UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

___________________

FORM

10-K

(MARK ONE)

|

ý

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

For

The Fiscal Year Ended December 31, 2008

OR

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

For

The Transition Period from ___________ to ________

Commission

File Number 0-6247

|

___________________

ARABIAN

AMERICAN DEVELOPMENT COMPANY

(Exact name of registrant as

specified in its charter)

|

Delaware

(State

or other jurisdiction of incorporation or organization)

|

75-1256622

(I.R.S.

Employer

Identification

No.)

|

|

10830

North Central Expressway Suite 175

Dallas,

Texas

(Address

of principal executive offices)

|

75231

(Zip

code)

|

Registrant’s

telephone number, including area code: (214) 692-7872

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

(Title

of Class)

Common

stock, par value $0.10 per share

___________________

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes¨ Noý

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes¨ No ý

_____________________

Indicate

by check mark whether the registrant (l) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yesý No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ý

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of

“accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange

Act. (Check one):

Large

accelerated filer ¨ Accelerated

filer ý Non-accelerated

filer ¨

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes¨ No ý

The

aggregate market value on June 30, 2008 of the registrant’s voting securities

held by non-affiliates was $103,469,814.

Number of

shares of registrant’s Common Stock, par value $0.10 per share, outstanding as

of March 6, 2009: 23,421,995.

DOCUMENTS

INCORPORATED BY REFERENCE

No

documents are incorporated by reference into this report.

TABLE

OF CONTENTS`

Item

Number and Description

|

PART

I

|

|

ITEM

1. BUSINESS

|

|

|

|

General

|

1

|

|

|

International

Operations

|

2

|

|

|

Competition

|

5

|

|

|

Environmental

Matters

|

6

|

|

|

Personnel

|

7

|

|

|

Available

Information

|

8

|

|

|

|

|

|

ITEM

1A. RISK FACTORS

|

8

|

|

|

|

|

|

ITEM

1B. UNRESOLVED STAFF COMMENTS

|

11

|

|

|

|

|

|

ITEM

2. PROPERTIES

|

|

|

|

United

States Specialty Products Facility

|

11

|

|

|

Saudi

Arabia Mining Properties

|

13

|

|

|

United

States Mineral Interests

|

18

|

|

|

Offices

|

19

|

|

|

|

|

|

ITEM

3. LEGAL PROCEEDINGS

|

21

|

|

|

|

|

|

ITEM

4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY

HOLDERS

|

21

|

|

|

|

|

|

|

PART

II

|

|

|

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY AND

RELATED SHAREHOLDER

MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES

|

22

|

|

|

|

|

|

ITEM

6. SELECTED FINANCIAL DATA

|

23

|

|

|

|

|

|

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND

RESULTS

OF OPERATION

|

|

|

|

General

|

23

|

|

|

Liquidity

and Capital Resources

|

23

|

|

|

Results

of Operations

|

27

|

|

|

Critical

Accounting Policies

|

32

|

|

|

|

|

|

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK

|

35

|

|

|

|

|

|

ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY

DATA

|

35

|

|

|

|

|

|

ITEM

9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING

AND

FINANCIAL DISCLOSURE

|

36

|

|

|

|

|

|

ITEM

9A. CONTROLS AND PROCEDURES

|

36

|

|

|

|

|

|

ITEM

9B. OTHER INFORMATION

|

37

|

|

|

|

|

|

|

PART

III

|

|

|

ITEM

10. DIRECTORS AND EXECUTIVE OFFICERS OF THE

REGISTRANT

|

38

|

|

|

|

|

|

ITEM

11. EXECUTIVE COMPENSATION

|

39

|

|

|

|

|

|

ITEM

12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS

AND

MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

43

|

|

|

|

|

|

ITEM

13. CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS

|

45

|

|

|

|

|

|

ITEM

14. PRINCIPAL ACCOUNTING FEES AND

SERVICES

|

45

|

|

|

|

|

|

|

PART

IV

|

|

|

ITEM

15. EXHIBITS, FINANCIAL STATEMENT

SCHEDULES

|

47

|

PART

I

ITEM

1. Business.

General

Arabian

American Development Company (the “Company”) was organized as a Delaware

corporation in 1967. The Company’s principal business activities include

manufacturing various specialty petrochemical products and developing mineral

properties in Saudi Arabia and the United States.

United States Activities. The

Company’s domestic activities are primarily conducted through a wholly owned

subsidiary, American Shield Refining Company (the “Petrochemical Company”),

which owns all of the capital stock of Texas Oil and Chemical Co. II, Inc.

(“TOCCO”). TOCCO owns all of the capital stock of South Hampton Resources Inc.

(“South Hampton”), and South Hampton owns all of the capital stock of Gulf State

Pipe Line Company, Inc. (“Gulf State”). South Hampton owns and operates a

specialty petrochemical facility near Silsbee, Texas which produces high purity

petrochemical solvents and other petroleum based products. Gulf State owns and

operates three pipelines which connect the South Hampton facility to a natural

gas line, to South Hampton’s truck and rail loading terminal and to a major

petroleum products pipeline owned by an unaffiliated third party. The

Company also directly owns approximately 55% of the capital stock of a Nevada

mining company, Pioche-Ely Valley Mines, Inc. (“Pioche”). Pioche does

not conduct any substantial business activities. See Item 2.

Properties.

Saudi Arabia Activities.

Prior to December 2008, the Company held a thirty (30) year mining lease (which

commenced on May 22, 1993) covering an approximate 44 square kilometer area in

the Al Masane area in southwestern Saudi Arabia. The lease carries an option to

renew or extend the term of the lease for additional periods not to exceed

twenty (20) years. The lease was contributed to Al Masane Al Kobra

Mining Company (“AMAK” formerly known as “ALAK”) in December 2008 in return for

a fifty percent ownership interest in AMAK.

In 1999

the Company applied for an exploration license covering an area of approximately

2,850 square kilometers surrounding the mining lease area, where it has

previously explored with the written permission of the Saudi Ministry of

Petroleum and Mineral Resources. In 2005 the Saudi Mining Code was

changed which necessitated the re-submission of these applications and the

re-submission is being prepared in the format required by the new

Code. The information relating to these areas were also transferred

to AMAK, and the new applications will be in the name of the joint

venture.

See Item 2. Properties for

additional discussions regarding all of the Company’s properties and financing

of the Al Masane project.

Note 16 to the Consolidated

Financial Statements contains information regarding the Company’s

industry segments and geographic financial information for the years ended

December 31, 2008, 2007 and 2006. In addition, see Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations for a

discussion of the Company’s liquidity, capital resources and operating

results.

International

Operations

A

substantial portion of the Company’s mineral properties and related interests is

located in Saudi Arabia. Specific and known risks are discussed in detail in

this report; however, the Company’s international operations involve additional

general risks not usually associated with domestic operations, any of which

could have a material and adverse affect on the Company’s business, financial

condition or results of operations, including a heightened risk of the

following:

Economic and Political Instability;

Terrorist Acts; War and Other Political Unrest. The U.S. military action

in Iraq and Afganistan, the terrorist attacks that took place in the United

States on September 11, 2001, the potential for additional future terrorist acts

and other recent events have caused uncertainty in the world’s financial markets

and have significantly increased global political, economic and social

instability, including in Saudi Arabia, a country in which the Company has

substantial interests. It is possible that further acts of terrorism may be

directed against the United States domestically or abroad, and such acts of

terrorism could be directed against the Company’s investment in those locations.

The Company’s interests in Saudi Arabia and elsewhere could be further adversely

affected by post-war conditions in Iraq or Afganistan if armed hostilities, acts

of terrorism or other unrest persist. Recent acts of terrorism and threats of

armed conflicts elsewhere in the Middle East could also limit or disrupt the

Company’s operations.

War and

other political unrest may also cause unforeseen delays in the development of

the Company’s interests located in Saudi Arabia and may pose a direct security

risk to their interests.

Such

economic and political uncertainties may materially and adversely affect the

Company’s business, financial condition or results of operations in ways that

cannot be predicted at this time.

Terrorist

acts, conflicts and wars may seriously harm our business and revenue, costs and

expenses and financial condition and stock price. Terrorist acts, conflicts or

wars (wherever located around the world) may cause damage or disruption to the

Company, its employees, facilities, partners, suppliers, distributors, resellers

or customers. The potential for future attacks, the national and international

responses to attacks or perceived threats to national security, and other actual

or potential conflicts or wars, including the ongoing military operations in

Iraq, have created many economic and political uncertainties. Although it is

impossible to predict the occurrences or consequences of any such events, they

could result in a decrease in demand for our products, make it difficult or

impossible to deliver products to our customers or to receive components from

our suppliers, create delays and inefficiencies in our supply chain and result

in the need to impose employee travel restrictions. The Company is predominantly

uninsured for losses and interruptions caused by terrorist acts, conflicts and

wars. The Company’s future revenue, gross margin, expenses and financial

condition also could suffer due to a variety of international factors,

including:

|

|

•

|

ongoing

instability or changes in a country’s or region’s economic or political

conditions, including inflation, recession, interest rate fluctuations and

actual or anticipated military or political

conflicts;

|

• longer

accounts receivable cycles and financial instability among

customers;

|

|

•

|

trade

regulations and procedures and actions affecting production, pricing and

marketing of products;

|

• local

labor conditions and regulations;

• geographically

dispersed workforce;

• changes

in the regulatory or legal environment;

• differing

technology standards or customer requirements;

|

|

•

|

import,

export or other business licensing requirements or requirements relating

to making foreign direct investments, which could affect our ability to

obtain favorable terms for labor and raw materials or lead to penalties or

restrictions;

|

|

|

•

|

difficulties

associated with repatriating cash generated or held abroad in a

tax-efficient manner and changes in tax laws;

and

|

|

|

•

|

fluctuations

in freight costs and disruptions in the transportation and shipping

infrastructure at important geographic points of exit and entry for our

products and shipments.

|

Currency

variations also contribute to fluctuations in sales of products and services in

impacted jurisdictions. In addition, currency variations can adversely affect

margins on sales of the Company’s products in countries outside of the United

States.

Business

disruptions could harm the Company’s future revenue and financial condition and

increase its costs and expenses. The Company’s operations could be subject to

earthquakes, power shortages, telecommunications failures, water shortages,

tsunamis, floods, hurricanes, typhoons, fires, extreme weather conditions,

medical epidemics and other natural or manmade disasters or business

interruptions, for some of which the Company may be self-insured. The occurrence

of any of these business disruptions could harm the Company’s revenue and

financial condition and increase its costs and expenses.

Termination of Mining Lease;

Expropriation or Nationalization of Assets. AMAK’s mining lease for the

Al Masane area in Saudi Arabia, which it received from the Company in December

2008, is subject to the risk of termination if AMAK does not comply with its

contractual obligations. See Item 2. Properties. Further,

the Company’s foreign investments in assets are subject to the risk of

expropriation or nationalization. If a dispute arises, the Company may have to

submit to the jurisdiction of a foreign court or panel or may have to enforce

the judgment of a foreign court or panel in that foreign

jurisdiction.

Compliance with Foreign Laws.

Because of the Company’s substantial international investments, its business is

affected by changes in foreign laws and regulations (or interpretation of

existing laws and regulations) affecting both the mining and petrochemical

industries, and foreign taxation. The Company will be directly affected by the

adoption of rules and regulations (and the interpretations of such rules and

regulations) regarding the exploration and development of mineral properties for

economic, environmental and other policy reasons. The Company may be required to

make significant capital expenditures to comply with non-U.S. governmental laws

and regulations. It is also possible that these laws and regulations

may in the future add significantly to the Company’s

operating

costs or may significantly limit its business activities. Additionally, the

Company’s ability to compete in the international market may be adversely

affected by non-U.S. governmental regulations favoring or requiring the awarding

of leases, concessions and other contracts or exploration licenses to local

contractors or requiring foreign contractors to employ citizens of, or purchase

supplies from, a particular jurisdiction. The Company is not

currently aware of any specific situations of this nature, but there is always

opportunity for this type of difficulty to arise in the international business

environment.

Mining Management

Risks. The Company’s management and Board of Directors have

many years of experience in the exploration for, and development of, mineral

prospects in various parts of the world. The members of the Company’s Board

serving concurrently on the AMAK Board are:

Mr. Hatem El Khalidi,

who holds a MSc. Degree in Geology from Michigan State University, is also a

consultant in oil and mineral exploration. He has served as President

of the Company since 1975 and Chief Executive Officer of the Company since

February 1994. Mr. El Khalidi originally discovered the Al Masane

deposits, and development has been under his direct supervision throughout the

life of the project. Mr. El Khalidi’s current term expires in

2010. Mr. El Khalidi serves on the Board of AMAK.

Mr. Ghazi Sultan, a

Saudi citizen, holds a MSc. Degree in Geology from the University of

Texas. Mr. Sultan served as the Saudi Deputy Minister of Petroleum

and Mineral Resources 1965-1988 and was responsible for the massive expansion of

the mineral resources section of the Ministry. Mr. Sultan is a member of the

Audit, Nominating, and Compensation Committees of the Company. Mr.

Sultan’s current term expires in 2010. Mr. Sultan serves on the

Board of AMAK.

Mr. Nicholas Carter,

the Company’s Executive Vice President and Chief Operating Officer, is a

graduate of Lamar University with a BBA Degree in Accounting, is a CPA, and has

extensive experience in the management of the Company’s petrochemical

segment. His employment in the petrochemical business predates the

acquisition by the Company in 1987. Mr. Carter was appointed to the Board on

April 27, 2006. Mr. Carter’s current term expires in

2011. Mr. Carter also serves as a Director and President of Pioche

Ely Valley Mines, Inc. of which the Company owns 55% of the outstanding

stock. Mr. Carter was appointed to the Board of AMAK in February

2009.

Dr. Ibrahim Al Moneef

was appointed to the Board on April 26, 2007. Dr. Al Moneef holds a

PhD in Business Administration from the University of Indiana. He

currently is owner and chief editor of The Manager Monthly Magazine,

a Saudi business journal. He has held key positions with companies doing

business in the Kingdom, including the Mawarid Group, the Ace Group, and the

Saudi Consolidated Electric Company. Dr. Al Moneef serves on the Compensation

and Nominating Committees, and his current term expires in 2009. Dr.

Al Moneef was a member of the Audit Committee until February 21, 2008, when he

tendered his resignation. Mr. Al Moneef serves on the Board of

AMAK.

Neither

management nor Board members have personally operated a mine on a day to day

basis, nor have they marketed the product of a mining operation. The

Company and AMAK have from time to time employed various respected engineering

and financial advisors to assist in the development and evaluation of the mining

projects. The consultants most currently used to update the

feasibility of the Al Masane project are SNC-Lavalin of Toronto,

Canada. The Company and AMAK also use the services of Adrian Molinari

of Toronto, Canada for ongoing guidance. The Company believes that

with the use of competent consultants and with the hiring of experienced

personnel by AMAK in which the Company holds a fifty percent ownership interest

and four of the eight seats on the AMAK Board, the mining venture is being

established and operated in a professional and successful

manner. The

amount of risk will ultimately depend upon the Company’s and AMAK’s ability to

use consultants and experienced personnel to manage the operation.

Other Difficulties and Risks

Associated with International Operations. The Company also may experience

difficulty in managing and staffing operations across international borders,

particularly in remote locations. Additional risks associated with the Company’s

international operations, any of which could disrupt the Company’s operations,

include changing political conditions, foreign and domestic monetary policies,

international economics, world metal price fluctuations, foreign currency

fluctuations, foreign taxation, foreign exchange restrictions, trade protective

measures and tariffs. The establishment of AMAK with its own

management and staff should assist in mitigating many of these potential

risks.

Competition

The

Company competes in both the petrochemical and mining industries. Accordingly,

the Company is subject to intense competition among a large number of companies,

both larger and smaller than the Company, many of which have financial

capability, facilities, personnel and other resources greater than the Company.

In the specialty products and solvents markets, the Petrochemical Company has

one principal competitor.

All of

the Petrochemical Company’s raw materials are purchased on the open

market. The Company has contracts in place for approximately

two-thirds of its monthly supply and purchases the remainder on the spot market

depending on inventory and operational needs. The contracts are

priced upon monthly averages of posted market prices with the remainder being a

function of spot market oil and gas prices. The price of the

feedstock utilized by the Company historically carries an 88% correlation to

crude oil prices but is not as volatile on a day to day basis. However, the

historic correlation has not held true with the price fluctuations of crude

since mid-2008. Currently, and the feedstock prices appear

to be moving in relation to the price of motor gasoline more so than in prior

years.

Because

of the following factors, as well as other variables affecting operating

results, past financial performance may not be a reliable indicator of future

performance, and historical trends should not be used to anticipate results or

trends in future periods. The Company encounters aggressive

competition from numerous and varied competitors in all areas of its business,

and competitors may target the Company’s key market segments. The Company

competes primarily on the basis of performance, price, quality, reliability,

reputation, distribution, service, and account relationships. If the Company’s

products, services, support and cost structure do not enable it to compete

successfully based on any of those criteria, the Company’s operations, results

and prospects could be harmed. The Company has a portfolio of

businesses and must allocate resources across these businesses while competing

with companies that specialize in one or more of these product lines. As a

result, the Company may invest less in certain areas of its businesses than

competitors do, and these competitors may have greater financial, technical and

marketing resources available to them than the Company’s businesses that compete

against them. Industry consolidation also may affect competition by creating

larger, more homogeneous and potentially stronger competitors in the markets in

which the Company competes, and competitors also may affect the Company’s

business by entering into exclusive arrangements with existing or potential

customers or suppliers. The Company may have to continue to lower the prices of

many of its products and services to stay competitive, while at the same time

trying to maintain or improve revenue and gross margin.

If the

Company cannot continue to develop, manufacture and market products and services

that meet customer requirements, its revenue and gross margin may suffer. The

Company must make long-term investments and commit significant resources before

knowing whether its predictions will accurately reflect customer demand for

products and services. After the Company develops a product, it must be able to

manufacture appropriate volumes quickly and at competitive costs. In the course

of conducting business, the Company must adequately address quality issues

associated with its products and services. In order to address quality issues,

the Company works extensively with its customers and suppliers to determine the

cause of the problem and to determine appropriate solutions. However, the

Company may have limited ability to control quality issues. If the Company is

unable to determine the cause or find an appropriate solution it may delay

shipment to customers, which would delay revenue recognition and could adversely

affect the Company’s revenue and reported results. Finding solutions to quality

issues can be expensive, adversely affecting Company profits. If new or existing

customers have difficulty utilizing the Company’s products, its operating

margins could be adversely affected, and it could face possible claims if the

Company fails to meet its customers’ expectations. In addition, quality issues

can impair the Company’s relationships with new or existing customers and

adversely affect its reputation, which could have a material adverse effect on

operating results.

Economic

uncertainty could affect adversely the Company’s revenue, gross margin and

expenses. The Company’s revenue and gross margin depend significantly on general

economic conditions and the demand for products in the markets in which it

competes. Future continued economic weakness may result in decreased revenue,

gross margin, earnings or growth rates and problems with the Company’s ability

to manage inventory levels and collect customer receivables. The Company could

experience such economic weakness and reduced spending due to the effects of

high fuel costs. In addition, future customer financial difficulties could

result in increases in bad debt write-offs and additions to reserves in the

Company’s receivables portfolio. The Company also has experienced, and may

experience in the future, gross margin declines in certain businesses,

reflecting the effect of items such as competitive pricing pressures, inventory

write-downs, and increases in post-retirement benefit expenses. Economic

downturns, such as the current worldwide economic downturn, may also lead to

restructuring actions and associated expenses. Uncertainty about future economic

conditions makes it difficult for the Company to forecast operating results and

to make decisions about future investments.

Environmental

Matters

In 1993,

during remediation of a small spill area, the Texas Commission on Environmental

Quality (TCEQ) required South Hampton to drill a well to check for groundwater

contamination under the spill area. Two pools of hydrocarbons were discovered to

be floating on the groundwater at a depth of approximately 25 feet. One pool is

under the site of a former gas processing plant owned and operated by Sinclair,

Arco and others before its purchase by South Hampton in 1981. Analysis of the

material indicates it entered the ground prior to South Hampton’s acquisition of

the property. The other pool is under the original South Hampton

facility and analysis indicates the material was deposited decades ago. Tests

conducted have determined that the hydrocarbons are contained on the property

and not migrating in any direction. The recovery process was initiated in June

1998 and approximately $53,000 was spent setting up the system. The recovery is

proceeding as planned and is expected to continue for many years until the pools

are reduced to acceptable levels. Expenses of recovery and periodic migration

testing are being recorded as normal operating expenses. Expenses

for

future recovery are expected to stabilize and be less per annum than the initial

set up cost, although there is no assurance of this effect.

The light

hydrocarbon recovered from the former gas plant site is compatible with the

normal Penhex feedstock and is accumulated and transferred into the Penhex

feedstock tank. The material recovered from under the original South

Hampton site is accumulated and sold as a by-product. Approximately

503 barrels were recovered during 2007 and 405 barrels during

2008. The recovered material had an economic value of approximately

$40,000 during 2007 and $17,050 during 2008. Consulting engineers

estimate that as much as 20,000 barrels of recoverable material may be available

to South Hampton for use in its process or for sale. At current

market values this material, if fully recovered would be worth approximately

$840,000. The final volume present and the ability to recover it are both highly

speculative issues due to the area over which it is spread and the fragmented

nature of the pockets of hydrocarbon.

South

Hampton has drilled additional wells periodically to further delineate the

boundaries of the pools and to ensure that migration has not taken place. These

tests confirmed that no migration of the hydrocarbon pools has

occurred. The TCEQ has deemed the current action plan acceptable and

reviews the plan on a semi-annual basis.

In other

remediation activity, South Hampton investigated a potential chemical dump site

on the facility property relating to ownership by Arco in the 1950’s. The

investigation indicated no further action is required and the site was closed in

November of 2007. The Company also continues to remediate the site of

a pipeline leak which occurred in 2001. The affected site contains less than

one-eighth acre of land and the cost of remediation is being covered by

insurance. The amount of material spilled was minimal and due to the nature of

the soil and location, further remediation will rely on natural

attenuation. The Company has applied to the Texas Railroad Commission

for approval to consider the site closed if two years of annual monitoring

indicate no movement of hydrocarbon. Also, see Item 3. Legal

Proceedings.

The Clean

Air Act Amendments of 1990 have had a positive effect on the Petrochemical

Company’s business as manufacturers search for ways to use more environmentally

acceptable materials in their processes. There is a current trend among

manufacturers toward the use of lighter and more recoverable C5 hydrocarbons

(pentanes) which comprise a large part of the Petrochemical Company’s product

line. Management believes its ability to manufacture high quality solvents in

the C5 hydrocarbon market will provide a basis for growth over the coming

years. Also, as the use of C6 solvents is phased out in parts

of the industry, several manufacturers of such solvents have opted to no longer

market those products. As the number of producers has consolidated,

the Company has increased its market share at higher sales prices from customers

who still require C6 solvents in their business. Also, see Item

2. Properties.

Personnel

Mr. Hatem

El Khalidi, a US citizen and the Company’s President and Chief Executive Officer

splits his time between the US and Saudi Arabia. Mr. El Khalidi

supervised the Company’s 14-15 mining segment employees in Saudi Arabia,

consisting of the office personnel and field crews who were primarily charged

with maintaining and caring for the facilities and equipment located at the mine

site. These employees are being terminated in early 2009 as AMAK has

taken over the operation of the mine site. Mr. El Khalidi also serves

as a Director of AMAK. Mr. El Khalidi has announced plans to retire

from his positions as President and Chief Executive Officer of the

Company

effective June 30, 2009. Mr. Carter will assume these positions upon

Mr. El Khalidi’s retirement.

Mr.

Nicholas Carter, Executive Vice President and Chief Operating Officer of the

Company and President of the Petrochemical Segment, resides in southeast Texas,

and is a US citizen. The Petrochemical Company employs 130 persons.

Ms.

Connie Cook, Secretary/Treasurer of the Company and Controller of the

petrochemical companies resides in southeast Texas, and is a US

citizen.

Available

Information

The

Company will provide paper copies of this Annual Report on Form 10-K, its

quarterly reports on Form 10-Q, its current reports on Form 8-K and amendments

to those reports, all as filed or furnished pursuant to Section 13(a) or 15(d)

of the Securities Exchange Act of 1934, free of charge upon written or oral

request to Arabian American Development Company, P. O. Box 1636, Silsbee,

TX 77656, (409) 385-8300. The Company’s website address is

arabianamericandev.com. The petrochemical subsidiary, South Hampton

Resources, Inc. has a website at southhamptonr.com.

ITEM

1A. Risk

Factors.

The

Company’s use of single source suppliers for certain raw materials could create

supply issues. Replacing a single source supplier could delay production of some

products as replacement suppliers initially may be subject to capacity

constraints or other output limitations. The loss of a single source supplier,

the deterioration of the Company’s relationship with a single source supplier,

or any unilateral modification to the contractual terms under which the Company

is supplied raw materials by a single source supplier could adversely affect the

Company’s revenue and gross margins.

The

revenue and profitability of the Company’s operations have historically varied,

which makes its future financial results less predictable. The Company’s

revenue, gross margin and profit vary among its products, customer groups and

geographic markets and therefore will likely be different in future periods than

currently. Overall gross margins and profitability in any given period are

dependent partially on the product, customer and geographic mix reflected in

that period’s net revenue. In addition, newer geographic markets may be

relatively less profitable due to investments associated with entering those

markets and local pricing pressures. Market trends, competitive pressures,

increased raw material or shipping costs, regulatory impacts and other factors

may result in reductions in revenue or pressure on gross margins of certain

segments in a given period, which may necessitate adjustments to the Company’s

operations.

Unanticipated

changes in the Company’s future tax rate or exposure to additional income tax

liabilities could affect its profitability. The Company is currently subject to

income taxes in the United States.

In order

to be successful, the Company must attract, retain and motivate executives and

other key employees, including those in managerial, technical, sales, and

marketing positions. The Company also must keep employees focused on the

Company’s strategies and goals. The failure to hire or loss of key employees

could have a significant impact on the Company’s operations.

The

Company’s stock price, like that of other companies, can be volatile. Some of

the factors that can affect its stock price are:

|

|

•

|

Speculation

in the press or investment community about, or actual changes in, our

executive team, strategic position, business, organizational structure,

operations, financial condition, financial reporting and results,

effectiveness of cost cutting efforts, prospects or extraordinary

transactions;

|

|

|

•

|

Announcements

of new products, services, technological innovations or acquisitions by

the Company or competitors; and

|

|

|

•

|

Quarterly

increases or decreases in revenue, gross margin or earnings, changes in

estimates by the investment community or guidance provided by the Company,

and variations between actual and estimated financial

results.

|

General

or industry-specific market conditions or stock market performance or domestic

or international macroeconomic and geopolitical factors unrelated to the

Company’s performance also may affect the price of the Company’s common stock.

For these reasons, investors should not rely on recent trends to predict future

stock prices, financial condition, results of operations or cash flows. In

addition, following periods of volatility in a company’s securities, securities

class action litigation against a company is sometimes instituted. If instituted

against the Company, this type of litigation, while insured against monetary

awards and defense cost, could result in substantial diversion of management’s

time and resources.

As part

of the Company’s business strategy, it sometimes engages in discussions with

third parties regarding possible investments, acquisitions, strategic alliances,

joint ventures, divestitures and outsourcing transactions (‘‘extraordinary

transactions’’) and enters into agreements relating to such extraordinary

transactions in order to further our business objectives. In order to pursue

this strategy successfully, the Company must identify suitable candidates for

and successfully complete extraordinary transactions, some of which may be large

and complex, and manage post-closing issues such as the integration of acquired

companies or employees. Integration and other risks of extraordinary

transactions can be more pronounced for larger and more complicated

transactions, or if multiple transactions are pursued simultaneously. If the

Company fails to identify and complete successfully extraordinary transactions

that further its strategic objectives, it may be required to expend resources to

develop products and technology internally, it may be at a competitive

disadvantage or it may be adversely affected by negative market perceptions, any

of which may have a material adverse effect on the Company’s revenue, gross

margin and profitability. Integration issues are complex, time-consuming and

expensive and, without proper planning and implementation, could significantly

disrupt the Company’s business. The challenges involved in integration

include:

|

|

•

|

combining

product offerings and entering into new markets in which the Company is

not experienced;

|

|

|

•

|

convincing

customers and distributors that the transaction will not diminish client

service standards or business focus, preventing customers and distributors

from deferring purchasing decisions or switching to other suppliers (which

could result in

our incurring additional obligations in order to address customer

uncertainty), and

coordinating sales, marketing and distribution

efforts;

|

|

|

•

|

minimizing

the diversion of management attention from ongoing business

concerns;

|

|

|

•

|

persuading

employees that business cultures are compatible, maintaining employee

morale and retaining key employees, engaging with employee works councils

representing an acquired company’s non-U.S. employees, integrating

employees into the Company, correctly estimating employee benefit costs

and implementing restructuring

programs;

|

|

|

•

|

coordinating

and combining administrative, manufacturing, and other operations,

subsidiaries, facilities and relationships with third parties in

accordance with local laws and other obligations while maintaining

adequate standards, controls and

procedures;

|

•

achieving savings from supply chain integration; and

|

|

•

|

managing

integration issues shortly after or pending the completion of other

independent transactions.

|

The

Company periodically evaluates and enters into significant extraordinary

transactions on an ongoing basis. The Company may not fully realize all of the

anticipated benefits of any extraordinary transaction, and the timeframe for

achieving benefits of an extraordinary transaction may depend partially upon the

actions of employees, suppliers or other third parties. In addition, the pricing

and other terms of the Company’s contracts for extraordinary transactions

require it to make estimates and assumptions at the time it enters into these

contracts, and, during the course of its due diligence, the Company may not

identify all of the factors necessary to estimate its costs accurately. Any

increased or unexpected costs, unanticipated delays or failure to achieve

contractual obligations could make these agreements less profitable or

unprofitable. Managing extraordinary transactions requires varying levels of

management resources, which may divert the Company’s attention from other

business operations. These extraordinary transactions also have resulted and in

the future may result in significant costs and expenses and charges to earnings.

Moreover, the Company has incurred and will incur additional depreciation and

amortization expense over the useful lives of certain assets acquired in

connection with extraordinary transactions, and, to the extent that the value of

goodwill or intangible assets with indefinite lives acquired in connection with

an extraordinary transaction becomes impaired, the Company may be required to

incur additional material charges relating to the impairment of those assets. In

order to complete an acquisition, the Company may issue common stock,

potentially creating dilution for existing stockholders, or borrow, affecting

the Company’s financial condition and potentially its credit ratings. Any prior

or future downgrades in the Company’s credit rating associated with an

acquisition could adversely affect its ability to borrow and result in more

restrictive borrowing terms. In addition, the Company’s effective tax rate on an

ongoing basis is uncertain, and extraordinary transactions could impact its

effective tax rate. The Company also may experience risks relating to the

challenges and costs of closing an extraordinary transaction and the risk that

an announced extraordinary transaction may not

close. As

a result, any completed, pending or future transactions may contribute to

financial results that differ from the investment community’s expectations in a

given quarter.

ITEM

1B. Unresolved Staff

Comments.

None

ITEM

2. Properties.

United

States Specialty Products Facility

South

Hampton owns and operates a specialty petrochemical facility near Silsbee, Texas

which is approximately 30 miles north of Beaumont, Texas, and 90 miles east of

Houston. The facility presently consists of six operating units which, while

interconnected, make distinct products through differing processes: (i) a Penhex

Unit; (ii) a Reformer; (iii) a Cyclo-pentane Unit; (iv) an Aromax® Unit; (v) an

Aromatics Hydrogenation Unit; and (vi) a White Oil Fractionation Unit. All of

these units are currently in operation.

The

Penhex Unit has the capacity to process approximately 6,700 barrels per day of

fresh feed, with the Reforming Unit, the Aromax® Unit, and the Cyclo-Pentane

Unit further processing streams produced by the Penhex Unit. The

Aromatics Hydrogenation Unit has a capacity of approximately 400 barrels per

day, and the White Oils Fractionation Unit has a capacity of approximately 3,000

barrels per day. The facility generally consists of equipment

commonly found in most petroleum facilities such as fractionation towers and

hydrogen treaters except the facility is adapted to produce specialized products

that are high purity, very consistent, precise specification materials utilized

in the petrochemical industry as solvents, additives, blowing agents and cooling

agents. South Hampton produces eight distinct product streams and

markets several combinations of blends as needed in various customers’

applications. South Hampton does not produce motor fuel products or

any other commodity type products commonly sold directly to retail consumers or

outlets.

The

products from the Penhex Unit, Reformer, Aromax® Unit, and Cyclo-pentane Unit

are marketed directly to the customer by South Hampton marketing

personnel. The Penhex Unit had a utilization rate during 2008 of

approximately 90%. This compares to a rate of 91% for

2007. The Reformer and Aromax® units are operated as needed to

support the Penhex and Cyclo-pentane Units. Consequently, utilization

rates of these units are driven by production from the Penhex

Unit. Operating utilization rates are affected by product demand,

mechanical integrity, and unforeseen natural occurrences, such as weather

events. The nature of the refining process demands periodic

shut-downs for de-coking and other mechanical repairs. In 2007 there

were mechanical shut-downs resulting in approximately 12 total days of lost

production and another 6 days due to weather or other uncontrollable issues. The

Penhex Unit capacity was expanded in 2008 and now is configured in two

independent process units. Since the marketing effort may take several years to

utilize the expanded capacity, utilization rates of the unit could be

significantly lower over the next few years. However, the volume of

material available for sale will be much improved as the original PenHex Unit

was operating near capacity for the last several years. The two unit

configuration also improves reliability by reducing the amount of total down

time due to mechanical and other factors.

The other

two operating units at the plant site, an Aromatics Hydrogenation Unit and a

White Oils Fractionation Unit, are operated as two, independent and completely

segregated processes. These units are dedicated to the needs of two

different toll processing customers. The customers

supply

and

maintain title to the feedstock, South Hampton processes the feedstock into

products based upon customer specifications, and the customers market the

products. Products may be sold directly from South Hampton’s storage

tanks or transported to the customers’ location for storage and

marketing. As of October 2005, after the expansion program, the units

have a combined capacity of 3,400 BPD. Together they realized a utilization rate

58% for 2007 and 43% for 2008. The units are operated in accordance

with customer needs, and the contracts call for take or pay minimums of

production.

In the

summer of 2006 the Aromatics Hydrogenation Unit was modified to produce two

products in addition to that of the original design. Rotating the

three separate products through production was found to be inefficient and the

customer has concentrated on switching production between two products as a

standard operating routine. The unit has been kept at capacity using

this scheme.

In March

2007 the Board of Directors approved the expansion of the South Hampton Penhex

unit. The capacity was to be increased from 3,000 barrels per day to

approximately 6,000 barrels per day. The Company immediately began

acquiring equipment and ordering items, such as instrumentation, pumps, and

compressors which require a long lead time for delivery. The project

consists of an additional fractionation train identical to the current design,

and also entailed the expansion of the Aromax, reformer, and Cyclo-pentane units

to support the increased volumes. Construction work began in the fall

of 2007, with the initial focus being the infrastructure required to support the

increased operation, such as pipe racks, electrical capacity increases, fire

water line extensions, water well modifications, etc. The final

permit to construct was received from the TCEQ on February 28, 2008, and

foundation work for the primary equipment started on that date. Final

completion was in September 2008 and the new unit was in total operation in

October 2008. The final cost of the expansion was approximately $18.0

million and trial runs in October of 2008 set the new capacity at 3,700 barrels

per day in addition to the 3,000 barrels per day with existing equipment. For additional

information see Note 7 to the

Consolidated Financial Statements.

South

Hampton, in support of the petrochemical operation, owns approximately 69

storage tanks with total capacity approaching 225,000 barrels, and 106 acres of

land at the plant site, 55 acres of which are developed. South

Hampton also owns a truck and railroad loading terminal consisting of storage

tanks, four rail spurs, and truck and tank car loading facilities on

approximately 53 acres of which 13 acres are developed.

As a

result of various expansion programs and the toll processing contracts,

essentially all of the standing equipment at South Hampton is operational. South

Hampton has various surplus equipment stored on-site which may be used in the

future to assemble additional processing units as needs arise.

Gulf

State owns and operates three (3) 8-inch diameter pipelines aggregating

approximately 50 miles in length connecting South Hampton’s facility to: (1) a

natural gas line, (2) South Hampton’s truck and rail loading terminal and (3) a

major petroleum products pipeline system owned by an unaffiliated third

party. All pipelines are operated within Texas Railroad Commission

and DOT regulations for maintenance and integrity.

Saudi

Arabia Mining Properties

Al

Masane Project

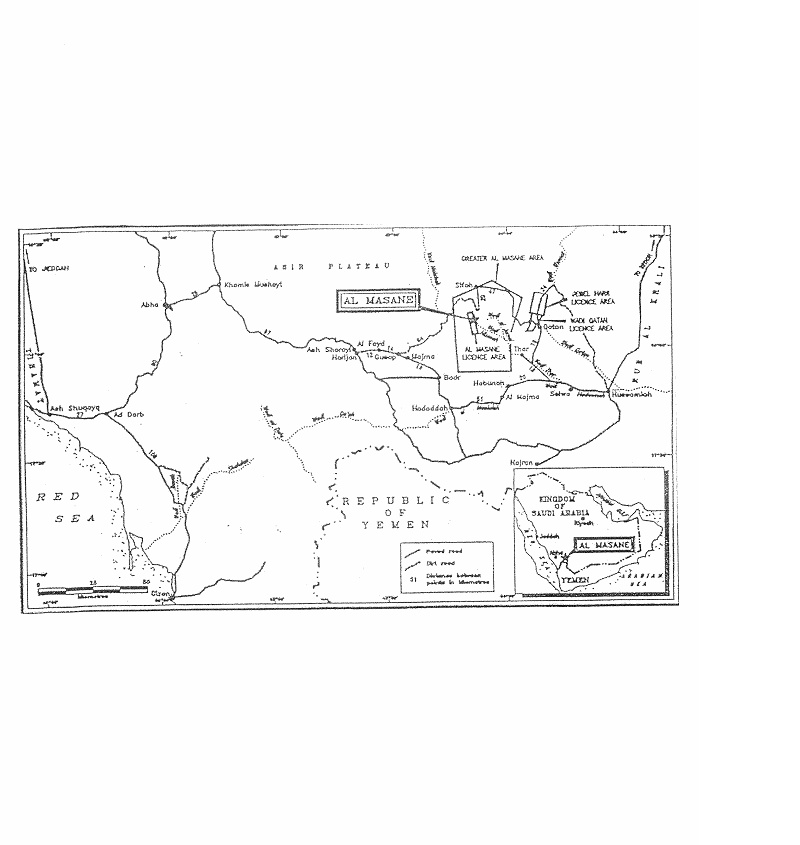

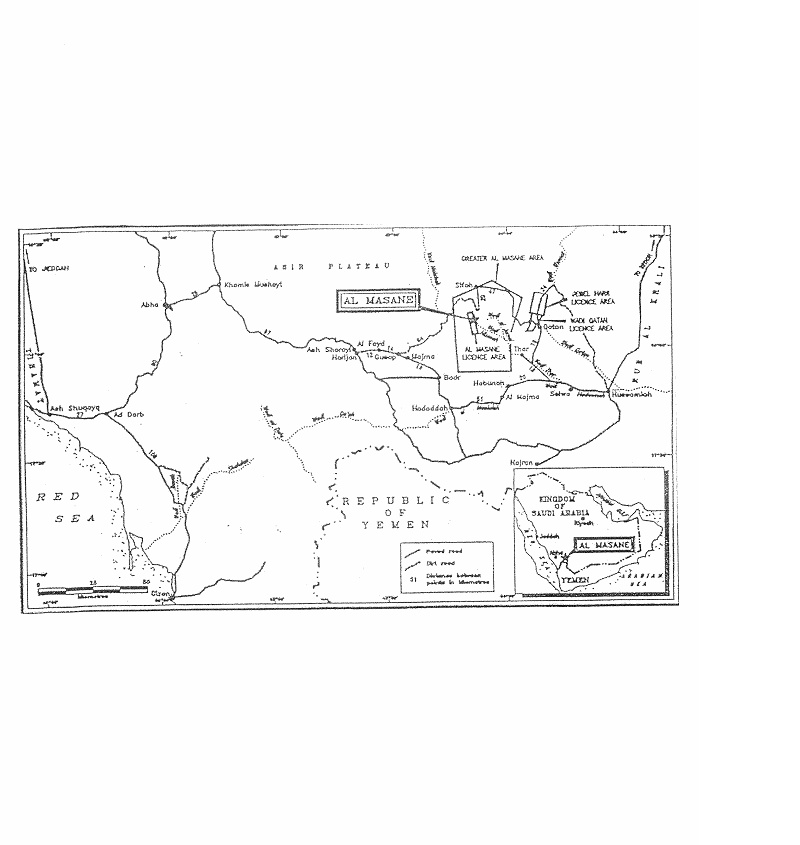

Location, Access and

Transportation. The Company’s Al Masane project, contributed

to AMAK in December 2008, consisted of a mining lease area of approximately 44

square kilometers in southwestern Saudi Arabia approximately 640 km southeast of

Jeddah. Reference is made to the map on page 20 of this Report for

information concerning the location of the Al Masane

project. Presently, the site can be accessed by heavy trucks via the

20 kilometer improved asphalt and gravel road from Sifah. The elevation of the

Al Masane project is approximately 1,620 meters above sea

level. Najran is the major town located in the area and is serviced

by air from Jeddah and Riyadh. Access from the town of Najran to the

project site is 130 km by a paved road which continues to

Sifah. There are scheduled flights from Jeddah to Abha and

Najran. From the west, there is paved road between Abha and Gusap,

and then a dirt road to the site.

Conditions to Retain

Title. The Saudi government granted the Company a mining lease

for the Al Masane area on May 22, 1993. The lease was contributed to

AMAK in December 2008. As holder of the Al Masane mining lease, the

Company has been, until December 2008, solely responsible to the Saudi Arabian

government for rental payments and other obligations required by the mining

lease and repayment of an $11 million loan. The Company’s interpretation of the

mining lease, and verified by the Ministry of Petroleum and Minerals in it’s

Letter of Approval for the transfer, is that repayment of this loan will be made

in accordance with a repayment schedule agreed upon with the Saudi Arabian

government from the Company’s share of the project’s cash flows. The initial

term of the lease is for a period of thirty (30) years beginning May 22, 1993,

with the Company (now AMAK) having the option to renew or extend the term of the

lease for additional periods not to exceed twenty (20) years. Under the lease,

the Company (now AMAK) is obligated to pay advance surface rental in the amount

of 10,000 Saudi riyals (approximately $2,667 at the current exchange rate) per

square kilometer per year (approximately $117,350 annually) during the period of

the lease. The Company paid $234,700 in March 2006, $117,300 in

February 2007, and $117,300 in February 2008 which paid the lease amounts in

full through the end of 2008. AMAK paid the lease fee in January

2009. In addition, the Company (now AMAK) must pay income tax in

accordance with the laws of Saudi Arabia then in force and pay all

infrastructure costs. The Saudi Arabian Mining Code provides that income tax is

to be paid yearly at the rate of 20% commencing immediately upon realization of

profits. The lease gives the Saudi Arabian government priority to purchase any

gold production from the project as well as the right to purchase up to 10% of

the annual production of other minerals on the same terms and conditions then

available to other similar buyers and at current prices then prevailing in the

free market. Furthermore, the lease contains provisions requiring that

preferences be given to Saudi Arabian suppliers and contractors, that the

Company employ Saudi Arabian citizens and provide training to Saudi Arabian

personnel.

History of Previous

Operations. The Al Masane project contains extensive ancient

mineral workings and smelters which were discovered by Hatem El Khalidi,

President and CEO of the Company while flying over the area and later mapped by

him on camel back during 1967. From ancient inscriptions in the area, it is

believed that mining activities occurred sporadically from 1000 BC to 700 AD.

The ancients are believed to have extracted mainly gold, silver and

copper. Various regional investigations of the Al Masane area were

carried out by the United States Geological Survey (USGS)

mission. The first systematic mapping was by Brown and Jackson who

published the Geologic Map of the Asir Quadrangle in 1959, and Greenwood carried

out

reconnaissance

mapping in 1974 of the Wadi Malahah quadrangle, which includes Al

Masane. Conway undertook geologic mapping of the area in

1976. Beginning in 1972, the Company undertook various geological,

geophysical, and geochemical surveys which lead to the discovery of the ore

lenses. In 1975, Robertson Research International (“RRI”)

reviewed the exploration program completed by the Company, prepared a

preliminary economic evaluation on the deposit and recommended ongoing

development. In 1977, the Company retained Watts, Griffis and McOuat

Limited of Toronto, Canada (WGM) to study the deposits and an underground

development program was recommended to define the tonnage and grade of the

deposit. By September 1980 a permanent exploration camp including

water supply and power plant was established. In April 1981 WGM

completed a program of 3,700 meters of underground access and development using

trackless mining equipment and 25,000 meters of underground diamond drilling and

20,000 meters of surface drilling (“Phase I”). Bulk underground

metallurgical samples were taken, and pilot plant test work was conducted at the

Colorado School of Mines Research to confirm the laboratory test work completed

previously by Lakefield Research in Canada on the drill core. This

work was financed primarily with the 1984 $11 million interest-free loan from

the Saudi Arabian Ministry of Finance. Continued surface prospecting

in the immediate area by the Company led to the discovery of the Moyeath zone in

late 1980. Although the surface expression of the gossans1 was small, preliminary diamond drilling

indicated a significant massive sulphide deposit at depth. Between

1982 and 1987, infill diamond drilling was conducted on the Al Houra and Moyeath

deposits which expanded the ore reserves. In addition, a number of

studies relating to water supply for the project were

completed. Environmental studies for the project were completed by

independent consultants in 1995 as part of the bankable feasibility

studies.

Description of Current Property

Condition. In 1982 WGM concluded that sufficient ore reserves

were established to justify completion of a fully bankable feasibility study to

determine the economic potential of establishing a commercial mining and ore

treatment operation at Al Masane. WGM determined that the Al Masane deposits

would support commercial production of copper, zinc, gold and silver and

recommended implementation of Phase II of the Al Masane development program,

which included construction of underground mining, ore treatment and support

facilities. WGM’s September 1984 reevaluation of the project resulted in no

substantial changes of its initial conclusions and

recommendations. In 1993, the Company commissioned WGM to prepare a

new fully bankable feasibility study to be used to obtain financing for

commercial development of the project. The study, which was completed in 1994,

contained specific recommendations to insure that project construction was

accomplished expeditiously and economically. The engineering design and costing

portions of the study were performed by Davy International of Toronto, Canada

(“Davy”). WGM and Davy updated this study in 1996. WGM recommended

that the Al Masane reserves be mined by underground methods using trackless

mining equipment. Once the raw ore is mined, it would be subjected to a grinding

and treating process resulting in three products to be delivered to smelters for

further refining. These products are zinc concentrate, copper concentrate and

Dore2 bullion. The copper and zinc concentrates also

contain valuable amounts of gold and silver. These concentrates and the Dore

bullion to be produced from the proposed cyanidization plant are estimated to be

22,000 ounces of gold and 800,000 ounces of silver and will be sold to copper

and zinc custom smelters and refineries worldwide. As recommended by

WGM, the source

|

1

|

“Gossan”

means the rust colored oxidized, capping or staining of a mineral deposit,

generally formed by the oxidation or alteration of iron

sulphide.

|

|

2

|

“Dore”

means unrefined gold and silver bullion bars consisting of approximately

90% precious metals which will be further refined to almost pure

metal.

|

of power

for the Al Masane site will be from diesel powered generators until such time as

the site is connected to the national power grid, which is presently 20 km from

the site.

In the

1994 feasibility study, WGM stated that there is potential to find more reserves

within the lease area, as the ore zones are all open at depth. Further diamond

drilling is required to quantify the additional mineralization associated with

these zones. A significant feature of the Al Masane ore zones is that they tend

to have a much greater vertical plunge than strike length; relatively small

surface exposures such as the Moyeath zone may be developed into sizeable ore

tonnages by thorough and systematic exploration. Similarly, systematic

prospecting of the small gossans in the area could yield significant tonnages of

new ore. The 1996 update showed the estimated capital cost to bring

the project into operation to be $89 million. At a production rate of 700,000

tons per year, the operating cost of the project (excluding concentrate freight,

ship loading, smelter charges, depreciation, interest and taxes) was estimated

to be $38.49 per ton of ore milled. The feasibility study was updated

in August of 2005, by SNC-Lavalin, Engineers and Constructors, Inc. of Toronto,

Canada using the field work and conclusions of the previous

studies. No design work or field work was performed, but the update

was designed to apply current costs and metal prices to the existing

work. The 2005 update indicates the current capital cost to be

approximately $116 million with an additional $7 million needed for the addition

of a Gold Recovery Circuit (GRC). The updated operating costs are

estimated to be $53.37 per ton of ore milled, without the GRC, or $60.01 with

the GRC.

Metal

prices were at record lows worldwide during 2003, and therefore, numerous mining

projects were not economically feasible. As prices recovered during

the 2006-2008 time period, the project became economically

viable. Despite the drop in metal prices over the last 3-4 months of

2008, if spot prices as of December 28, 2008, are used in the analysis, or even

the ten year average of prices is used, the project remains economically

attractive. Mining economics, as with other capital intensive

extractive industries such as offshore petroleum exploration, will vary over

time as market prices rise and fall with worldwide economic

performance.

The

following chart illustrates the change from the previous three year average to

current levels:

|

|

Average

Price

|

Spot

Price as of

|

Percentage

|

|

|

|

For 2006-2008

|

12/31/08

|

Increase (Decrease)

|

|

|

Gold

|

$723.00

per ounce

|

$869.75

per ounce

|

|

20.30 |

% |

|

Silver

|

$

13.30 per ounce

|

$

10.79 per ounce

|

|

(18.87 |

%) |

|

Copper

|

$ 3.16

per pound

|

$ 1.32 per

pound

|

|

(58.23 |

%) |

|

Zinc

|

$ 1.47

per pound

|

$ 0.51 per

pound

|

|

(65.31 |

%) |

Based on

the contractor’s report for December 2008, overall engineering progress on the

project was at 90%, procurement progress was at 37%, and construction progress

was at 14%. Permanent camp leveling works were in progress for

seniors’ quarters and explosives storage area, rock cutting work, crusher

station-retaining wall works, conveyor belt foundation works, and zinc flotation

tailing cyaniding/tailing head leveling were in progress. As noted

above, the estimated total capital cost to bring the Al Masane project into

production is $116 million. See Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations for a further

discussion of these matters.

Pursuant

to the mining lease agreement, when the Al Masane project is profitable the

Company was obligated to form a Saudi public stock company with the Saudi

Arabian Mining Company, a corporation wholly owned by the Saudi Arabian

government (“Ma’aden”), as successor to and

assignee

of the mining interests formerly held by the Petroleum Mineral Organization

(“Petromin”). Ma’aden is the Saudi Arabian government’s official mining company.

In 1994, the Company received instructions from the Saudi Ministry of Petroleum

and Mineral Resources stating that it is possible for the Company to form a

Saudi company without Petromin (now Ma’aden), but the sale of stock to the Saudi

public could not occur until the mine’s commercial operations were profitable

for at least two years. The instructions added that Petromin (now Ma’aden) still

had the right to purchase shares in the Saudi joint stock company any time it

desires. Title to the mining lease and the other obligations specified in the

mining lease would be transferred to the Saudi joint stock company. According to

the terms of the lease agreement the Company would remain responsible for

repaying the $11 million loan to the Saudi Arabian

government. However, as a condition of approval for transferring the

lease to AMAK in late 2008, the Ministry required the note to be transferred to

the books of AMAK.

The

Company and eight Saudi investors formed a Saudi joint stock company under the

name Al Masane Al Kobra Mining Company (AMAK) and received a commercial license

from the Ministry of Commerce in January 2008. In December 2008 the Company's

mining lease was transferred to AMAK and AMAK is constructing the mining and

treatment facilities, and will operate the mine. The basic terms of

agreement forming AMAK are as follows: (1) the capitalization is the amount

necessary to develop the project, approximately $120 million, (2) the Company

owns 50% of AMAK with the remainder being held by the Saudi investors,

(3) the Company has contributed the mining assets and mining lease for a

credit of $60 million and the Saudi investors have contributed $60 million cash,

and (4) the remaining capital for the project will be raised by AMAK by other

means which may include application for a loan from the Saudi Industrial

Development Fund, loans from private banks, and/or the inclusion of other

investors. The appraisal of the assets, which is necessary for the Company to

receive full credit toward its capital contribution is underway and is expected

to be completed in April 2009. AMAK will have all powers of

administration over the Al Masane mining project. Subsequent to the above

agreement, the cash contribution was deposited in the accounts for AMAK in

September and October of 2007. The Company has four directors

representing its interests on an eight person board of directors with the

Chairman of AMAK chosen from the directors representing the Saudi investors. The

original documents are in Arabic, and English translations have been provided to

the parties. The Board meetings are conducted in English for the

benefit of all attendees.

Rock Formations and

Mineralization. Three mineralized zones, the Saadah, Al Houra

and Moyeath, have been outlined by diamond drilling. The Saadah and

Al Houra zones occur in a volcanic sequence that consists of two mafic-felsic

sequences with interbedded exhalative cherts and metasedimentary

rocks. The Moyeath zone was discovered after the completion of

underground development in 1980. It is located along an angular

unconformity with underlying felsic volcanics and shales. The

principle sulphide minerals in all of the zones are pyrite, sphalerite, and

chalcopyrite. The precious metals occur chiefly in tetrahedrite and

as tellurides and electrum. The following table sets forth a summary

of the diluted recoverable, proven and probable mineralized materials at the Al

Masane project, along with the estimated average grades of these mineralized

materials:

|

Zone

|

|

Mineralized

Materials

(Tonnes)

|

|

|

Copper

(%)

|

|

|

Zinc

(%)

|

|

|

Gold

(g/t)

|

|

|

Silver

(g/t)

|

|

|

Saadah

|

|

|

3,872,400 |

|

|

|

1.67 |

|

|

|

4.73 |

|

|

|

1.00 |

|

|

|

28.36 |

|

|

Al

Houra

|

|

|

2,465,230 |

|

|

|

1.22 |

|

|

|

4.95 |

|

|

|

1.46 |

|

|

|

50.06 |

|

|

Moyeath

|

|

|

874,370 |

|

|

|

0.88 |

|

|

|

8.92 |

|

|

|

1.29 |

|

|

|

64.85 |

|

|

Total

|

|

|

7,212,000 |

|

|

|

1.42 |

|

|

|

5.31 |

|

|

|

1.19 |

|

|

|

40.20 |

|

For

purposes of calculating proven and probable mineralized materials, a dilution of

5% at zero grade on the Saadah zone and 15% at zero grade on the Al Houra and

Moyeath zones was assumed. A mining recovery of 80% was used for the Saadah zone

and 88% for the Al Houra and Moyeath zones. Mining dilution is the amount of

wallrack adjacent to the ore body that is included in the ore extraction

process.

Proven

mineralized materials are those mineral deposits for which quantity is computed

from dimensions revealed in outcrops, trenches, workings or drill holes, and

grade is computed from results of detailed sampling. For ore deposits to be

proven the sites for inspection, sampling and measurement must be spaced so

closely and the geologic character must be so well defined that the size, shape,

depth and mineral content of reserves are well established. Probable mineralized

materials are those for which quantity and grade are computed from information

similar to that used for proven mineralized materials, but the sites for

inspection, sampling and measurement are farther apart or are otherwise less

adequately spaced. However, the degree of assurance, although lower than that

for proven mineralized materials, must be high enough to assume continuity

between points of observation.

The

metallurgical studies conducted on the ore samples taken from the zones

indicated that 87.7% of the copper and 82.6% of the zinc could be recovered in

copper and zinc concentrates. Overall, gold and silver recovery from the ore was

estimated to be 77.3% and 81.3%, respectively, partly into copper concentrate

and partly as bullion through cyanide processing of zinc concentrates and mine

tailings. Further studies recommended by consultants may improve those

recoveries and thus the potential profitability of the project; however, there

can be no assurances of this effect. WGM was contracted by AMAK to

recalculate the reserves using the latest methods and technology. The

results are not expected to appreciably change the economics of the

project.

Other

Exploration Areas in Saudi Arabia

During

the course of its exploration and development work in the Al Masane area, the

Company has carried on exploration work in other areas in Saudi

Arabia. This work was contributed to AMAK in December

2008.

Wadi

Qatan and Jebel Harr. The Wadi Qatan area is located in southwestern

Saudi Arabia. Jebel Harr is north of Wadi Qatan. Both areas are approximately 30

kilometers east of the Al Masane area. These areas consist of 40 square

kilometers, plus a northern extension of an additional 13 square kilometers. The

Company’s geological, geophysical and limited core drilling in the past

disclosed the existence of massive sulfides containing an average of 1.2%

nickel. Reserves for these areas have not yet been classified and additional

exploration work is required. When and if AMAK obtains an exploration license

for the Wadi Qatan and Jebel Harr areas, AMAK may continue the exploratory

drilling program initiated by the Company in order to prove whether

sufficient

ore reserves exist to justify a viable mining operation; however there is no

assurance that a viable mining operation can be established.

Greater

Al Masane. On June 22, 1999, the Company submitted a formal application

for a five-year exclusive mineral exploration license for the Greater Al Masane

area of approximately 2,850 square kilometers, which surrounds the Al Masane

mining lease area and includes the Wadi Qatan and Jebel Harr areas. The Company

previously worked in the Greater Al Masane area after obtaining written

authorization from the Saudi Ministry of Petroleum and Mineral Resources, and

has expended over $2 million on exploration work. Geophysical, geochemical and

geological work and diamond core drilling on the Greater Al Masane area reveals

mineralization similar to that discovered at Al Masane. A detailed exploration

program and expenditures budget accompanied the application. The Company

indicated on its application that it would welcome the participation of Ma’aden

in this license. Ma’aden, which expressed an interest in the Greater Al Masane

area, was informed directly by the Company that its participation as a joint

venture partner in the license would be welcomed.

As

previously stated, neither AMAK nor the Company possess current formal

exploration licenses for any of the above areas. The absence of such licenses

creates uncertainty regarding AMAK’s and the Company’s rights and obligations,

if any, in these areas. The Company believes it has satisfied the Saudi Arabian

government’s requirements in these areas and that the government should honor

the Company’s (now AMAK’s) claims.

The new

Mining Code, adopted by the Saudi government in October, 2004, specifies that

the size of an exploration license cannot exceed one hundred (100) square

kilometers. However, there is no restriction on how many exploration

licenses can be held by one party simultaneously. AMAK is in the

process of identifying the best areas of the previously explored Greater Al

Masane Area. AMAK submitted application for exploration licenses for two of the

areas in question in late 2008. The applications were rejected and

will be resubmitted with additional information in early 2009.

Reference

is made to the map on page 20 of this Report for information concerning the

location of the foregoing areas.

United

States Mineral Interests

The