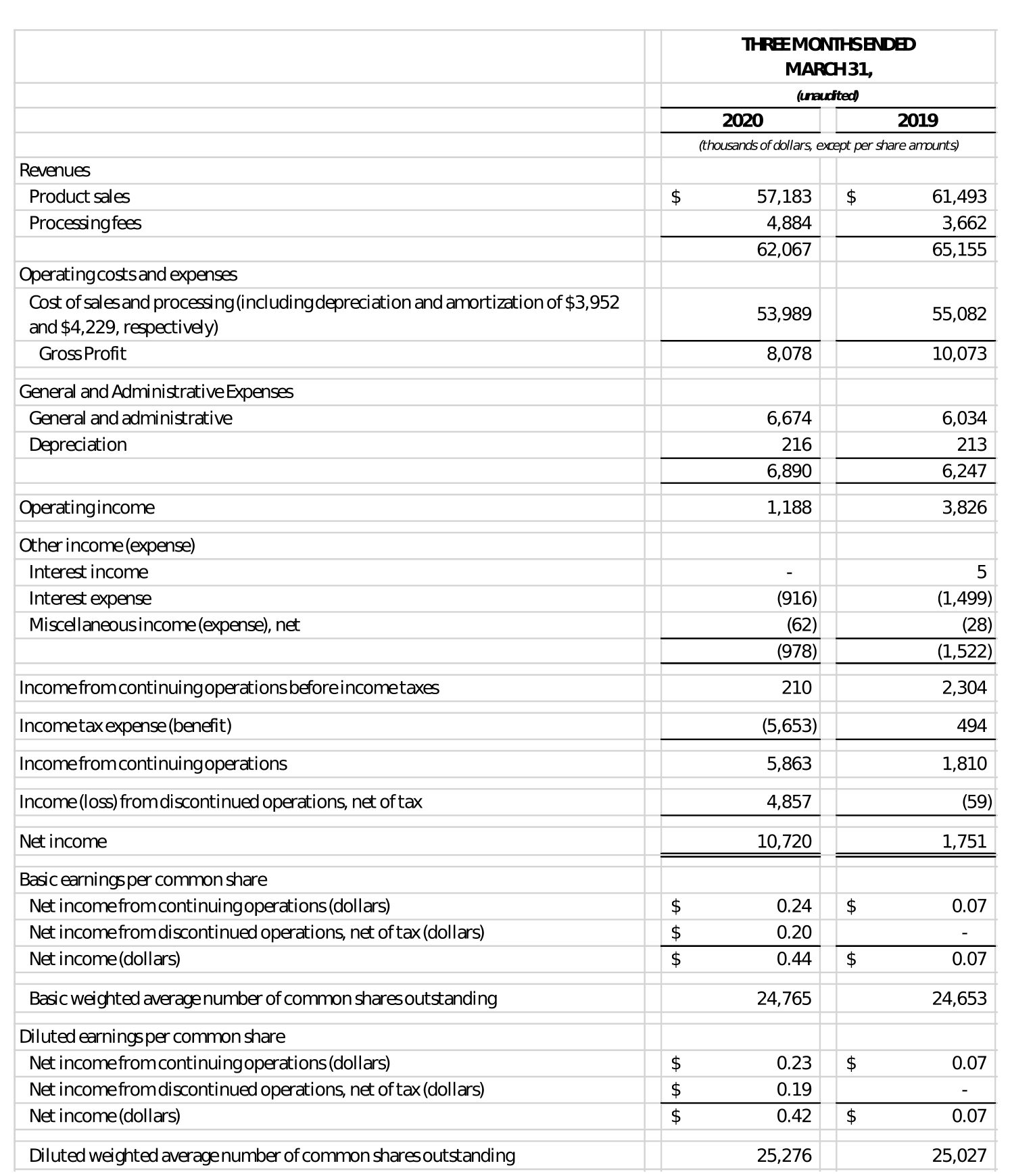

First Quarter 2020 Financial Results

Net income from continuing operations in the first quarter of 2020 was $5.9 million, or $0.23 per diluted share, compared to a net income from continuing operations of $1.8 million, or $0.07 per diluted share, in the first quarter of 2019. The first quarter of 2020 includes a benefit for net operating losses (“NOLs”) of approximately $5.7 million, or $0.22 per diluted share, from changes to the tax laws as a result of the enactment of the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) on March 27, 2020. The CARES Act allows for the deferral of income and social security tax payments, a five–year carryback for net operating losses, changes to interest expense and business loss limitation rules, certain new tax credits, and certain new loans and grants to businesses.

As a result, the Company will request tax refunds of approximately $17.8 million in taxes paid during prior periods which are recoverable under the provisions of the CARES Act. On April 30, 2020, we filed our first tax refund claim and expect to receive approximately $14 million in the third quarter.

Total revenue in the first quarter of 2020 was $62.1 million compared to $65.2 million in the first quarter of 2019. This year-over-year decrease was primarily due to a 12.1% decline in Specialty Petrochemicals sales volume, partially offset by increased revenue in our Specialty Waxes segment.

Gross profit in the first quarter of 2020 was $8.1 million, or 13.0% of total revenues, compared to $10.1 million, or 15.5% of total revenues, in the first quarter of 2019. Operating income in the first quarter of 2020 was $1.2 million compared to operating income of $3.8 million for the first quarter of 2019. While benchmark natural gasoline feedstock prices declined 18% from $1.15 per gallon in the first quarter of 2019 to $0.94 per gallon in the first quarter of 2020, our cost of materials were higher in the first quarter of 2020 compared to the first quarter of 2019 as we sold higher cost inventory.

Specialty Petrochemicals

Specialty Petrochemicals net income from continuing operations was $4.6 million in the first quarter of 2020, compared to net income of $6.1 million in the first quarter of 2019. Specialty Petrochemicals volume in the first quarter of 2020 was 19.7 million gallons, compared to 20.3 million gallons in the fourth quarter of 2019 and 22.5 million gallons in the first quarter of 2019. The volume reduction is mostly attributed to timing of demand in the first quarter of 2019 when we had unusually high demand into oil sands and the timing of export sales. We saw some minor reduction in export demand in March 2020 which we attribute to the COVID-19 pandemic.

Prime product volume in the first quarter of 2020 was 16.2 million gallons, compared to 16.3 million gallons in the fourth quarter of 2019 and 17.6 million gallons in the first quarter of 2019. By-product sales volume was 3.5 million gallons in the first quarter of 2020. Adjusted EBITDA from continuing operations for Specialty Petrochemicals in the first quarter of 2020 was $6.5 million compared to $11.4 million in the first quarter of 2019.

Dollar amounts in thousands/rounding may apply | THREE MONTHS ENDED | |||||||

MARCH 31, | ||||||||

2020 | 2,019 | % Change | ||||||

Product sales | $50,386 | $ | 55,490 | (9)% | ||||

Processing fees | 1,244 | 1,383 | (10)% | |||||

Gross revenues | $51,630 | $ | 56,873 | (9)% | ||||

Operating profit before depreciation and amortization | 6,490 | 11,407 | (43)% | |||||

Operating profit | 3,872 | 8,333 | (54)% | |||||

Net profit before taxes | 2,942 | 7,135 | (59)% | |||||

Depreciation and amortization | 2,617 | 3,074 | (15)% | |||||

Adjusted EBITDA from continuing operations | 6,473 | 11,405 | (43)% | |||||

Capital expenditures | 1,601 | 1,378 | 16% | |||||

Specialty Waxes

Specialty Waxes net income from continuing operations was $1.2 million in the first quarter of 2020, compared to a net loss from continuing operations of $2.5 million in the first quarter of 2019. Specialty Waxes generated revenues of approximately $10.4 million in the first quarter of 2020, a $1.6 million increase from $8.8 million in the fourth quarter of 2019, and a $2.2 million increase from the first quarter of 2019. Revenue included $6.8 million of wax product sales in the first quarter of 2020. Wax sales volumes increased approximately 29.1% or nearly 2.3 million pounds from the first quarter of 2019. The increased sales volumes in the first quarter of 2020 reflect reliable supply throughout the quarter of wax feedstock and the absence of supply interruptions and our maintenance outage in the same period for the prior year.

Processing revenues, which were $3.6 million in the first quarter of 2020, increased 59.7% or approximately $1.4 million from the first quarter of 2019. The increase was due to significantly improved operation and reliability of the hydrogenation/distillation unit as a result of equipment and operating enhancements made to the unit, as well as strong revenues from other custom processing customers. Adjusted EBITDA from continuing operations for Specialty Waxes in the first quarter of 2020 was $1.1 million compared to $(0.9) million in the first quarter of 2019.

Dollar amounts in thousands/rounding may apply | THREE MONTHS ENDED | |||||||

MARCH 31, | ||||||||

2020 | 2,019 | % Change | ||||||

Product sales | $6,797 | $ | 6,003 | 13% | ||||

Processing fees | 3,640 | 2,279 | 60% | |||||

Gross revenues | $10,437 | $ | 8,282 | 26% | ||||

Operating profit (loss) before depreciation and amortization | 1,066 | (849) | 226% | |||||

Operating loss | (262) | (2,197) | 88% | |||||

Net loss before taxes | (242) | (2,539) | 90% | |||||

Depreciation and amortization | 1,328 | 1,348 | (1)% | |||||

Adjusted EBITDA from continuing operations | 1,104 | (888) | 224% | |||||

Capital expenditures | 316 | 509 | (38)% | |||||

COVID-19 Business Update

Mr. Quarles stated, “Our manufacturing operations, global supply chain and customer order fulfillment did not experience any material impacts in the first quarter. In the second quarter, we are seeing reduced demand in certain end markets, in particular, durable consumer goods, which we attribute to the COVID-19 pandemic. This weakened demand in certain end markets is likely to continue in the near-term and may continue for the remainder of 2020, and could spread more broadly to our other end markets. Although near-term market conditions present uncertainty and are likely to remain unpredictable throughout 2020 and, potentially beyond, we believe our long-term demand thereafter remains intact.”

Earnings Call

Tomorrow’s conference call and presentation slides will be simulcast live on the Internet, and can be accessed on the investor relations section of the Company's website at http://www.trecora.com or at https://edge.media-server.com/mmc/p/biiej38p. A replay of the call will also be available through the same link.

To participate via telephone, callers should dial in five to ten minutes prior to the 10:00 am Eastern start time; domestic callers (U.S. and Canada) should call +1-866-417-5724 or

+1-409-217-8234 if calling internationally, using the conference ID 8798645. To listen to the playback, please call 1-855-859-2056 if calling within the United States or 1-404-537-3406 if calling internationally. Use pin number 8798645 for the replay.

+1-409-217-8234 if calling internationally, using the conference ID 8798645. To listen to the playback, please call 1-855-859-2056 if calling within the United States or 1-404-537-3406 if calling internationally. Use pin number 8798645 for the replay.

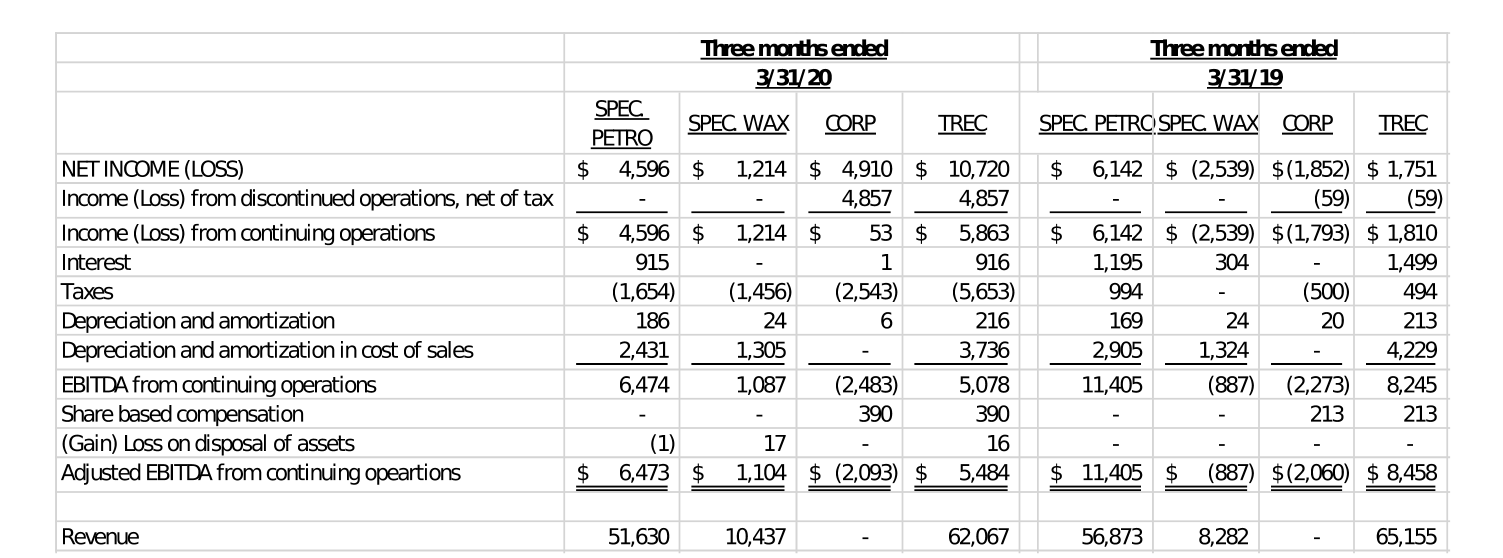

Use of Non-GAAP Measures

This press release includes the use of both U.S. generally accepted accounting principles ("GAAP") and non-GAAP financial measures. The Company believes certain financial measures, such as EBITDA from continuing operations and Adjusted EBITDA from continuing operations, which are non-GAAP measures, provide users of our financial statements with supplemental information that may be useful in evaluating our operating performance. The Company believes that such non-GAAP measures, when read in conjunction with our operating results presented under GAAP, can be used to better assess our performance from period to period and relative to performance of other companies in our industry, without regard to financing methods, historical cost basis or capital structure. These measures are not measures of financial performance or liquidity under GAAP and should be considered in addition to, and not as a substitute for, analysis of our results under GAAP.

We define EBITDA from continuing operations as net income (loss) from continuing operations plus interest expense (benefit), income taxes, depreciation and amortization. We define Adjusted EBITDA from continuing operations as EBITDA from continuing operations plus share–based compensation, plus restructuring and severance expenses, plus or minus equity in AMAK's earnings and losses, plus impairment losses and plus or minus gains or losses on disposal of assets.

These non-GAAP measures have been reconciled to the nearest GAAP measure in the tables below entitled Reconciliation of Selected GAAP Measures to Non-GAAP Measures.

Forward-Looking Statements

Some of the statements and information contained in this press release may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements regarding the Company’s financial position, business strategy and plans and objectives of the Company’s management for future operations and other statements that are not historical facts, are forward-looking statements. Forward-looking statements are often characterized by the use of words such as “outlook,” “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “contemplates,” “proposes,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “continue,” “intend,” or the negative of such terms and other comparable terminology, or by discussions of strategy, plans or intentions, including but not limited to: our expectations as to the continued impact of the COVID-19 pandemic (including governmental and regulatory actions) on demand for our products, on the economy and on our customers, suppliers, employees, business and results of operations; our expectations regarding cost reduction and profit generation for 2020 as a result of our value growth initiative; and our expectations regarding benefits to us and our liquidity position as a result of our participation in certain provisions of the CARES Act.

Forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other important factors that could cause the actual results, performance or our achievements, or industry results, to differ materially from historical results, any future results, or performance or achievements expressed or implied by such forward–looking statements. Such risks, uncertainties and factors include, but are not limited to: not completing, or not completely realizing the anticipated benefits from, the sale of our stake in AMAK; general economic and financial conditions domestically and internationally; insufficient cash flows from operating activities; our ability to attract and retain key employees; feedstock, product and mineral prices; feedstock availability and our ability to access third party transportation; competition; industry cycles; natural disasters or other severe weather events, health epidemics and pandemics (including COVID-19) and terrorist attacks; our ability to consummate extraordinary transactions, including acquisitions and dispositions, and realize the financial and strategic goals of such transactions; technological developments and our ability to maintain, expand and upgrade our facilities; regulatory changes; environmental matters; lawsuits; outstanding debt and other financial and legal obligations; difficulties in obtaining additional financing on favorable conditions, or at all (including having to return the amounts borrowed under the Paycheck Protection Program or failing to qualify for forgiveness of such loans, in whole or in part); local business risks in foreign countries, including civil unrest and military or political conflict, local regulatory and legal environments and foreign currency fluctuations; and other risks detailed in our latest Annual Report on Form 10-K, including but not limited to: “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertainties are currently amplified by and will continue to be amplified by, or in the future may be amplified by, the COVID–19 pandemic.

There may be other factors of which we are currently unaware or deem immaterial that may cause our actual results to differ materially from the forward-looking statements. In addition, to the extent any inconsistency or conflict exists between the information included in this press release and the information included in our prior releases, reports and other filings with the SEC, the information contained in this press release updates and supersedes such information. Forward-looking statements are based on current plans, estimates, assumptions and projections, and, therefore, you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update them in light of new information or future events.

About Trecora Resources (TREC)

TREC owns and operates a specialty petrochemicals facility specializing in high purity hydrocarbons and other petrochemical manufacturing and a specialty wax facility, both located in Texas, and provides custom processing services at both facilities. In addition, the Company is the original developer and a 28.3% owner of Al Masane Al Kobra Moining Co., a Saudi Arabian joint stock company.

Investor Relations Contact:

Jason Finkelstein

The Piacente Group, Inc.

212-481-2050

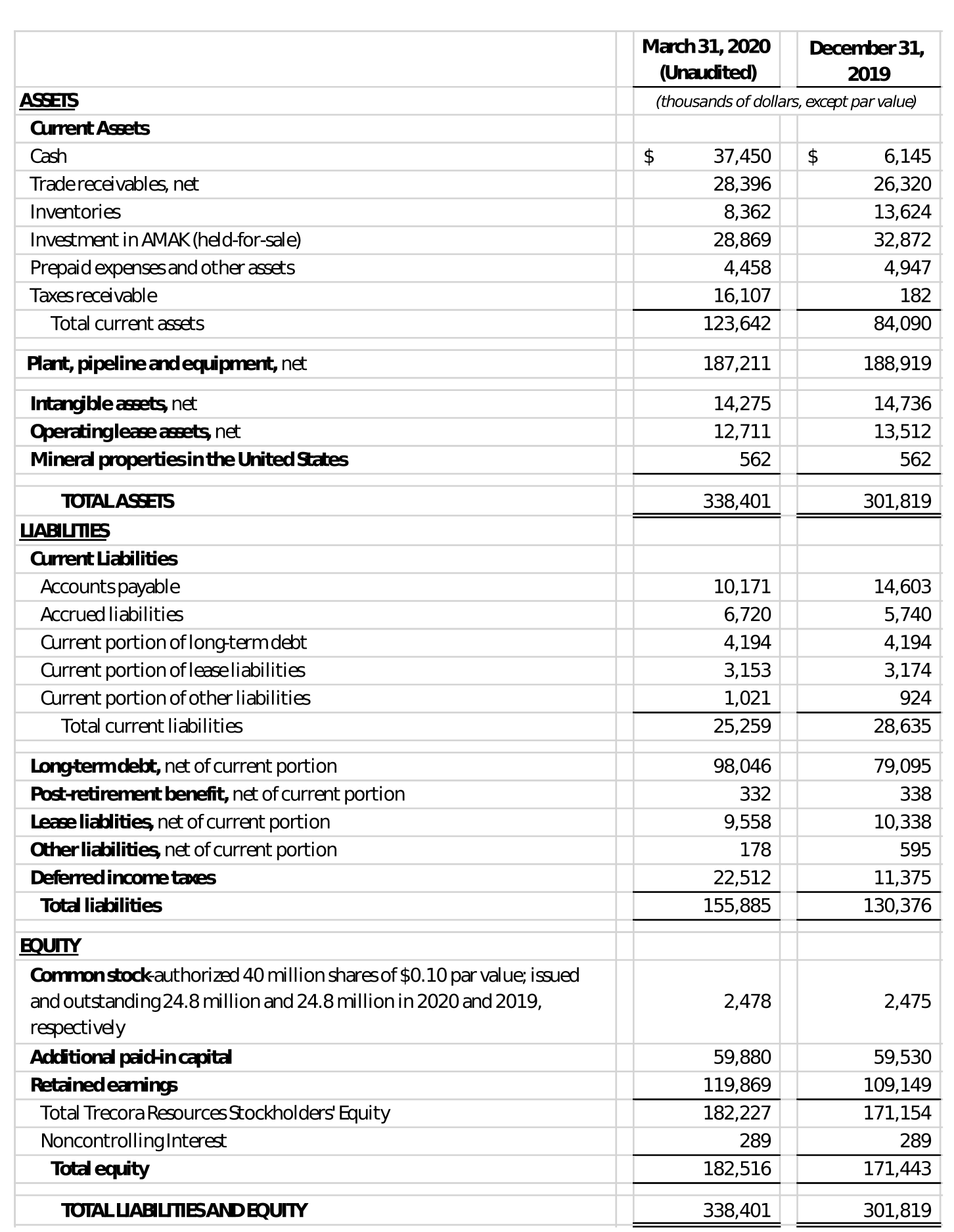

TRECORA RESOURCES AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

TRECORA RESOURCES AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

TRECORA RESOURCES AND SUBSIDIARIES

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES

EBITDA from continuing operations and Adjusted EBITDA from continuing operations

(thousands of dollars; rounding may apply)