Trecora Resources Announces Second Quarter 2021 Results • Second quarter net income and Adjusted EBITDA increased year-over-year due to economic recovery and strong demand from end-use markets • Second quarter net income from continuing operations of $2.3 million compared to net loss from continuing operations of $1.9 million in the second quarter of 2020 • Second quarter Adjusted EBITDA from continuing operations of $8.1 million compared to Adjusted EBITDA from continuing operations of $4.2 million in the second quarter of 2020, driven by sharply improved results for both Specialty Petrochemicals and Specialty Waxes • Repurchased 633,273 shares year-to-date, or approximately $5 million, under $20 million share repurchase authorization • Strong balance sheet with ample liquidity to fund growth intiatives • Conference call at 10:00 am ET, August 5, 2021 SUGAR LAND, Texas, August 4, 2021 – Trecora Resources (“Trecora” or the “Company”) (NYSE: TREC), a leading provider of specialty hydrocarbons and specialty waxes, today announced financial results for the second quarter ended June 30, 2021. Executive Commentary “We delivered strong top and bottom line growth in the second quarter of 2021 as compared to the same period last year,” stated Pat Quarles, Trecora’s President and Chief Executive Officer. “The reopening of economies and an improving macroeconomic environment in the United States led to a significant improvement in demand across all of our end-markets, particularly for our prime products and waxes. This quarter demonstrates the strength of our business model as the economy continues to recover from the pandemic impacts and our industry recovers from the Texas freeze event in February. Product revenues for our Specialty Waxes segment were up 26.1% year-over-year, primarily reflecting increases in wax pricing. For our Specialty Petrochemicals segment, an 84.9% year-over-year increase in product revenues was driven by strong sales volumes as well as higher product prices. These factors led to second quarter net income from continuing operations of approximately $2.3 million and Adjusted EBITDA from continuing operations of $8.1 million, nearly doubling last year’s second quarter Adjusted EBITDA.” “We continue to focus on maintaining a strong balance sheet and delivering on our organic growth programs while seeking additional external opportunites to grow. In every instance, we are commited to increasing our earnings and cashflow and creating long-term value for our stockholders. As part of that commitment, during the quarter we completed the repurchase of $5 million of shares of the $20 million authorization from our Board,” concluded Mr. Quarles. Sami Ahmad, Trecora's Chief Financial Officer stated, “Our enhanced operational efficiencies and strong competitive positioning, coupled with improving execution at Trecora Chemical, enabled us to capitalize on the economic upturn and generate improved profitability in the second quarter. Cash used in operations in the second quarter was $4.3 million as the growth in the business resulted in an increase in working capital of nearly $16 million. We are extremely confident in our liquidity position, with cash at the end of the quarter of $39.1 million, and an undrawn revolver. Total bank debt at the end of the quarter was $44.0 million. The strength of our balance sheet affords us a great amount of financial flexibility to manage our business and execute on our strategic plan,” concluded Mr. Ahmad.

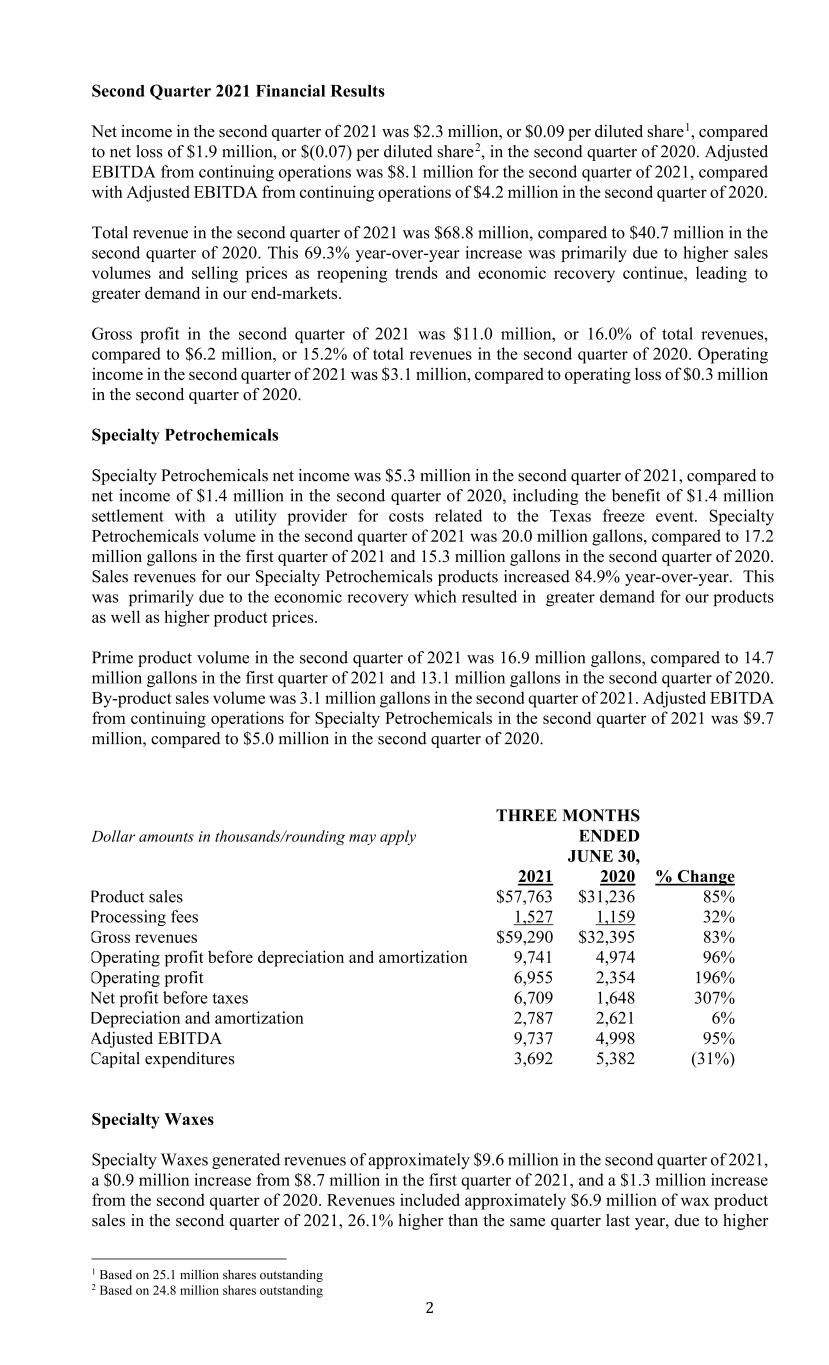

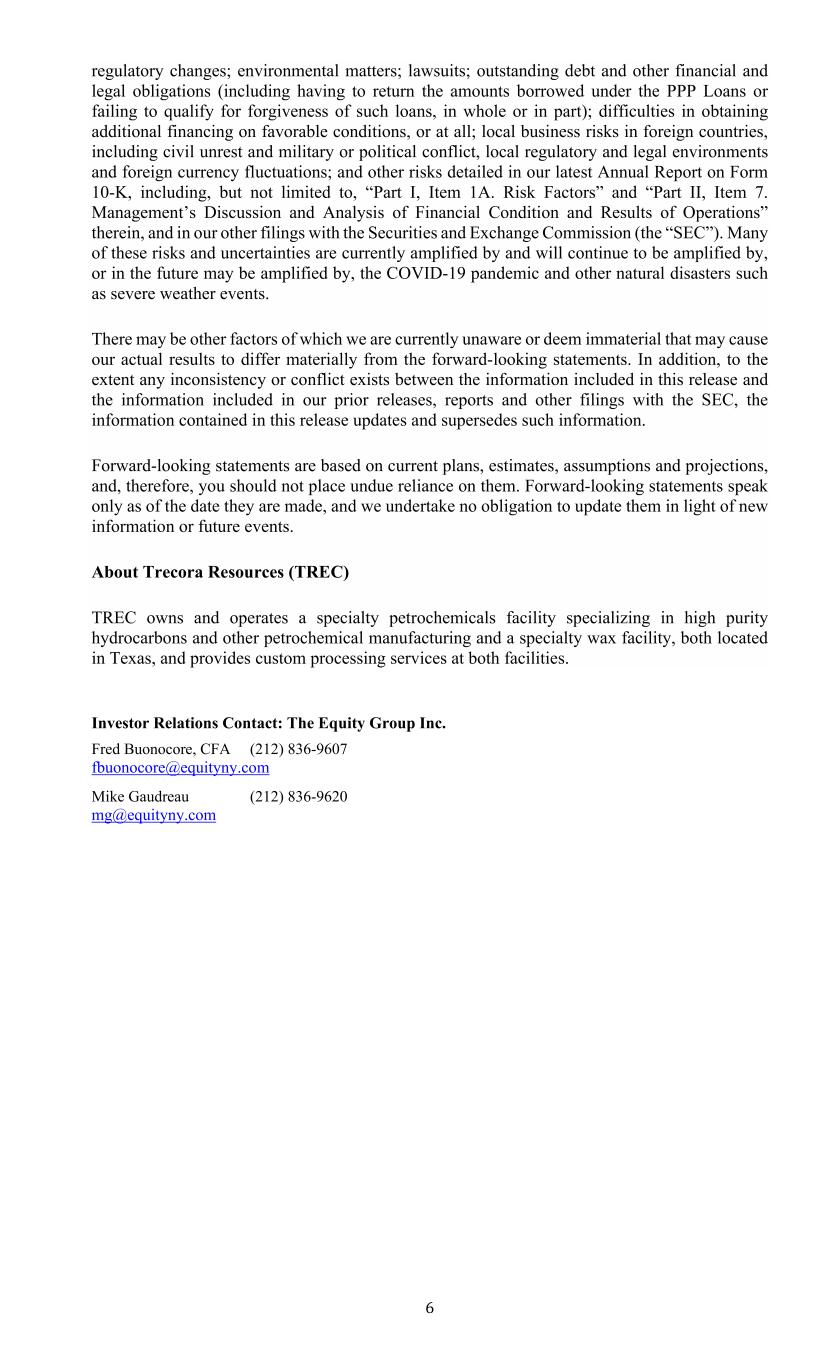

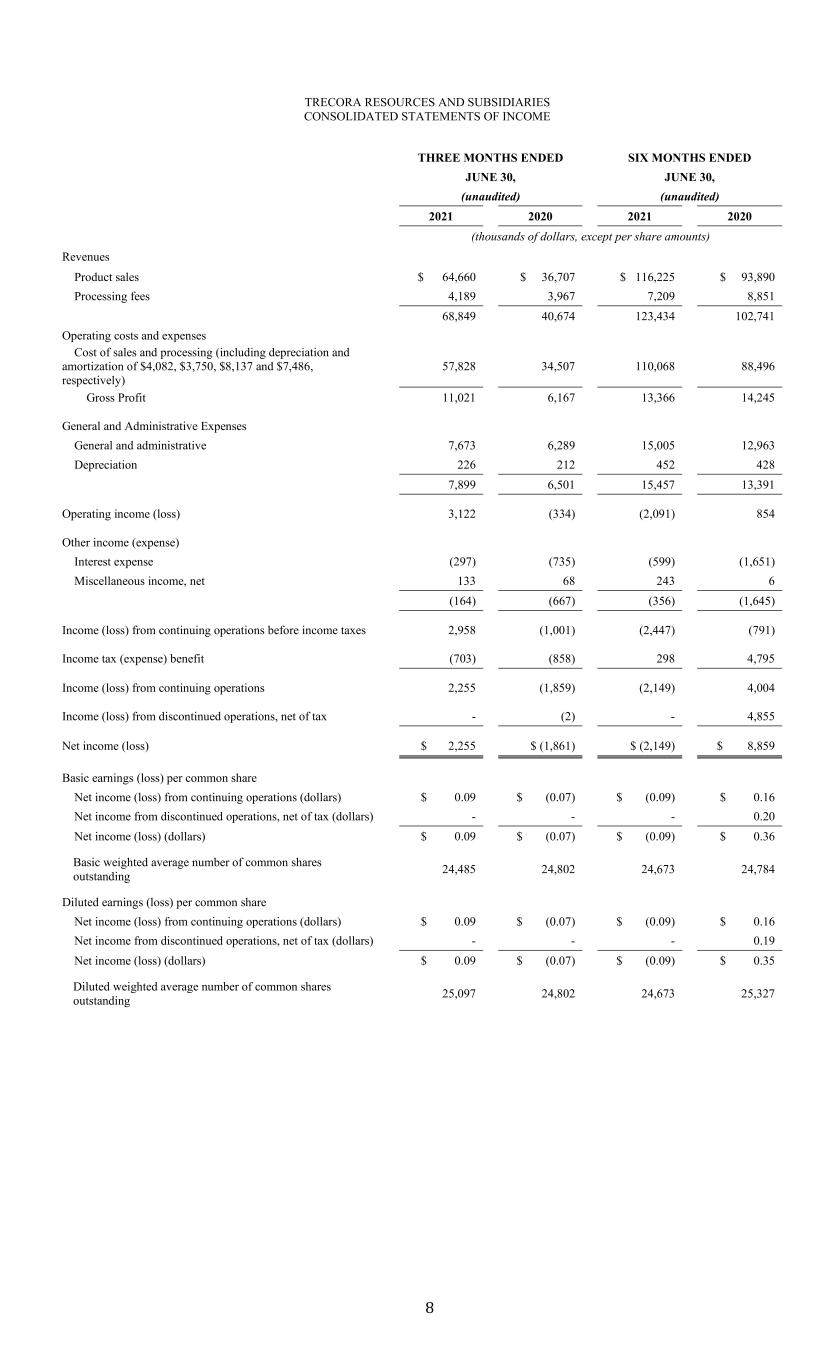

2 Second Quarter 2021 Financial Results Net income in the second quarter of 2021 was $2.3 million, or $0.09 per diluted share1, compared to net loss of $1.9 million, or $(0.07) per diluted share2, in the second quarter of 2020. Adjusted EBITDA from continuing operations was $8.1 million for the second quarter of 2021, compared with Adjusted EBITDA from continuing operations of $4.2 million in the second quarter of 2020. Total revenue in the second quarter of 2021 was $68.8 million, compared to $40.7 million in the second quarter of 2020. This 69.3% year-over-year increase was primarily due to higher sales volumes and selling prices as reopening trends and economic recovery continue, leading to greater demand in our end-markets. Gross profit in the second quarter of 2021 was $11.0 million, or 16.0% of total revenues, compared to $6.2 million, or 15.2% of total revenues in the second quarter of 2020. Operating income in the second quarter of 2021 was $3.1 million, compared to operating loss of $0.3 million in the second quarter of 2020. Specialty Petrochemicals Specialty Petrochemicals net income was $5.3 million in the second quarter of 2021, compared to net income of $1.4 million in the second quarter of 2020, including the benefit of $1.4 million settlement with a utility provider for costs related to the Texas freeze event. Specialty Petrochemicals volume in the second quarter of 2021 was 20.0 million gallons, compared to 17.2 million gallons in the first quarter of 2021 and 15.3 million gallons in the second quarter of 2020. Sales revenues for our Specialty Petrochemicals products increased 84.9% year-over-year. This was primarily due to the economic recovery which resulted in greater demand for our products as well as higher product prices. Prime product volume in the second quarter of 2021 was 16.9 million gallons, compared to 14.7 million gallons in the first quarter of 2021 and 13.1 million gallons in the second quarter of 2020. By-product sales volume was 3.1 million gallons in the second quarter of 2021. Adjusted EBITDA from continuing operations for Specialty Petrochemicals in the second quarter of 2021 was $9.7 million, compared to $5.0 million in the second quarter of 2020. Dollar amounts in thousands/rounding may apply THREE MONTHS ENDED JUNE 30, 2021 2020 % Change Product sales $57,763 $31,236 85% Processing fees 1,527 1,159 32% Gross revenues $59,290 $32,395 83% Operating profit before depreciation and amortization 9,741 4,974 96% Operating profit 6,955 2,354 196% Net profit before taxes 6,709 1,648 307% Depreciation and amortization 2,787 2,621 6% Adjusted EBITDA 9,737 4,998 95% Capital expenditures 3,692 5,382 (31%) Specialty Waxes Specialty Waxes generated revenues of approximately $9.6 million in the second quarter of 2021, a $0.9 million increase from $8.7 million in the first quarter of 2021, and a $1.3 million increase from the second quarter of 2020. Revenues included approximately $6.9 million of wax product sales in the second quarter of 2021, 26.1% higher than the same quarter last year, due to higher 1 Based on 25.1 million shares outstanding 2 Based on 24.8 million shares outstanding

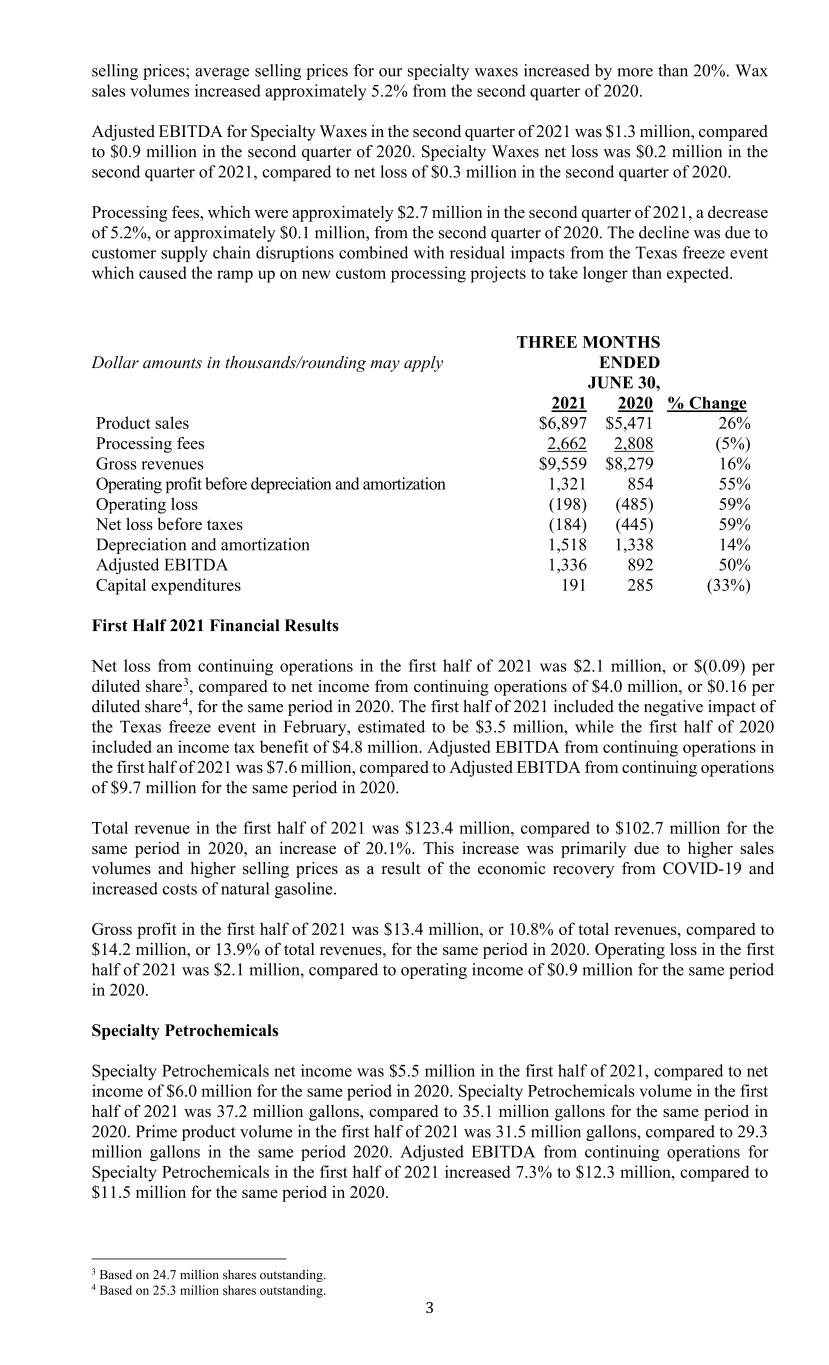

3 selling prices; average selling prices for our specialty waxes increased by more than 20%. Wax sales volumes increased approximately 5.2% from the second quarter of 2020. Adjusted EBITDA for Specialty Waxes in the second quarter of 2021 was $1.3 million, compared to $0.9 million in the second quarter of 2020. Specialty Waxes net loss was $0.2 million in the second quarter of 2021, compared to net loss of $0.3 million in the second quarter of 2020. Processing fees, which were approximately $2.7 million in the second quarter of 2021, a decrease of 5.2%, or approximately $0.1 million, from the second quarter of 2020. The decline was due to customer supply chain disruptions combined with residual impacts from the Texas freeze event which caused the ramp up on new custom processing projects to take longer than expected. First Half 2021 Financial Results Net loss from continuing operations in the first half of 2021 was $2.1 million, or $(0.09) per diluted share3, compared to net income from continuing operations of $4.0 million, or $0.16 per diluted share4, for the same period in 2020. The first half of 2021 included the negative impact of the Texas freeze event in February, estimated to be $3.5 million, while the first half of 2020 included an income tax benefit of $4.8 million. Adjusted EBITDA from continuing operations in the first half of 2021 was $7.6 million, compared to Adjusted EBITDA from continuing operations of $9.7 million for the same period in 2020. Total revenue in the first half of 2021 was $123.4 million, compared to $102.7 million for the same period in 2020, an increase of 20.1%. This increase was primarily due to higher sales volumes and higher selling prices as a result of the economic recovery from COVID-19 and increased costs of natural gasoline. Gross profit in the first half of 2021 was $13.4 million, or 10.8% of total revenues, compared to $14.2 million, or 13.9% of total revenues, for the same period in 2020. Operating loss in the first half of 2021 was $2.1 million, compared to operating income of $0.9 million for the same period in 2020. Specialty Petrochemicals Specialty Petrochemicals net income was $5.5 million in the first half of 2021, compared to net income of $6.0 million for the same period in 2020. Specialty Petrochemicals volume in the first half of 2021 was 37.2 million gallons, compared to 35.1 million gallons for the same period in 2020. Prime product volume in the first half of 2021 was 31.5 million gallons, compared to 29.3 million gallons in the same period 2020. Adjusted EBITDA from continuing operations for Specialty Petrochemicals in the first half of 2021 increased 7.3% to $12.3 million, compared to $11.5 million for the same period in 2020. 3 Based on 24.7 million shares outstanding. 4 Based on 25.3 million shares outstanding. Dollar amounts in thousands/rounding may apply THREE MONTHS ENDED JUNE 30, 2021 2020 % Change Product sales $6,897 $5,471 26% Processing fees 2,662 2,808 (5%) Gross revenues $9,559 $8,279 16% Operating profit before depreciation and amortization 1,321 854 55% Operating loss (198) (485) 59% Net loss before taxes (184) (445) 59% Depreciation and amortization 1,518 1,338 14% Adjusted EBITDA 1,336 892 50% Capital expenditures 191 285 (33%)

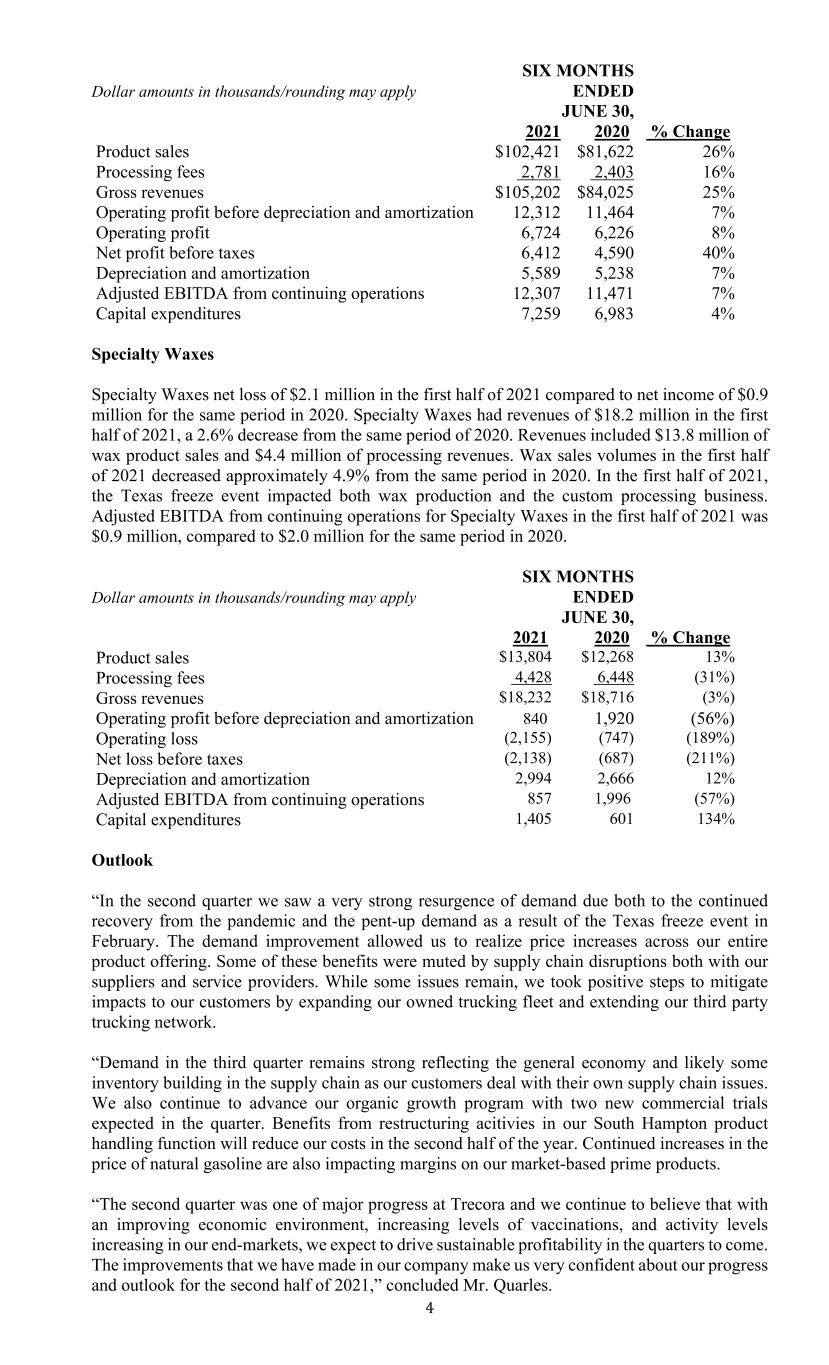

4 Dollar amounts in thousands/rounding may apply SIX MONTHS ENDED JUNE 30, 2021 2020 % Change Product sales $102,421 $81,622 26% Processing fees 2,781 2,403 16% Gross revenues $105,202 $84,025 25% Operating profit before depreciation and amortization 12,312 11,464 7% Operating profit 6,724 6,226 8% Net profit before taxes 6,412 4,590 40% Depreciation and amortization 5,589 5,238 7% Adjusted EBITDA from continuing operations 12,307 11,471 7% Capital expenditures 7,259 6,983 4% Specialty Waxes Specialty Waxes net loss of $2.1 million in the first half of 2021 compared to net income of $0.9 million for the same period in 2020. Specialty Waxes had revenues of $18.2 million in the first half of 2021, a 2.6% decrease from the same period of 2020. Revenues included $13.8 million of wax product sales and $4.4 million of processing revenues. Wax sales volumes in the first half of 2021 decreased approximately 4.9% from the same period in 2020. In the first half of 2021, the Texas freeze event impacted both wax production and the custom processing business. Adjusted EBITDA from continuing operations for Specialty Waxes in the first half of 2021 was $0.9 million, compared to $2.0 million for the same period in 2020. Dollar amounts in thousands/rounding may apply SIX MONTHS ENDED JUNE 30, 2021 2020 % Change Product sales $13,804 $12,268 13% Processing fees 4,428 6,448 (31%) Gross revenues $18,232 $18,716 (3%) Operating profit before depreciation and amortization 840 1,920 (56%) Operating loss (2,155) (747) (189%) Net loss before taxes (2,138) (687) (211%) Depreciation and amortization 2,994 2,666 12% Adjusted EBITDA from continuing operations 857 1,996 (57%) Capital expenditures 1,405 601 134% Outlook “In the second quarter we saw a very strong resurgence of demand due both to the continued recovery from the pandemic and the pent-up demand as a result of the Texas freeze event in February. The demand improvement allowed us to realize price increases across our entire product offering. Some of these benefits were muted by supply chain disruptions both with our suppliers and service providers. While some issues remain, we took positive steps to mitigate impacts to our customers by expanding our owned trucking fleet and extending our third party trucking network. “Demand in the third quarter remains strong reflecting the general economy and likely some inventory building in the supply chain as our customers deal with their own supply chain issues. We also continue to advance our organic growth program with two new commercial trials expected in the quarter. Benefits from restructuring acitivies in our South Hampton product handling function will reduce our costs in the second half of the year. Continued increases in the price of natural gasoline are also impacting margins on our market-based prime products. “The second quarter was one of major progress at Trecora and we continue to believe that with an improving economic environment, increasing levels of vaccinations, and activity levels increasing in our end-markets, we expect to drive sustainable profitability in the quarters to come. The improvements that we have made in our company make us very confident about our progress and outlook for the second half of 2021,” concluded Mr. Quarles.

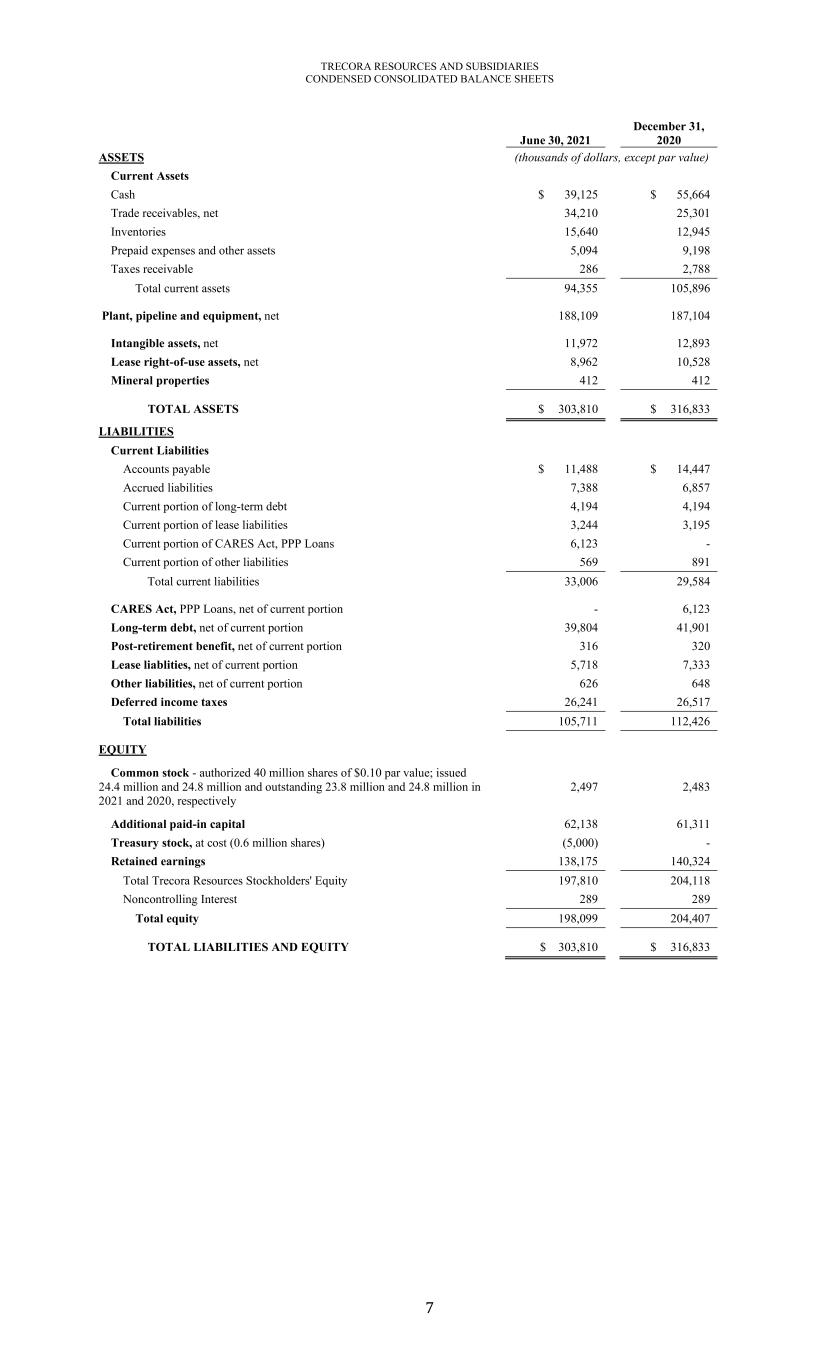

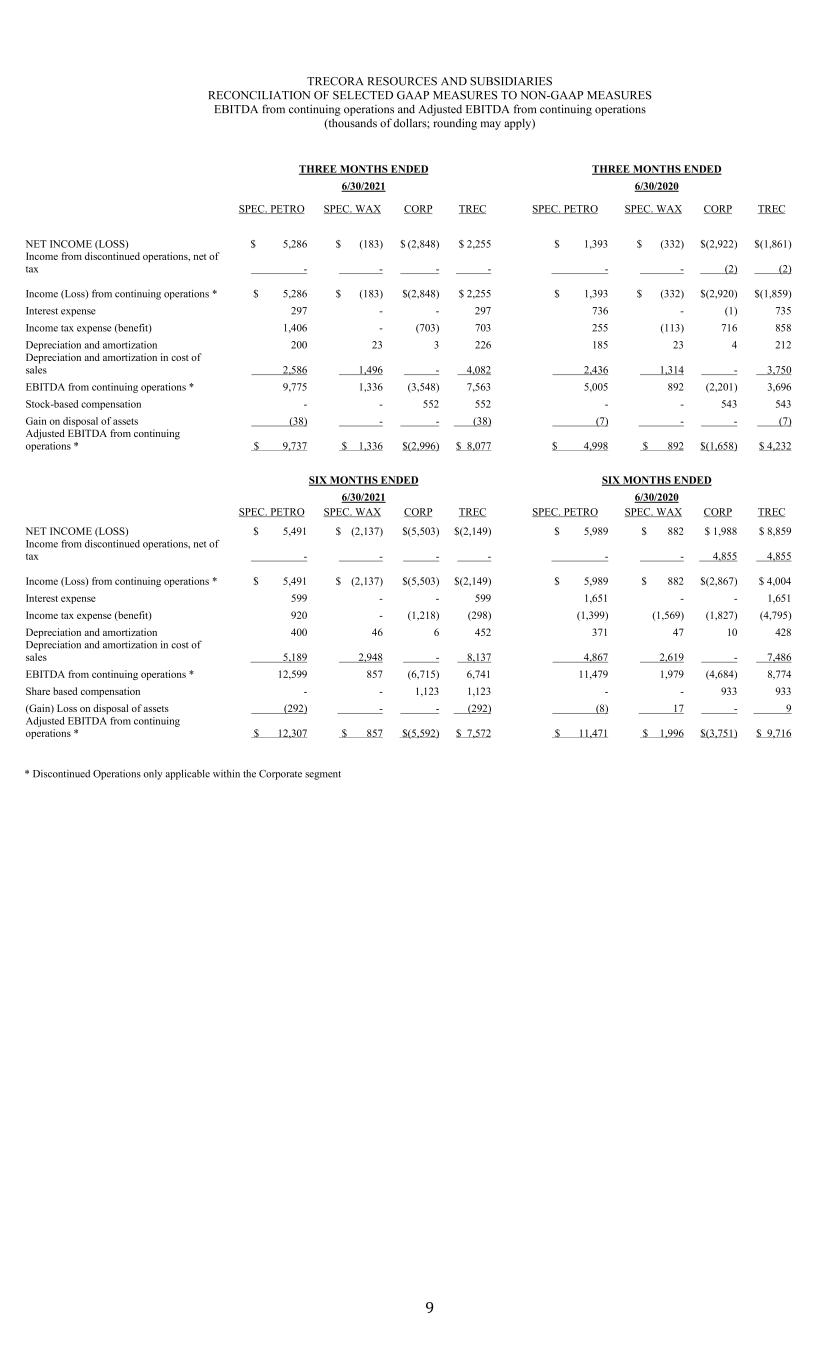

5 Earnings Call Tomorrow’s conference call, on August 5, 2021 at 10:00 am Eastern Time, will be simulcast live on the Internet, and can be accessed on the investor relations section of the Company's website at http://www.trecora.com/ or at https://edge.media-server.com/mmc/p/zcza6anf. A replay of the call will also be available through the same link until October 5, 2021. To participate via telephone, callers should dial in at least ten to fifteen minutes prior to the 10:00 am Eastern Time start; domestic callers (U.S. and Canada) should call +1-866-417-5724 or +1- 409-217-8234 if calling internationally, using the conference ID 9462308. To listen to the playback, please call 1-855-859-2056 if calling within the United States or 1-404-537-3406 if calling internationally. Use pin number 9462308 for the replay. Use of Non-GAAP Measures This earnings press release includes non-GAAP financial measures of EBITDA from continuing operations and Adjusted EBITDA from continuing operations and provide reconciliations from our most directly comparable GAAP financial measures to those measures. We believe these financial measures provide users of our financial statements with supplemental information that may be useful in evaluating our operating performance. We also believe that such non-GAAP measures, when read in conjunction with our operating results presented under GAAP, can be used to better assess our performance from period to period and relative to performance of other companies in our industry, without regard to financing methods, historical cost basis or capital structure. These measures are not measures of financial performance or liquidity under GAAP and should be considered in addition to, and not as a substitute for, analysis of our results under GAAP. We define EBITDA from continuing operations as net income (loss) from continuing operations plus interest expense, income tax expense (benefit), and depreciation and amortization. We define Adjusted EBITDA from continuing operations as EBITDA from continuing operations plus share-based compensation and plus or minus gains or losses on disposal of assets. Forward-Looking Statements Some of the statements and information contained in this earnings press release may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements regarding the Company’s financial position, business strategy and plans and objectives of the Company’s management for future operations and other statements that are not historical facts, are forward-looking statements. Forward-looking statements are often characterized by the use of words such as “outlook,” “may,” “will,” “can,” “shall,” “should,” “could,” “expects,” “plans,” “anticipates,” “contemplates,” “proposes,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “continue,” “intend,” or the negative of such terms and other comparable terminology, or by discussions of strategy, plans or intentions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other important factors that could cause the actual results, performance or our achievements, or industry results, to differ materially from historical results, any future results, or performance or achievements expressed or implied by such forward-looking statements. Such risks, uncertainties and factors include, but are not limited to the impacts of the COVID-19 pandemic on our business, financial results and financial condition and that of our customers, suppliers, and other counterparties; general economic and financial conditions domestically and internationally; insufficient cash flows from operating activities; our ability to attract and retain key employees; feedstock and product prices; feedstock availability and our ability to access third party transportation; competition; industry cycles; natural disasters or other severe weather events (such as the Texas freeze event), health epidemics and pandemics (including the COVID-19 pandemic) and terrorist attacks; our ability to consummate extraordinary transactions, including acquisitions and dispositions, and realize the financial and strategic goals of such transactions; technological developments and our ability to maintain, expand and upgrade our facilities;

6 regulatory changes; environmental matters; lawsuits; outstanding debt and other financial and legal obligations (including having to return the amounts borrowed under the PPP Loans or failing to qualify for forgiveness of such loans, in whole or in part); difficulties in obtaining additional financing on favorable conditions, or at all; local business risks in foreign countries, including civil unrest and military or political conflict, local regulatory and legal environments and foreign currency fluctuations; and other risks detailed in our latest Annual Report on Form 10-K, including, but not limited to, “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertainties are currently amplified by and will continue to be amplified by, or in the future may be amplified by, the COVID-19 pandemic and other natural disasters such as severe weather events. There may be other factors of which we are currently unaware or deem immaterial that may cause our actual results to differ materially from the forward-looking statements. In addition, to the extent any inconsistency or conflict exists between the information included in this release and the information included in our prior releases, reports and other filings with the SEC, the information contained in this release updates and supersedes such information. Forward-looking statements are based on current plans, estimates, assumptions and projections, and, therefore, you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update them in light of new information or future events. About Trecora Resources (TREC) TREC owns and operates a specialty petrochemicals facility specializing in high purity hydrocarbons and other petrochemical manufacturing and a specialty wax facility, both located in Texas, and provides custom processing services at both facilities. Investor Relations Contact: The Equity Group Inc. Fred Buonocore, CFA (212) 836-9607 fbuonocore@equityny.com Mike Gaudreau (212) 836-9620 mg@equityny.com

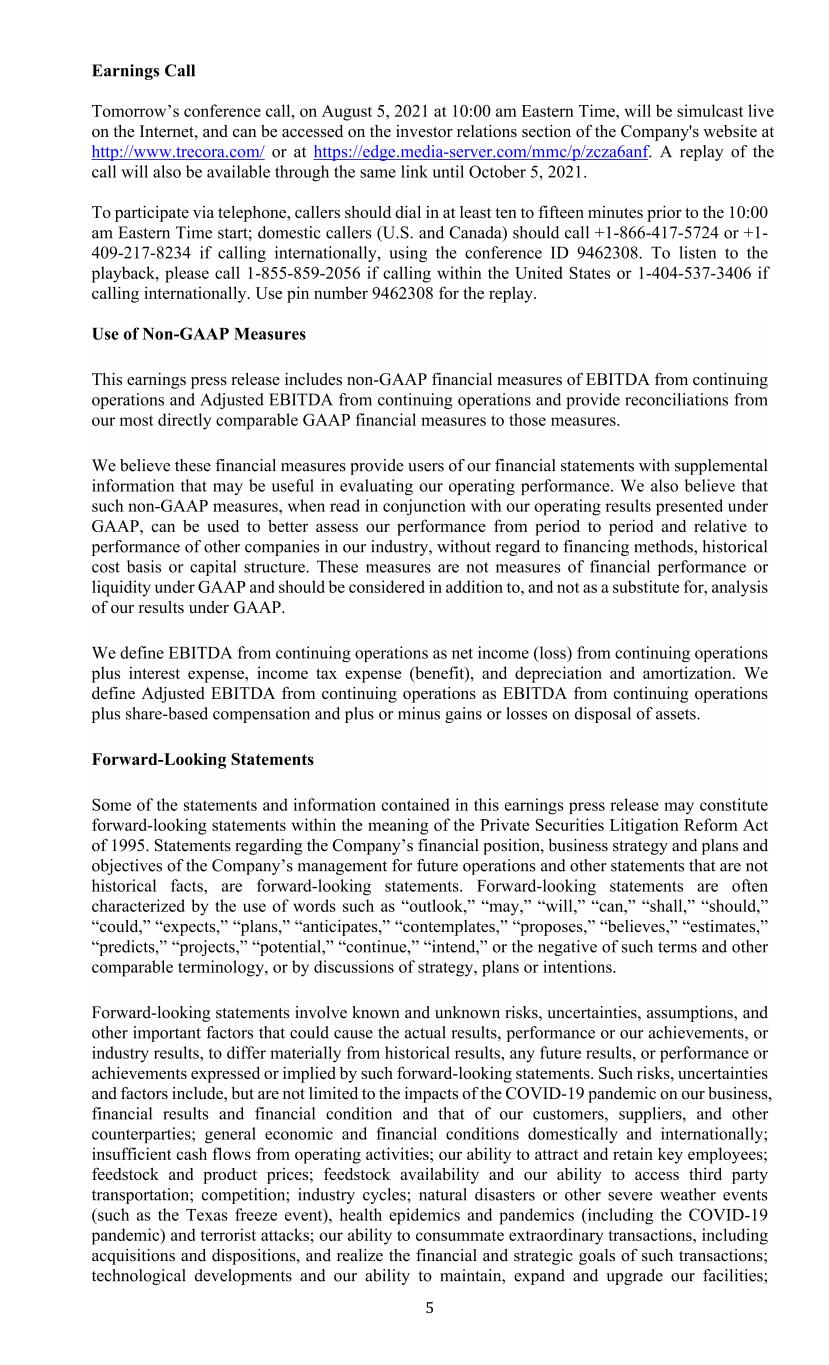

7 TRECORA RESOURCES AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS June 30, 2021 December 31, 2020 ASSETS (thousands of dollars, except par value) Current Assets Cash $ 39,125 $ 55,664 Trade receivables, net 34,210 25,301 Inventories 15,640 12,945 Prepaid expenses and other assets 5,094 9,198 Taxes receivable 286 2,788 Total current assets 94,355 105,896 Plant, pipeline and equipment, net 188,109 187,104 Intangible assets, net 11,972 12,893 Lease right-of-use assets, net 8,962 10,528 Mineral properties 412 412 TOTAL ASSETS $ 303,810 $ 316,833 LIABILITIES Current Liabilities Accounts payable $ 11,488 $ 14,447 Accrued liabilities 7,388 6,857 Current portion of long-term debt 4,194 4,194 Current portion of lease liabilities 3,244 3,195 Current portion of CARES Act, PPP Loans 6,123 - Current portion of other liabilities 569 891 Total current liabilities 33,006 29,584 CARES Act, PPP Loans, net of current portion - 6,123 Long-term debt, net of current portion 39,804 41,901 Post-retirement benefit, net of current portion 316 320 Lease liablities, net of current portion 5,718 7,333 Other liabilities, net of current portion 626 648 Deferred income taxes 26,241 26,517 Total liabilities 105,711 112,426 EQUITY Common stock - authorized 40 million shares of $0.10 par value; issued 24.4 million and 24.8 million and outstanding 23.8 million and 24.8 million in 2021 and 2020, respectively 2,497 2,483 Additional paid-in capital 62,138 61,311 Treasury stock, at cost (0.6 million shares) (5,000) - Retained earnings 138,175 140,324 Total Trecora Resources Stockholders' Equity 197,810 204,118 Noncontrolling Interest 289 289 Total equity 198,099 204,407 TOTAL LIABILITIES AND EQUITY $ 303,810 $ 316,833

8 TRECORA RESOURCES AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME THREE MONTHS ENDED SIX MONTHS ENDED JUNE 30, JUNE 30, (unaudited) (unaudited) 2021 2020 2021 2020 (thousands of dollars, except per share amounts) Revenues Product sales $ 64,660 $ 36,707 $ 116,225 $ 93,890 Processing fees 4,189 3,967 7,209 8,851 68,849 40,674 123,434 102,741 Operating costs and expenses Cost of sales and processing (including depreciation and amortization of $4,082, $3,750, $8,137 and $7,486, respectively) 57,828 34,507 110,068 88,496 Gross Profit 11,021 6,167 13,366 14,245 General and Administrative Expenses General and administrative 7,673 6,289 15,005 12,963 Depreciation 226 212 452 428 7,899 6,501 15,457 13,391 Operating income (loss) 3,122 (334) (2,091) 854 Other income (expense) Interest expense (297) (735) (599) (1,651) Miscellaneous income, net 133 68 243 6 (164) (667) (356) (1,645) Income (loss) from continuing operations before income taxes 2,958 (1,001) (2,447) (791) Income tax (expense) benefit (703) (858) 298 4,795 Income (loss) from continuing operations 2,255 (1,859) (2,149) 4,004 Income (loss) from discontinued operations, net of tax - (2) - 4,855 Net income (loss) $ 2,255 $ (1,861) $ (2,149) $ 8,859 Basic earnings (loss) per common share Net income (loss) from continuing operations (dollars) $ 0.09 $ (0.07) $ (0.09) $ 0.16 Net income from discontinued operations, net of tax (dollars) - - - 0.20 Net income (loss) (dollars) $ 0.09 $ (0.07) $ (0.09) $ 0.36 Basic weighted average number of common shares outstanding 24,485 24,802 24,673 24,784 Diluted earnings (loss) per common share Net income (loss) from continuing operations (dollars) $ 0.09 $ (0.07) $ (0.09) $ 0.16 Net income from discontinued operations, net of tax (dollars) - - - 0.19 Net income (loss) (dollars) $ 0.09 $ (0.07) $ (0.09) $ 0.35 Diluted weighted average number of common shares outstanding 25,097 24,802 24,673 25,327

9 TRECORA RESOURCES AND SUBSIDIARIES RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES EBITDA from continuing operations and Adjusted EBITDA from continuing operations (thousands of dollars; rounding may apply) THREE MONTHS ENDED THREE MONTHS ENDED 6/30/2021 6/30/2020 SPEC. PETRO SPEC. WAX CORP TREC SPEC. PETRO SPEC. WAX CORP TREC NET INCOME (LOSS) $ 5,286 $ (183) $ (2,848) $ 2,255 $ 1,393 $ (332) $(2,922) $(1,861) Income from discontinued operations, net of tax - - - - - - (2) (2) Income (Loss) from continuing operations * $ 5,286 $ (183) $(2,848) $ 2,255 $ 1,393 $ (332) $(2,920) $(1,859) Interest expense 297 - - 297 736 - (1) 735 Income tax expense (benefit) 1,406 - (703) 703 255 (113) 716 858 Depreciation and amortization 200 23 3 226 185 23 4 212 Depreciation and amortization in cost of sales 2,586 1,496 - 4,082 2,436 1,314 - 3,750 EBITDA from continuing operations * 9,775 1,336 (3,548) 7,563 5,005 892 (2,201) 3,696 Stock-based compensation - - 552 552 - - 543 543 Gain on disposal of assets (38) - - (38) (7) - - (7) Adjusted EBITDA from continuing operations * $ 9,737 $ 1,336 $(2,996) $ 8,077 $ 4,998 $ 892 $(1,658) $ 4,232 SIX MONTHS ENDED SIX MONTHS ENDED 6/30/2021 6/30/2020 SPEC. PETRO SPEC. WAX CORP TREC SPEC. PETRO SPEC. WAX CORP TREC NET INCOME (LOSS) $ 5,491 $ (2,137) $(5,503) $(2,149) $ 5,989 $ 882 $ 1,988 $ 8,859 Income from discontinued operations, net of tax - - - - - - 4,855 4,855 Income (Loss) from continuing operations * $ 5,491 $ (2,137) $(5,503) $(2,149) $ 5,989 $ 882 $(2,867) $ 4,004 Interest expense 599 - - 599 1,651 - - 1,651 Income tax expense (benefit) 920 - (1,218) (298) (1,399) (1,569) (1,827) (4,795) Depreciation and amortization 400 46 6 452 371 47 10 428 Depreciation and amortization in cost of sales 5,189 2,948 - 8,137 4,867 2,619 - 7,486 EBITDA from continuing operations * 12,599 857 (6,715) 6,741 11,479 1,979 (4,684) 8,774 Share based compensation - - 1,123 1,123 - - 933 933 (Gain) Loss on disposal of assets (292) - - (292) (8) 17 - 9 Adjusted EBITDA from continuing operations * $ 12,307 $ 857 $(5,592) $ 7,572 $ 11,471 $ 1,996 $(3,751) $ 9,716 * Discontinued Operations only applicable within the Corporate segment