Second Quarter 2021 Earnings NYSE: TREC www.trecora.com August 5, 2021

Forward Looking Statements 2 Forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other important factors that could cause the actual results, performance or our achievements, or industry results, to differ materially from historical results, any future results, or performance or achievements expressed or implied by such forward-looking statements. Such risks, uncertainties and factors include, but are not limited to the impacts of the COVID-19 pandemic on our business, financial results and financial condition and that of our customers, suppliers, and other counterparties; general economic and financial conditions domestically and internationally; insufficient cash flows from operating activities; our ability to attract and retain key employees; feedstock and product prices; feedstock availability and our ability to access third party transportation; competition; industry cycles; natural disasters or other severe weather events (such as the Texas freeze event), health epidemics and pandemics (including the COVID-19 pandemic) and terrorist attacks; our ability to consummate extraordinary transactions, including acquisitions and dispositions, and realize the financial and strategic goals of such transactions; technological developments and our ability to maintain, expand and upgrade our facilities; regulatory changes; environmental matters; lawsuits; outstanding debt and other financial and legal obligations (including having to return the amounts borrowed under the PPP Loans or failing to qualify for forgiveness of such loans, in whole or in part); difficulties in obtaining additional financing on favorable conditions, or at all; local business risks in foreign countries, including civil unrest and military or political conflict, local regulatory and legal environments and foreign currency fluctuations; and other risks detailed in our latest Annual Report on Form 10-K, including, but not limited to, “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, under similar headings in this Quarterly Report on Form 10-Q and in our other filings with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertainties are currently amplified by and will continue to be amplified by, or in the future may be amplified by, the COVID-19 pandemic and other natural disasters such as severe weather events. There may be other factors of which we are currently unaware or deem immaterial that may cause our actual results to differ materially from the forward-looking statements. In addition, to the extent any inconsistency or conflict exists between the information included in this report and the information included in our prior releases, reports and other filings with the SEC, the information contained in this report updates and supersedes such information. Forward-looking statements are based on current plans, estimates, assumptions and projections, and, therefore, you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update them in light of new information or future events.

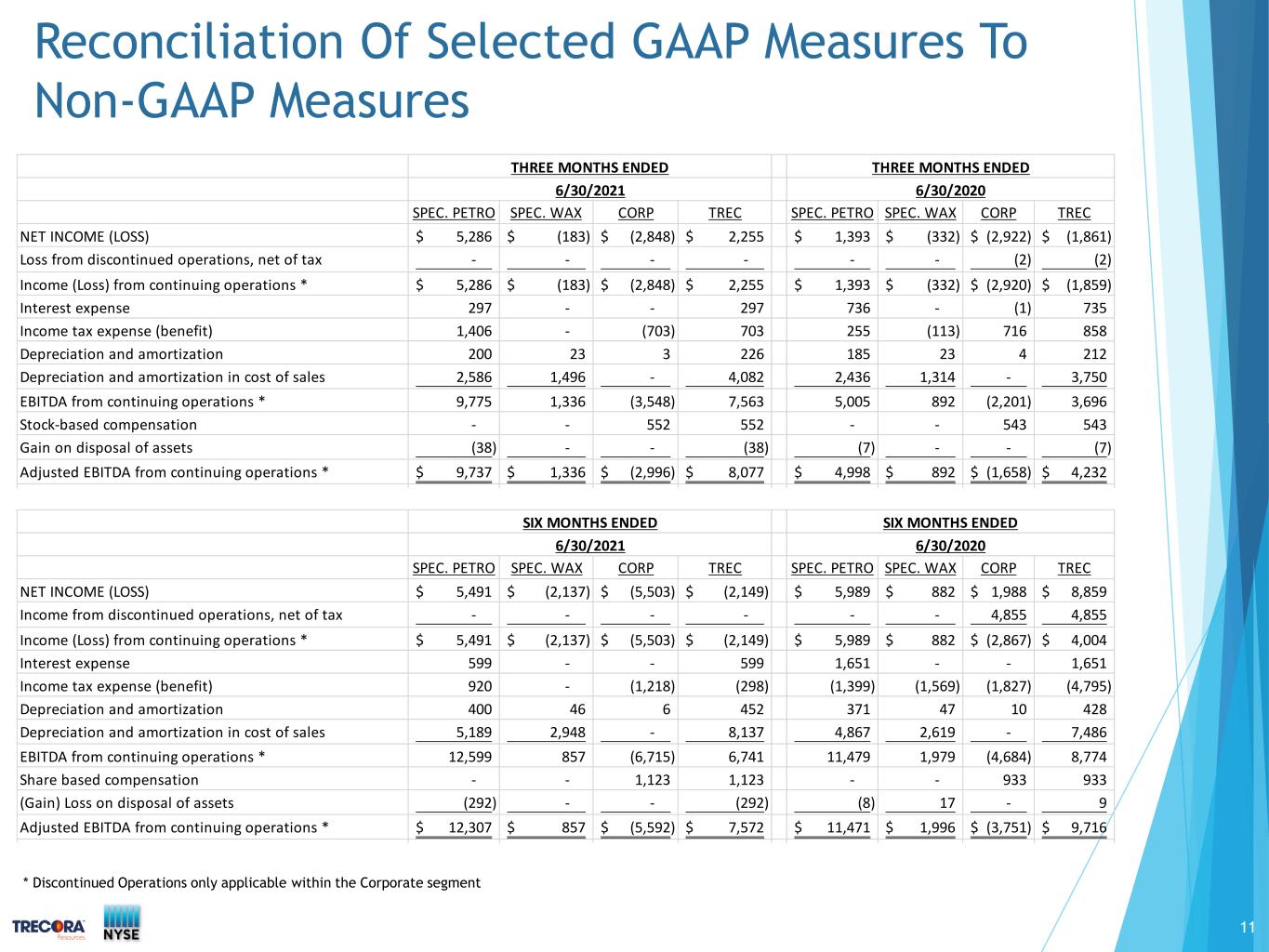

Non-GAAP Measures This presentation includes the non-GAAP financial measures of EBITDA from continuing operations and Adjusted EBITDA from continuing operations and provides reconciliations from our most directly comparable GAAP financial measures to those measures. We believe these financial measures provide users of our financial statements with supplemental information that may be useful in evaluating our operating performance. We also believe that such non-GAAP measures, when read in conjunction with our operating results presented under GAAP, can be used to better assess our performance from period to period and relative to performance of other companies in our industry, without regard to financing methods, historical cost basis or capital structure. These measures are not measures of financial performance or liquidity under GAAP and should be considered in addition to, and not as a substitute for, analysis of our results under GAAP. We define EBITDA from continuing operations as net income (loss) from continuing operations plus interest expense, income tax expense (benefit), and depreciation and amortization. We define Adjusted EBITDA from continuing operations as EBITDA from continuing operations plus share-based compensation and plus or minus gains or losses on disposal of assets. 3

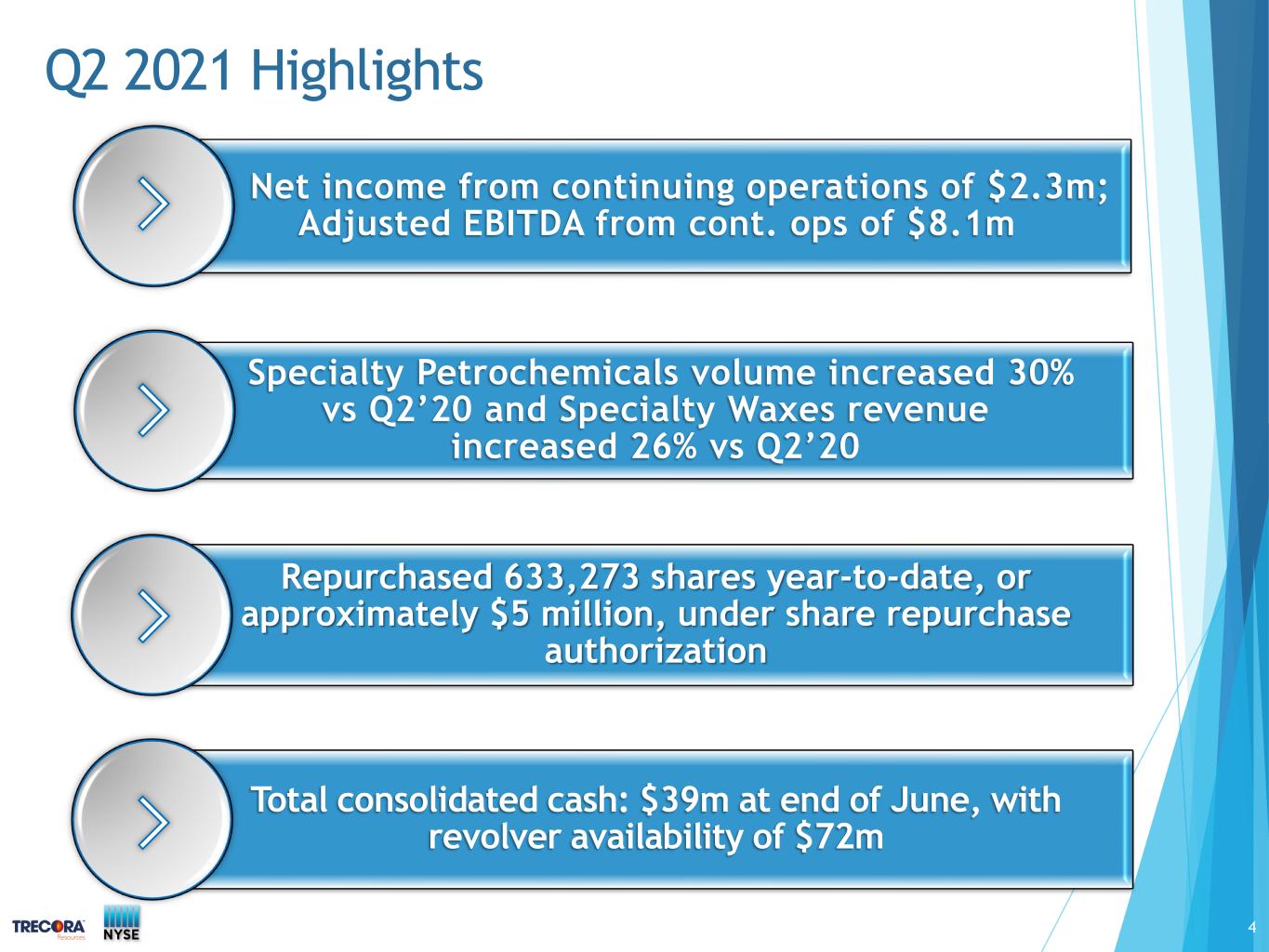

4 Q2 2021 Highlights Net income from continuing operations of $2.3m; Adjusted EBITDA from cont. ops of $8.1m Specialty Petrochemicals volume increased 30% vs Q2’20 and Specialty Waxes revenue increased 26% vs Q2’20 Repurchased 633,273 shares year-to-date, or approximately $5 million, under share repurchase authorization Total consolidated cash: $39m at end of June, with revolver availability of $72m

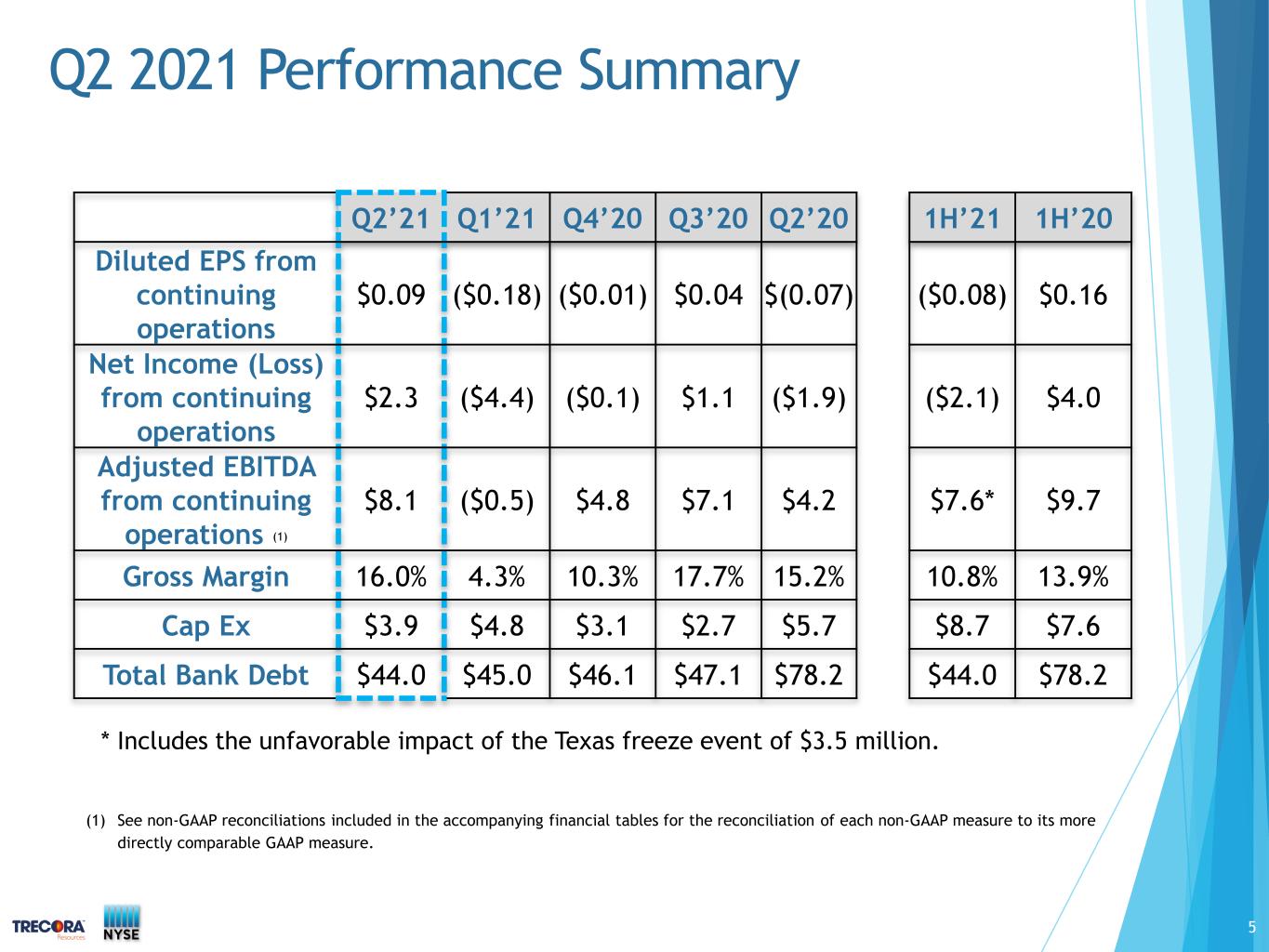

Q2 2021 Performance Summary Q2’21 Q1’21 Q4’20 Q3’20 Q2’20 1H’21 1H’20 Diluted EPS from continuing operations $0.09 ($0.18) ($0.01) $0.04 $(0.07) ($0.08) $0.16 Net Income (Loss) from continuing operations $2.3 ($4.4) ($0.1) $1.1 ($1.9) ($2.1) $4.0 Adjusted EBITDA from continuing operations (1) $8.1 ($0.5) $4.8 $7.1 $4.2 $7.6* $9.7 Gross Margin 16.0% 4.3% 10.3% 17.7% 15.2% 10.8% 13.9% Cap Ex $3.9 $4.8 $3.1 $2.7 $5.7 $8.7 $7.6 Total Bank Debt $44.0 $45.0 $46.1 $47.1 $78.2 $44.0 $78.2 (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its more directly comparable GAAP measure. 5 * Includes the unfavorable impact of the Texas freeze event of $3.5 million.

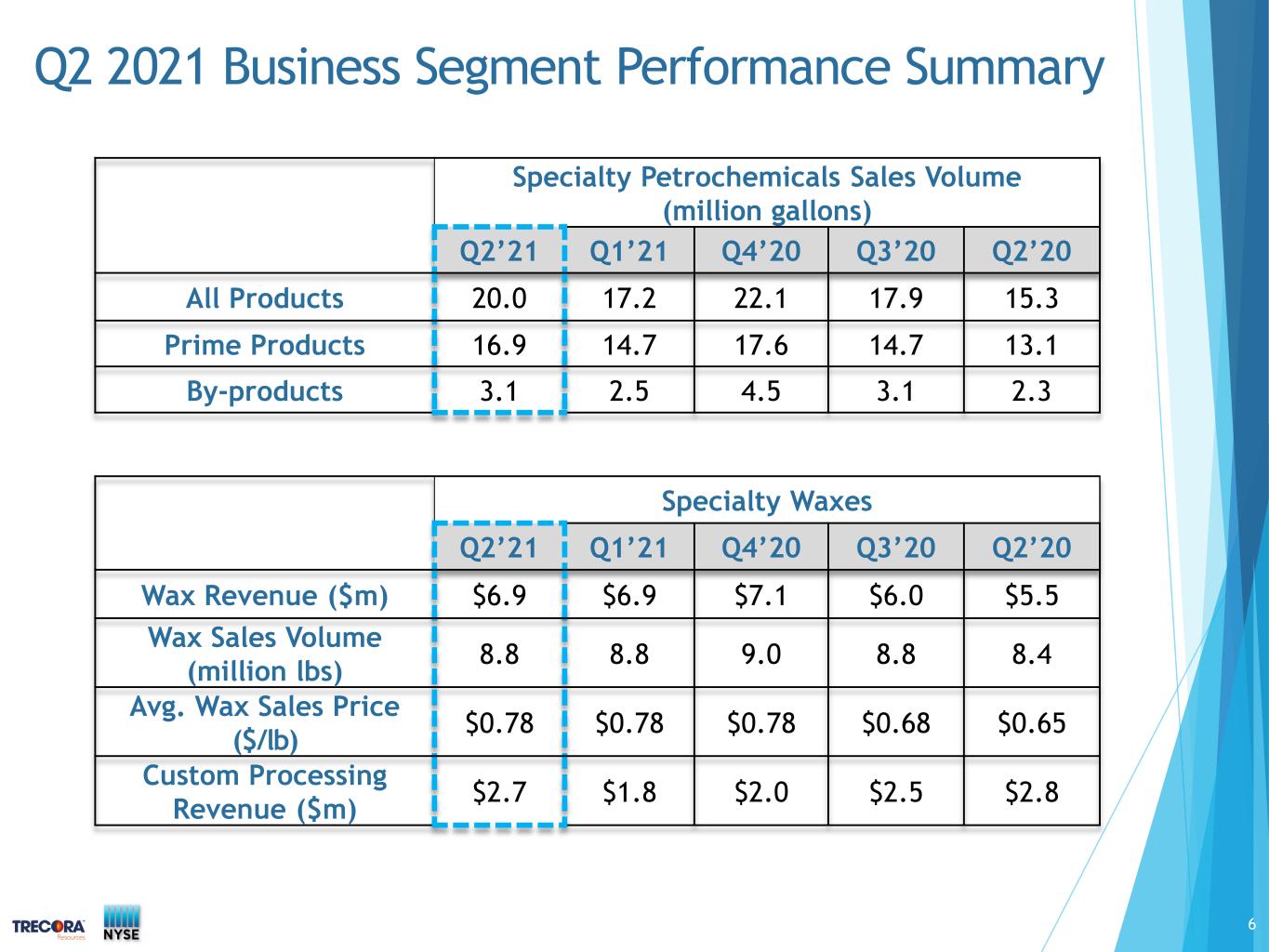

Q2 2021 Business Segment Performance Summary Specialty Petrochemicals Sales Volume (million gallons) Q2’21 Q1’21 Q4’20 Q3’20 Q2’20 All Products 20.0 17.2 22.1 17.9 15.3 Prime Products 16.9 14.7 17.6 14.7 13.1 By-products 3.1 2.5 4.5 3.1 2.3 6 Specialty Waxes Q2’21 Q1’21 Q4’20 Q3’20 Q2’20 Wax Revenue ($m) $6.9 $6.9 $7.1 $6.0 $5.5 Wax Sales Volume (million lbs) 8.8 8.8 9.0 8.8 8.4 Avg. Wax Sales Price ($/lb) $0.78 $0.78 $0.78 $0.68 $0.65 Custom Processing Revenue ($m) $2.7 $1.8 $2.0 $2.5 $2.8

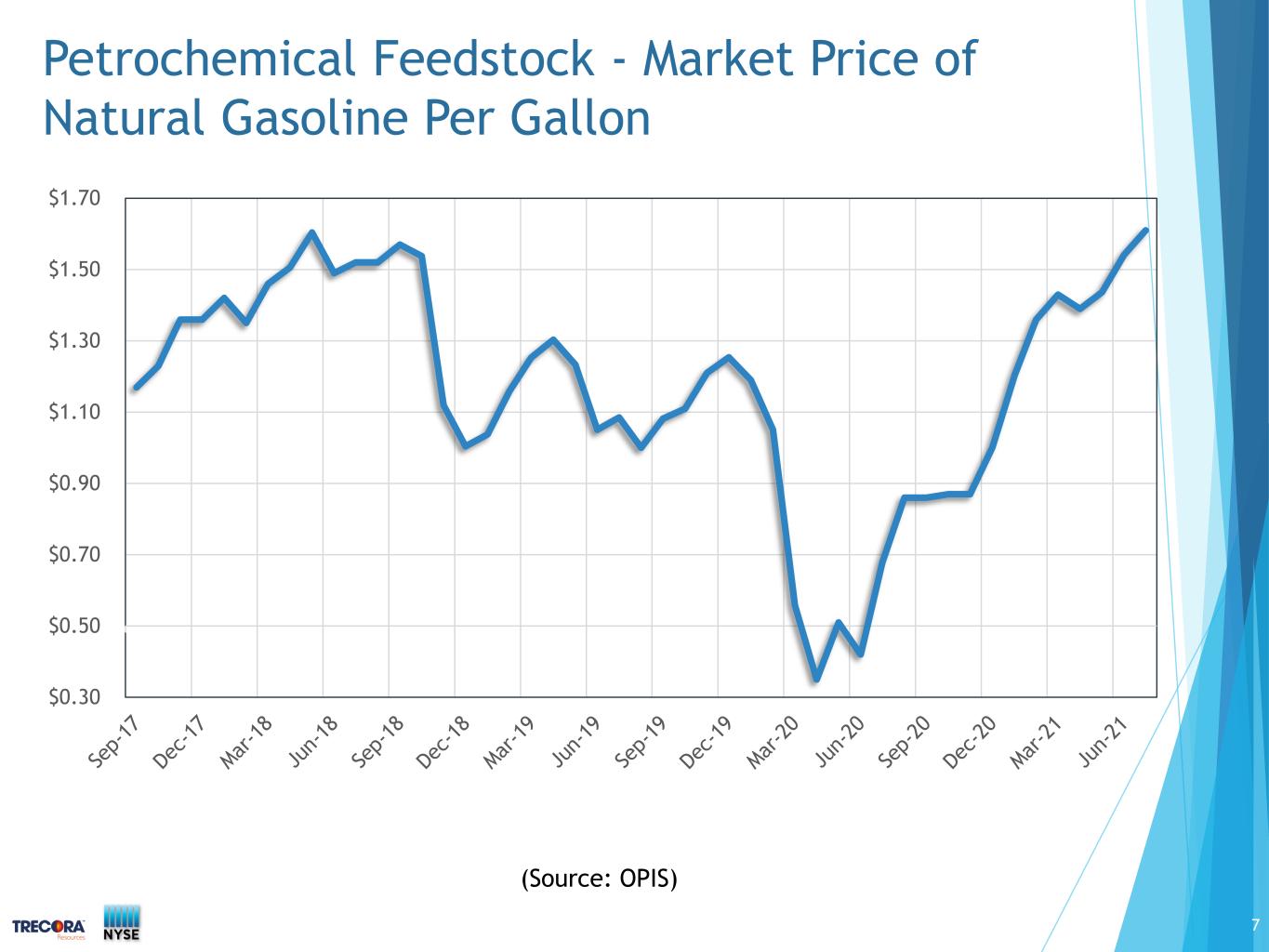

Petrochemical Feedstock - Market Price of Natural Gasoline Per Gallon $0.30 $0.50 $0.70 $0.90 $1.10 $1.30 $1.50 $1.70 7 (Source: OPIS)

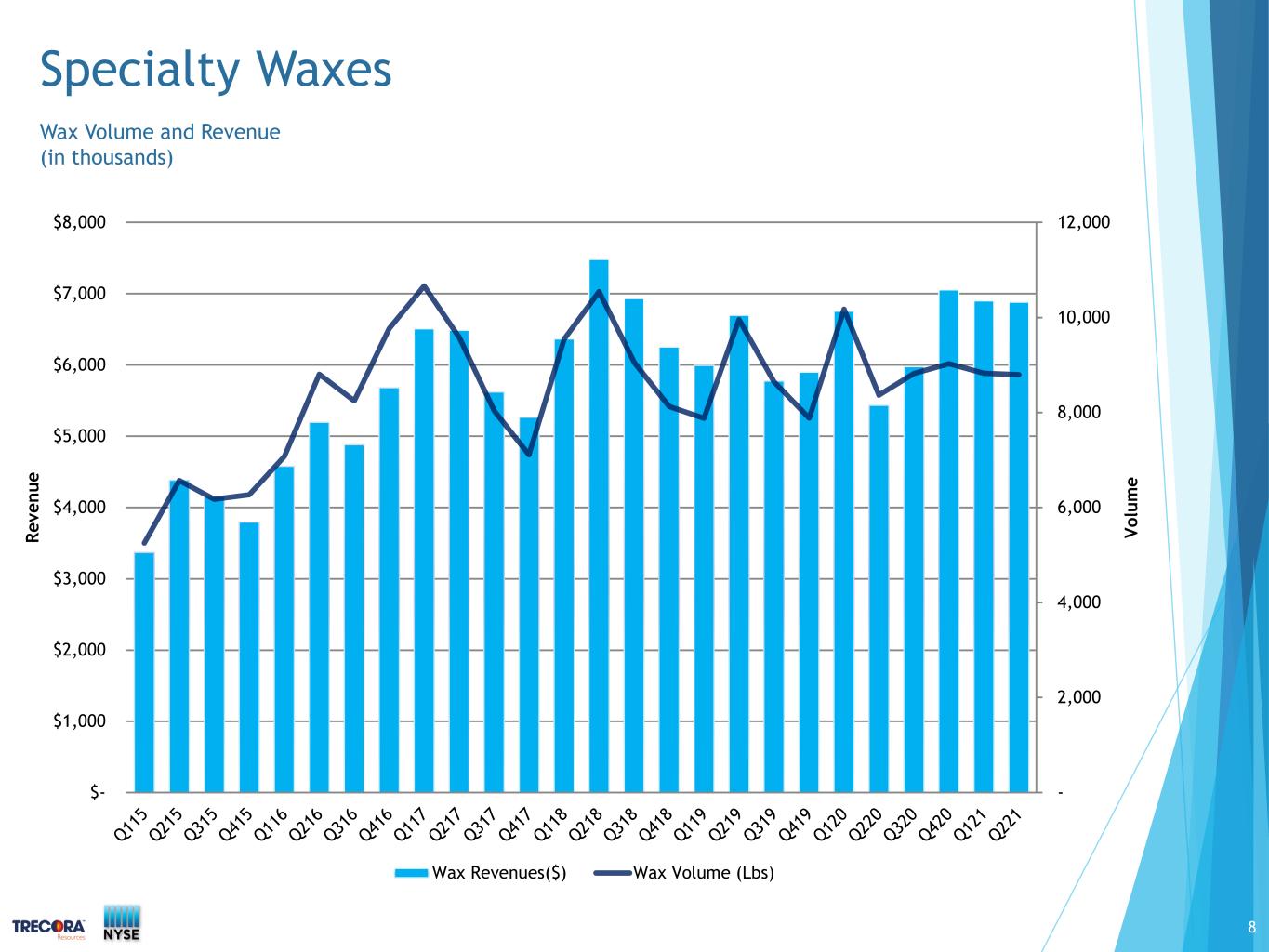

Wax Volume and Revenue (in thousands) 8 Specialty Waxes - 2,000 4,000 6,000 8,000 10,000 12,000 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 V ol um e Re ve nu e Wax Revenues($) Wax Volume (Lbs)

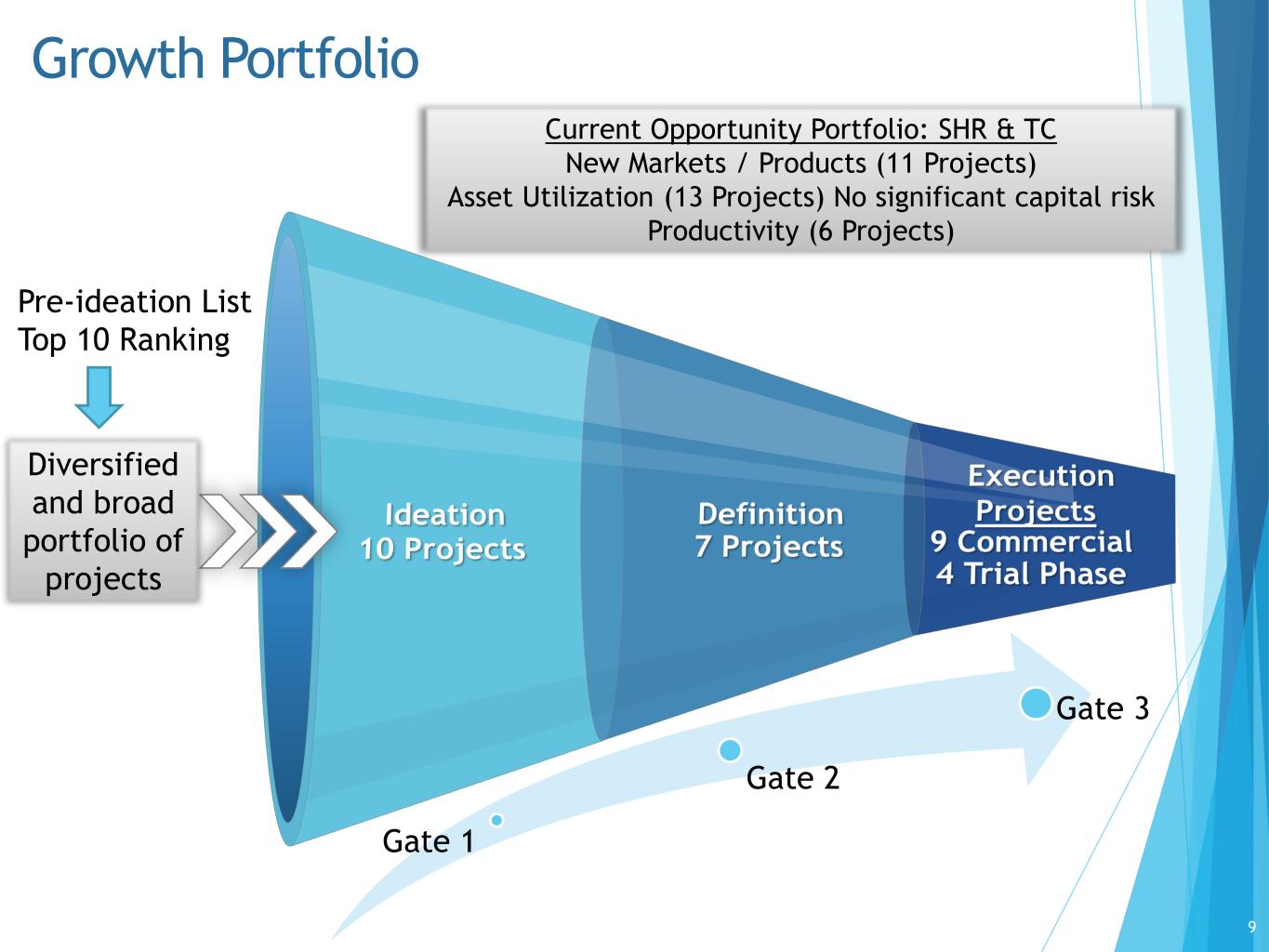

Gate 1 Gate 2 Gate 3 9 3 Current Opportunity Portfolio: SHR & TC New Markets / Products (11 Projects) Asset Utilization (13 Projects) No significant capital risk Productivity (6 Projects) Growth Portfolio Diversified and broad portfolio of projects Pre-ideation List Top 10 Ranking

For more information, please visit our website: http://www.trecora.com 10

SIX MONTHS ENDED SIX MONTHS ENDED 6/30/2021 6/30/2020 SPEC. PETRO SPEC. WAX CORP TREC SPEC. PETRO SPEC. WAX CORP TREC NET INCOME (LOSS) 5,491$ (2,137)$ (5,503)$ (2,149)$ 5,989$ 882$ 1,988$ 8,859$ Income from discontinued operations, net of tax - - - - - - 4,855 4,855 Income (Loss) from continuing operations * 5,491$ (2,137)$ (5,503)$ (2,149)$ 5,989$ 882$ (2,867)$ 4,004$ Interest expense 599 - - 599 1,651 - - 1,651 Income tax expense (benefit) 920 - (1,218) (298) (1,399) (1,569) (1,827) (4,795) Depreciation and amortization 400 46 6 452 371 47 10 428 Depreciation and amortization in cost of sales 5,189 2,948 - 8,137 4,867 2,619 - 7,486 EBITDA from continuing operations * 12,599 857 (6,715) 6,741 11,479 1,979 (4,684) 8,774 Share based compensation - - 1,123 1,123 - - 933 933 (Gain) Loss on disposal of assets (292) - - (292) (8) 17 - 9 Adjusted EBITDA from continuing operations * 12,307$ 857$ (5,592)$ 7,572$ 11,471$ 1,996$ (3,751)$ 9,716$ 11 Reconciliation Of Selected GAAP Measures To Non-GAAP Measures * Discontinued Operations only applicable within the Corporate segment THREE MONTHS ENDED THREE MONTHS ENDED 6/30/2021 6/30/2020 SPEC. PETRO SPEC. WAX CORP TREC SPEC. PETRO SPEC. WAX CORP TREC NET INCOME (LOSS) 5,286$ (183)$ (2,848)$ 2,255$ 1,393$ (332)$ (2,922)$ (1,861)$ Loss from discontinued operations, net of tax - - - - - - (2) (2) Income (Loss) from continuing operations * 5,286$ (183)$ (2,848)$ 2,255$ 1,393$ (332)$ (2,920)$ (1,859)$ Interest expense 297 - - 297 736 - (1) 735 Income tax expense (benefit) 1,406 - (703) 703 255 (113) 716 858 Depreciation and amortization 200 23 3 226 185 23 4 212 Depreciation and amortization in cost of sales 2,586 1,496 - 4,082 2,436 1,314 - 3,750 EBITDA from continuing operations * 9,775 1,336 (3,548) 7,563 5,005 892 (2,201) 3,696 Stock-based compensation - - 552 552 - - 543 543 Gain on disposal of assets (38) - - (38) (7) - - (7) Adjusted EBITDA from continuing operations * 9,737$ 1,336$ (2,996)$ 8,077$ 4,998$ 892$ (1,658)$ 4,232$