UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 10-K/A

(Amendment No. 1)

(MARK ONE)

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2009

OR

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Transition Period from ___________ to ________

|

Commission File Number 1-33926

ARABIAN AMERICAN DEVELOPMENT COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

75-1256622

(I.R.S. Employer

Identification No.)

|

|

1600 Hwy 6 S, Suite 240

Sugar Land, TX

(Address of principal executive offices)

|

77478

(Zip code)

|

Registrant’s telephone number, including area code: (409) 385-8300

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

(Title of Class)

Common stock, par value $0.10 per share

___________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Noý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes¨ No ý

_____________________

Indicate by check mark whether the registrant (l) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes¨ No ¨ The registrant is not yet subject to this requirement.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer ¨ Accelerated filer ý

Non-accelerated filer ¨ Smaller reporting company¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes¨ No ý

The aggregate market value on June 30, 2009, of the registrant’s voting securities held by non-affiliates was approximately $62 million.

Number of shares of registrant’s Common Stock, par value $0.10 per share, outstanding as of March 15, 2010: 23,436,745.

DOCUMENTS INCORPORATED BY REFERENCE

No documents are incorporated by reference into this report.

TABLE OF CONTENTS`

Item Number and Description

|

PART I

|

| EXPLANATORY NOTE |

1 |

| |

|

|

ITEM 1. BUSINESS

|

|

| |

General

|

2

|

| |

United States Activities

|

2

|

| |

European Activities

|

2

|

| |

Saudi Arabia Activities

|

2

|

| |

Investment In AMAK

|

3

|

| |

Environmental

|

11

|

| |

Personnel

|

13

|

| |

Competition

|

13

|

| |

Available Information

|

14

|

| |

|

|

|

ITEM 1A. RISK FACTORS

|

14

|

| |

|

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS

|

20

|

| |

|

|

|

ITEM 2. PROPERTIES

|

|

| |

United States Specialty Products Facility

|

20

|

| |

United States Mineral Interests

|

21

|

| |

Offices

|

22

|

| |

|

|

|

ITEM 3. LEGAL PROCEEDINGS

|

22

|

| |

|

|

|

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

22

|

| |

|

|

| |

PART II

|

|

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

23

|

| |

|

|

|

ITEM 6. SELECTED FINANCIAL DATA

|

24

|

| |

|

|

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

|

|

| |

Overview

|

24

|

| |

Business Environment & Risk Assessment

|

25

|

| |

Liquidity and Capital Resources

|

25

|

| |

Results of Operations

|

29

|

| |

New Accounting Standards

|

34

|

| |

Critical Accounting Policies

|

35

|

| |

|

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

37

|

| |

|

|

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

37

|

| |

|

|

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

37

|

| |

|

|

|

ITEM 9A. CONTROLS AND PROCEDURES

|

38

|

| |

|

|

|

ITEM 9B. OTHER INFORMATION

|

38

|

| |

|

|

| |

PART III

|

|

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS OF THE REGISTRANT

|

39

|

| |

|

|

|

ITEM 11. EXECUTIVE COMPENSATION

|

42

|

| |

|

|

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

52

|

| |

|

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

54

|

| |

|

|

|

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

|

56

|

| |

|

|

| |

PART IV

|

|

|

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

57

|

EXPLANATORY NOTE

We are filing this Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) to our Annual Report on Form 10-K for the fiscal year ended December 31, 2009, initially filed with the Securities and Exchange Commission on March 15, 2010 (the “Original Filing”). This Amendment No. 1 is being filed to incorporate disclosures made in connection with comment letters we received from the Security and Exchange Commission on February 23, 2010, May 7, 2010, July 1, 2010, August 31, 2010, and December 7, 2010.

The revisions do not impact the Company’s financial statements for the period ended December 31, 2009 or earlier.

The items of the Original Filing which are amended and restated by this Annual Report on Form 10-K/A

(Amendment No. 1) as a result of the foregoing are:

| |

•

|

|

Part I—Item 1—Business—Investment in AMAK—Description of Current Condition

|

|

| |

|

|

|

|

| |

•

|

|

Part I—Item 1—Business—Investment in AMAK—Cash Flows from AMAK

|

|

| |

|

|

|

|

| |

•

|

|

Part I—Item 1—Environmental

|

|

| |

•

|

|

Part I—Item 1A.—Risk Factors—Guaranteeing Performance by Third Parties

|

| |

|

|

|

| |

•

|

|

Part I—Item 1A.—Risk Factors—Inability to Recoup Investment in AMAK

|

| |

|

|

|

| |

•

|

|

Part I—Item 1B.—Unresolved Staff Comments

|

| |

•

|

|

Part II—Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Credit Agreement

|

|

| |

|

|

|

|

| |

•

|

|

Part II—Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—General Corporate Expenses—Contractual Obligations

|

|

| |

|

|

|

|

| |

•

|

|

Part II—Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Investment in AMAK

|

|

| |

•

|

|

Part III—Item 10—Directors and Executive Officers of the Registrant

|

| |

•

|

|

Part III—Item 11—Executive Compensation

|

| |

|

|

|

| |

•

|

|

Part III—Item 13—Certain Relationships and Related Transactions and Director Independence—Review, Approval or Ratification of Transaction with Management and Others

|

| |

•

|

|

Part IV—Item 15—Exhibits and Financial Statement Schedules [Note 8]

|

For the convenience of the reader, this Form 10-K/A sets forth the Original Filing in its entirety. Other than as described above, none of the other disclosures in the Original Filing have been amended or updated. Among other things, forward-looking statements made in the Original Filing have not been revised to reflect events that occurred or facts that became known to the Company after the filing of the Original Filing, and such forward-looking statements should be read in their historical context. Accordingly, this Annual Report on Form 10-K/A should be read in conjunction with the Company’s filings with the Securities and Exchange Commission subsequent to the Original Filing.

PART I

Item 1. Business

General

Arabian American Development Company (the “Company”) was incorporated in the State of Delaware in 1967. The Company’s principal business activities include manufacturing various specialty petrochemical products and owning an interest in a Saudi Arabian joint stock mining company and in mineral properties in the United States. Unless the context requires otherwise, references to “we,” “us,” “our,” and the “Company” are intended to mean consolidated Arabian American Development Company and its subsidiaries.

Prior to 2009 the Company operated in 2 business segments, petrochemical and mining. As a result of the transfer in December 2008 of the Company’s mining assets located in Saudi Arabia to the joint stock company, Al Masane Al Kobra (“AMAK”), we now operate in only one segment, petrochemical. See Note 16 to the Consolidated Financial Statements.

United States Activities

The Company’s domestic activities are primarily conducted through a wholly owned subsidiary, American Shield Refining Company (the “Petrochemical Company”), which owns all of the capital stock of Texas Oil and Chemical Co. II, Inc. (“TOCCO”). TOCCO owns all of the capital stock of South Hampton Resources Inc. (“South Hampton”), and South Hampton owns all of the capital stock of Gulf State Pipe Line Company, Inc. (“Gulf State”). South Hampton owns and operates a specialty petrochemical facility near Silsbee, Texas which produces high purity petrochemical solvents and other petroleum based products including iso-pentane, normal pentane, isohexane and hexane which may be used in the production of polyethylene, packaging, polypropylene, expandable polystyrene, poly-iso/urethane foams, and in the catalyst support industry. The Company’s petrochemical products are typically transported to customers by rail car, tank truck and iso-container. Gulf State owns and operates three pipelines which connect the South Hampton facility to a natural gas line, to South Hampton’s truck and rail loading terminal and to a major petroleum products pipeline owned by an unaffiliated third party. The Company also directly owns approximately 55% of the capital stock of a Nevada mining company, Pioche-Ely Valley Mines, Inc. (“Pioche”). Pioche did not conduct any substantial business activity during 2009, and the Company has no plans to make any capital expenditures in the near term involving Pioche. See Item 2. Properties.

European Actitivies

In 2009 the Company formed South Hampton Resources International, SL (“SHRI”) which is located in Spain. The Company owns 100% of the capital stock of SHRI. SHRI serves as a sales office for South Hampton products in Europe and the Middle East.

Saudi Arabia Activities

Prior to December 2008, the Company held a thirty (30) year mining lease (which commenced on May 22, 1993) covering an approximate 44 square kilometer area in the Al Masane area in western Najran province in southwestern Saudi Arabia. The lease carries an option to renew or extend the term of the lease for additional periods not to exceed twenty (20) years. The lease and other related assets located in Saudi Arabia were contributed to Al Masane Al Kobra Mining Company (“AMAK”) in December 2008 in return for a 50% ownership interest in AMAK, which was subsequently reduced to a 41% ownership interest as discussed below. The above-ground ore processing facility is currently under construction and is scheduled to be completed in 2010. Underground work on the mine is estimated to be complete mid-2011. If work progresses as scheduled, the mine should be fully operational in mid-2011.

In 1999 the Company applied for an exploration license covering an area of approximately 2,850 square kilometers surrounding the mining lease area, where it had previously explored with the written permission of the Saudi Ministry of Petroleum and Mineral Resources. In 2005 the Saudi Mining Code was changed which necessitated the re-submission of these applications and the re-submission is being prepared in the format required by the new Code. The information relating to these areas was also transferred to AMAK, and new applications are being submitted in the name of AMAK. See “Investment in AMAK” below for additional discussion regarding all of the Company’s properties and financing of the Al Masane project.

Note 16 to the Consolidated Financial Statements contains information regarding the Company’s industry segments and geographic financial information for the years ended December 31, 2009, 2008 and 2007. In addition, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for a discussion of the Company’s liquidity, capital resources and operating results.

Investment in AMAK

Location, Access and Transportation

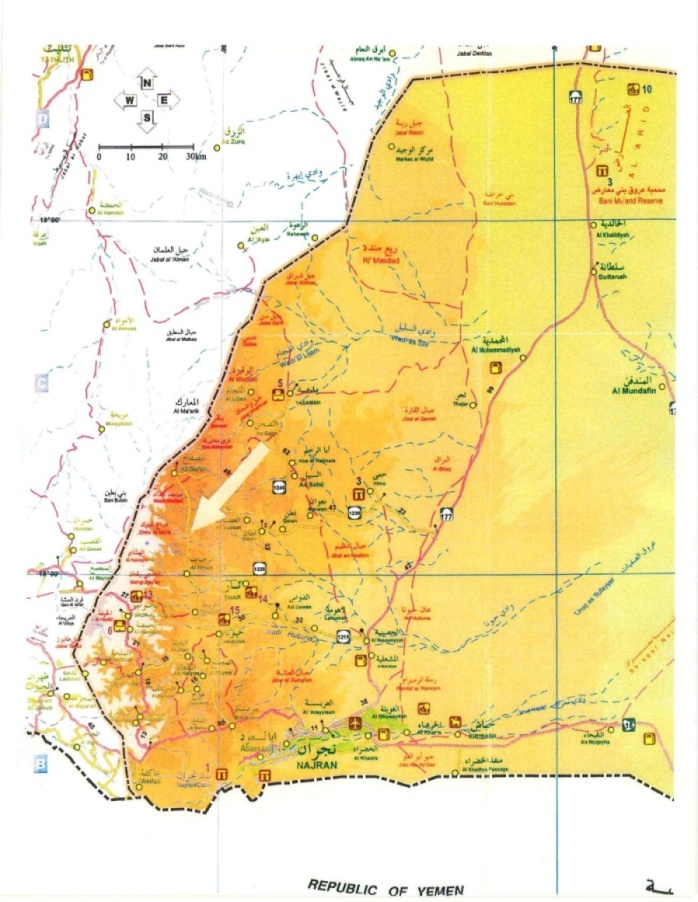

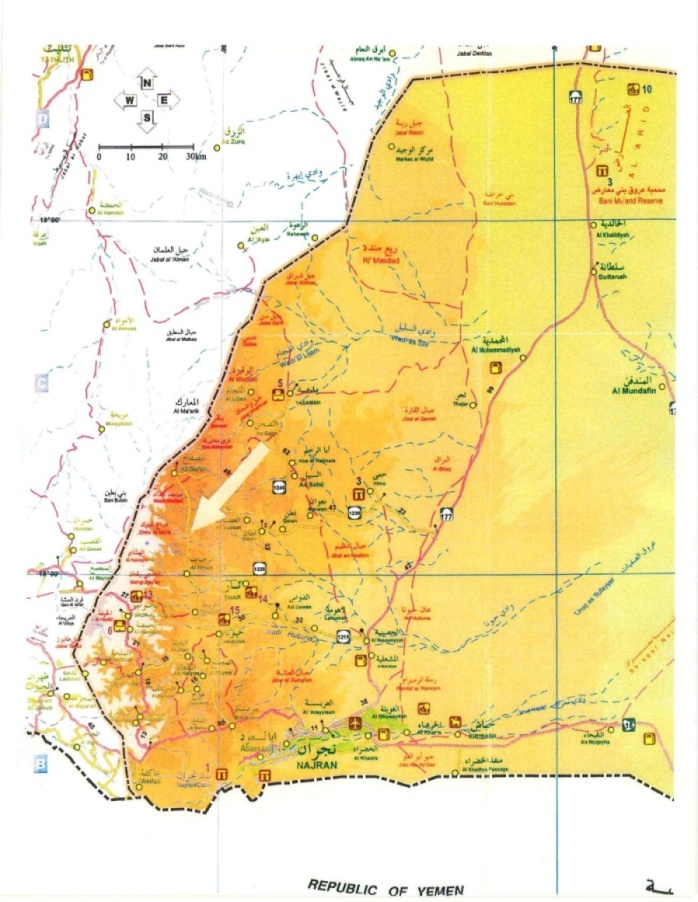

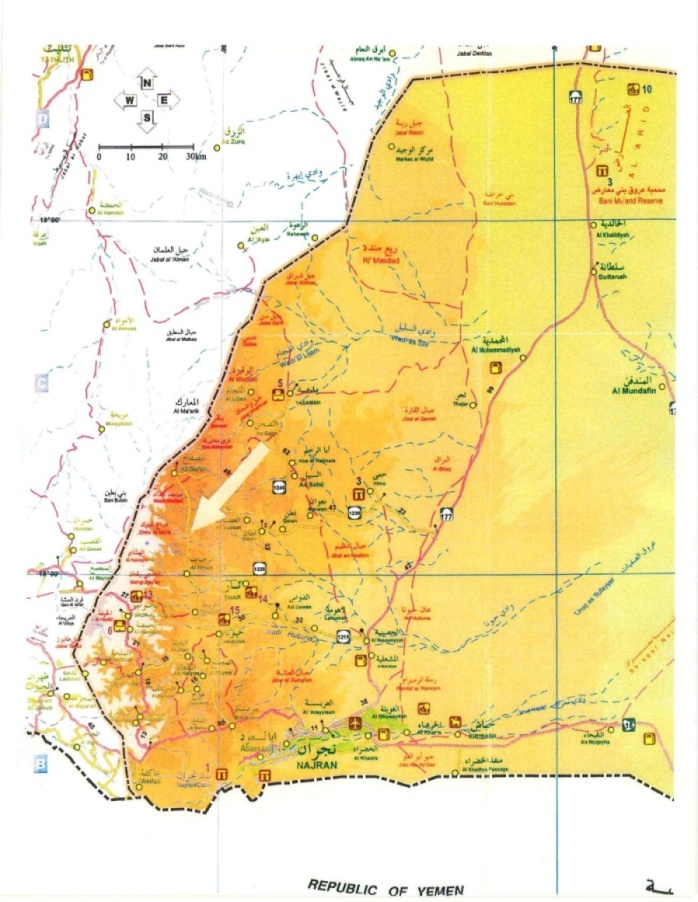

The project site is located in the Najran province in southwestern Saudi Arabia. Najran, the capital of the province of the same name, is approximately 700 km southesast of Jeddah and is served by regularly scheduled air service with other parts of the Kingdom. The project site is located 25 km northwest of the Najran, midway between the outpost of Rihab and the district town of Sufah. A modern, paved highway extends from Najran through the town of Habuna passing by the project site and on to Sufah (see map on page 11). Another modern, paved highway extends west from the town of Tirima about 30 km to the Asir provincial line, becomes a four-lane divided highway, and intersects with a highway leading to Khamis Mushait and Abha. A joining highway then extends down the western slope of the Sarawat mountains to the coastal highway which follows the coast south to the port of Jizan. The latter will be the route for AMAK’s trucks carrying copper and zinc concentrate to the port for export.

Conditions to Retain Title

The Saudi government granted the Company a mining lease for the Al Masane area on May 22, 1993 (the “Lease”). The Lease was assigned to AMAK in December 2008. As holder of the Lease, the Company was, until December 2008, solely responsible to the Saudi Arabian government for rental payments and other obligations required by the Lease, as well as, repayment of an $11 million loan. According to the terms of the Lease, the Company would remain responsible for repaying the $11 million note to the Saudi Arabian government. However, as a condition of approval for transferring the Lease to AMAK in late 2008, the Ministry required the $11 million note to be transferred to the books of AMAK. The initial term of the Lease is thirty years beginning May 22, 1993, with AMAK having the option to renew or extend the term of the Lease for additional periods not to exceed twenty years. Under the Lease, AMAK is obligated to pay advance surface rental in the amount of 10,000 Saudi riyals (approximately $2,667 at the current exchange rate) per square kilometer per year approximately $117,300 annually) during the term of the Lease. The Company paid $117,300 in February 2007 and $117,300 in February 2008 which covered the rent in full through the end of 2008. AMAK paid the Lease fee in January 2009. In addition, AMAK must pay income tax in accordance with the laws of Saudi Arabia and pay all infrastructure costs. The Lease gives the Saudi Arabian government priority to purchase any gold production from the project, as well as, the right to purchase up to 10% of the annual production of other minerals on the same terms and conditions then available to other similar buyers and at current prices then prevailing in the free market. Furthermore, the Lease contains provisions requiring that preferences be given to Saudi Arabian suppliers and contractors, that AMAK employ Saudi Arabian citizens and provide training to Saudi Arabian personnel.

History of Previous Operations

The Al Masane project is located in an area which contains extensive ancient mineral workings and smelters that were discovered by Hatem El Khalidi, the recently retired president and CEO of the Company, while flying over the area and later mapped by him on camel back during 1967. From ancient inscriptions in the area, it is believed that mining activities occurred sporadically from 1000 BC to 700 AD. The ancients are believed to have extracted mainly gold, silver and copper. There is an often suggested possibility that this area was where Queen Bilquis of Saba (the biblical Queen of Sheba) discovered her great wealth. Various regional investigations of the Al Masane area were carried out by a United States Geological Survey (USGS) mission. The first systematic mapping was by Brown and Jackson who published the Geologic Map of the Asir Quadrangle in 1959, and Greenwood carried out reconnaissance mapping in 1974 of the Wadi Malahah quadrangle, which includes Al Masane. Conway undertook geologic mapping of the area in 1976. Beginning in 1972, the Company undertook various geological, geophysical, and geochemical surveys which led to the discovery of the ore lenses. In 1975 Robertson Research International (“RRI”) reviewed the exploration program completed by the Company, prepared a preliminary economic evaluation on the deposit and recommended ongoing development. In 1977 the Company retained Watts, Griffis and McOuat Limited of Toronto, Canada (WGM) to study the deposits and an underground development program was recommended to define the tonnage and grade of the deposit. By September 1980 a permanent exploration camp including water supply and power plant was established. In April 1981 WGM completed a program of 3,700 meters of underground access and development using trackless mining

equipment and 25,000 meters of underground diamond drilling and 20,000 meters of surface drilling (“Phase I”). Bulk underground metallurgical samples were taken, and pilot plant test work was conducted at the Colorado School of Mines Research to confirm the laboratory test work completed previously by Lakefield Research in Canada on the drill core. This work was financed primarily with the 1984 $11 million interest-free loan from the Saudi Arabian Ministry of Finance. Continued surface prospecting in the immediate area by the Company led to the discovery of the Moyeath zone in late 1980. Although the surface expression of the mineralization was small, preliminary diamond drilling indicated a significant massive sulphide deposit at depth. Between 1982 and 1987, infill diamond drilling was conducted on the Al Houra and Moyeath deposits which expanded the ore reserves. In addition, a number of studies relating to water supply for the project were completed. Environmental studies for the project were completed by independent consultants in 1995 as part of the feasibility studies.

Description of Current Condition

In 1982 WGM conducted a feasibility study on the project. This study was updated first in 1994 by WGM and later in 2005 by SNC Lavalin. WGM was subsequently engaged to provide an Australasian Joint Reserves Committee (“JORC”) compliant reserve estimate and also to model the ore reserves and provide a mining plan. AMAK plans to subcontract the entire mining operation and has engaged SRK Beijing to prepare the Invitation to Bid (ITB) documents. Commissioning of the process plant is dependent on the mine providing ore at the design grades and tonnages, so the appointment of a mining contractor is critical to the project.

Beijing General Research Institute of Mining and Metallurgy (BGRIMM) conducted a metallurgical test-work program to verify the process-flow, grades and recoveries put forward in the bid document, which was based on earlier studies. The comprehensive program validated the original results and also led to a few modifications to the process. Cyanide leaching tests of the zinc concentrate and the flotation tailings indicate that gold and silver could be recovered from these streams. The basis of design is a plant throughput of 83 t/h with copper recoveries of 85% at a grade of 25% copper and a zinc recovery of 82% at a grade of 55% zinc. The mass balance is compliant with the grades and tonnages specified in the ITB documents.

In 2007 prior to the transfer of our assets, AMAK began negotiations with a Chinese company, China National Geological and Mining Corporation (CGM), for a turnkey processing plant. NESMA, a Saudi engineering and contracting firm, then became involved as the prime contractor. AMAK subsequently entered into an engineering, procurement and construction turnkey (EPC) contract with NESMA and Partners (NESMA) on November 26, 2007 for the construction of its surface facilities at the AMAK mine. The scope of work comprised:

|

•

|

EPC, commissioning and handover of the ore-treatment plant,

|

|

•

|

EPC, commissioning and handover of the related infrastructure facilities,

|

|

•

|

EPC, commissioning and handover of the concentrate storage and handling facilities at the port of Jizan, which is approximately 460km from the mine.

|

The concentrator comprises:

|

•

|

SAG milling and pebble crushing,

|

|

•

|

Secondary ball milling,

|

|

•

|

Copper and zinc flotation,

|

|

•

|

Concentrate thickening,

|

|

•

|

Reagent handling, make-up and distribution,

|

|

•

|

Tailings-dam constructions, and

|

|

•

|

Utilities and related infrastructure.

|

Related infrastructure includes a 300 men capacity camp for single status accommodation for expatriates and Saudi employees, an on-site medical facility, a service building for 300 employees, on-site diesel generation of 10 megawatts prior to connection to the national grid, potable water supply, sewage treatment plant and an assay laboratory.

The port of Jizan comprises:

|

•

|

Concentrate storage, and

|

|

•

|

Reclamation and ship-loading facilities.

|

NESMA signed a back-to-back contract with CGM for the entire EPC contract. There is a possibility that CGM will sign a further contract with AMAK for the mine development and the operation of the entire facility. There is also the possibility that AMAK will contract the underground portion of the work to a separate contractor. The contract signed between AMAK and NESMA was for the sum of $110,828,000 and the surface plant subcontract awarded to CGM by NESMA is valued at $96,000,000.

BGRIMM, who acts as a subcontractor to CGM, has been responsible for the overall design of the plant, including the civil, mechanical and structural, electrical and process aspects. The basic design documents formed part of the bid document. The detailed engineering drawings were found by Behre Dolbear International Limited (Behre Dolbear) to be of a high standard comparable with western-style projects. Equipment throughput and availabilities were all specified in the ITB document.

Based on NESMA’s report for December 2009, overall engineering progress on the ore-treatment plant and related infrastructure facilities was at 99.29%, procurement progress was at 98.44%, and construction progress was at 71%. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for a further discussion of these matters.

In the 1994 feasibility study, WGM stated that there is potential to find more reserves within the Lease area, as the ore zones are all open at depth. Further diamond drilling is required to quantify the additional mineralization associated with these zones. A significant feature of the Al Masane ore zones is that they tend to have a much greater vertical plunge than strike length; relatively small surface exposures such as the Moyeath zone may be developed into sizeable ore tonnages by thorough and systematic exploration. Similarly, systematic prospecting of the small surface indicators of mineralization in the area could yield significant tonnages of new ore. Updates to the feasibility study were completed in 1996, 2005 and July 2009. The 2009 update indicates the current capital cost to be approximately $166.4 million. The updated operating costs are estimated to be approximately $63.24 per ton of ore milled.

Metal prices were at record lows worldwide during 2003, and therefore, numerous mining projects were not economically feasible. As prices recovered during the 2007-2009 time period, the project became economically viable. If spot prices as of December 31, 2009, are used in the analysis, or even the three year average of prices is used, our investment in AMAK remains economically viable. Mining economics, as with other capital intensive extractive industries such as offshore petroleum exploration, will vary over time as market prices rise and fall with worldwide economic performance.

The following chart illustrates the change from the previous three year average to current levels:

| |

Average Price

|

Spot Price as of

|

|

Percentage

|

|

| |

For 2007-2009

|

12/31/09

|

|

Increase

|

|

|

Gold

|

$846.00 per ounce

|

$1,087.00 per ounce

|

|

|

28.49 |

% |

|

Silver

|

$ 14.34 per ounce

|

$ 16.90 per ounce

|

|

|

17.85 |

% |

|

Copper

|

$ 2.91 per pound

|

$ 3.33 per pound

|

|

|

14.43 |

% |

|

Zinc

|

$ 1.02 per pound

|

$ 1.17 per pound

|

|

|

14.71 |

% |

Pursuant to the Lease, when the Al Masane project became viable the Company was obligated to form a Saudi public stock company with the Saudi Arabian Mining Company, a corporation wholly owned by the Saudi Arabian government (“Ma’aden”), as successor to and assignee of the mining interests formerly held by the Petroleum Mineral Organization (“Petromin”). Ma’aden is the Saudi Arabian government’s official mining company. In 1994, the Company received instructions from the Saudi Ministry of Petroleum and Mineral Resources stating that it was possible for the Company to form a Saudi company without Petromin (now Ma’aden), but the sale of stock to the Saudi public could not occur until the mine’s commercial operations were profitable for at least two years. The instructions added that Petromin (now Ma’aden) still had the right to purchase shares in the Saudi joint stock company any time it desires. Title to the Lease and the other obligations specified in the Lease would be transferred to the Saudi joint stock company. According to the terms of the Lease, the Company would remain responsible for repaying the $11 million note to the Saudi Arabian government. However, as a condition of approval for transferring the Lease to AMAK in late 2008, the Ministry required the $11 million note to be transferred to the books of AMAK.

The Company and eight Saudi investors formed a Saudi joint stock company under the name Al Masane Al Kobra Mining Company (AMAK) and received a commercial license from the Ministry of Commerce in January 2008. In December 2008 the Company's mining lease and certain other assets and liabilities were transferred to AMAK. AMAK is constructing the mining and treatment facilities, and will operate the mine. The basic terms of agreement forming AMAK as initially understood by the Company were as follows: (1) the capitalization was the amount necessary to develop the project, approximately $120 million, (2) the Company owned 50% of AMAK with the remainder being held by the Saudi investors, (3) the Company contributed the mining assets and mining lease and the Saudi investors contributed $60 million cash, and (4) the remaining capital for the project would be raised by AMAK by other means which may include application for a loan from the Saudi Industrial Development Fund, loans from private banks, and/or the inclusion of other investors. The Company’s $11 million note payable to the Saudi government was transferred to AMAK in December 2008 and reconfirmed in August 2009 in connection with the letter agreement.

AMAK has all powers of administration over the Al Masane mining project. Subsequent to the above agreement, the cash contribution was deposited in the accounts for AMAK in September and October of 2007. The Company has four directors representing its interests on an eight person board of directors with the Chairman of AMAK chosen from the directors representing the Saudi investors, although the Company’s current level of representation on the Board is subject to change on August 25, 2012 as described below. The Bylaws provide that the Chairman position shall be held by a Saudi investor. The original formation documents are in Arabic, and English translations have been provided to the parties. The Board meetings are conducted in English for the benefit of all attendees.

During an April 2009 AMAK Board meeting, the validity of the Partnership Agreement between the Company and the Saudi investors which had been relied upon by the Company as the operating document since it was signed was questioned. Issues raised included: discrepancies between the terms of the original Memorandum of Understanding and the Partnership Agreement; an allegation that various signatures for one or more of the Saudi investors on the Partnership Agreement were not authorized; the Saudi attorney who prepared the Partnership Agreement exceeded his authority; and whether the Company’s capital contribution for 50% of AMAK’s stock was fully paid. The Company had relied upon the Partnership Agreement for the past year.

After extensive research, investigation and deliberation, the Board of Directors of the Company determined that while the documents relating to the formation of AMAK were poorly drafted and ambiguous in certain areas, a business decision should be made to settle the dispute and move the project forward rather than spend time and legal fees resolving the issues in the judicial arena of Saudi Arabia, with the outcome uncertain and potentially damaging to the progress of the venture. The Company and Saudi investors reached a definitive written agreement effective August 25, 2009, with the following terms and conditions: (1) The Company conveyed nine percent or 4,050,000 shares of AMAK

stock to the other AMAK shareholders pro rata; (2) The Articles of Association and Bylaws of AMAK will be amended to reflect that: (a) the Company has fully and completely paid the subscription price for 18,450,000 shares of AMAK stock (or 41% of the issued and outstanding shares), (b) neither AMAK nor the other AMAK shareholders may require the Company to make an additional capital contribution without the Company’s written consent, and (c) the Company shall retain seats on the AMAK Board equal in number to that of the Saudi Arabian shareholders for a three year period beginning August 25, 2009; (3) AMAK will assume the $11 million note from the Saudi Arabian Ministry of Finance & National Economy Loan to the Company, dated January 24, 1979, and will indemnify and defend the Company against any and all claims related to said note; (4) For a three year period commencing August 25, 2009, the Company has the option to repurchase from the Saudi Arabian shareholders 4,050,000 shares of AMAK stock at a price equal to the then fair market value of said shares less ten percent; and (5) the two Memorandums of Understanding dated May 21, 2006 and June 10, 2006 respectively, as well as the Partnership Agreement dated August 6, 2006, are terminated for all purposes. The Company prepared draft amendments to the AMAK Articles of Association and Bylaws to reflect the above. These documents are currently under consideration by the Saudi Arabian shareholders and are expected to be filed with Ministry of Commerce in the upcoming weeks. Copies of the two Memorandums, Partnership Agreement, and AMAK Articles of Association and Bylaws are attached as exhibits.

Initially, the Company accounted for its investment in AMAK using the equity method of accounting under the presumption that since it owned more than 20% of AMAK, the Company would have the ability to exercise significant influence over the operating and financial policies of AMAK. AMAK’s bylaws require that audited financial statements for each year ended December 31 be submitted to its stockholders by June 30 of the following year. As a result, the Company had expected to obtain the audited financial statements of AMAK by June 30, 2009, and in addition the Company expected to be able to secure the cooperation of AMAK and its auditors in converting those financial statements from generally accepted accounting principles in Saudi Arabia (“Saudi GAAP”) to U.S. generally accepted accounting principles (“U.S. GAAP”). However, by August 2009, no financial statements of AMAK had been produced. In May 2010 the Company received a draft of the 2009 financial statements of AMAK prepared under Saudi Arabian GAAP. At that time the Company introduced a resolution at a meeting of the AMAK Board of Directors that would have required AMAK to produce the annual and quarterly financial statements prepared in accordance with U.S. GAAP which the Company required in order to apply the equity method of accounting for the investment. The resolution was defeated as the result of the casting of the tie breaking vote held by the Saudi Chairman of the Board. Consequently, the Company concluded that since August 2009 it no longer had significant influence over the operating and financial policies of AMAK, and the Company changed to the cost method of accounting for its investment in AMAK. The Company recorded its cost method investment in AMAK at the carrying amount of its equity method investment at the date the method of accounting was changed. Also see risk factor disclosure titled “Inability to significantly influence AMAK activities” on page 18.

Going forward, the lack of ability to exert significant influence basically means that the Company holds a passive ownership interest in AMAK. The AMAK Saudi directors have taken the lead in dealing with: (i) the various contractors who are constructing the underground and above ground mining facilities, (ii) personnel issues, (iii) credit facilities from third party lenders, and (iv) consultants assisting in various phases of mine development. The Company believes that it has developed a good working relationship with the other AMAK stockholders and feels comfortable with allowing the AMAK Saudi directors to oversee the operation, especially since the project is located in their region and they are better qualified to deal with cultural issues and other unique aspects of doing business in Saudi Arabia. Periodically the Company makes suggestions as to how the operation could be improved and generally the AMAK Saudi directors have been receptive to these ideas.

Cash Flows from AMAK

The Company’s investment in AMAK will produce cash flows to the Company at such time as AMAK pays dividends. The Company anticipates that AMAK may have the ability to begin paying dividends once it has commenced commercial operations, and its cash flows from those operations are sufficient to pay dividends after AMAK first services its $100 million credit facility and AMAK’s Board of Directors sets aside cash for required statutory reserves and any other reserves its Board of Directors believes are necessary and appropriate. Since the Company has no significant influence over AMAK’s Board of Directors, the amount and timing of the dividends the Company receives from AMAK will be controlled by the other investors in AMAK.

AMAK will nonetheless not begin paying any dividends until it has commenced commercial production and achieved positive operating cash flows. AMAK’s current development plans call for underground development to begin in early 2011 with small quantities of ore being processed in the mill and gradually increasing over time as the underground

tunnels, vent shafts and turnarounds are constructed. Metal concentrates will be trucked to the Port of Jizan and stored until such time as there are quantities sufficient to fill a transport ship. Once the mine is at 100% capacity, approximately four ships a year will be loaded with metal concentrates. Cash flows to AMAK from the sale of its production will be delayed due to shipping times unless AMAK can successfully negotiate partial payment from customers at the time the metal concentrates are loaded.

As a result of the foregoing, the Company does not anticipate receiving any substantial cash flows from its investment in AMAK until 2013 at the earliest, and there can be no assurance as to the amount or timing of any cash flows the Company will receive from its investment in AMAK.

The Company will test its investment in AMAK to determine if it is impaired at least annually and at other times if circumstances arise that indicate that impairment may have occurred. The AMAK investment will be considered impaired if its fair value is less than its recorded amount at the time of the impairment test. In such instances, the recorded amount of the AMAK investment will be reduced to its fair value. The fair value of the Company’s investment in AMAK will be estimated by using updated estimates of AMAK’s recoverable ore reserves and the amount and timing of the cash flows to be generated by the production of those reserves.

Other Exploration Areas in Saudi Arabia

During the course of its exploration and development work in the Al Masane area, the Company carried on exploration work in other areas in Saudi Arabia. Results of this work were also contributed to AMAK in December 2008.

In 1971 the Saudi Arabian government awarded the Company exclusive mineral exploration licenses to explore for and develop the Wadi Qatan area in southwestern Saudi Arabia. The Company was subsequently awarded an additional license in 1977 for an area north of Wadi Qatan at Jebel Harr. These licenses have expired. On June 22, 1999, the Company submitted a formal application for a five-year exclusive exporation license for the Greater Al Masane area of approximately 2,850 square kilometers that surrounds the Al Masane mining lease area and includes the Wadi Qatan and Jebel Harr areas. Although a license had not been formally granted for the Greater Al Masane area, the Company was authorized in writing by the Saudi Arabian government to carry out exploration work on the area. The Company previously worked the Greater Al Masane area after obtaining written authorization from the Saudi Ministry of Petroleum and Mineral Resources, and has expended over $2 million in exploration work. Geophysical, geochemical and geological work and diamond core drilling on the Greater Al Masane area had revealed mineralization similar to that discovered at Al Masane.

Prior to December 31, 2008, the Company incurred deferred exploration and development costs in the amount of approximately $2.4 million, consisting of approximately $1.5 million associated with the Greater Al Masane area and the balance of approximately $0.9 million was associated primarily with the Wadi Qatan and Jebel Harr areas.

The related rights to the licenses in the Greater Al Masane, Wadi Qatan and Jebel Harr areas were transferred to AMAK in December 2008, as part of the Company’s capital contribution to AMAK. These $2.4 million in deferred exploration and development costs are an asset of AMAK and the fact that the related benefit of these costs incurred would benefit AMAK in the future. The Company was informed prior to the transfer of licenses that the Saudi Arabian Mining Code was undergoing significant revision and was advised by the Saudi Arabian Ministry of Petroleum and Minerals to delay the reapplication for those area licenses until the transfer of the existing mining licenses were completed by AMAK. Once the transfer was complete, AMAK reapplied for those licenses. AMAK has received positive feedback from the Ministry as of March 8, 2010, concerning these licenses but expects that it will take several months for the documentation to work its way through the governmental process.

Wadi Qatan and Jebel Harr

The Wadi Qatan area is located in southwestern Saudi Arabia. Jebel Harr is north of Wadi Qatan. Both areas are approximately 30 kilometers east of the Al Masane area. These areas consist of 40 square kilometers, plus a northern extension of an additional 13 square kilometers. The Company’s geological, geophysical and limited core drilling in the past disclosed the existence of massive sulfides containing an average of 1.2% nickel. Reserves for these areas have not yet been classified and additional exploration work is required. When and if AMAK obtains an exploration license for the Wadi Qatan and Jebel Harr areas, AMAK may continue the exploratory drilling program initiated by the Company in order to prove whether sufficient ore reserves exist to justify a viable mining operation; however there is no assurance that a viable mining operation can be established.

Greater Al Masane

The new Mining Code, adopted by the Saudi government in October, 2004, specifies that the size of an exploration license cannot exceed one hundred (100) square kilometers. However, there is no restriction on how many exploration licenses can be held by one party simultaneously. AMAK is in the process of identifying the best areas of the previously explored Greater Al Masane Area. AMAK submitted applications for exploration licenses for two of the areas in question in late 2008. The applications were rejected due to difficulties with the survey information attached to the applications. AMAK resubmitted the application for a mining license in 2009 and is currently awaiting approval from the Ministry.

Reference is made to the map on page 10 of this Report for information concerning the location of the foregoing areas.

With respect to accrued salaries and termination benefits due employees working in Saudi Arabia, the Company has continued employing these individuals to meet the needs of the corporate office in Saudi Arabia. Upon finalization of the transfer of the lease and the assets to AMAK, the Board voted to terminate the employees and give them an opportunity to apply for work with AMAK if they chose. Funds to pay severance and any back pay were transferred to the Company’s bank account in Saudi Arabia in January 2009, and the termination process began during 2009. As of December 31, 2009, the Company had terminated 13 of the 20 employees working in Saudi Arabia at a cost of $683,000. The Company estimates another $392,000 in accrued salaries and termination benefits is due the remaining Saudi Arabian employees. The Company anticipates that all of the Saudi Arabian employees will either be terminated or transferred to AMAK no later than June 30, 2010.

[

Environmental

General. The Company’s operations are subject to stringent and complex federal, state, local and foreign laws and regulations relating to release of hazardous substances or wastes into the environment or otherwise relating to protection of the environment. As with the industry generally, compliance with existing and anticipated environmental laws and regulations increases the Company’s overall costs of doing business, including costs of planning, constructing, and operating plants, pipelines, and other facilities. Included in the Company’s construction and operation costs are capital cost items necessary to maintain or upgrade equipment and facilities. Similar costs are likely upon changes in laws or regulations and upon any future acquisition of operating assets.

Any failure to comply with applicable environmental laws and regulations, including those relating to equipment failures and obtaining required governmental approvals, may result in the assessment of administrative, civil or criminal penalties, imposition of investigatory or remedial activities and, in less common circumstances, issuance of injunctions or construction bans or delays. The Company believes that it currently hold all material governmental approvals required to operate the Company’s major facilities. As part of the regular overall evaluation of the Company’s operations, the Company has implemented procedures to review and update governmental approvals as necessary. The Company believes that its operations and facilities are in substantial compliance with applicable environmental laws and regulations and that the cost of compliance with such laws and regulations currently in effect will not have a material adverse effect on the Company’s operating results or financial condition.

The clear trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment, and thus there can be no assurance as to the amount or timing of future expenditures for environmental compliance or remediation, and actual future expenditures may be different from the amounts the Company currently anticipates. Moreover, risks of process upsets, accidental releases or spills are associated with the Company’s possible future operations, and the Company cannot assure you that the Company will not incur significant costs and liabilities, including those relating to claims for damage to property and persons as a result of any such upsets, releases, or spills. In the event of future increases in environmental costs, the Company may be unable to pass on those cost increases to the Company’s customers. A discharge of hazardous substances or wastes into the environment could, to the extent losses related to the event are not insured, subject us to substantial expense, including both the cost to comply with applicable laws and regulations and to pay fines or penalties that may be assessed and the cost related to claims made by neighboring landowners and other third parties for personal injury or damage to natural resources or property. The Company will attempt to anticipate future regulatory requirements that might be imposed and plan accordingly to comply with changing environmental laws and regulations and to minimize costs with respect to more stringent future laws and regulations of more rigorous enforcement of existing laws and regulations.

Hazardous Substance and Waste. To a large extent, the environmental laws and regulations affecting the Company’s operations relate to the release of hazardous substances or solid wastes into soils, groundwater and surface water, and include measures to prevent and control pollution. These laws and regulations generally regulate the generation, storage, treatment, transportation and disposal of solid and hazardous wastes, and may require investigatory and corrective actions at facilities where such waste may have been released or disposed. For instance, the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, also known as the “Superfund” law, and comparable state laws, impose liability without regard to fault or the legality of the original conduct, on certain classes of persons that contributed to a release of “hazardous substance” into the environment. Potentially liable persons include the owner or operator of the site where a release occurred and companies that disposed or arranged for the disposal of the hazardous substances found at the site. Under CERCLA, these persons may be subject to joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources, and for the costs of certain health studies. CERCLA also authorizes the EPA and, in some cases, third parties to take actions in response to threats to the public health or the environment and to seek to recover from the potentially responsible classes of persons the costs they incur. The Company has not received any notification that it may be potentially responsible for cleanup costs under CERCLA or any analogous federal or state laws, except as expressly provided herein.

The Company also generates, and may in the future generate, both hazardous and nonhazardous solid wastes that are subject to requirements of the federal Resource Conservation and Recovery Act, or RCRA, and/or comparable state statutes. From time to time, the Environmental Protection Agency, or EPA, and state regulatory agencies have considered the adoption of stricter disposal standards for nonhazardous wastes, including crude oil and natural gas wastes. Moreover, it is possible that some wastes generated by us that are currently classified as nonhazardous may

in the future be designated as “hazardous wastes,” resulting in the wastes being subject to more rigorous and costly management and disposal requirements.

Air Emissions. The Company’s current and future operations are subject to the federal Clean Air Act and comparable state laws and regulations. These laws and regulations regulate emissions of air pollutants from various industrial sources, including the Company’s facilities, and impose various monitoring and reporting requirements. Pursuant to these laws and regulations, the Company may be required to obtain environmental agency pre-approval for the construction or modification of certain projects or facilities expected to produce air emissions or result in an increase in existing air emissions, obtain and comply with the terms of air permits, which include various emission and operational limitations, or use specific emission control technologies to limit emissions. The Company likely will be required to incur certain capital expenditures in the future for air pollution control equipment in connection with maintaining or obtaining governmental approvals addressing air-emission related issues. Failure to comply with applicable air statutes or regulations may lead to the assessment of administrative, civil or criminal penalties, and may result in the limitation or cessation of construction or operation of certain air emission sources. The Company believes such requirements will not have a material adverse effect on the Company’s financial condition or operating results, and the requirements are not expected to be more burdensome to us than any similarly situated company.

Climate Change. In response to concerns suggesting that emissions of certain gases, commonly referred to as “greenhouse gases” (including carbon dioxide and methane), may be contributing to warming of the Earth’s atmosphere, the U.S. Congress is actively considering legislation to reduce such emissions. In addition, at least one-third of the states, either individually or through multi-state regional initiatives, have already taken legal measures intended to reduce greenhouse gas emissions, primarily through the planned development of greenhouse gas emission inventories and/or greenhouse gas cap and trade programs. In addition, EPA is taking steps that would result in the regulation of greenhouse gases as pollutants under the federal Clean Air Act. Furthermore, in September 2009 EPA finalized regulations that require monitoring and reporting of greenhouse gas emissions on an annual basis including extensive greenhouse gas monitoring and reporting requirements beginning in 2010. Although the greenhouse gas reporting rule does not control greenhouse gas emission levels from any facilities, it will still cause us to incur monitoring and reporting costs for emissions that are subject to the rule. Some of the Company’s facilities include source categories that are subject to the greenhouse gas reporting requirements included in the final rule. In December 2009 EPA also issued findings that greenhouse gases in the atmosphere endanger public health and welfare, and that emissions from mobile sources cause or contribute to greenhouse gases in the atmosphere. The endangerment findings will not immediately affect the Company’s operations, but standards eventually promulgated pursuant to these findings could affect the Company’s operations and ability to obtain air permits for new or modified facilities. Legislation and regulations relating to control or reporting of greenhouse gas emissions are also in various stages of discussions or implementation in about one-third of the states. Lawsuits have been filed seeking to force the federal government to regulate greenhouse gases emissions under the Clean Air Act and to require individual companies to reduce greenhouse gas emissions from their operations. These and other lawsuits may result in decisions by state and federal courts and agencies that could impact the Company’s operations and ability to obtain certifications and permits to construct future projects.

Passage of climate change legislation or other federal or state legislative or regulatory initiatives that regulate or restrict emissions of greenhouse gases in areas in which the Company conducts business could adversely affect the demand for the products the Company stores, transports, and processes, and depending on the particular program adopted, could increase the costs of the Company’s operations including costs to operate and maintain the Company’s facilities, install new emission controls on the Company’s facilities, acquire allowances to authorize the Company’s greenhouse gas emissions, pay any taxes related to the Company’s greenhouse gas emissions and/or administer and manage a greenhouse gas emissions program. The Company may be unable to recover any such lost revenues or increased costs in the rates it charges customers, and any such recovery may depend on events beyond the Company’s control. Reductions in the Company’s revenues or increases in the Company’s expenses as a result of climate control initiatives could have adverse effects on the Company’s business, financial position, results of operations and prospects.

Clean Water Act. The Federal Water Pollution Control Act, also known as the Clean Water Act, and comparable state laws impose restrictions and strict controls regarding the discharge of pollutants, including natural gas liquid related wastes, into state waters or waters of the United States. Regulations promulgated pursuant to these laws require that entities that discharge into federal and state waters obtain National Pollutant Discharge Elimination System, or NPDES, and/or state permits authorizing these discharges. The Clean Water Act and analogous state

laws assess administrative, civil and criminal penalties for discharges of unauthorized pollutants into the water and impose substantial liability for the costs of removing spills from such waters. In addition, the Clean Water Act and analogous state laws require that individual permits or coverage under general permits be obtained by covered facilities for discharges of storm water runoff. The Company believes that it is in substantial compliance with Clean Water Act permitting requirements as well as the conditions imposed there under, and that continued compliance with such existing permit conditions will not have a material effect on the Company’s operations.

TCEQ. In 1993 during remediation of a small spill area, the Texas Commission on Environmental Quality (TCEQ) required South Hampton to drill a well to check for groundwater contamination under the spill area. Two pools of hydrocarbons were discovered to be floating on the groundwater at a depth of approximately 25 feet. One pool is under the site of a former gas processing plant owned and operated by Sinclair, Arco and others before its purchase by South Hampton in 1981. Analysis of the material indicates it entered the ground prior to South Hampton’s acquisition of the property. The other pool is under the original South Hampton facility and analysis indicates the material was deposited decades ago. Tests conducted have determined that the hydrocarbons are contained on the property and not migrating in any direction. The recovery process was initiated in June 1998 and approximately $53,000 was spent setting up the system. The recovery is proceeding as planned and is expected to continue for many years until the pools are reduced to acceptable levels. Expenses of recovery and periodic migration testing are being recorded as normal operating expenses. Expenses for future recovery are expected to stabilize and be less per annum than the initial set up cost, although there is no assurance of this effect. The light hydrocarbon recovered from the former gas plant site is compatible with our normal Penhex feedstock and is accumulated and transferred into the Penhex feedstock tank. The material recovered from under the original South Hampton site is accumulated and sold as a by-product. Approximately 473 barrels were recovered during 2009 and 405 barrels during 2008. The recovered material had an economic value of approximately $30,000 during 2009 and $17,050 during 2008. Consulting engineers estimate that as much as 20,000 barrels of recoverable material may be available to South Hampton for use in its process or for sale. At current market values this material, if fully recovered would be worth approximately $1,500,000. The final volume present and the ability to recover it are both highly speculative issues due to the area over which it is spread and the fragmented nature of the pockets of hydrocarbon. South Hampton has drilled additional wells periodically to further delineate the boundaries of the pools and to ensure that migration has not taken place. These tests confirmed that no migration of the hydrocarbon pools has occurred. The TCEQ has deemed the current action plan acceptable and reviews the plan on a semi-annual basis. In other remediation activity, South Hampton continues to remediate the site of a pipeline leak which occurred in 2001. The affected site contains less than one-eighth acre of land and the cost of remediation is being covered by insurance. The amount of material spilled was minimal and due to the nature of the soil and location, further remediation will rely on natural attenuation. South Hampton applied to the Texas Railroad Commission for approval to close the site since two years of annual monitoring indicated no movement of hydrocarbon. Approval was granted on December 1, 2009. Also, see Item 3. Legal Proceedings.

The Clean Air Act Amendments of 1990. The Clean Air Act Amendments of 1990 have had a positive effect on the Petrochemical Company’s business as manufacturers search for ways to use more environmentally acceptable materials in their processes. There is a current trend among manufacturers toward the use of lighter and more recoverable C5 hydrocarbons (pentanes) which comprise a large part of the Petrochemical Company’s product line. We believe our ability to manufacture high quality solvents in the C5 hydrocarbon market will provide a basis for growth over the coming years. Also, as the use of C6 solvents is phased out in parts of the industry, several manufacturers of such solvents have opted to no longer market those products. As the number of producers has consolidated, we have increased our market share at higher sales prices from customers who still require C6 solvents in their business. Also, see Item 2. Properties.

Personnel

The number of regular employees was approximately 140, 130 and 150 at years ended 2009, 2008 and 2007, respectively. Regular employees are defined as active executive, management, professional, technical and wage employees who work full time or part time for the Company and are covered by the Company’s benefit plans and programs.

Competition

The petrochemical and mining industries are highly competitive. There is competition within the industries and also with other industries in supplying the chemical and mineral needs of both industrial and individual consumers. The Company competes with other firms in the sale or purchase of needed goods and services and employs all methods of

competition which are lawful and appropriate for such purposes. See further discussion under “Intense competition” in Item 1a.

Available Information

The Company will provide paper copies of this Annual Report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to those reports, all as filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, free of charge upon written or oral request to Arabian American Development Company, P. O. Box 1636, Silsbee, TX 77656, (409) 385-8300. These reports are also available free of charge on our website, www.arabianamericandev.com, as soon as reasonably practicable after they are filed electronically with the SEC. The petrochemical subsidiary, South Hampton Resources, Inc. also has a website at www.southhamptonr.com.

Item 1A. Risk Factors

The Company’s financial and operating results are subject to a variety of risks inherent in the global petrochemical and mining businesses (due to our investment in AMAK). Many of these risk factors are not within the Company’s control and could adversely affect our business, our financial and operating results or our financial condition. We discuss some of those risks in more detail below.

Use of single source suppliers for raw materials could create supply issues

The Company’s use of single source suppliers for certain raw materials could create supply issues. Replacing a single source supplier could delay production of some products as replacement suppliers initially may be subject to capacity constraints or other output limitations. The loss of a single source supplier, the deterioration of our relationship with a single source supplier, or any unilateral modification to the contractual terms under which we are supplied raw materials by a single source supplier could adversely affect our revenue and gross margins.

Dependence on a limited number of customers could adversely impact profitability

During 2008 and 2009, sales to each of two customers by the Petrochemical Company minimally exceeded 10 percent or more of the Company’s revenues. The loss of either of these two customers could adversely affect the Petrochemical Company’s ability to market its products on a competitive basis and generate a profit.

Varying economic conditions could adversely impact demand for products

The demand for petrochemicals and metals correlates closely with general economic growth rates. The occurrence of recessions or other periods of low or negative growth will typically have a direct adverse impact on our results. Other factors that affect general economic conditions in the world or in a major region, such as changes in population growth rates or periods of civil unrest, also impact the demand for petrochemicals and metals. Economic conditions that impair the functioning of financial markets and institutions also pose risks to the Company, including risks to the safety of our financial assets and to the ability of our partners and customers to fulfill their commitments to the Company. In addition, the revenue and profitability of our operations have historically varied, which makes future financial results less predictable. The Company’s revenue, gross margin and profit vary among our products, customer groups and geographic markets; and therefore, will likely be different in future periods than currently. Overall gross margins and profitability in any given period are dependent partially on the product, customer and geographic mix reflected in that period’s net revenue. In addition, newer geographic markets may be relatively less profitable due to investments associated with entering those markets and local pricing pressures. Market trends, competitive pressures, increased raw material or shipping costs, regulatory impacts and other factors may result in reductions in revenue or pressure on gross margins of certain segments in a given period which may necessitate adjustments to our operations.

Environmental regulation

The petrochemical industry is subject to extensive environmental regulation pursuant to a variety of federal and state regulations. Such environmental legislation imposes, among other things, restrictions, liabilities and obligations in connection with storage, transportation, treatment and disposal of hazardous substances and waste. Legislation also requires us to operate and maintain our facilities to the satisfaction of applicable regulatory authorities. Costs to comply with these regulations are significant to our business. Failure to comply with these laws or failure to obtain permits may expose us to fines, penalties or interruptions in operations that could be material to our results of operations.

Regulatory and litigation

Even in countries with well-developed legal systems where the Company does business, we remain exposed to changes in law that could adversely affect our results, such as increases in taxes, price controls, changes in environmental regulations or other laws that increase our cost of compliance, and government actions to cancel contracts or renegotiate items unilaterally. We may also be adversely affected by the outcome of litigation or other legal proceedings, especially in countries such as the United States in which very large and unpredictable punitive damage awards may occur. AMAK’s mining lease for the Al Masane area in Saudi Arabia is subject to the risk of termination if AMAK does not comply with its contractual obligations. Further, our foreign investments in assets are subject to the risk of expropriation or nationalization. If a dispute arises, the Company may have to submit to the jurisdiction of a foreign court or panel or may have to enforce the judgment of a foreign court or panel in that foreign jurisdiction. Because of our substantial international investments, our business is affected by changes in foreign laws and regulations (or interpretation of existing laws and regulations) affecting both the mining and petrochemical industries, and foreign taxation. The Company will be directly affected by the adoption of rules and regulations (and the interpretations of such rules and regulations) regarding the exploration and development of mineral properties for economic, environmental and other policy reasons. We may be required to make significant capital expenditures to comply with non-U.S. governmental laws and regulations. It is also possible that these laws and regulations may in the future add significantly to our operating costs or may significantly limit our business activities. Additionally, the Company’s ability to compete in the international market may be adversely affected by non-U.S. governmental regulations favoring or requiring the awarding of leases, concessions and other contracts or exploration licenses to local contractors or requiring foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. We are not currently aware of any specific situations of this nature, but there are always opportunities for this type of difficulty to arise in the international business environment.

Loss of key personnel

In order to be successful, we must attract, retain and motivate executives and other key employees, including those in managerial, technical, sales, and marketing positions. We must also keep employees focused on our strategies and goals. The failure to hire or loss of key employees could have a significant adverse impact on operations.

Market place volatility

The Company’s stock price, like that of other companies, can be volatile. Some of the factors that can affect our stock price are:

|

•

|

Speculation in the press or investment community about, or actual changes in, our executive team, strategic position, business, organizational structure, operations, financial condition, financial reporting and results, effectiveness of cost cutting efforts, prospects or extraordinary transactions;

|

|

•

|

Announcements of new products, services, technological innovations or acquisitions by the Company or competitors; and

|

|

•

|

Quarterly increases or decreases in revenue, gross margin or earnings, changes in estimates by the investment community or guidance provided by the Company, and variations between actual and estimated financial results.

|

General or industry-specific market conditions or stock market performance or domestic or international macroeconomic and geopolitical factors unrelated to our performance may also affect the price of our common stock. For these reasons, investors should not rely on recent trends to predict future stock prices, financial condition, results of operations or cash flows. In addition, following periods of volatility in a company’s securities, securities class action litigation against a company is sometimes instituted. If instituted against us, this type of litigation, while insured against monetary awards and defense cost, could result in substantial diversion of management’s time and resources.

Risk associated with extraordinary transactions

As part of the Company’s business strategy, we sometimes engage in discussions with third parties regarding possible investments, acquisitions, strategic alliances, joint ventures, divestitures and outsourcing transactions (“extraordinary transactions”) and enter into agreements relating to such extraordinary transactions in order to further our business objectives. In order to pursue this strategy successfully, we must identify suitable candidates for and successfully

complete extraordinary transactions, some of which may be large and complex, and manage post-closing issues such as the integration of acquired companies or employees. Integration and other risks of extraordinary transactions can be more pronounced for larger and more complicated transactions, or if multiple transactions are pursued simultaneously. If the Company fails to identify and complete successfully extraordinary transactions that further our strategic objectives, we may be required to expend resources to develop products and technology internally, we may be at a competitive disadvantage or we may be adversely affected by negative market perceptions, any of which may have a material adverse effect on the Company’s revenue, gross margin and profitability. Integration issues are complex, time-consuming and expensive and, without proper planning and implementation, could significantly disrupt our business. The challenges involved in integration include:

|

•

|

Combining product offerings and entering into new markets in which we are not experienced;

|

|

•

|

Convincing customers and distributors that the transaction will not diminish client service standards or business focus, preventing customers and distributors from deferring purchasing decisions or switching to other suppliers (which could result in our incurring additional obligations in order to address customer uncertainty), and coordinating sales, marketing and distribution efforts;

|

|

•

|

Minimizing the diversion of management attention from ongoing business concerns;

|

|

•

|

Persuading employees that business cultures are compatible, maintaining employee morale and retaining key employees, engaging with employee works councils representing an acquired company’s non-U.S. employees, integrating employees into the Company, correctly estimating employee benefit costs and implementing restructuring programs;

|

|

•

|

Coordinating and combining administrative, manufacturing, and other operations, subsidiaries, facilities and relationships with third parties in accordance with local laws and other obligations while maintaining adequate standards, controls and procedures;

|

|

•

|

Achieving savings from supply chain integration; and

|

|

•

|

Managing integration issues shortly after or pending the completion of other independent transactions.

|

The Company periodically evaluates and enters into significant extraordinary transactions on an ongoing basis. We may not fully realize all of the anticipated benefits of any extraordinary transaction, and the timeframe for achieving benefits of an extraordinary transaction may depend partially upon the actions of employees, suppliers or other third parties. In addition, the pricing and other terms of our contracts for extraordinary transactions require us to make estimates and assumptions at the time we enter into these contracts, and, during the course of our due diligence, we may not identify all of the factors necessary to estimate our costs accurately. Any increased or unexpected costs, unanticipated delays or failure to achieve contractual obligations could make these agreements less profitable or unprofitable. Managing extraordinary transactions requires varying levels of management resources, which may divert our attention from other business operations. These extraordinary transactions also have resulted and in the future may result in significant costs and expenses and charges to earnings. Moreover, the Company has incurred and will incur additional depreciation and amortization expense over the useful lives of certain assets acquired in connection with extraordinary transactions, and, to the extent that the value of goodwill or intangible assets with indefinite lives acquired in connection with an extraordinary transaction becomes impaired, we may be required to incur additional material charges relating to the impairment of those assets. In order to complete an acquisition, we may issue common stock, potentially creating dilution for existing stockholders, or borrow, affecting our financial condition and potentially our credit ratings. Any prior or future downgrades in the Company’s credit rating associated with an acquisition could adversely affect our ability to borrow and result in more restrictive borrowing terms. In addition, the Company’s effective tax rate on an ongoing basis is uncertain, and extraordinary transactions could impact our effective tax rate. We also may experience risks relating to the challenges and costs of closing an extraordinary transaction and the risk that an announced extraordinary transaction may not close. As a result, any completed, pending or future transactions may contribute to financial results that differ from the investment community’s expectations in a given quarter.

Guaranteeing Performance by Third Parties

From time to time, the Company may be required or determine it is advisable to guarantee performance of loan agreements by third parties in which the Company maintains a financial interest. In such instances, if the primary obligor

is unable to perform its obligations, the Company might be forced to perform the primary obligor’s obligations which could negatively impact the Company’s financial interests.

Economic and Political Instability; Terrorist Acts; War and Other Political Unrest