UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

| | | | | |

Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

TRECORA RESOURCES

(Name of Registrant as specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

¨

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| | | | | | | | | | | |

| ¨ | Fee paid previously with preliminary materials. | |

| | | | | | | | |

¨

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

1650 Highway 6 South, Suite 190

Sugar Land, TX 77478

(281) 980-5522

April 1, 2021

To Our Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the 2021 annual meeting of stockholders on May 14, 2021, at 10:30 a.m., Central Time. Consistent with the 2020 annual meeting of stockholders, this year's meeting will also be a completely virtual meeting of stockholders, which will be conducted solely online via live webcast. You will be able to attend and participate in the meeting online, vote your shares electronically and submit your questions prior to and during the meeting.

Matters to be acted upon at the meeting are described in the attached Notice of 2021 Annual Meeting of Stockholders and proxy statement. We have also included a copy of our Annual Report on Form 10-K for the year ended December 31, 2020, for your review.

Your vote on the business to be considered at the meeting is important regardless of the number of shares you own. Whether or not you plan to attend, we urge you to grant your proxy to vote your shares by telephone or through the Internet by following the instructions included on the Notice of Internet Availability of Proxy Materials that you received, or if you received a paper copy of the proxy card or voting instruction form, to mark, sign and date such proxy card or voting instruction form. Please note that submitting a proxy will not prevent you from attending the meeting and voting electronically during the meeting. Please note, however, if an intermediary, such as a bank, broker, trustee or other nominee, holds your shares of record and you wish to vote at the meeting, you must register in advance using the instructions described in the accompanying proxy statement. If you do attend the meeting, you may withdraw your proxy should you wish to vote electronically during the meeting.

Your Board and management have been active stewards of your investment in Trecora over the past year. Undoubtedly, managing the company through the COVID-19 pandemic was historically challenging on many fronts. We implemented necessary health and safety protocols at our facilities, transitioned to remote work for many employees and successfully maintained plant and business operations. We are pleased that we were able to manage our costs and liquidity without workforce reductions while continuing the high level of customer service that we are known for.

We achieved our long-stated strategic goal of selling our interest in AMAK for an attractive price. The proceeds from the sale enabled us to repay approximately $37 million of debt, which significantly strengthens our balance sheet and positions the company for growth.

We appreciate your participation in the 2021 annual meeting of stockholders and look forward to continuing the Board’s focus on delivering long-term stockholder value.

Sincerely,

Karen A. Twitchell

Chair of the Board of Directors

TRECORA RESOURCES

1650 Highway 6 South, Suite 190

Sugar Land, TX 77478

(281) 980-5522

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | |

| Time and Date: | | 10:30 a.m. Central Time, May 14, 2021 |

| | |

| Access to the Meeting: | | You will be able to attend and participate in the 2021 annual meeting of stockholders (the “Annual Meeting”) online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: www.meetingcenter.io/205107604. |

| | |

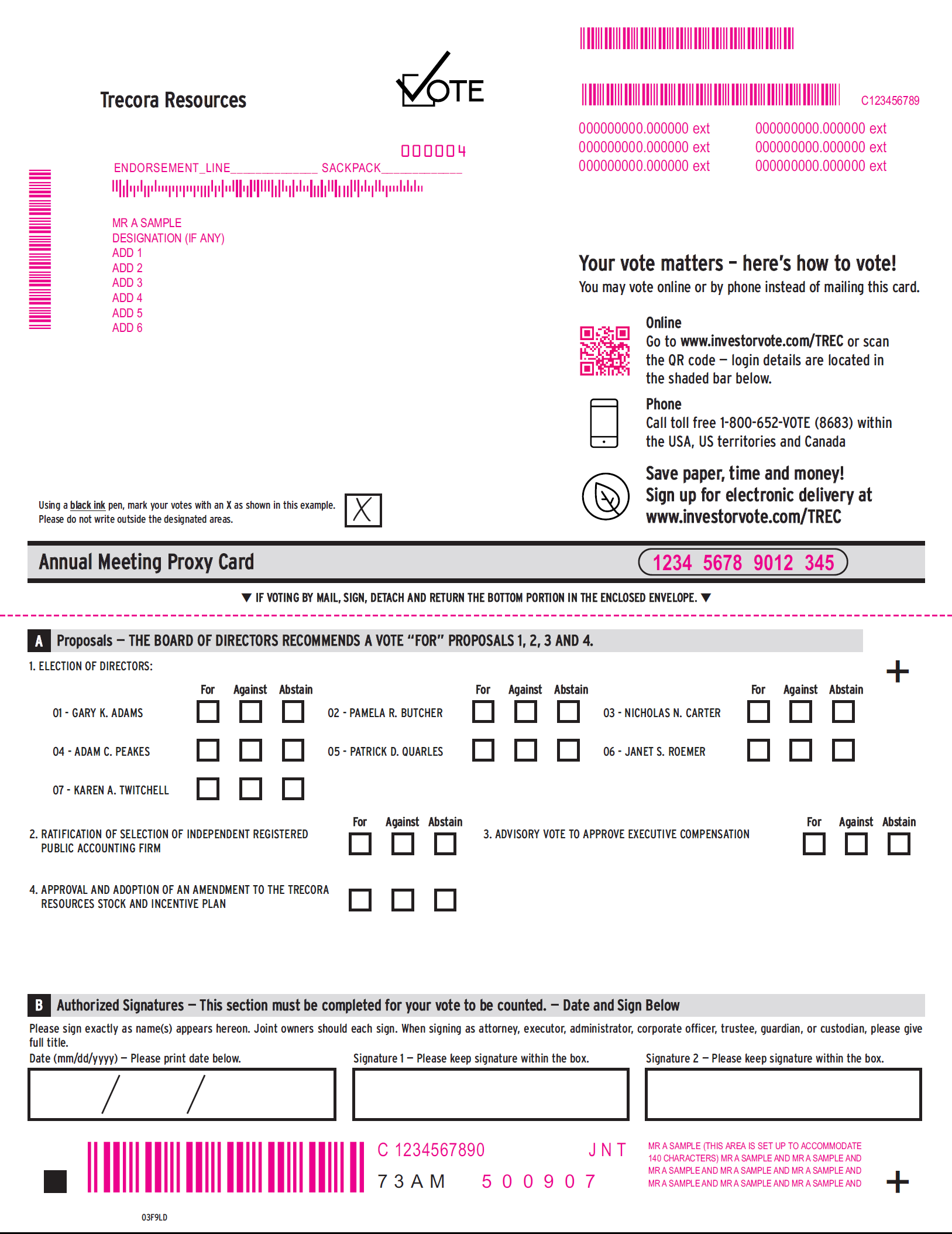

| Items of Business: | (1) | Election of seven directors, each to serve until the 2022 annual meeting of stockholders or, in each case, until his or her successor shall have been duly elected and qualified or until his or her earlier retirement, death, resignation or removal; |

| (2) | Ratification of the appointment of BKM Sowan Horan, LLP as our independent registered public accounting firm for the 2021 fiscal year; |

| (3) | Approval, by non-binding advisory vote, of the compensation of our named executive officers; |

| (4) | Approval and adoption of an amendment to the Trecora Resources Stock and Incentive Plan to extend its term; and |

| (5) | To transact any other business that may properly come before the Annual Meeting and postponement or adjournment of the Annual Meeting. |

| | |

| Adjournments and Postponements: | | Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. |

| | |

| | | | | | | | | | | |

| Record Date: | | The close of business on March 29, 2021 has been fixed as the record date for determining those Trecora Resources stockholders entitled to vote at the Annual Meeting. Accordingly, only stockholders of record as of the close of business on that date will be eligible to vote at the Annual Meeting and any adjournment or postponement of the Annual Meeting. A list of our stockholders as of the close of business on the record date will be available to view online at the time of the Annual Meeting and at the Company’s corporate office, 1650 Highway 6 South, Suite 190, Sugar Land, TX 77478, for the ten days prior to the Annual Meeting. |

| Meeting Admission: | | You are entitled to attend and vote at the Annual Meeting only if you were a Trecora Resources stockholder of record as of the close of business on March 29, 2021 or hold a valid proxy for the Annual Meeting. If you are not a stockholder of record but hold shares through an intermediary, such as a bank, broker, trustee or other nominee, you must register in advance of the Annual Meeting to attend and vote at the Annual Meeting online by submitting proof of your proxy power (legal proxy) reflecting your beneficial ownership along with your name and email address. |

On or about April 1, 2021, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders of record. Additionally, on or after April 1, 2021, we will begin mailing printed copies of the proxy material to each beneficial owner. All stockholders will have the ability, beginning on or about April 1, 2021, to access the proxy materials on the website referred to in the Notice of Internet Availability of Proxy Materials or the printed copy of proxy materials and accompanying instructions, whichever you may receive. Instructions on how our stockholders of record may request proxy materials in printed form by mail or electronically by email may be found in the Notice of Internet Availability of Proxy Materials. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Michael W. Silberman

Corporate Secretary

YOUR VOTE IS IMPORTANT! PLEASE VOTE BY TELEPHONE OR THROUGH THE INTERNET BY FOLLOWING THE INSTRUCTIONS INCLUDED ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS OR PRINTED COPIES OF THE PROXY MATERIALS AND ACCOMPANY INSTRUCTIONS YOU RECEIVE, OR BY MARKING, SIGNING AND RETURNING YOUR PROXY CARD OR VOTING INSTRUCTION FORM AS SOON AS POSSIBLE, REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE ANNUAL MEETING.

PROXY STATEMENT SUMMARY

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Trecora Resources, a Delaware corporation (the “Company”), for the Company’s 2021 annual meeting of stockholders (the “Annual Meeting”).

The following summary contains highlights of important information you will find elsewhere in our proxy statement and is qualified in its entirety by the full proxy statement. This summary does not contain all of the information you should consider before voting. Please read the entire proxy statement before voting. We refer to our website throughout this proxy statement; however, no information on our website or any other website is incorporated by reference into or otherwise made a part of this proxy statement.

Annual Meeting Information

| | | | | |

Virtual Access: | www.meetingcenter.io/205107604 |

Date: | May 14, 2021 |

Time: | 10:30 a.m., Central Time |

This proxy statement provides a description of the business matters to be covered at the Annual Meeting. As a stockholder, you are entitled and encouraged to attend the Annual Meeting and to vote on the matters described in this proxy statement. Detailed information on voting is provided below.

Other General Information

References in this proxy statement to (1) “we,” “us,” “our,” “TREC” or the “Company” refer to Trecora Resources and, as the context requires, our direct and indirect subsidiaries, (2) “TOCCO” refers to Texas Oil & Chemical Co. II, Inc. (our wholly owned subsidiary and parent of SHR and TC), (3) “SHR” refers to South Hampton Resources, Inc. (our Specialty Petrochemicals segment), (4) “TC” refers to Trecora Chemical (our Specialty Waxes segment), (5) “AMAK” refer to Al Masane Al Kobra Mining Company (our previously held-for-sale mining investment; sold in September 2020) and (6) “PEVM” refer to Pioche Ely Valley Mines, Inc. (inactive mines; 55% ownership).

Proposals to be Voted on at the Annual Meeting

| | | | | |

Proposal 1: | Election of seven directors, each to serve until the 2022 annual meeting of stockholders (the “2022 Annual Meeting”) or, in each case, until his or her successor shall have been duly elected and qualified or until his or her earlier retirement, death, resignation or removal |

Proposal 2: | Ratification of the appointment of BKM Sowan Horan, LLP as our independent registered public accounting firm for the 2021 fiscal year |

Proposal 3: | Approval, by non-binding advisory vote, of the compensation of our named executive officers |

Proposal 4: | Approval and adoption of an amendment to the Trecora Resources Stock and Incentive Plan to extend its term |

Stockholders will also be asked to consider such other business that may properly come before the Annual Meeting and postponement or adjournment of the Annual Meeting. At this time, the Board is not aware of any other business to be acted upon at the Annual Meeting.

Questions and Answers about the Meeting and Voting

Who is making this solicitation of proxies?

This solicitation is made by the Company on behalf of the Board. A Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) is first being mailed on or about April 1, 2021 to stockholders of record. Additionally, a printed copy of our proxy materials will be mailed on or after April 1, 2021 to beneficial owners. The cost of solicitation of proxies, including the cost of reimbursing brokerage houses and other custodians, nominees or fiduciaries for forwarding proxies and proxy statements to their principals, will be borne by the Company. Solicitation may be made in person, by telephone, by email or by fax by officers or regular employees of the Company, who will not receive additional compensation for solicitation activity. In addition, we have retained Morrow Sodali LLC, 470 West Avenue, Stamford, Connecticut 06902, to assist in the solicitation of proxies for a fee of $7,500 plus customary expenses.

Who is entitled to vote?

Company stockholders of record and beneficial owners of record at the close of business on the record date, which is March 29, 2021 (the “record date”), are entitled to vote at the Annual Meeting and any adjournment or postponement of the meeting. On the record date, there were 24,963,190 shares of common stock of the Company, par value $0.10 (the “Common Stock”), issued and outstanding. Holders of our Common Stock are entitled to one vote per share.

How do I attend the Annual Meeting?

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the record date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held.

You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.meetingcenter.io/205107604. You also will be able to vote your shares online by attending the Annual Meeting by webcast.

To participate in the Annual Meeting, you will need to review the information included on your Notice of Internet Availability, on your proxy card or on the instructions that accompanied your proxy materials. The password for the meeting is TREC2021.

If you hold your shares through an intermediary, such as a bank, broker, trustee or other nominee (referred to herein as a “broker”), you must register in advance using the instructions below.

The online meeting will begin promptly at 10:30 a.m., Central Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

How do I register to attend the Annual Meeting virtually on the Internet?

If you are a stockholder of record (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the Notice of Internet Availability or proxy card that you received.

If you are a beneficial owner who holds shares through an intermediary, such as a broker, you must register in advance to attend the Annual Meeting virtually on the Internet.

To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your beneficial ownership along with your name and email address to Computershare in advance of the Annual Meeting. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 4, 2021.

You will receive a confirmation of your registration by email after we receive your registration materials. Requests for registration should be directed to us at the following:

By email: Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail:

Computershare

TREC Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Will there be a question and answer session?

As part of the virtual Annual Meeting, we will hold a live Q&A session, during which we intend to answer as many questions as time permits. Questions must comply with the Annual Meeting procedures and be pertinent to the Company, our stockholders and the Annual Meeting matters.

1. If you wish to submit a question in advance of the virtual Annual Meeting: For two weeks prior to the virtual Annual Meeting, stockholders may submit questions, in writing, by following the instructions on the virtual Annual Meeting website. To submit a question in advance of the Meeting, beneficial owners must register in advance of the Annual Meeting. See "How do I attend the Annual Meeting?" above.

2. If you wish to ask a question during the virtual Annual Meeting: Log in to the virtual Annual Meeting website and enter the control number included on your Notice of Internet Availability, proxy card or voting instruction form. Questions and answers may be grouped by topic and substantially similar questions may be grouped and answered once.

What if I have technical questions?

Beginning at 8:30 a.m. on May 14, 2021 and through the conclusion of the virtual Annual Meeting, we will have a support team ready to assist stockholders with any technical difficulties accessing and participating in the virtual Annual Meeting. If you encounter any difficulties during the check-in or meeting time, you should call the support team listed on the virtual Annual Meeting website at www.meetingcenter.io/205107604 or by phone, within the U.S., U.S.

territories & Canada: +1-888-724-2416 or outside of the U.S., U.S. territories & Canada: +1-781-575-2748.

Why are you holding a virtual meeting instead of a physical meeting?

We are sensitive to the continued public health and travel concerns our stockholders may have, and the protocols that federal, state, and local governments may continue to impose as it relates to the ongoing COVID-19 pandemic. Therefore, we intend to again hold the Annual Meeting in a virtual format via a live webcast. Further, we also believe that hosting a completely virtual meeting will enable more of our stockholders to attend and participate from any location around the world with Internet access.

In the event that the logistics of our Annual Meeting are further impacted by developments related to, or stemming from, the COVID-19 pandemic, we will announce such information as promptly as practicable. Please monitor our website at https://ir.trecora.com for updated information. As always, we encourage you to vote your shares prior to the Annual Meeting.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Under rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to use a hybrid “notice and access” approach pursuant to which our stockholders of record will receive the Notice of Internet Availability (unless such stockholders have specifically requested printed copies of the proxy materials), while beneficial owners will receive a printed copy of the proxy materials. Accordingly, on or about April 1, 2021, we will mail the Notice of Internet Availability to stockholders of record. Additionally, on or after April 1, 2021, we will begin mailing printed proxy materials to beneficial owners. All stockholders will have the ability to access the proxy materials (i.e., this proxy statement, the form of proxy card and our Annual Report on Form 10-K for the year ended December 31, 2020) on the website referred to in the Notice of Internet Availability or printed proxy materials and accompanying instructions, whichever you may receive. Instructions on how to request proxy materials in printed form by mail or electronically by email may be found on the Notice of Internet Availability.

If you received the Notice of Internet Availability, then you will not receive a paper copy of the proxy materials unless you request one. We encourage our stockholders to take advantage of the availability of the proxy materials on the Internet to contribute to our sustainability endeavors and to help reduce cost to us associated with the physical printing and mailing of proxy materials.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name, you are the stockholder of record of those shares. As a stockholder of record, you have the right to grant your voting proxy directly to the Company or a third party or vote online at the Annual Meeting.

If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in “street name.” As the beneficial owner of those shares, you have the right to direct your broker how to vote your shares, and you will receive separate instructions from your broker describing how to vote your shares. Except for the ratification of the selection of BKM Sowan Horan, LLP as our independent registered public accounting firm

for 2021, your broker is not permitted to vote on your behalf on matters at the Annual Meeting unless you communicate your voting decisions to your broker before the date of the Annual Meeting.

How do I vote?

Because many stockholders cannot attend the Annual Meeting, it is necessary that a large number of stockholders be represented by proxy. You may vote online or by proxy in one of the following ways:

1.Voting Online at the Annual Meeting

Stockholders of record and beneficial owners who have obtained a legal proxy (from their broker that holds their shares) giving them the right to vote the shares are invited to attend the Annual Meeting online by following procedures described in this proxy statement.

2.Voting by Submitting a Proxy

Regardless of whether you plan to attend the Annual Meeting, as an alternative to voting at the Annual Meeting, stockholders of record have the option of voting their shares by submitting a proxy by telephone, via the Internet or by mail.

•Submitting a Proxy by Telephone. Stockholders of record may vote by telephone by calling (toll free) 1-800-652-VOTE (8683). Telephone proxy submission is available 24 hours a day.

•Submitting a Proxy via the Internet. Stockholders of record may vote by accessing the website listed on the Notice of Internet Availability, www.investorvote.com/TREC, and following the instructions found on the website. Internet proxy submission is available 24 hours a day.

•Submitting a Proxy by Mail. If you choose to submit a proxy for your shares by mail, you should request a paper copy of the proxy materials which will include a paper copy of the proxy card and a postage paid pre-addressed envelope. Instructions on how to order a paper copy of the proxy materials can be found on the Notice of Internet Availability. Upon request, these will be mailed to you at no cost. To vote by proxy, stockholders of record must complete, sign and date their proxy cards and mail them back in the pre-addressed envelopes.

By casting your vote in any of the three ways listed above, you are authorizing the individuals listed on the proxy to vote your shares in accordance with your instructions.

3.Instructing your Broker

Beneficial owners may vote by submitting voting instructions to their broker. Your voting instruction form should be provided by your broker. Please refer to your voting instruction form for voting procedures and additional information.

What are the deadlines to vote and to request proxy materials?

Stockholders of record may vote by telephone or via the Internet by following the instructions provided above and on the Notice of Internet Availability prior to the conclusion of the Annual Meeting.

Any vote by proxy submitted in the mail must be received no later than 10:30 a.m., Central Time, on May 14, 2021. If you are a stockholder of record and attend the meeting, you may also vote online during the Annual Meeting. To facilitate timely delivery, requests for paper copies of the proxy materials must be submitted on or before May 4, 2021.

Beneficial owners should refer to the voting instruction form provided by their broker for applicable deadlines.

Can I revoke my proxy?

A stockholder of record may change his or her vote by: (1) submitting a later-dated vote by proxy by telephone or via the Internet or submitting a valid, later-dated proxy card to be received no later than the deadlines provided above (the latest-dated, properly completed proxy that you submit in a timely manner, whether by telephone, via the Internet, or by mail, will count as your vote); (2) providing written notice of revocation to the Corporate Secretary at 1650 Highway 6 South, Suite 190, Sugar Land, Texas 77478 to be received no later than May 13, 2021, or (3) attending the Annual Meeting and voting using the electronic voting options during the live webcast.

A beneficial owner may change his or her vote by either: (1) submitting new voting instructions to the appropriate broker; or (2) if they have obtained a legal proxy from their broker giving them the legal right to vote their shares, by attending the Annual Meeting and voting online.

What if I don’t vote?

If you sign your proxy card without giving specific instructions, your shares will be voted in accordance with the recommendations of the Board (“FOR” the Company’s nominees to the Board, “FOR” the ratification of BKM Sowan Horan, LLP as the Company’s independent registered public accounting firm for 2021, “FOR” the approval, by non-binding advisory vote, of the compensation for the Company’s Named Executive Officers (as defined herein), and “FOR” the approval and adoption of an amendment to the Trecora Resources Stock and Incentive Plan to extend its term).

Shares of beneficial owners who do not provide their broker with voting instructions, will constitute “broker non-votes.” Generally, brokers only have discretion to vote your shares without your specific instructions with respect to “routine” proposals. The “routine” proposal in this proxy statement is Proposal 2. All other proposals (i.e., Proposals 1, 3 and 4) are “non-routine” and your broker may not vote your shares. Accordingly, your broker will not be able to vote your shares on Proposals 1, 3 and 4 unless your broker receives specific voting instructions regarding those Proposals from you.

How many votes are required for each proposal?

For each proposal you may vote “FOR,” “AGAINST” or “ABSTAIN”. If you provide specific instructions with regard to certain proposals, your shares will be voted as you instruct on such proposals.

•Proposal 1. Each director nominee for whom the number of votes cast “FOR” such director’s election exceeds the number of votes cast “AGAINST” that director’s election will be elected. If any director nominee receives less than a majority of the votes cast, such director shall tender his or her resignation to the Board. Within 90 days of such

resignation, the Board will either (a) accept the resignation of such director or (b) by unanimous vote of the Board, decline to accept such resignation. In either case, the Board’s determination will be made public by means of a Current Report on Form 8-K filed with the SEC. “ABSTAIN” votes and broker non-votes will not be counted as votes cast either “FOR” or “AGAINST” any director’s election and will have no effect on the election of directors.

•Proposal 2. In order for Proposal 2 to be approved, the number of votes cast “FOR” Proposal 2 must exceed the number of votes cast “AGAINST” such proposal. “ABSTAIN” votes will not be counted as votes cast either “FOR” or “AGAINST” Proposal 2 and because brokers have discretion to vote on Proposal 2, we do not expect any broker non-votes with respect to Proposal 2.

•Proposal 3. In order for Proposal 3 to be approved, the number of votes cast “FOR” Proposal 3 must exceed the number of votes cast “AGAINST” such proposal. “ABSTAIN” votes and broker non-votes will not be counted as votes cast either “FOR” or “AGAINST” Proposal 3.

•Proposal 4. In order for Proposal 4 to be approved, the (i) number of votes cast “FOR” Proposal 4 must exceed (ii) the number of votes cast “AGAINST” plus the number of votes cast “ABSTAIN." Broker non-votes will not be counted as votes cast either “FOR” or “AGAINST” Proposal 4.

Are there any additional proposals expected at the Annual Meeting?

Other than the proposals listed in the Notice of 2021 Annual Meeting of Stockholders attached hereto, the Board is not aware of any other business to be acted upon at the Annual Meeting. However, if you grant a proxy, the persons named as proxy holders will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any reason any nominee is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board.

What are the quorum requirements?

The quorum requirement for holding the Annual Meeting and transacting business is that holders of a majority of the voting power of all of the shares of stock entitled to vote at the Annual Meeting must be present at the Annual Meeting or represented by proxy. Both “ABSTAIN” votes and broker non-votes are counted for the purpose of determining the presence of a quorum.

Where can I find more information?

Questions regarding the Annual Meeting, this proxy statement, voting or otherwise should be directed to the individual listed below at the provided contact information. Stockholders of record may also request a set of proxy materials in print form by mail or electronically by email on the website referred to in the Notice of Internet Availability.

Morrow Sodali LLC

470 West Avenue

Stamford, Connecticut 06902

Toll-Free: 800-662-5200

You may access our proxy materials on the website referred to in the Notice of Internet Availability or the printed proxy materials and accompanying instructions, whichever you may receive. Our proxy statement and Annual Report on Form 10-K for the year ended December 31, 2020, may also be accessed on our website at https://ir.trecora.com.

CORPORATE GOVERNANCE

The Company is committed to maintaining the highest standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving our stockholders well and maintaining the Company’s integrity in the marketplace. The Company has adopted Corporate Governance Guidelines and Standards of Business Conduct that apply to all of the Company’s directors, officers and all other employees. The Company’s Corporate Governance Guidelines and Standards of Business Conduct, in conjunction with the Certificate of Incorporation, Bylaws and Board committee charters, form the framework for governance of the Company.

The Company’s Corporate Governance Guidelines, Standards of Business Conduct, Certificate of Incorporation, Bylaws and Board committee charters are available on the Company’s website at https://ir.trecora.com. Stockholders may also request free printed copies of these from the Corporate Secretary at 1650 Highway 6 South, Suite 190, Sugar Land, Texas 77478.

Directors and Executive Officers

The following sets forth the name and age of each current director of the Company that will be standing for re-election at the Annual Meeting, the date from which each director has served on our Board, all other positions and offices with the Company held by him or her, and each director’s participation on other public company boards.

| | | | | | | | |

Name; Current Positions Held & Other Public Company Boards | Age | Director since |

| | |

Gary K. Adams Director, Chair of Compensation Committee and Member of Nominating and Governance Committee Boards: Phillips 66 | 70 | 2012 |

Pamela R. Butcher

Director, Chair of Nominating and Governance Committee and Member of Compensation Committee | 63 | 2016 |

Nicholas N. Carter Director | 74 | 2004 |

Adam C. Peakes

Director, Chair of Audit Committee

and Member of Compensation Committee | 48 | 2019 |

Patrick D. Quarles President, Chief Executive Officer and Director | 54 | 2018 |

Janet S. Roemer Director, Member of Audit and Nominating and Governance Committees | 65 | 2019 |

Karen A. Twitchell Director, Chair of the Board, Member of Audit and Compensation Committees Boards: Kraton Corporation | 65 | 2015 |

Mr. Gary K. Adams holds a Bachelor of Science degree in Industrial Management from the University of Arkansas and has over 40 years of experience in the petrochemical and plastics industries. He started his chemical industry career with Union Carbide and after 15 years serving in a number of positions at Union Carbide, Mr. Adams joined Chemical Market Associates Inc. (“CMAI”). He began at CMAI as the director of the Monomers Market Advisory Service and progressed to President, CEO and Chairman of the Board from 1997 until its acquisition by IHS in 2011. Mr. Adams served as the Chief Advisor – Chemicals for IHS Market until April 1, 2017. Mr. Adams is a director of Phillips 66 and previously served on the boards of Westlake Chemical Partners LP and Phillips 66 Partners LP from 2013 until 2016. His experience leading a global petrochemical advisory service and his board experience in energy and chemical companies provides critical insight to important market drivers of the Company's performance and growth opportunities.

Ms. Pamela R. Butcher holds a Bachelor degree in Agronomy and a Master of Science degree from Purdue University. In addition, she is a graduate of the Northwestern University Marketing Executive Program and has participated in the Prince of Wales Sustainability Conference and the Asian Master Class on Asian Business. Ms. Butcher was the CEO, President and Chief Operating Officer of Pilot Chemical Corp. from January 2010 until July 2016, when she retired. In November 2017, she was asked by the Pilot Board to return as CEO and President. As of January 2021, Ms. Butcher retired as CEO and became a Special Advisor to the Pilot Chair. Previously, she worked 29 years for Dow Inc. (formerly known as The Dow Chemical Company), where she held a variety of executive leadership positions including Business Vice President of Specialty Chemicals, Vice President of Corporate Marketing & Sales and Vice President and General Manager of Adhesives and Sealants. She was a distinguished recipient of Dow's Genesis Award for people excellence, which is Dow's highest recognition for people leadership. She currently serves as a director on the boards of Pilot Chemical Corp., Gruden Topco Holdings, LP and as a member of the US Bank Regional Advisory Board. Previously, she also served on the board of trustees for the Chemical Educational Foundation, on the Board of the American Cleaning Institute and the Ohio Manufacturers' Association. Her broad knowledge of, and extensive leadership experience in, the chemical industry makes her a valuable resource to our Board.

Mr. Nicholas N. Carter holds a Bachelor of Business Administration degree in Accounting from Lamar University. Mr. Carter is currently a non–employee, non–independent director and was previously the Chairman of the Board from July 2015 until February 2019 and President and Chief Executive Officer of the Company from July 2009 until his retirement in July 2015. He worked at the Sabine River Authority of Texas as a Project Accountant from 1973 until 1975. From 1975 until 1977 he was a Staff Accountant with Wathen, DeShong and Company, CPA's. From 1977 until 2015 Mr. Carter had been employed by the Company in a succession of positions with increasing and broader operating responsibilities, as follows: from 1977 until 1979, Controller of SHR; from 1979 until 1982, Facility Manager at a ship dock and terminal facility owned by TOCCO; from 1982 until 1987, Treasurer of TOCCO; from 1987 until 2013, President of SHR; and 2007 to 2009, Executive Vice President of the Company. This succession of positions with the Company gave Mr. Carter broad experience and knowledge in operations, finances and strategy of the Company. Mr. Carter serves as a Director and President of PEVM. Mr. Carter was appointed to the Board of AMAK in February 2009 and served in such role until the sale of all of the Company's ownership interest in AMAK in September 2020. His broad experience in the Specialty Petrochemicals market and his deep understanding of the Company's unique product and service offering is a critical resource to our Board.

Mr. Adam C. Peakes holds a Bachelor of Arts degree in Managerial Studies and Political Science from Rice University and a Master of Business Administration degree from Harvard Business School. Mr. Peakes has more than 20 years of finance and investment banking experience in various natural resources industries. Since November 2020, he has served as Executive Vice President and Chief Financial Officer at Merichem Corporation, a privately-held company focused on sulfur removal and spent caustic handling. From 2017 until 2019, he served as Chief Financial Officer for Noble Corporation, where he was responsible for the accounting, treasury, tax, financial planning, mergers and acquisitions and investor relations teams globally for this publicly–traded oil and gas drilling contractor. Prior to Noble, Mr. Peakes spent 17 years as an investment banker with Tudor Pickering Holt & Co. and Goldman Sachs specializing in mergers and acquisitions, debt and equity financings and strategic advisory assignments for

companies in the oilfield services and global natural resources sectors. Mr. Peakes brings strategic leadership and expertise in capital markets, valuations, investor relations, mergers and acquisitions, global management and risk management to the Board.

Mr. Patrick D. Quarles holds a Bachelor of Science degree in Mechanical Engineering from Clemson University and an Master of Business Administration degree from the Kellogg School of Management at Northwestern University. Mr. Quarles was appointed President and Chief Executive Officer of the Company in December 2018, as well as serving as a director. Mr. Quarles also serves on the shareholder advisory committee for OQ Chemicals International Holding GmbH and on the supervisory board for its subsidiary, OQ Chemicals Holding GmbH. OQ Chemicals is an Oman sovereign owned company that globally manufactures oxo intermediate and derivative chemicals. Prior to joining the Company, Mr. Quarles served as Executive Vice President and President, Acetyl Chain and Integrated Supply Chain at Celanese Corporation from 2015 until 2017. Prior to that role, Mr. Quarles held a variety of leadership positions at LyondellBasell Industries N.V., before serving as Senior Vice President of the Intermediates and Derivatives (“I&D”) segment and the supply chain and procurement functions from January 2015 until June 2015. Those earlier roles included serving as a member of LyondellBasell's Management Board from 2014 until 2015, Senior Vice President – I&D from 2009 until 2014, Senior Vice President Propylene Oxide and Derivatives from 2008 until 2009, and Vice President of Performance Chemicals from 2004 until 2008. Mr. Quarles began his career in 1990 at ARCO Chemical/Union Carbide, where he held various positions in sales, marketing and business management. Mr. Quarles’ knowledge and experience in forming and leading lean teams focused on stockholder value across manufacturing, financial and commercial operations provides a wealth of knowledge to the Board.

Ms. Janet S. Roemer holds a Bachelor of Science degree in Chemistry from Miami University and has a Master of Business Administration degree from the University of Chicago. Ms. Roemer has a breadth of operational experience including leadership roles in sales and marketing, customer service and logistics, strategic planning, manufacturing, capital projects, R&D and IT. Ms. Roemer brings more than 30 years of industry experience including executive leadership roles in global petrochemicals and biochemicals. After starting her career as a chemist with National Starch & Chemical, she had a 24 year career with Amoco and BP Group where she held a wide variety of positions with increasing responsibilities, including General Manager, Vice President Digital Business, Business Unit Leader and Chief of Staff to the CEO of Innovene. She most recently served as Chief Operating Officer of Verenium Corporation. Ms. Roemer’s career in the chemical industry where she has integrated operational experience with strategy formation provides a critical resource to our Board.

Ms. Karen A. Twitchell holds a Bachelor of Arts degree in Economics from Wellesley College and a Master of Business Administration degree from Harvard University. Ms. Twitchell serves on the public company board of Kraton Corporation, currently as Chair of the Audit Committee and as a member of the Compensation Committee, and on the private company board of HMTX Industries. She previously served on the board of KMG Chemicals, where she was Chair of the Audit Committee for five years. From 2010 until her retirement in 2013, Ms. Twitchell served as the Executive Vice President and Chief Financial Officer of Landmark Aviation, where she was responsible for all financial and strategic planning functions. Previously. she held senior management roles at LyondellBasell Industries and Lyondell Chemical Company from 2001

until 2009. Prior to that, she was Vice President and Treasurer of Kaiser Aluminum Corporation and Southdown, Inc., and she was an investment banker with Credit Suisse First Boston during the first decade of her career. Ms. Twitchell brings extensive experience to the Board in governance, accounting matters, financings and capital structure, investor relations, enterprise risk management, executive compensation and mergers and acquisitions.

None of our directors is party to any legal proceedings required to be disclosed under Item 103 of Regulation S-K.

The table below shows each director’s skill set.

| | | | | | | | | | | | | | | | | | | | | | | |

Experience, Expertise or Attribute | Adams | Butcher | Carter | Peakes | Quarles | Roemer | Twitchell |

Strategic Executive Leadership | * | * | * | * | * | * | * |

Global Business Acumen | * | * | * | * | * | * | * |

Chemical Operations Expertise | * | * | * | | * | * | |

Chemical Commercial Expertise | * | * | * | | * | * | |

Corporate Finance / Capital Structure Expertise | | * | | * | * | | * |

Financial Expertise / Literacy | * | * | * | * | * | * | * |

Mergers and Acquisitions | * | * | | * | * | * | * |

Investments/Fund Management/Investor Relations | | | * | * | * | * | * |

Risk & Compliance Management | | * | | * | * | | * |

Governance | * | * | * | * | * | * | * |

The following sets forth the name and age of each current executive officer of the Company, the date of his or her appointment and all other positions and offices with the Company held by him or her.

| | | | | | | | | | | |

Name of Executive | Positions | Age | Appointed |

Patrick D. Quarles | President, Chief Executive Officer and Director | 54 | 2018 |

S. Sami Ahmad | Chief Financial Officer and Treasurer | 59 | 2016 |

Peter M. Loggenberg | Chief Sustainability Officer | 58 | 2018/2014 |

John R. Townsend | Executive Vice President and Chief Manufacturing Officer | 67 | 2018 |

Michael W. Silberman | General Counsel and Corporate Secretary | 50 | 2020 |

Each executive officer of the Company serves for a term extending until his or her successor is elected and qualified.

Please refer to the director discussion above for Mr. Quarles’ business experience.

Mr. S. Sami Ahmad received his Bachelor of Science degree in Chemical Engineering from the University of Pennsylvania and a Master of Business Administration degree from the University of Chicago. He has over 30 years of experience in finance, corporate development and engineering, primarily in the chemical and energy industries. Mr. Ahmad was appointed Chief Financial Officer of the Company in October 2016 and, in February 2018, he was also appointed Treasurer of the Company. Prior to joining the Company, he was Chief Financial Officer of

Armada Water Assets, Inc., an oil field service company, which he helped build from its formation in 2013 until October 2016. Prior to that role, he served as Chief Financial Officer for Southwest Water Company, a private-equity owned water utility, and as Vice President and Treasurer for Exterran, a publicly-owned oil and gas services company. Earlier from 1998 until 2009, he worked for LyondellBasell Industries and Lyondell Chemical Company, where his positions included Director, Corporate Development, Assistant Treasurer, Corporate Finance and Director, Investor Relations. From 1991 until 1998, he held various positions with ARCO Chemical Company where his responsibilities included managing acquisitions and business development, marketing and investor relations.

Dr. Peter M. Loggenberg received his Bachelor of Science degree in Chemistry and Mathematics, Honors degree in Chemistry, Master of Science degree in Physical Chemistry and a PhD in Chemistry (Catalysis). He has over 25 years of experience in the chemical industry with over 15 years at the corporate level. In March 2018, Mr. Loggenberg was appointed Chief Sustainability Officer of the Company. Prior to that, he served as President of TC since the Company’s acquisition of SSI Chusei, Inc. in October 2014. From 2010 until 2014, he served as President of SSI Chusei, Inc.

Mr. John R. Townsend has a Bachelor of Science degree in Chemical Engineering from Louisiana Tech University. He has over 30 years of experience in the petrochemical industry garnered through his employment with Mobil Chemical Company, which subsequently became ExxonMobil Chemical Company. During his tenure at ExxonMobil, he held the positions of Technical Service Engineer, Technical Department Section Supervisor, Planning Associate, Operations Manager, Plant Manager and Site Manager. Mr. Townsend retired from ExxonMobil Chemical Company in 2010. Mr. Townsend served on our Board as a director from 2011 until his resignation in May 2019, and joined the Company as Executive Vice President and Chief Manufacturing Officer in June 2018.

Mr. Michael W. Silberman has a Bachelor of Arts degree with distinction from the University of Pennsylvania and a Juris Doctor degree from Emory University School of Law. He has over 25 years of legal experience with over 17 years in the chemical industry. In June 2020, Mr. Silberman joined the Company as General Counsel and Corporate Secretary. From April 2016 until May 2020, he served as Vice President and Deputy General Counsel and Assistant Secretary at Celanese Corporation where he was the global general counsel for the Acetyl Chain division and Global Supply Chain organization. From August 2012 until March 2016, he served as Assistant General Counsel and Assistant Secretary at FMC Corporation where he was the chief M&A and corporate counsel for the company. Earlier at FMC from April 2004 until July 2012, he served as the global division counsel of the FMC Health & Nutrition division. Prior to FMC, he served as an associate at Morgan, Lewis & Bockius LLP and Blank Rome LLP, and as a law clerk and court mediator at the Superior Court of New Jersey.

There are no family relationships among our directors and executive officers.

Board Leadership Structure

The Board will annually elect one director to serve as Chair of the Board. The Chair of the Board may also be the Chief Executive Officer or any other officer of the Company, but is not required to be an executive officer of the Company. The Board does not have a policy on whether the roles of Chair of the Board and Chief Executive Officer should be separate or combined. This

allows the Board flexibility to determine whether the two roles should be separated or combined based upon the Company’s needs and the Board’s assessment of the Company’s leadership from time to time. Ms. Twitchell has served as an independent director of the Company since 2015. During her tenure, she has served as Chair of the Audit Committee and Lead Independent Director. The Board believes that these experiences, in-depth knowledge obtained in the various positions held by Ms. Twitchell described above and other insights put Ms. Twitchell in the best position to provide broad leadership for the Board as it considers strategy and exercises its fiduciary responsibilities to stockholders. Further, the Board has demonstrated its commitment and ability to provide independent oversight of management. Each independent director has access to the Chief Executive Officer and other Company executives, may call meetings of the independent directors and may request agenda topics to be added or dealt with in more detail at meetings of the full Board or an appropriate Board committee.

Voting for Directors under Bylaws

In an uncontested director election, each director nominee who receives a majority of votes cast shall be deemed to be elected. Therefore, director nominees for whom the number of votes cast “FOR” such director’s election exceeds the number of votes cast “AGAINST” that director’s election will be elected. With respect to incumbent directors, if any director nominee receives less than a majority of the votes cast, such director shall tender his or her resignation to the Board, whereupon the Board shall within 90 days after the receipt thereof either (a) accept the resignation of such director or (b) upon the unanimous vote of the Board, decline to accept such resignation. In either case, the Board’s determination will be made public by means of a Current Report on Form 8-K filed with the SEC.

In the case of a contested director election in which the number of nominees exceeded the number of directors to be elected, each director would be elected by a plurality of the votes cast. Cumulative voting is not permitted in the election of directors.

Board Independence

The Company’s Corporate Governance Guidelines and the NYSE listing standards require that a majority of the Board consist of independent directors. The Board has determined that each of our directors, other than Mr. Carter and Mr. Quarles, is independent within the meaning of the NYSE listing standards. In determining the independence of directors, the Board evaluated transactions between the Company and entities with which directors were affiliated that occurred in the ordinary course of business and that were provided on the same terms and conditions available to other customers.

Meetings of the Board and Its Committees

Quarterly Board meetings are typically held in person. However, due to the COVID-19 pandemic, all board and committee meetings were transitioned to virtual meetings since March 2020. Other Board meetings may be held via telephone conference call due to the geographical distance between members of the Board. In the instance where all members cannot meet or be contacted at once, members may be contacted individually, and upon agreement, Unanimous Consent Resolutions may be signed. During 2020, the Board held seven meetings.

Board Structure and Committee Composition

As of the date of this proxy statement, our Board has seven directors and the following three standing committees: (1) Audit Committee; (2) Compensation Committee; and (3) Nominating and Governance Committee. Committee membership as of the date of this proxy statement, meetings during the last fiscal year and the function of each of the standing committees are described below. Mr. Carter, our former Chairman, and Mr. Quarles, our President and Chief Executive Officer, do not serve on any of our standing committees. Each of the standing committees operates under a written charter adopted by the applicable committee and approved by the Board. Committee charters are available on the Company’s website at https://ir.trecora.com. Free printed copies are also available to any stockholder who makes a request to the Corporate Secretary at the address listed on page 9.

All of our directors attended 100% of the Board and applicable standing committee meetings during 2020. Directors are also encouraged to attend annual meetings of Company stockholders. All of our directors attended our 2020 annual meeting of stockholders via the webcast.

| | | | | | | | | | | |

Name of Director | Audit | Compensation | Nominating and Governance |

Independent Directors: | | | |

Gary K. Adams | | Chair | Member |

Pamela R. Butcher | | Member | Chair |

Adam C. Peakes | Chair | Member | |

Janet S. Roemer | Member | | Member |

Karen A. Twitchell | Member | Member | |

Number of Meetings in Fiscal 2020 | 6 | 7 | 4 |

Audit Committee

The Company has a separately designated standing Audit Committee established in accordance with the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee assists the Board in fulfilling its responsibilities for generally overseeing the Company’s financial reporting processes and the audit of the Company’s financial statements, including:

•the integrity of the Company’s financial statements, including the Company’s compliance with legal and regulatory requirements;

•the qualifications and independence of the independent registered public accounting firm; and

•the performance of the Company’s internal audit function and the independent registered public accounting firm, risk assessment and risk management and finance and investment functions.

Among other things, the Audit Committee:

•prepares the Audit Committee report for inclusion in the annual proxy statement;

•annually reviews its charter and performance;

•appoints, evaluates and determines the compensation of the independent registered public accounting firm;

•reviews and approves the scope of the annual audit, the audit fee and the financial statements;

•reviews and approves all permissible non-audit services to be performed by the independent registered public accounting firm;

•reviews the Company’s disclosure controls and procedures, internal controls, information and cyber security policies, internal audit function, and corporate policies with respect to financial information;

•reviews regulatory and accounting initiatives and off-balance sheet structures, oversees the Company’s compliance programs with respect to legal and regulatory requirements;

•oversees investigations into complaints concerning financial matters;

•reviews other risks that may have a significant impact on the Company’s financial statements;

•reviews and oversees treasury matters, the Company’s loans and debt, and loan guarantees;

•reviews the Company’s capitalization; and

•coordinates with the Compensation Committee regarding the cost, funding and financial impact of the Company’s equity compensation plans and benefit programs.

The Audit Committee works closely with management as well as the Company's independent registered public accounting firm. In performance of its oversight function, the Audit Committee has the authority to obtain advice, assistance from, and receive appropriate funding from the Company for, outside legal, accounting or other advisors as the Audit Committee deems necessary from time to time to carry out its duties.

The individuals serving on the Audit Committee of the Board are Adam C. Peakes (Chair), Karen A. Twitchell and Janet S. Roemer. The Board has determined that each of the Audit Committee members is independent pursuant to SEC rules and NYSE listing standards governing audit committee members. The Board also determined that each member of the Audit Committee is “financially literate” pursuant to the listing standards of the NYSE and that each of Mr. Peakes and Ms. Twitchell is an “audit committee financial expert” as defined by SEC rules and NYSE listing standards. Please refer to the biographies of Mr. Peakes and Ms. Twitchell on pages 12 and 13 above for a summary of their respective experience.

The charter of the Audit Committee is available on the Company’s website at https://ir.trecora.com. A free printed copy is also available to any stockholder who requests it from the Corporate Secretary at the address listed on page 9.

Compensation Committee

The Compensation Committee:

•discharges the Board’s responsibilities relating to the compensation of the Company’s executives and directors;

•prepares the Compensation Committee report required to be included in the annual proxy statement;

•provides general oversight of the Company’s compensation structure;

•reviews and provides guidance on the Company’s human resources programs; and

•retains and approves the terms of the retention of compensation consultants and other compensation experts.

Other specific duties and responsibilities of the Compensation Committee include:

•reviewing and approving objectives relevant to executive officer compensation, evaluating performance and determining the compensation of executive officers in accordance with those objectives;

•approving severance arrangements and other applicable agreements for executive officers;

•overseeing the Company’s equity-based and incentive compensation plans;

•overseeing non-equity-based benefit plans and approving any changes to such plans involving a material financial commitment by the Company;

•monitoring workforce management programs;

•establishing compensation policies and practices for service on the Board and its committees;

•developing guidelines for and monitoring director and executive stock ownership; and

•annually evaluating its performance and its charter.

The individuals serving on the Compensation Committee of the Board are Gary K. Adams (Chair), Pamela R. Butcher, Adam C. Peakes and Karen A. Twitchell. The Board has determined that each of the Compensation Committee members is independent pursuant to NYSE listing standards governing compensation committee members.

The charter of the Compensation Committee is available on the Company’s website at https://ir.trecora.com. A free printed copy is also available to any stockholder who requests it from the Corporate Secretary at the address listed on page 9.

Nominating and Governance Committee

The Nominating and Governance Committee:

•recommends candidates to be nominated for election as directors at the Company’s annual meeting, consistent with criteria approved by the Board;

•develops and regularly reviews corporate governance principles and related policies for approval by the Board;

•oversees the organization of the Board to discharge the Board’s duties and responsibilities properly and efficiently; and

•sees that proper attention is given and effective responses are made to stockholder concerns regarding corporate governance.

Other specific duties and responsibilities of the Nominating and Governance Committee include:

•annually assessing the size and composition of the Board, including developing and reviewing director qualifications for approval by the Board;

•identifying and recruiting new directors and considering candidates proposed by stockholders;

•recommending assignments of directors to committees to ensure that committee membership complies with applicable laws and listing standards;

•conducting annual evaluations of Board performance and recommending improvements;

•conducting a preliminary review of director independence and financial literacy and expertise of Audit Committee members and making recommendations to the Board relating to such matters; and

•overseeing director orientation and continuing education.

The Nominating and Governance Committee also reviews and approves any executive officers for purposes of Section 16 of the Exchange Act (“Section 16 Officers”) standing for election for outside for-profit boards of directors; and reviews stockholder proposals and recommends Board responses.

The individuals serving on the Nominating and Governance Committee of the Board are Pamela R. Butcher (Chair), Gary K. Adams and Janet S. Roemer. The Board has determined that each of the Nominating and Governance Committee members is independent pursuant to NYSE listing standards governing nominating committee members.

The charter of the Nominating and Governance Committee is available on the Company’s website at https://ir.trecora.com. A free printed copy is also available to any stockholder who requests it from the Corporate Secretary at the address listed on page 9.

Stockholder Recommendations

The policy of the Nominating and Governance Committee is to consider properly submitted stockholder recommendations of candidates for membership on the Board as described below under “Identifying and Evaluating Candidates for Directors.” In evaluating such recommendations, the Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth below under “Director Qualifications.” Any stockholder recommendations proposed for consideration by the Nominating and Governance Committee should include the candidate’s name and qualifications for Board membership and should be addressed to the Corporate Secretary at the address listed on page 9.

Director Qualifications

The Company maintains certain criteria that apply to nominees recommended for a position on the Company’s Board. Under these criteria, members of the Board should have the highest professional and personal ethics and values, consistent with longstanding Company values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public service. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all stockholders of the Company.

Identifying and Evaluating Candidates for Directors

The Company recognizes that the strength and effectiveness of the Board reflects the balance, experience and diversity of the individual directors, their commitment and the ability of directors to work effectively as a group in carrying out their responsibilities. The Company seeks candidates with diverse backgrounds who possess knowledge and skills in areas of importance to the Company. In addition to seeking a diverse set of business or academic experiences, the Nominating and Governance Committee seeks a mix of nominees whose perspectives reflect diverse life experiences and backgrounds. The Nominating and Governance Committee does not use quotas but considers diversity when evaluating potential new directors.

The Nominating and Governance Committee uses a variety of methods for identifying and evaluating nominees for director. The Nominating and Governance Committee regularly assesses the appropriate size of the Board and whether any vacancies on the Board are anticipated due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Nominating and Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Nominating and Governance Committee through current Board members, professional search firms, stockholders or other persons. Identified candidates are evaluated at regular or special meetings of the Nominating and Governance Committee and may be considered at any point during the year. As described above, the Nominating and Governance Committee considers properly submitted stockholder recommendations for candidates for the Board to be included in the Company’s proxy statement.

Board Oversight of Risk Management

The Board oversees management of risk. The Board regularly reviews information regarding the Company’s business and operations, including the key operational and financial risks. As described below, consistent with SEC regulations and NYSE requirements, the Board committees are also engaged in overseeing risk associated with the Company.

•The Audit Committee oversees management of exposure to financial risks, monitors and evaluates the effectiveness of the Company’s risk management and risk assessment guidelines and policies and evaluates compliance with the Company's ethics, conflicts of interest and other compliance programs.

•The Compensation Committee oversees the management of risks relating to the Company’s executive compensation plans and incentive structure.

•The Nominating and Governance Committee oversees the Company’s ethics and compliance policies and procedures.

While each committee is responsible for evaluating certain risks and overseeing the management of those risks, the full Board is ultimately responsible for overseeing the Company’s risk exposures and management thereof, and the Board is regularly informed on these matters through committee and senior management presentations.

Executive Sessions

Executive sessions of non-employee directors are held at least four times a year with Ms. Twitchell, our Chair, scheduling and presiding over such sessions. Additionally, Ms. Twitchell schedules and presides over executive sessions of our independent directors only at least four times a year. During 2020, four executive sessions of the non-employee directors and six executive sessions of the independent directors were held either in person or via telephone. Any independent director may request that an additional executive session be scheduled.

Communications with the Board

Individuals may communicate with the Board by contacting:

Corporate Secretary

Trecora Resources

1650 Highway 6 South, Suite 190

Sugar Land, TX 77478

All directors have access to this correspondence. In accordance with instructions from the Board, the secretary to the Board reviews all correspondence, organizes the communications for review by the Board and relays communications to the full Board or individual directors, as appropriate. The Company’s independent directors have requested that certain items that are unrelated to the Board’s duties, such as spam, junk mail, mass mailings, solicitations, resumes and job inquiries, not be forwarded.

Communications that are intended specifically for the independent directors or non-management directors should be sent to the address noted above to the attention of independent directors.

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of March 29, 2021, concerning beneficial ownership of Company Common Stock by:

(1)Company non-employee directors and nominees;

(2)Each of our Named Executive Officers;

(3)Current directors and Company executive officers as a group; and

(4)All individuals owning more than 5% of the Company’s outstanding Common Stock.

The information provided in the table is based on the Company’s records, information filed with the SEC and information provided to the Company, except where otherwise noted.

The number of shares beneficially owned by each entity or individual is determined under SEC rules, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the entity or individual has sole or shared voting power or investment power and also any shares that the entity or individual has the right to acquire as of March 29, 2021, through the exercise of any stock option or other right. Unless otherwise indicated, each person has sole voting and investment power (or shares such powers with his or her spouse) with respect to the shares set forth in the following table.

BENEFICIAL OWNERSHIP TABLE

| | | | | | | | | | | |

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) |

Note | Percent of Class |

Current Non-Employee Directors | | 10 | |

Gary K. Adams | 128,620 | 2,3 | * |

Pamela R. Butcher | 33,361 | 3,4 | * |

Nicholas N. Carter | 628,451 | 2,3 | 2.52 |

Adam C. Peakes | 22,121 | 3 | * |

Janet S. Roemer | 38,665 | 3 | * |

Karen A. Twitchell | 38,931 | 3 | * |

Named Executive Officer | | 10 | |

S. Sami Ahmad | 22,080 | | * |

Peter M. Loggenberg | 55,522 | | * |

Patrick D. Quarles | 253,314 | | 1.01 |

Joseph M. Tanner | 12,394 | 9 | * |

John R. Townsend | 32,049 | | * |

| | | |

All directors and executive officers as a group (12 persons) | 1,266,176 | 2,3,4 | 5.07 |

| | | |

Individuals with beneficial ownership of more than 5% of outstanding Common Stock | | | |

BlackRock, Inc. | 1,275,264 | 5 | 5.11 |

Fahad Mohammed Saleh Al Athel | 2,457,959 | 6 | 9.85 |

Funds affiliated with Pangaea Ventures, L.P., Ortelius Advisors, L.P. and Mr. Peter DeSorcy | 1,829,459 | 7 | 7.33 |

Funds affiliated with Wellington Management Group LLP (number of shares includes those owned by Wellington Trust Company, NA and Wellington Trust Company, National Association Multiple Common Trust Funds Trust, Micro Cap Equity Portfolio) | 3,434,307 | 8 | 13.76 |

__________________

* Indicates beneficial ownership of less than 1% of shares outstanding.

(1)Unless otherwise indicated, to the knowledge of the Company, the owner has sole voting and investment power.

(2)Includes 250,000 aggregate shares, which these directors have the right to acquire through the exercise of presently exercisable stock options. These options are held as follows: Mr. Adams 100,000 shares and Mr. Carter 150,000 shares.

(3)Includes 79,506 aggregate shares, which these directors and Named Executive Officers have the right to acquire presently or upon vesting within 60 days. These shares are held as follows: Mr. Adams 13,251 shares; Mr. Carter 13,251 shares; Ms. Butcher 13,251 shares; Mr. Peakes 13,251 shares; Ms. Roemer 13,251 shares; and Ms. Twitchell 13,251 shares.

(4)Includes 350 shares owned by Ms. Butcher’s immediate family, with respect to which Ms. Butcher disclaims beneficial ownership.

(5)As reported on Schedule 13G filed with the SEC on February 2, 2021. As of December 31, 2020, BlackRock, Inc., reported that it had sole power to vote 1,251,386 shares of Common Stock and sole power to dispose of 1,275,264 shares of Common. BlackRock, Inc.’s principal business office address is BlackRock, Inc., 55 East 52nd Street, New York, NY 10055.

(6)As reported on a Form 4 dated September 17, 2019, and filed with the SEC on September 17, 2019, Mr. Fahad Al-Athel is the beneficial owner of 2,457,959 shares. According to the Form 4, Mr. Fahad Al-Athel's address is 323 Al Aruba Street, P.O. Box 4900, Riyadh, Saudi Arabia.

(7)As reported on Schedule 13D filed jointly by Pangaea Ventures, L.P., Ortelius Advisors, L.P. and Mr. Peter DeSorcy (the “Pangaea Entities”) with the SEC on March 18, 2021, for their holdings as of March 8, 2021. Each such entity reported that it has shared power to vote 1,829,459 shares of Common Stock and shared power to dispose of 1,829,459 shares of Common Stock. According to such filing, Ortelius Advisors, L.P. is the investment manager of Pangaea Ventures, L.P. and Mr. DeSorcy is the Managing Member of the general partner of Ortelius Advisors, L.P., a Managing Member of Ortelius Advisors, L.P., and has a controlling interest in Ortelius Advisors, L.P., and, as a result, Mr. DeSorcy may be deemed to beneficially own the securities beneficially owned by Pangaea Ventures, L.P. Each of the Pangaea Entities principal business office address is 450 Park Avenue, Suite 2700, New York, NY 10022.

(8)As reported in Amendment No. 12 to Schedule 13G filed by Wellington Management Group LLP, Wellington Group Holdings LLP, Wellington Investment Advisors Holdings LLP and Wellington Management Company LLP (the “Wellington Entities”) with the SEC on February 4, 2021, for their holdings as of December 31, 2020. Each such entity reported that it has shared power to vote 3,434,307 shares of Common Stock and shared power to dispose of 3,434,307 shares of Common Stock, except for Wellington Management Company LLP, which reported that it has shared power to vote 3,373,158 shares of Common Stock and shared power to dispose of 3,373,158 shares of Common Stock. Each such entity’s principal business office address is c/o Wellington Management Company LLP, 280 Congress Street, Boston, MA 02210. Although the number of shares reported as beneficially owned by the Wellington Entities in the Schedule 13G/A includes shares of our outstanding Common Stock beneficially owned by Wellington Trust Company, NA (“Wellington Trust”), Wellington Trust separately filed a Schedule 13G/A with the SEC to report its beneficial ownership. As reported in Amendment No. 12 to Schedule 13G filed by Wellington Trust with the SEC on February 3, 2021, for its holdings as of December 31, 2020, Wellington Trust reported that it has shared power to vote and dispose of 3,373,158 shares (which represents 13.59% of shares of outstanding Common Stock). Wellington Trust’s principal business office address is c/o Wellington Management Company LLP, 280 Congress Street, Boston, MA 02210. Additionally, although the number of shares reported as beneficially owned by the Wellington Entities in each of the aforementioned Schedule 13G/A include shares of our outstanding Common Stock beneficially owned by Wellington Trust Company, National Association Multiple Common Trust Funds Trust, Micro Cap Equity Portfolio (“Wellington Micro Cap”), Wellington Micro Cap separately filed a Schedule 13G/A with the SEC to report its beneficial ownership. As reported in Amendment No. 2 to Schedule 13G filed by Wellington Micro Cap with the SEC on February 3, 2021, for its holdings as of December 31, 2020, Wellington Micro Cap reported that it has shared power to vote and dispose of 1,640,165 shares (which represents 6.61% of shares of outstanding Common Stock). Wellington Micro Cap’s principal business office address is c/o Wellington Management Company LLP, 280 Congress Street, Boston, MA 02210.

(9)Mr. Tanner retired from the Company effective as of March 15, 2021.

(10)The address for the beneficial owner is Trecora Resources, 1650 Highway 6 South, Suite 190, Sugar Land, TX 77478.

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Exchange Act requires our directors, executive officers and holders of more than 10% of Company Common Stock to file reports of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the SEC. Based solely on our review of copies of these reports, or written representations from reporting persons, we believe that during the year ended December 31, 2020, all of our executive officers, directors and greater than 10% holders filed the reports required to be filed under Section 16(a) on a timely basis under Section 16(a), except that a Form 4 filed on June 3, 2020 with respect to awards granted to Michael W. Silberman in connection with his joining the Company should have also reflected an additional award of Restricted Stock Units (as defined herein) representing his pro rata participation in the Company's 2020 long-term incentive plan.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company directly owns approximately 55% of the outstanding capital stock of PEVM. Nicolas N. Carter, one of our directors, is currently a director and President of PEVM. The Company is providing funds necessary to cover the PEVM operations. During 2018, 2019 and 2020, the Company advanced approximately $35,000, $95,000 and $40,000, respectively, for such purposes. As of December 31, 2020, PEVM owed the Company an aggregate of approximately $741,000 as a result of advances made by the Company. During the first quarter of 2021, the Company advanced approximately $2,000 and, at March 25, 2021, PEVM owed the Company approximately $743,000.

Consulting fees of approximately $94,000, $123,000, and zero were incurred during 2018, 2019, and 2020, respectively, for Mr. Carter. Due to his history and experience with the Company as President and Chief Executive Officer, and in order to provide continuity after his retirement, we entered into a consulting agreement with Mr. Carter in July 2015. This consulting agreement was most recently amended and restated in March 2019. There is currently no consulting agreement in place with Mr. Carter as it expired on December 31, 2019. At December 31, 2020, we had no outstanding liability payable to Mr. Carter.

In addition, two of Mr. Carter’s sons-in-law are non-executive salaried employees of the Company.

Review, Approval or Ratification of Transactions with Management and Others

The Company’s Standards of Business Conduct addresses conflicts of interest and is available on our website. The Company’s directors, officer and employees are required to abide by this code by avoiding activities that conflict with, or are reasonably likely to conflict with, the best interests of the Company and its stockholders. Personal activities, interests, or relationships that would or could negatively influence judgment, decisions, or actions must be disclosed to the Board with prompt and full disclosure for Board review and/or action.