2022 PROXY STATEMENT

AND

NOTICE OF 2022 ANNUAL

MEETING OF STOCKHOLDERS

[ ], [ ], 2022

[ ] a.m., Central Time

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Trecora Resources

(Name of the Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2022 PROXY STATEMENT

AND

NOTICE OF 2022 ANNUAL

MEETING OF STOCKHOLDERS

[ ], [ ], 2022

[ ] a.m., Central Time

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – DATED MAY 9, 2022

Trecora Resources 2022 Stockholder Letter

[ ], 2022

To Our Stockholders:

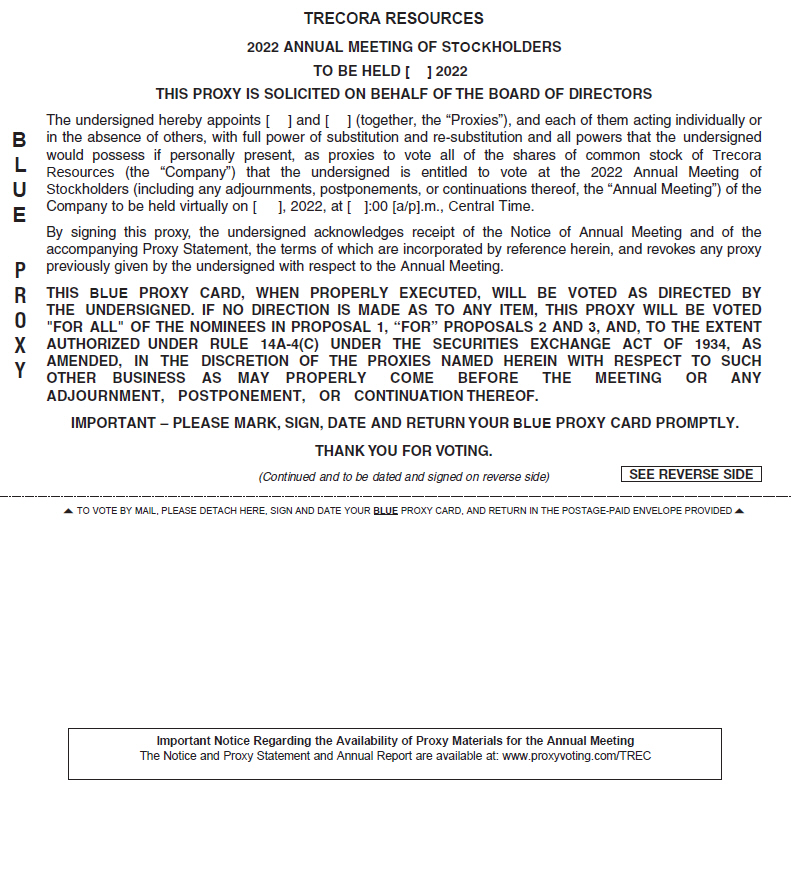

On behalf of the Board of Directors (the “Board”), I cordially invite you to attend the Trecora Resources 2022 Annual Meeting of Stockholders (including any adjournments or postponements thereof, the “Annual Meeting”) on [ ], 2022, at [ ] a.m., Central Time.

For the continued health and safety of our stockholders, directors, employees and other participants, the Annual Meeting will be a virtual meeting. Stockholders will be able to listen, vote, and submit questions during the Annual Meeting from any remote location that has Internet connectivity by registering to attend in advance of the meeting at least 24 hours prior to the Annual Meeting start time at www.cesonlineservices.com/trec22_vm.

Stockholders of record of the Company at the close of business on [ ], 2022 are entitled to notice of, and to vote at, the Annual Meeting. The accompanying Notice of 2022 Annual Meeting of Stockholders and Proxy Statement describe the business to be conducted at the Annual Meeting. Also included are a BLUE proxy card and postage-paid return envelope. BLUE proxy cards are being solicited on behalf of your Board. The Proxy Statement, accompanying BLUE proxy card, and the Annual Report on Form 10-K for the year ended December 31, 2021, were first sent or given to our stockholders on or about [ ], 2022.

Your vote is especially important at this year’s Annual Meeting. As you may have seen, an investment firm and stockholder, Ortelius Advisors, L.P. (collectively with its affiliates, “Ortelius”), has nominated three candidates (the “Ortelius Nominees”) for election as directors at the Annual Meeting. As a result, you may receive solicitation materials, including a white proxy card, from Ortelius seeking your proxy to vote for the Ortelius’ Nominees.

Your Board does not endorse any of the Ortelius Nominees and unanimously recommends that you vote “FOR ALL” of the Board’s nominees to be elected, and vote in accordance with the Board’s recommendations on each other proposal before the Annual Meeting on the BLUE proxy card. Your Board strongly urges you to discard and NOT sign or return any white proxy card sent to you by Ortelius. If you have already submitted a white proxy card, you can revoke that proxy and vote for your Board’s nominees and on the other matters to be voted on at the Annual Meeting by completing, signing and dating the enclosed BLUE proxy card and returning it in the enclosed postage-paid envelope or by voting via Internet or telephone by following the instructions on your BLUE proxy card or BLUE voting instruction form. Only your latest dated proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the accompanying Proxy Statement.

Your vote is extremely important no matter how many shares you own. Whether or not you expect to attend the Annual Meeting, please vote and submit your proxy over the Internet, by telephone or by mail.

Thank you for being a stockholder of Trecora. We look forward to continuing the Board’s focus on delivering long-term stockholder value, and we appreciate your continued partnership and support.

Sincerely,

Karen A. Twitchell

Chair of the Board of Directors

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

| Date: |

[ ], [ ], 2022. | |

| Time: |

[ ] a.m., Central Time | |

| Where: |

Due to the continuing risks and uncertainty posed by the COVID-19 pandemic, the Trecora Resources (the “Company”) 2022 Annual Meeting of Stockholders (including any adjournments or postponements thereof, the “Annual Meeting”) will be held in a virtual format only to provide a safe experience for our stockholders, directors, employees and other participants. Our virtual meeting will be structured in a manner intended to provide our stockholders with a participation experience similar to an in-person meeting.

Stockholders will be able to listen, vote, and submit questions during the Annual Meeting from any remote location that has Internet connectivity by registering to attend in advance of the meeting at least 24 hours prior to the Annual Meeting start time at www.cesonlineservices.com/trec22_vm. | |

| Record Date: |

Only stockholders of record of our common stock at the close of business on [ ], 2022 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. | |

| Purpose: |

| |

| How to Vote: |

All stockholders are cordially invited to virtually attend the Annual Meeting. Whether you plan to virtually attend the Annual Meeting or not, it is important that your shares be represented at the Annual Meeting, regardless of the number of shares you may hold. Even though you may plan to attend the Annual Meeting virtually, please promptly vote using one of the following methods: | |

| Vote Right Away Through Advance Voting Methods | Voting During the Meeting | |||||

|

|

|

| |||

| Vote by Internet Go to the website |

Vote by Phone Call the number on |

Vote by Mail Sign, date and return the |

Vote During the Meeting See the instructions below regarding how to vote | |||

If your shares of common stock are held in a brokerage account or by a bank, trustee or other nominee (i.e., your shares are held in “street name”), you will receive a BLUE voting instruction form from that nominee. You must provide voting instructions by completing the BLUE voting instruction form and returning it to your broker, bank, trustee or other nominee for your shares to be voted. We recommend that you instruct your broker, bank, trustee or other nominee to vote your shares on the enclosed BLUE voting instruction form. The proxy is revocable and will not affect your right to vote in person if you attend the Annual Meeting.

Additional details regarding the Annual Meeting, the business to be conducted, and information about the Company that you should consider when you vote your shares are described in our Proxy Statement.

Your vote is especially important at this year’s Annual Meeting. As you may have seen, an investment firm and stockholder, Ortelius Advisors, L.P. (collectively with its affiliates, “Ortelius”), has nominated three candidates (the “Ortelius Nominees”) for election as directors at the Annual Meeting. You may receive solicitation materials from Ortelius, including proxy statements and white proxy cards. The Company recommends that you disregard them. The Company is not responsible for the accuracy or completeness of any information provided by or relating to Ortelius or the Ortelius Nominees contained in solicitation materials filed or disseminated by or on behalf of Ortelius or any other statements Ortelius may make.

Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible so that your voice is heard. Your Board of Directors (the “Board”) does not endorse any of the Ortelius Nominees and unanimously recommends that you vote “FOR ALL” of the Board’s nominees to be elected and vote in accordance with the Board’s recommendations on each other proposal before the Annual Meeting on the BLUE proxy card.

Your Board urges you to sign, date and return only the enclosed BLUE proxy card. Your Board strongly urges you to discard and NOT sign or return any white proxy card sent to you by Ortelius. If you have already submitted a white proxy card, you can revoke that proxy and vote for your Board’s nominees and on the other matters to be voted on at the Annual Meeting by completing, signing and dating the enclosed BLUE proxy card and returning it in the enclosed postage-paid envelope or by voting via Internet or telephone by following the instructions on your BLUE proxy card or BLUE voting instruction form. Only your latest dated proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the accompanying proxy statement. We encourage you to vote only on the BLUE proxy card.

The Board’s nominees for election as directors of the Company are listed in the accompanying Proxy Statement and BLUE proxy card. The accompanying Proxy Statement also provides detailed information about the matters to be considered at the Annual Meeting. This Notice, the Annual Report on Form 10-K for the year ended December 31, 2021 and the attached Proxy Statement and form of BLUE proxy card are first being sent on or about [ ], 2022 to stockholders as of the Record Date. IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING, REGARDLESS OF WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING VIRTUALLY. ACCORDINGLY, AFTER READING THE ACCOMPANYING PROXY STATEMENT, PLEASE FOLLOW THE INSTRUCTIONS ON THE ENCLOSED BLUE PROXY CARD AND PROMPTLY SUBMIT YOUR PROXY BY INTERNET OR TELEPHONE AS DESCRIBED ON THE BLUE PROXY CARD. PLEASE NOTE THAT EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING VIRTUALLY, WE RECOMMEND THAT YOU VOTE USING THE ENCLOSED BLUE PROXY CARD PRIOR TO THE ANNUAL MEETING TO ENSURE THAT YOUR SHARES WILL BE REPRESENTED. EVEN IF YOU VOTE YOUR SHARES PRIOR TO THE ANNUAL MEETING, IF YOU ARE A RECORD HOLDER OF SHARES, OR A BENEFICIAL HOLDER WHO OBTAINS A LEGAL PROXY FROM YOUR BROKER, BANK, TRUSTEE, OR OTHER NOMINEE, YOU STILL MAY ATTEND THE VIRTUAL ANNUAL MEETING AND VOTE YOUR SHARES AT THE ANNUAL MEETING.

Regardless of the number of shares of common stock of the Company that you own, your vote will be important. Thank you for your continued support, interest and investment in Trecora Resources.

If you have any questions or need assistance voting your shares, please call our proxy solicitor, Morrow Sodali LLC, at (800) 662-5200; banks and brokers can call collect at (203) 658-9400.

| By order of the Board of Directors: |

Michael W. Silberman General Counsel and Corporate Secretary |

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – DATED MAY 9, 2022

1650 Highway 6 South, Suite 190

Sugar Land, TX 77478

(281) 980-5522

2022 PROXY STATEMENT

We are providing this Proxy Statement (this “Proxy Statement”) in connection with the solicitation by the Board of Directors (the “Board”) of Trecora Resources, a Delaware corporation (the “Company,” “Trecora,” “we,” “us” and “our”), of proxies to be voted at our 2022 Annual Meeting of Stockholders (the “Annual Meeting”) and at any reconvened or rescheduled meeting following any adjournment or postponement. The Annual Meeting will be held on [ ], [ ], 2022 at [ ] a.m., Central Time in a virtual-only meeting format. Stockholders will be able to listen, vote, and submit questions during the Annual Meeting from any remote location that has Internet connectivity by registering to attend in advance of the meeting at least 24 hours prior to the Annual Meeting start time at www.cesonlineservices.com/trec22_vm.

This Proxy Statement contains important information for you to consider when deciding how to vote. Please read this information carefully.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON [ ], 2022

This Proxy Statement and BLUE proxy card are furnished in connection with the solicitation of proxies to be voted at the Annual Meeting, which will be held virtually on [ ], 2022, at [ ] a.m., Central Time in a virtual-only meeting format.

This Proxy Statement and the accompanying BLUE proxy card are available, free of charge, at www.proxyvoting.com/TREC. Information on this website, other than this Proxy Statement, is not a part of this Proxy Statement. We intend to begin mailing these proxy materials on or about [ ], 2022 to all stockholders of record entitled to vote at the Annual Meeting.

Please sign, date and promptly return the enclosed BLUE proxy card in the envelope provided, or grant a proxy and give voting instructions by Internet, so that you may be represented at the Annual Meeting. Instructions are on your BLUE proxy card or on the BLUE voting instruction form provided by your bank, broker, trust or other nominee.

The Securities and Exchange Commission’s (“SEC”) e-proxy rules require companies to post their proxy materials on the Internet and permit them to provide only a Notice of Internet Availability of Proxy Materials to stockholders. For this Proxy Statement, we have chosen to follow the SEC’s “full set” delivery option and therefore, although we are posting a full set of our proxy materials (this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “2021 Form 10-K”)) online, we are also mailing a full set of our proxy materials to our stockholders. The Proxy Statement and our 2021 Form 10-K are also available at ir.trecora.com.

1

2

This summary highlights information regarding our financial and operational performance, compensation program and governance for the fiscal year ended December 31, 2021. This summary does not contain all of the information you should consider before voting. Please read the entire Proxy Statement before voting. We refer to our website throughout this Proxy Statement; however, no information on our website or any other website is incorporated by reference into or otherwise made a part of this Proxy Statement.

| ANNUAL MEETING INFORMATION | ||||

|

Date and Time [ ] a.m., Central Time [ ], 2022 |

Record Date

[ ], 2022 |

Where Virtually online at www.cesonlineservices.com/trec22_vm | ||

MEETING AGENDA AND RECOMMENDATION OF THE BOARD

| Agenda Item |

Board Recommendation |

Page Number | ||

| Proposal 1

Election of Six Directors |

“FOR ALL” Trecora director nominees |

16 | ||

| Proposal 2

Ratification of BKM Sowan Horan, LLP as the Independent Registered Public Accounting Firm for 2022 |

“FOR” |

31 | ||

| Proposal 3

Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers (“NEOs”) |

“FOR” |

34 | ||

2021 FINANCIAL PERFORMANCE AND BUSINESS ACHIEVEMENTS

2021 was a turning point for the Company, and we achieved progress against many of our key initiatives and delivered growth in several key metrics we use to measure performance, including:

| • | Full year revenue of $272.7 million, an increase of 30.7% compared with the prior year, driven by price and volume increases in the Specialty Petrochemicals segment while Specialty Wax segment revenue growth benefitted from higher selling prices. |

| • | Net income from continuing operations of $5.0 million. |

| • | Adjusted EBITDA(1) from continuing operations of $21.6 million. |

| • | Successfully converted five growth projects into new custom processing commitments with our customers. |

| • | Invested in the expansion of our truck fleet for delivery to our prime products customers and maintained high customer service levels despite a challenging supply chain. |

3

| • | Further simplified and streamlined our corporate structure through the sale of all remaining mining assets owned at Pioche Ely Valley Mines, Inc. (“PEVM”). |

(1) Adjusted EBITDA from continuing operations is a non-GAAP financial measure. See Appendix B—Reconciliation of Non-GAAP Measures for a description of this non-GAAP measure and reconciliation to the most directly comparable GAAP financial measure.

GOVERNANCE HIGHLIGHTS

We have a highly experienced Board that brings a range of relevant skills and qualifications to the Company. Key highlights of the composition of your Board’s nominees to continue as directors include:

| Board Independence |

Board Diversity | |||||||

| 83% | 5 of 6 nominated directors are independent |

50% | 3 of 6 nominated directors are women | |||||

| Board Refreshment |

Average Tenure (in years) | |||||||

| 50% | 3 of 6 nominated directors have been added since 2017 | 51⁄2 | Average director tenure of our nominated directors | |||||

In addition, our governance “best practices” include the following:

| Independent Committees |

• All of our committees are composed solely of independent directors | |

| Board Leadership Evaluation and Succession Planning |

• The Board annually evaluates the CEO’s performance • The Board annually conducts a rigorous review and assessment of the succession planning process for the CEO and other executive officers | |

| Majority Vote Standard |

• In an uncontested election, directors are elected by a majority of votes cast • Any director who does not receive a majority of votes cast must tender his or her resignation. Within 90 days of such resignation, the Board will either (a) accept the resignation of such director or (b) by unanimous vote of the Board, decline to accept such resignation | |

| Simple Majority Required to Amend Bylaws |

• Our Amended and Restated Bylaws (as may be amended from time to time, the “Bylaws”) may be amended by stockholders beneficially owning at least a majority of the Company’s common stock, par value $0.10 per share (the “common stock”) | |

| Stockholders Can Call Special Meetings |

• Stockholders beneficially owning at least a majority of the common stock may call special meetings | |

| Board & Committee Evaluations |

• The Board and each of our committees conduct detailed annual self-evaluations | |

| Limits on Outside Board Service |

• Outside directors are limited in their ability to serve on other public company boards, and must seek pre-approval from the Nominating and Governance Committee • Currently, our CEO does not serve on any other public company boards | |

| Anti-Hedging/Pledging Policy |

• Our Policy on Insider Trading prohibits our directors and executive officers from entering into pledging, hedging or monetization transactions designed to limit the financial risk of ownership of the Company’s securities • None of our directors or executive officers have any pledged common stock | |

| Executive Sessions |

• The Board and Board committees meet regularly in executive session • In 2021, the non-employee directors met in executive session at each of the Board’s four quarterly meetings, as well as four additional Board meetings • Our independent directors also met in an executive session on ten occasions in 2021 |

4

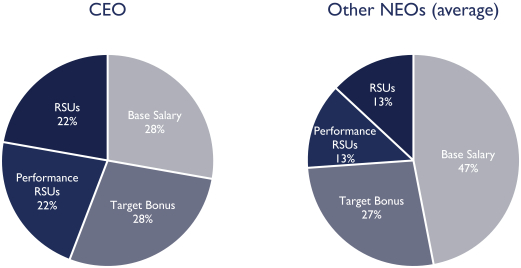

COMPENSATION HIGHLIGHTS

Below is a summary of executive compensation highlights for our 2021 program:

| • | Pay-for-Performance Philosophy and Variable Compensation: Our compensation program is designed to align with performance improvement (focused on both growth and productivity) that, in turn, drives financial performance and creates value for our stockholders. Accordingly, a significant portion of our executives’ compensation is subject to forfeiture and/or is linked to our performance or stock price with metrics that are aligned with our strategy. |

| • | Annual Cash Incentive Plan Linked to Financial Performance and Sustainability Targets: An annual cash incentive plan consisting of cash bonuses tied to our financial results provides a strong link between pay and performance. In 2021, our annual cash incentive plan incorporated metrics that support our environmental, health and safety (“EHS”) efforts, as well as incentivize cost control at our company. |

| • | Long-Term Incentive Plan Grants Included Performance-Based RSUs: Our long-term incentive (“LTI”) equity plan consists of 50% performance-based restricted stock units (“RSUs”) and 50% time-based RSUs to both retain and incentivize our executives. |

| • | Competitive Pay Practices: Our long-term success depends on our people. We strive to ensure that our employees’ contributions and performance are recognized and rewarded through a competitive compensation program. We target an executive compensation package that is competitive against the market in which we compete for talent. |

| • | Compensation Risk Assessment: We conduct an annual risk assessment to ensure that the structure and design of our executive compensation program is not likely to result in excessive-risk taking that could have an adverse effect on the Company. |

| • | Independent Compensation Consultant: Our independent compensation consultant, Pearl Meyer, reports directly to the Compensation Committee, providing guidance and data on benchmarking, best practices and other matters to support our compensation plan design and development. |

5

Compensation Best Practices:

| What We Do | What We Don’t Do | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

6

THE PROXY MATERIALS AND ANNUAL MEETING

WHY DID I RECEIVE THESE PROXY MATERIALS?

You are receiving this Proxy Statement and the accompanying proxy materials because you were a stockholder of record of common stock at the close of business on [ ], 2022 (the “Record Date”) and you otherwise are entitled to notice of, and to vote at, the Annual Meeting. Your Board is delivering this Proxy Statement and the accompanying proxy materials, including a BLUE proxy card, to you in connection with the solicitation of proxies by and on behalf of the Board, for use at the Annual Meeting, which will take place on [ ], 2022, and at any adjournments and postponements thereof. This Proxy Statement is intended to assist you in making an informed vote on the proposals described in this Proxy Statement. This Proxy Statement and the accompanying proxy materials are first being mailed on or about [ ], 2022 in connection with the solicitation of proxies on behalf of your Board. Copies of these proxy materials are also available, free of charge, at www.proxyvoting.com/TREC.

YOUR BOARD UNANIMOUSLY RECOMMENDS VOTING “FOR ALL” OF THE BOARD’S NOMINEES ON PROPOSAL 1, “FOR” PROPOSAL 2 AND “FOR” PROPOSAL 3 USING THE ENCLOSED BLUE PROXY CARD OR VOTING INSTRUCTION FORM.

THE BOARD URGES YOU NOT TO SIGN, RETURN OR VOTE ANY PROXY CARD SENT TO YOU, OTHER THAN THE BLUE PROXY CARD, EVEN AS A PROTEST VOTE, AS ONLY YOUR LATEST DATED PROXY CARD WILL BE COUNTED.

IS MY VOTE IMPORTANT?

Your vote will be particularly important at the Annual Meeting. As you may have seen, an investment firm and stockholder, Ortelius Advisors, L.P. (collectively with its affiliates, “Ortelius”), has nominated three candidates (the “Ortelius Nominees”) for election as directors at the Annual Meeting.

You may receive proxy solicitation materials from Ortelius, including proxy statements and proxy cards. The Board recommends that you disregard them. We are not responsible for the accuracy of any information provided by or relating to Ortelius or the Ortelius Nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Ortelius or any other statements that Ortelius or its representatives have made or may otherwise make.

WHAT ITEMS OF BUSINESS WILL BE VOTED ON AT THE ANNUAL MEETING?

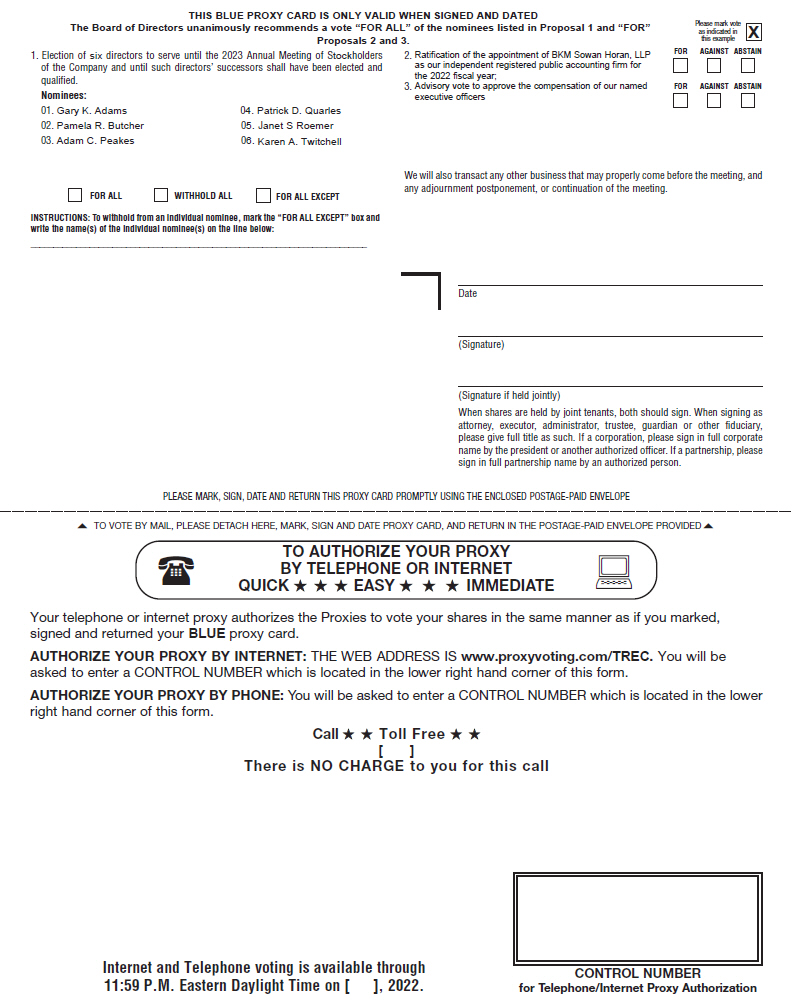

The items of business scheduled to be voted on at the Annual Meeting are:

| Proposal 1: |

The election of six directors, each to serve until the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) or, in each case, until his or her successor shall have been duly elected and qualified. | |

| Proposal 2: |

Ratification of the appointment of BKM Sowan Horan, LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2022 (the “2022 Fiscal Year”). | |

| Proposal 3: |

Advisory vote to approve the compensation of our NEOs. | |

| Other Proposals: |

Transact such other business as may properly come before the Annual Meeting or any reconvened meeting following any adjournment or postponement thereof. | |

7

HAVE OTHER CANDIDATES BEEN NOMINATED FOR ELECTION AT THE ANNUAL MEETING IN OPPOSITION TO THE BOARD’S NOMINEES?

Ortelius has nominated three candidates for election as directors at the Annual Meeting. Your Board does not endorse any of the Ortelius Nominees and unanimously recommends that you vote “FOR ALL” of the Board’s nominees to be elected and vote in accordance with the Board’s recommendations on each other proposal before the Annual Meeting on the BLUE proxy card. Your Board strongly urges you to discard and NOT sign or return any white proxy card sent to you by Ortelius.

HOW DOES THE BOARD RECOMMEND I VOTE ON THESE PROPOSALS?

Your Board unanimously recommends that you vote your shares on your BLUE proxy card as follows:

| Proposal 1: |

FOR ALL of the Board’s nominees for election to the Board to serve until the 2023 Annual Meeting or, in each case, until his or her successor shall have been duly elected and qualified. | |

| Proposal 2: |

FOR the ratification of the appointment of BKM Sowan Horan, LLP as our independent registered public accounting firm for the 2022 Fiscal Year. | |

| Proposal 3: |

FOR advisory approval of the compensation of our NEOs. | |

YOUR BOARD UNANIMOUSLY RECOMMENDS VOTING “FOR ALL” OF THE BOARD’S NOMINEES ON PROPOSAL 1, “FOR” PROPOSAL 2 AND “FOR” PROPOSAL 3 USING THE ENCLOSED BLUE PROXY CARD OR VOTING INSTRUCTION FORM.

Your Board strongly urges you to discard and NOT sign or return any white proxy card sent to you by Ortelius.

Your Board urges you to sign, date and return only the enclosed BLUE proxy card. If you have previously signed any proxy card sent to you by Ortelius in respect of the Annual Meeting, you can revoke it by signing, dating and returning the enclosed BLUE proxy card or by following the instructions provided in the BLUE proxy card for submitting a proxy to vote your shares over the Internet or by telephone or voting in person at the virtual Annual Meeting. Completing, signing, dating and returning any proxy card that Ortelius may send to you, even with instructions to vote “withhold” with respect to the Ortelius Nominees, will cancel any proxy you may have previously submitted to have your shares voted for the Board’s nominees, as only your latest proxy card or voting instruction form will be counted. Beneficial owners who own their shares in “street name” should follow the voting instructions provided by their bank, broker, trustee or other nominee to ensure that their shares are represented and voted at the Annual Meeting, or to revoke prior voting instructions.

WHO MAY VOTE AT THE ANNUAL MEETING?

Stockholders of the Company at the close of business on the Record Date are entitled to vote on all items being voted on at the Annual Meeting and any adjournments or postponements thereof. As of the Record Date, there were [ ] shares of common stock outstanding. Each share of common stock is entitled to one vote.

WHO CAN ATTEND THE ANNUAL MEETING?

The Company will hold the Annual Meeting in a virtual meeting format only, and stockholders will not be able to attend the Annual Meeting in person. Stockholders may participate online by pre-registering for the virtual meeting at www.cesonlineservices.com/trec22_vm. All stockholders participating online will be in listen-only mode but will have an opportunity to submit questions and vote.

To attend the Annual Meeting, you will need to pre-register by [ ] a.m., Central Time, on [ ], [ ], 2022. To pre-register for the Annual Meeting, please follow the instructions described below.

Registered Stockholders

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), you are considered, with respect to those shares, the stockholder of record (or a “Registered

8

stockholder”). For Registered stockholders, the control number can be found on the BLUE proxy card you received. To pre-register to participate in the Annual Meeting remotely, visit the website www.cesonlineservices.com/trec22_vm.

Please have your BLUE proxy card containing your control number available and follow the instructions to complete your registration request. After registering, you will receive a confirmation email with a link and instructions for accessing the Annual Meeting. Please verify that you have received the confirmation email in advance of the Annual Meeting, including the possibility that it may be in your spam or junk folder. Requests to register to participate in the Annual Meeting must be received no later than [ ] a.m., Central Time, on [ ], [ ], 2022. You must pre-register to vote and/or submit a comment or question during the Annual Meeting.

Beneficial Stockholders

For stockholders who hold their shares through an intermediary, such as a brokerage firm or bank (a “Beneficial stockholder”), the control number can be found on the BLUE voting instruction form, or other instructions you receive from your bank, brokerage firm, or other intermediary. To pre-register to participate in the Annual Meeting remotely, visit the website www.cesonlineservices.com/trec22_vm.

Please have your BLUE voting instruction form containing your control number available and follow the instructions to complete your registration request. After registering, you will receive a confirmation email with a link and instructions for accessing the Annual Meeting. Please verify that you have received the confirmation email in advance of the Annual Meeting, including the possibility that it may be in your spam or junk folder. Requests to register to participate in the Annual Meeting remotely must be received no later than [ ] a.m., Central Time, on [ ], [ ], 2022. You must pre-register to vote and/or submit a comment or question during the Annual Meeting.

We encourage you to vote in advance of the Annual Meeting. If you intend to vote during the Annual Meeting, you must obtain a legal proxy from your brokerage firm or bank. Most brokerage firms or banks allow stockholders to obtain a legal proxy either online or by mail. Follow the instructions provided by the brokerage firm or bank. If you have requested a legal proxy online, and you have not received an email with your legal proxy within two business days of your request, you should contact your brokerage firm or bank. If you have requested a legal proxy by mail, and you have not received it within five business days of your request, you should contact your brokerage firm or bank.

WHAT SHARES ARE INCLUDED ON THE ENCLOSED BLUE PROXY CARD?

If you are a Registered stockholder of the Company as of the Record Date, the enclosed BLUE proxy card represents all shares of common stock that are registered in your name.

If your shares are held through a broker, bank or other nominee, your broker, bank or other nominee has enclosed a BLUE voting instruction form for you to use to direct it how to vote the shares held by such broker, bank or other nominee. Please return your completed BLUE voting instruction form to your broker, bank or other nominee. If your broker, bank or other nominee permits you to provide voting instructions via the Internet or by telephone, you may vote that way as well.

If you hold shares in the Texas Oil and Chemical Co. II, Inc. 401(K) Plan, the trustee for such plan will separately send you proxy materials together with a voting instruction form for you to use to direct it how to vote and may also provide the opportunity for you to vote by telephone or by Internet.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE BLUE PROXY CARD ON OR ABOUT THE SAME TIME?

It generally means that you hold shares registered in more than one account. In order to vote all of your shares, please sign, date and return each BLUE proxy card or voting instruction form in the postage-paid envelope provided or, if you vote via the Internet or telephone, please be sure to vote using each BLUE proxy card or voting instruction form you receive.

If Ortelius proceeds with its previously announced alternative director nominations, we will likely conduct multiple mailings prior to the Annual Meeting so that stockholders have our latest proxy information and materials to vote. We

9

will send you a new BLUE proxy card with each mailing, regardless of whether you have previously voted. The latest-dated, validly executed proxy you submit will be counted, and, if you wish to vote as recommended by your Board, then you should only submit BLUE proxy cards.

WHAT SHOULD I DO IF I RECEIVE A PROXY CARD FROM ORTELIUS?

Ortelius has nominated three candidates for election as directors at the Annual Meeting. We expect that you may receive proxy solicitation materials from Ortelius, including opposition proxy statements and proxy cards.

The Board strongly and unanimously urges you NOT to sign or return any proxy cards or voting instruction forms that you may receive from Ortelius, including to vote “WITHHOLD” with respect to the Ortelius Nominees. We are not responsible for the accuracy of any information provided by or relating to Ortelius or the Ortelius Nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Ortelius or any other statements that Ortelius or its representatives have made or may otherwise make. If you have already voted using the proxy card provided by Ortelius, you have every right to change your vote by completing and returning the enclosed BLUE proxy card or by voting over the Internet or by telephone by following the instructions provided on the enclosed BLUE proxy card or BLUE voting instruction form. Only the latest proxy you submit will be counted. If you vote “WITHHOLD” on the Ortelius Nominees using the proxy card sent to you by Ortelius, your vote will not be counted as a vote for any of the director nominees recommended by our Board, but will result in the revocation of any previous vote you may have cast on the BLUE proxy card. If you wish to vote pursuant to the recommendation of our Board, you should disregard any proxy card that you receive other than the BLUE proxy card.

IS THE COMPANY USING A UNIVERSAL PROXY CARD IN CONNECTION WITH VOTING AT THE ANNUAL MEETING?

No. The SEC has adopted new rules requiring the use of a universal proxy card in contested director elections that take place after August 31, 2022. As the Annual Meeting will be held on [ ], 2022, stockholders voting by proxy at the Annual Meeting will vote using a customary proxy card, as has been the case in prior years. Your Board unanimously recommends using the enclosed BLUE proxy card to vote “FOR ALL” the nominees proposed by your Board. Your Board recommends that you disregard any white proxy cards that you may receive.

HOW DO I VOTE MY SHARES?

We encourage all stockholders to submit proxies in advance of the Annual Meeting by telephone, by Internet or by mail. Sending your proxy by any of these methods will not affect your right to virtually attend and vote at the Annual Meeting or by executing a proxy designating a representative to vote for you at the Annual Meeting.

If you are a Registered stockholder as of the Record Date, you can vote (i) by following the instructions on the enclosed BLUE proxy card to vote by telephone or Internet, (ii) by completing, signing, dating and mailing the enclosed BLUE proxy card in the postage-paid envelope provided or (iii) by attending the Annual Meeting virtually and voting during the meeting as described below under the heading “How do I vote my shares during the Annual Meeting?”. We strongly urge you to use the enclosed BLUE proxy card to vote “FOR ALL” your Board’s nominees and “FOR” the other proposals recommended by your Board.

If you hold shares through a broker, bank or other nominee, that institution has enclosed a BLUE voting instruction form for you to use to direct it how to vote those shares held by such broker, bank or other nominee. Your ability to vote by telephone or over the Internet depends upon your broker, bank or other nominee’s voting process. Please follow the instructions on your BLUE voting instruction form carefully.

Even if you plan to attend the Annual Meeting virtually, we encourage you to vote your shares by submitting your BLUE proxy card or voting instruction form in advance of the Annual Meeting.

10

HOW DO I VOTE MY SHARES DURING THE ANNUAL MEETING?

Stockholders that pre-register for the Annual Meeting may also vote during the Annual Meeting by clicking on the “Shareholder Ballot” link that will be available on the Annual Meeting website during the Annual Meeting.

Registered stockholders may vote directly by simply accessing the available ballot on the meeting website. Beneficial stockholders must upload their legal proxy during the meeting when completing the ballot. See above section “Who can attend the Annual Meeting?” under the caption “Beneficial Stockholders” on obtaining a legal proxy from your brokerage firm or bank. Instructions for presenting the legal proxy (if necessary) along with the online ballot will be provided during the Annual Meeting. Please prepare in advance by obtaining a legal proxy as soon as possible.

HOW DO I ASK A QUESTION DURING THE MEETING?

Stockholders that pre-registered for the Annual Meeting and received confirmation may submit written comments or questions during the annual meeting by typing in the “Ask a Question” box and clicking the “Send” button that will be available on the meeting website during the Annual Meeting.

Questions received during the Annual Meeting will be answered as the allotted Annual Meeting time permits. We cannot ensure that every stockholder who wishes to have a question or comment addressed during the Annual Meeting will be able to do so.

CAN I REVOKE MY PROXY OR CHANGE MY VOTE ONCE I VOTE BY MAIL, BY TELEPHONE OR OVER THE INTERNET?

Yes. You have the right to change or revoke your proxy (1) at any time before it is exercised at the Annual Meeting by (a) notifying the Company’s Corporate Secretary in writing at 1650 Highway 6 South, Suite 190, Sugar Land, Texas 77478, (b) returning a later dated, validly executed proxy card or (c) entering a later dated telephone or Internet vote; or (2) by voting during the Annual Meeting. Your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting.

If you have already voted using a white proxy card sent to you by Ortelius, you have every right to change your vote and we strongly urge you to revoke that proxy by voting “FOR ALL” your Board of Directors’ nominees by completing, signing, dating and returning the enclosed BLUE proxy card in the postage-paid envelope provided or following the instructions on your BLUE proxy card to vote by telephone or via the Internet. Only the latest dated, validly executed proxy that you submit will be counted — any proxy may be revoked at any time prior to its exercise at the Annual Meeting.

WHO WILL COUNT AND CERTIFY THE VOTES?

Representatives of [ ] will tabulate the votes and will act as the inspector of election.

WHAT CONSTITUTES A QUORUM?

Holders of record of our common stock at the close of business on [ ], 2022, the Record Date, are entitled to vote at the Annual Meeting or any adjournments or postponements thereof. As of that date, there were [ ] shares of our common stock outstanding and entitled to vote.

A quorum of stockholders is necessary to hold a valid Annual Meeting. A quorum will be present if the holders of a majority of the voting power of all of the shares of the stock entitled to vote at the meeting are present in person or by proxy. Thus [ ] shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the Annual Meeting. Abstentions will be counted towards the quorum requirement. If your shares are held in “street name,” your shares are counted as present for purposes of determining a quorum if you provide voting instructions to your broker, bank, trust or other nominee and such broker, bank, trust or other nominee submits a proxy covering your shares. Broker

11

non-votes, if any, will not count for quorum requirements. If you receive proxy materials only from the Company and you do not submit any voting instructions to your broker or other nominee, your broker or other nominee may vote your shares without your specific instruction with respect to Proposal 2, the ratification of the selection of BKM Sowan Horan LLP as the Company’s independent registered public accounting firm for the 2022 Fiscal Year, and your shares will therefore be counted for purposes of determining whether a quorum exists.

WHAT VOTE IS REQUIRED FOR PROPOSAL 1, THE ELECTION OF DIRECTORS?

Ortelius has nominated three candidates for election as directors at the Annual Meeting in opposition to the nominees recommended by your Board. As a result, assuming such nominations have not been withdrawn by Ortelius on or prior to the tenth day before we mail the Notice of 2022 Annual Meeting of Stockholders accompanying this Proxy Statement, the election of directors will be considered a contested election and, as provided under Article I, Section 7(c)(ii) of the Bylaws, directors will be elected on a plurality basis. Under the plurality voting standard, you may vote “FOR” or “WITHHOLD” authority to vote for each nominee, and the six director nominees receiving the greatest number of votes cast “FOR” their election will be elected, regardless of whether they were nominated by your Board or by Ortelius. Votes to “WITHHOLD” with respect to any nominee are not votes cast and will result in the applicable nominee(s) receiving fewer votes cast “FOR” such nominee(s). Broker non-votes are also not considered votes cast and will not have any effect on the election of directors.

It will NOT help elect the nominees recommended by your Board if you sign and return white proxy cards sent by Ortelius even if you vote to “WITHHOLD” with respect to Ortelius directors using Ortelius’ white proxy card. In fact, doing so will cancel any previous vote you cast on a BLUE proxy card sent to you by the Company. The only way to support your Board’s nominees is to vote “FOR ALL” your Board’s nominees on the BLUE proxy card. ONLY THE LATEST DATED, VALIDLY EXECUTED PROXY RECEIVED WILL BE COUNTED.

In the event that Ortelius withdraws its nominees on or prior to the tenth day before we mail the Notice of 2022 Annual Meeting of Stockholders accompanying this Proxy Statement, we will disclose such withdrawal to our stockholders and, as provided under Article I, Section 7(a)(iii) of the Bylaws, the affirmative vote of a majority of votes cast with respect to each director nominee will be required for the nominee to be elected. A majority of votes cast means that the number of votes cast “FOR” a director nominee must exceed the number of votes cast “AGAINST” that director nominee. In an uncontested election of directors, for each of the nominees you may vote “FOR” such nominee, “AGAINST” such nominee, or you may “ABSTAIN” from voting with respect to such nominee. If any director nominee receives less than a majority of the votes cast in an uncontested election, such director shall tender his or her resignation to the Board. Within 90 days of such resignation, the Board will either (a) accept the resignation of such director or (b) by unanimous vote of the Board, decline to accept such resignation. In either case, the Board’s determination will be made public by means of a Current Report on Form 8-K filed with the SEC.

WHAT VOTE IS REQUIRED FOR APPROVAL OF EACH OTHER MATTER TO BE CONSIDERED AT THE ANNUAL MEETING?

Proposal 2 — Ratification of the Selection of BKM Sowan Horan, LLP. In order for the selection of BKM Sowan Horan LLP to be approved, the number of votes cast “FOR” this proposal must exceed the number of votes cast “AGAINST” this proposal. Abstentions and broker non-votes are not considered votes cast on this proposal and will not have any effect on this proposal.

Proposal 3 — Advisory Vote on Compensation. In order for the advisory vote on compensation to be approved, the number of votes cast “FOR” this proposal must exceed the number of votes cast “AGAINST” this proposal. Abstentions and broker non-votes are not considered votes cast on this proposal and will not have any effect on this proposal.

For proposals 2 and 3, you may vote “FOR”, “AGAINST” or “ABSTAIN”.

WHAT HAPPENS IF I HOLD SHARES IN STREET NAME AND DO NOT SUBMIT VOTING INSTRUCTIONS? WHAT IS A BROKER NON-VOTE?

A broker non-vote occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker or nominee does not have discretionary voting power for that particular item and

12

has not received instructions from the beneficial owner. Under applicable rules that govern brokers or other nominees who are voting with respect to shares held in street name, brokers or other nominees ordinarily have the discretion to vote on “routine” matters (e.g., ratification of the selection of independent public accountants) but not on non-routine matters (e.g., election of directors and advisory votes on executive compensation).

Given that we expect the Annual Meeting to be a contested meeting, if your shares are held in street name and the brokers and other nominees holding shares in your account have provided you with competing proxy materials from Ortelius, under applicable rules, such brokers and other nominees will not be permitted to exercise discretionary authority regarding any of the proposals to be voted on at the Annual Meeting. Accordingly, in such circumstances, if you do not submit any voting instructions to your broker or other nominee, your shares will not be counted in determining the outcome of any of the proposals at the Annual Meeting, nor will your shares be counted for purposes of determining whether a quorum exists. However, if you receive proxy materials only from the Company, your broker or other nominee may vote your shares without your specific instruction with respect to Proposal 2, the ratification of the selection of BKM Sowan Horan LLP as the Company’s independent registered public accounting firm for the 2022 Fiscal Year, which would be a “routine” matter, and your shares will be counted for purposes of determining whether a quorum exists.

HOW WILL MY SHARES BE VOTED IF I SUBMIT A BLUE PROXY CARD BUT DO NOT SPECIFY HOW I WANT TO VOTE?

If you submit a validly executed BLUE proxy card or voting instruction form but do not specify how you want to vote your shares with respect to a particular proposal, then your shares will be voted in line with the Board’s recommendations with respect to any such proposal, i.e., (i) “FOR ALL” your Board’s six director nominees, (ii) “FOR” the ratification of the selection of BKM Sowan Horan LLP as the Company’s independent registered public accounting firm for the 2022 Fiscal Year and (iii) “FOR” the approval, on a non-binding advisory basis, of the compensation of the Company’s NEOs.

As of the date of this Proxy Statement, your Board knows of no business other than that set forth above to be transacted at the Annual Meeting, but if other matters requiring a vote do arise, it is the intention of S. Sami Ahmad and Michael W. Silberman, as the individuals to whom you are granting your proxy on the BLUE proxy card, to vote in accordance with their best judgment on such matters.

Your Board urges you to mark your BLUE proxy card in accordance with your Board’s recommendations.

HOW WILL BROKER NON-VOTES AND ABSTENTIONS BE TREATED?

Abstentions will be treated as present for the purpose of determining whether a quorum exists. Abstentions with respect to any nominee in Proposal 1, the election of directors, are not votes cast and will result in the applicable nominee(s) receiving fewer votes cast “FOR” such nominee(s). Abstentions with respect to Proposals 2 and 3 (ratification of the selection of BKM Sowan Horan LLP and advisory vote on compensation, respectively) will not be counted as votes cast either “FOR” or “AGAINST” such proposals and will have no effect on their approval.

Given that we expect the Annual Meeting to be a contested meeting, broker non-votes will have no effect on the vote.

Accordingly, we strongly urge you to promptly give instructions to your broker to vote “FOR ALL” your Board’s recommended nominees by using the BLUE voting instruction card provided to you by your custodian.

WHAT SHOULD I DO WITH ANY WHITE PROXY CARDS SENT TO ME BY ORTELIUS?

Ortelius has nominated three candidates for election at the Annual Meeting in opposition to the nominees recommended by your Board. We do not know whether Ortelius will in fact solicit proxies. The nominations made by Ortelius have NOT been endorsed by your Board. The Company is not responsible for the accuracy or completeness of any information provided by or relating to Ortelius or its nominees contained in solicitation materials filed or disseminated by or on behalf of Ortelius or any other statements Ortelius may make.

13

Your Board does not endorse any of the Ortelius Nominees and strongly urges you to discard and NOT sign or return any white proxy card or other solicitation materials that may be sent to you by Ortelius. Voting to “WITHHOLD” with respect to any Ortelius Nominees on any white proxy card sent to you by Ortelius is not the same as voting “FOR” each of your Board’s nominees, because a vote to “WITHHOLD” with respect to any of the Ortelius Nominees on its white proxy card will revoke any previous proxy submitted by you.

The only way to support your Board’s director nominees and other voting recommendations is to vote “FOR ALL” of your Board’s director nominees and “FOR” the other proposals, as recommended by your Board. If you have already voted using a white proxy card sent to you by Ortelius, you have every right to change it and we strongly urge you to revoke that proxy by voting in favor of your Board’s nominees by using the BLUE proxy card to vote by telephone or by Internet or by completing, signing, dating and returning the enclosed BLUE proxy card in the postage-paid envelope provided.

Only the latest dated, validly executed proxy that you submit will be counted — any proxy may be revoked at any time prior to its exercise at the Annual Meeting by following the instructions under “Can I revoke or change my vote once I vote by mail, by telephone or over the Internet?”. You may also revoke any previously submitted proxy by attending the Annual Meeting virtually and voting your shares at the Annual Meeting. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Morrow Sodali LLC (“Morrow Sodali”), toll-free at 1 (800) 662-5200.

WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING?

Given that we expect the Annual Meeting to be a contested meeting, we will not be announcing preliminary results of the voting at the Annual Meeting. We expect to report preliminary results based on the preliminary report of the Independent Inspector of Elections on a Current Report on Form 8-K filed with the SEC within four business days following the Annual Meeting, and final results as certified by the Independent Inspector of Elections as soon as practicable thereafter.

DO I HAVE ANY DISSENTERS’ OR APPRAISAL RIGHTS WITH RESPECT TO ANY OF THE MATTERS TO BE VOTED ON AT THE ANNUAL MEETING?

No. Delaware law does not provide stockholders any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting.

WHO WILL PAY FOR THE SOLICITATION OF PROXIES?

The costs and expenses of the Board’s soliciting of proxies, including the preparation, assembly and mailing of this Proxy Statement, the BLUE proxy card, the Notice of 2022 Annual Meeting of Stockholders and any additional information furnished to stockholders will be borne by the Company. Solicitation of proxies may be in person, by telephone, facsimile, electronic mail or personal solicitation by our directors, officers or staff members. Other than the persons described in this Proxy Statement, no general class of employee of the Company will be employed to solicit stockholders in connection with this proxy solicitation. However, in the course of their regular duties, our employees, officers and directors may be asked to perform clerical or ministerial tasks in furtherance of this solicitation. None of these individuals will receive any additional or special compensation for doing this, but they may be reimbursed for reasonable out-of-pocket expenses. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodian holding shares of our common stock in their names that are beneficially owned by others to forward to those beneficial owners. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation material to the beneficial owners of our common stock.

We have engaged Morrow Sodali to assist in the solicitation of proxies in connection with the Annual Meeting, for a service fee and the reimbursement of customary disbursements, which are not expected to exceed $[ ] in total. Morrow Sodali expects that approximately [ ] of its employees will assist in the solicitation. The parties’ engagement letter contains confidentiality, indemnification, and other provisions that the Company believes are customary for this type of engagement.

14

Our total aggregate expenses, including legal fees for attorneys, accountants, public relations and other advisors, printing, advertising, postage, transportation, litigation and other costs incidental to the solicitation, but excluding (i) costs normally expended for a solicitation for an election of directors in the absence of a proxy contest and (ii) costs represented by salaries and wages of Company employees and officers, are expected to be approximately $[ ], of which $[ ] has been incurred as of the date of this Proxy Statement.

Appendix A sets forth information relating to our directors and director nominees, as well as certain of our officers and employees who are considered “participants” in our solicitation under the rules of the SEC by reason of their position as directors and director nominees of the Company or because they may be soliciting proxies on our behalf.

WHO IS SOLICITING THIS PROXY?

Solicitation of proxies is made on behalf of your Board. By completing, signing, dating and returning the BLUE proxy card or BLUE voting instruction form, or by submitting your proxy and voting instructions over the Internet or by telephone, you are authorizing the persons named as proxies to vote your shares of common stock at the Annual Meeting as you have instructed. Proxies will be solicited on behalf of the Board by the Company’s directors, director nominees and certain executive officers and other employees of the Company. Such persons are listed in Appendix A to this Proxy Statement.

The cost of soliciting proxies, including preparing, assembling and mailing the Proxy Statement, form of BLUE proxy card and other soliciting materials, as well as the cost of forwarding such material to the beneficial owners of our common stock, will be paid by us, except for some costs associated with individual stockholders’ use of the Internet or telephone, and postage. In addition to the solicitation by electronic communications and/or by mail, directors, officers, regular employees and others may also, but without compensation other than their regular compensation, solicit proxies personally or by telephone or other means of electronic communication. We may reimburse brokers and others holding stock in their names or in the names of nominees for their reasonable out-of-pocket expenses in sending proxy materials to principals and beneficial owners.

Additionally, the Company has retained Morrow Sodali, a proxy solicitation firm, which may solicit proxies on the Board’s behalf. You may also be solicited by press releases issued by us, postings on our corporate website, other websites or otherwise. Unless expressly indicated otherwise, information contained on our corporate website is not part of this Proxy Statement. In addition, none of the information on the other websites, if any, listed in this Proxy Statement is part of this Proxy Statement. Such website addresses are intended to be inactive textual references only.

WHO CAN I CONTACT IF I HAVE QUESTIONS OR NEED ASSISTANCE IN VOTING MY SHARES, OR IF I NEED ADDITIONAL COPIES OF THE PROXY MATERIALS?

You may contact Morrow Sodali at the following address and telephone number:

509 Madison Avenue

Suite 1206

New York, NY 10022

Banks and Brokers Call: (203) 658-9400

Stockholders Call Toll Free: (800) 662-5200

E-mail: TREC@investor.morrowsodali.com

15

PROPOSAL 1: ELECTION OF DIRECTORS

Our Amended and Restated Certificate of Incorporation provides that the number of directors on our Board shall be fixed from time to time by the Board. Our Board currently consists of seven directors. Our Board has determined that upon conclusion of the Annual Meeting our Board shall be fixed at six directors, and you will be asked to elect six directors at the Annual Meeting. All of the directors elected at the Annual Meeting will serve until the 2023 Annual Meeting or, in each case, until his or her successor shall have been duly elected and qualified or until his or her earlier retirement, death, resignation or removal. Having reached the mandatory age of retirement, Mr. Carter will not be standing for re-election at the Annual Meeting and is retiring upon the expiration of his term at the conclusion of the Annual Meeting in accordance with our Corporate Governance Guidelines.

As described below, in considering candidates for election to the Board, the Nominating and Governance Committee and the Board consider a number of factors, including, among other things the experience, skills, background and diversity of its members, the Board’s and the Company’s needs at that time and the desire to have a well-balanced Board that represents a diverse mix of backgrounds, perspectives and expertise.

Based upon the Company’s criteria for nominations of directors to the Board and the unanimous recommendation of the Nominating and Governance Committee, the Board unanimously determined to nominate Gary K. Adams, Pamela R. Butcher, Adam C. Peakes, Patrick D. Quarles, Janet S. Roemer and Karen A. Twitchell to serve until the 2023 Annual Meeting and not to nominate any of the Ortelius Nominees to be included in the Board’s slate of director nominees for the Annual Meeting. Each nominee has consented to being named in the Proxy Statement and to continue serving as a director if elected.

As described previously, Ortelius has nominated three alternative candidates for election as directors at the Annual Meeting in opposition to the nominees recommended by your Board. As a result, assuming such nominations have not been withdrawn by Ortelius on or prior to the tenth day before we mail the Notice of 2022 Annual Meeting of Stockholders accompanying this Proxy Statement, the election of directors will be considered a contested election and, as provided under Article I, Section 7(a)(iii) of the Bylaws, directors will be elected on a plurality basis. This means that the six director nominees receiving the greatest number of votes cast “FOR” their election will be elected. “WITHHOLD” votes will be counted for purposes of determining if there is a quorum at the Annual Meeting for this vote but will not be counted as votes cast and will result in the applicable nominee(s) receiving fewer votes cast “FOR” such nominee(s). However, if you are the beneficial owner of the shares, which means that your shares are held by a brokerage firm, bank, dealer, or other similar organization as your nominee, your shares will not be voted for the election of directors unless you have provided voting instructions to your nominee.

Your Board does not endorse any of the Ortelius Nominees and strongly urges you to discard and NOT sign or return any white proxy card or other solicitation materials that may be sent to you by Ortelius. Voting to “WITHHOLD” with respect to any of Ortelius Nominees on any white proxy card sent to you by Ortelius is not the same as voting “FOR” each of your Board’s nominees, because a vote to “WITHHOLD” with respect to any of the Ortelius Nominees on its white proxy card will revoke any previous proxy submitted by you.

The only way to support your Board’s director nominees and other voting recommendations is to vote “FOR ALL” of your Board’s director nominees and “FOR” the other proposals, as recommended by your Board. If you have already voted using a white proxy card sent to you by Ortelius, you have every right to change it and we strongly urge you to revoke that proxy by voting in favor of your Board’s nominees by using the BLUE proxy card to vote by telephone or by Internet or by completing, signing, dating and returning the enclosed BLUE proxy card in the postage-paid envelope provided.

Only the latest dated, validly executed proxy that you submit will be counted — any proxy may be revoked at any time prior to its exercise at the Annual Meeting by following the instructions under “Can I revoke or change my vote once I vote by mail, by telephone or over the Internet?” on page 11. You may also revoke any previously submitted proxy by attending the Annual Meeting virtually and voting your shares at the Annual Meeting. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Morrow Sodali, toll-free at 1 (800) 662-5200.

In the event that Ortelius withdraws its nominees on or prior to the tenth day before we mail the Notice of 2022 Annual Meeting of Stockholders accompanying this Proxy Statement, we will disclose such withdrawal to our stockholders and, as provided under Article I, Section 7(a)(iii) of the Bylaws, the affirmative vote of a majority of votes cast with respect to

16

each director nominee will be required for the nominee to be elected. A majority of votes cast means that the number of votes cast “FOR” a director nominee must exceed the number of votes cast “AGAINST” that director nominee. If any director nominee receives less than a majority of the votes cast in an uncontested election, such director shall tender his or her resignation to the Board. Within 90 days of such resignation, the Board will either (a) accept the resignation of such director or (b) by unanimous vote of the Board, decline to accept such resignation. In either case, the Board’s determination will be made public by means of a Current Report on Form 8-K filed with the SEC.

If you submit a validly executed BLUE proxy card but do not specify how you want to vote your shares with respect to the election of directors, then your shares will be voted in line with the Board’s recommendation with respect to the proposal, i.e., “FOR ALL” the six nominees proposed by your Board and named in this Proxy Statement. Should any of your Board’s nominees be unable or unwilling to stand for election at the time of the Annual Meeting, the proxies named on the BLUE proxy card may vote for a replacement nominee recommended by the Board, or the Board may reduce the number of directors to be elected at the Annual Meeting. At this time, the Board knows of no reason why any of the Board’s nominees would not be able to serve as a director if elected.

|

|

RECOMMENDATION OF THE BOARD

|

|||

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR ALL” OF YOUR BOARD’S NOMINEES TO BE ELECTED AS A DIRECTOR AT THE ANNUAL MEETING.

THE BOARD DOES NOT RECOMMEND ANY CANDIDATE FOR ELECTION OTHER THAN GARY K. ADAMS, PAMELA R. BUTCHER, ADAM C. PEAKES, PATRICK D. QUARLES, JANET S. ROEMER AND KAREN A. TWITCHELL.

|

|

17

NOMINEES FOR ELECTION AS DIRECTOR

Set forth in the following pages is certain information furnished to us by our director nominees, including information about their individual experience, qualifications, attributes and skills that led our Nominating and Governance Committee and the Board to conclude that they should serve as directors.

There are no family relationships among any of our directors or executive officers.

NOMINEES FOR BOARD OF DIRECTORS

| GARY K. ADAMS | ||

| Principal Occupation and Other Information | ||

|

Independent

Director Since: 2012

Age: 71

Committees: Compensation Committee (Chair); Nominating and Governance Committee

Other Public Company

Phillips 66 (since October 2016) |

Mr. Adams has been a member of our Board since 2012. Mr. Adams has over 45 years of experience in the chemical and plastics industries. Mr. Adams previously served as the Chief Advisor – Chemicals for IHS Markit (now S&P Global), an information provider, from 2011 until his retirement in April 2017, after having served as President, Chief Executive Officer and Chairman of the Board of Chemical Market Associates Inc. (“CMAI”) from 1997 until CMAI’s acquisition by IHS Inc. in 2011. During his tenure at CMAI, which began in 1990 as the director of the Monomers Market Advisory Service, Mr. Adams’ leadership responsibilities included the successful development and execution of the firm’s strategic plan and growth strategies expanding across its global operations. Mr. Adams started his chemical industry career with Union Carbide, serving in a number of positions during his 15 years tenure at the company from 1975 to 1990. Mr. Adams has served as a director of Phillips 66 (NYSE: PSX) since October 2016, where he currently serves on their Compensation and Human Relations committee and their Public Policy and Sustainability committee. Mr. Adams also previously served as a director of Westlake Chemical Partners LP from 2014 until 2016 and Phillips 66 Partners LP from 2013 until 2016. In 2018, Mr. Adams was the recipient of the prestigious “Petrochemical Heritage Award” by the Chemical Founders Club and the Science History Institute at the annual AFPM-IPC meeting “in recognition of his unique and thought-provoking analyses of chemicals and plastics markets, as well as his respected wisdom and trusted leadership in the petrochemical industry.” Mr. Adams holds a Bachelor of Science degree in Industrial Management from the University of Arkansas.

Mr. Adams’ capability in leading global petrochemical advisory services and board experience in public energy and chemical companies provides our Board critical insights as to corporate governance and strategic, market drivers regarding the Company’s performance and growth opportunities, including drivers for success in the hydrocarbon value chain and the potential benefits of synergies obtained from combining strategic assets.

| |

18

| PAMELA R. BUTCHER | ||

| Principal Occupation and Other Information | ||

|

Independent

Director Since: 2016

Age: 64

Committees: Nominating and Governance Committee (Chair); Compensation Committee

Other Public Company Directorships in Last Five Years:

PDC Energy, Inc. (since February 2022) |

Ms. Butcher has been a member of our Board since 2016. Ms. Butcher previously served as the Chief Executive Officer, President and Chief Operating Officer of Pilot Chemical Corp., a global specialty chemical company (“Pilot”), from January 2010 through January 2021, when, after having led a decade of significant revenue, profit growth, and investments, she retired from serving as an officer. Prior to joining Pilot, Ms. Butcher worked 29 years for The Dow Chemical Company (now Dow Inc.), where she held a variety of executive leadership positions including Business Vice President of Specialty Chemicals, Vice President of Corporate Marketing & Sales and Vice President and General Manager of Adhesives and Sealants. Ms. Butcher has served as a director of PDC Energy Inc. (NASDAQ: PDCE) since February 2022 and Pilot since 2016 (where she also serves in a special advisory role to the Chairman of the board of directors) and is a member of the US Bank Regional Advisory Board. Previously, Ms. Butcher also served as a director of Gruden Topco Holdings, LP/Quality Distribution, Inc. from 2016 to 2021. Ms. Butcher was a distinguished recipient of Dow’s Genesis Award for people excellence, which is Dow’s highest recognition for people leadership. As an active leader in the Chemical Industry, she was a past president of the board of trustees for the Chemical Educational Foundation and on the Boards of the American Cleaning Institute and the Ohio Manufacturers’ Association. She is a member of the National Association of Corporate Directors (the “NACD”) and has completed the Director Professionalism class. Ms. Butcher holds a bachelor’s degree in Agronomy and a Master of Science Degree from Purdue University. In addition, she is a graduate of the Northwestern University Marketing Executive Program and has participated in the Prince of Wales Sustainability Conference and the Asian Master Class on Asian Business.

Ms. Butcher’s broad knowledge of, and extensive leadership experience in, the chemical industry makes her a valuable resource to our Board.

| |

| ADAM C. PEAKES | ||

| Principal Occupation and Other Information | ||

|

Independent

Director Since: 2019

Age: 49

Committees: Audit Committee (Chair); Compensation Committee

Other Public Company Directorships in Last Five Years:

Diamond Offshore Drilling, Inc. (since April 2021) |

Mr. Peakes has been a member of our Board since 2019. Mr. Peakes has more than 20 years of finance and investment banking experience in various natural resources industries. Most recently, Mr. Peakes has served as Executive Vice President and Chief Financial Officer for the Hornblower Group, a global transportation and experiences company, since April 2022. Prior to joining the Hornblower Group, Mr. Peakes served as Executive Vice President and Chief Financial Officer at Merichem Corporation, a privately-held industrial services company focused on sulfur removal and spent caustic handling, from November 2020 to April 2022. From 2017 until September 2019, Mr. Peakes served as Senior Vice President and Chief Financial Officer for Noble Corporation, a publicly-traded offshore drilling contractor (“Noble”), where he was responsible for the accounting, treasury, tax, financial planning, mergers and acquisitions and investor relations teams globally. Prior to Noble, Mr. Peakes spent 17 years as an investment banker with Tudor Pickering Holt & Co. and Goldman Sachs specializing in mergers and acquisitions, debt and equity financings and strategic advisory assignments for companies in the global natural resources sectors. Mr. Peakes has served as a director of Diamond Offshore Drilling, Inc. (NYSE: DO) since April 2021, where he currently serves as Chairman of its Audit committee. Mr. Peakes holds a Bachelor of Arts degree in Managerial Studies and Political Science from Rice University and a Master of Business Administration degree from Harvard Business School.

Mr. Peakes brings strategic leadership and expertise in capital markets, valuations, investor relations, mergers and acquisitions, global management and risk management to the Board.

| |

19

| PATRICK D. QUARLES | ||

| Principal Occupation and Other Information | ||

|

Director Since: 2018

Age: 55

Committees: None

Other Public Company Directorships in Last Five Years:

None |

Mr. Quarles has been a member of our Board since 2018 and was appointed President and Chief Executive Officer of the Company in December 2018. Prior to joining the Company, Mr. Quarles served as Executive Vice President and President, Acetyl Chain and Integrated Supply Chain at Celanese Corporation, a global chemical and specialty materials company, from 2015 until December 2017. Prior to that role, Mr. Quarles held a variety of leadership positions at LyondellBasell Industries N.V., before serving as Senior Vice President of the Intermediates and Derivatives (“I&D”) segment and the supply chain and procurement functions from January 2015 until June 2015. Those earlier roles included serving as a member of LyondellBasell’s Management Board from 2014 until 2015, Senior Vice President – I&D from 2009 until 2014, Senior Vice President Propylene Oxide and Derivatives from 2008 until 2009, and Vice President of Performance Chemicals from 2004 until 2008. Mr. Quarles began his career in 1990 at ARCO Chemical/Union Carbide, where he held various positions in sales, marketing and business management. Mr. Quarles has served on the shareholder advisory committee for OQ Chemicals International Holding GmbH, an Oman sovereign owned company that globally manufactures oxo intermediate and derivative chemicals (“OQ Chemicals”), since June 2018. During the same period, Mr. Quarles has also served on the supervisory board for OQ Chemicals Holding GmbH, a subsidiary of OQ Chemicals. Mr. Quarles holds a Bachelor of Science degree in Mechanical Engineering from Clemson University and a Master of Business Administration degree from the Kellogg School of Management at Northwestern University.

Mr. Quarles’ knowledge and experience in forming and leading lean teams focused on stockholder value across manufacturing, financial, and commercial operations, provides a wealth of knowledge to the Board.

| |

| JANET S. ROEMER | ||

| Principal Occupation and Other Information | ||

|

Independent

Director Since: 2019

Age: 66

Committees: Audit Committee; Nominating and Governance Committee

Other Public Company Directorships in Last Five Years:

None |

Ms. Roemer has been a member of our Board since 2019. Ms. Roemer previously served as the Chief Operating Officer of Verenium, an industrial biotechnology company, from 2010 until her retirement upon its acquisition by BASF at a significant premium in 2014, after having joined Verenium in 2008 as Executive Vice President of the Specialty Enzyme Business Unit. Prior to that role, Ms. Roemer worked for five years in specialty chemicals and 24 years in petrochemicals with P&L responsibility for businesses ranging from $275 million to $1.7 billion, and from regional to global. During that time, she held several executive level positions with BP, the energy company, from 1999 to 2006, including Vice President for North American Olefins and Styrene, Vice President, Chemicals Information Technology and General Manager, Global Alpha Olefins. Over many years, she has had leading roles in business transformations via mergers, acquisitions, divestitures, digital transformations, and new product/new market initiatives. Ms. Roemer pursues continuing education in board matters as a member of Women Corporate Directors and the NACD, where she has completed the Director Professionalism class. She has also received Certification in Cybersecurity Oversight for Directors from Carnegie Mellon’s Software Engineering Institute. Ms. Roemer received a Master in Business Administration from the University of Chicago and a Bachelor of Science in Chemistry from Miami University.

Ms. Roemer is an accomplished operating executive with a track record of success in companies ranging from mega-cap to micro-cap. Ms. Roemer’s breadth of chemical industry knowledge and integration of operational and strategic experience provides a critical resource for our Board.

| |

20

| KAREN A. TWITCHELL | ||

| Principal Occupation and Other Information | ||

|

Independent

Director Since: 2015

Age: 66

Committees: Audit Committee; Nominating and Governance Committee

Other Public Company Directorships in Last Five Years:

Kraton Corporation (December 2009 - March 2022) KMG Chemicals (February 2010 - November 2018) |

Ms. Twitchell has been a member of our Board since 2015 and was appointed Chair of the Board in February 2019. Ms. Twitchell has over 35 years of experience in financial management, including financings and capital structures, mergers and acquisitions, investor relations, accounting matters and enterprise risk management. Ms. Twitchell previously served as Executive Vice President and Chief Financial Officer of Landmark Aviation, where she led all financial and strategic functions, from 2010 until her retirement in 2013. Prior to joining Landmark Aviation, Ms. Twitchell held senior management roles at LyondellBasell Industries and Lyondell Chemical company from 2001 to 2009. Prior to that she was Vice President and Treasurer of Kaiser Aluminum Corporation and Southdown, Inc. and she was an investment banker with Credit Suisse First Boston. Ms. Twitchell previously served as a director of two other public chemical companies, Kraton Corporation from December 2009 until it was acquired in March 2022, and KMG Chemicals from February 2010 until it was acquired in November 2018. Ms. Twitchell has completed the NACD’s Director Professionalism class. Ms. Twitchell holds a Bachelor of Arts degree in Economics from Wellesley College and a Master of Business Administration degree from Harvard Business School.